You might like

Bolivia is debating fuel subsidies again. The arguments are familiar. What’s being missed is timing. December is not neutral. Activity is already peaking, pass-through is faster, and expectations shift immediately. The same reform lands very differently depending on when it’s…

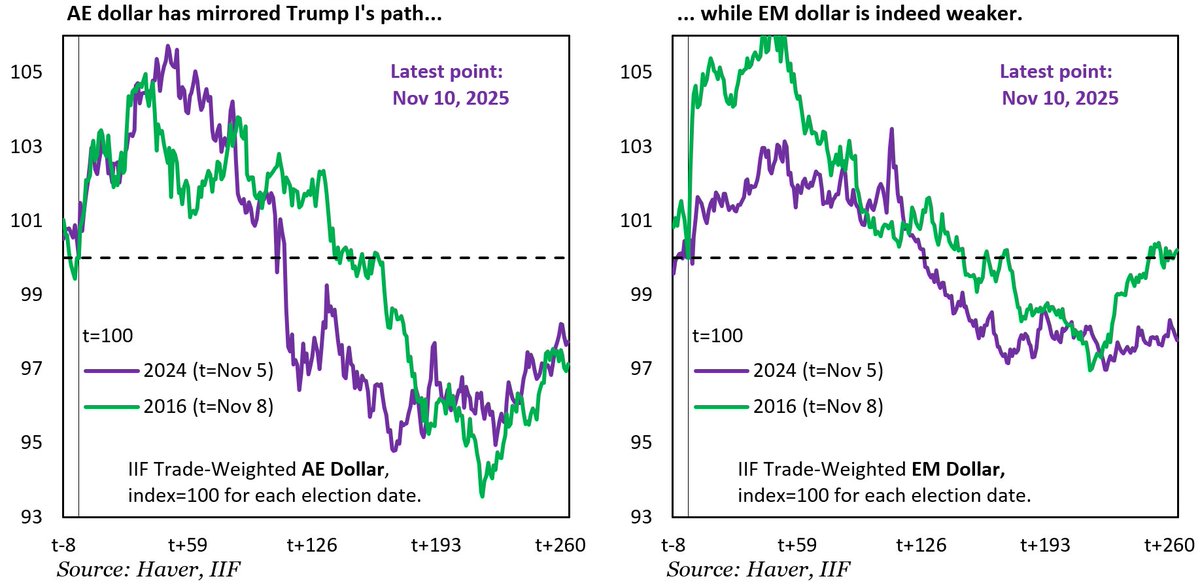

Two dollars, one story. The AE dollar has weakened, but no more than it did under Trump I... nothing extraordinary. The EM dollar is weaker still, as EM currencies quietly regain ground. The dollar isn’t collapsing, it’s evolving.

Quoted in @business on Bolivia’s macro path after the election of Rodrigo Paz. The fiscal hole is immense. Adjustment is no longer optional, only a question of speed and disruption. The government may resist the optics, but in my view they will need to turn to the IMF.

Fresh off winning Sunday’s election, Bolivia’s next president Rodrigo Paz is blazing a rare centrist path out of his country’s economic crisis, focusing on practical policies over ideological divisions engulfing its neighbors bloomberg.com/news/articles/…

bloomberg.com

Bolivia’s Next President Targets Pragmatic Path Out of Crisis

Fresh off winning Sunday’s election, Bolivia’s next president Rodrigo Paz is blazing a rare centrist path out of his country’s economic crisis, focusing on practical policies over ideological...

Rodrigo Paz has won Bolivia’s presidency with 54.5% of the vote. But the fiscal hole exceeds 16% of GDP, fuel subsidies are unsustainable, and his economics team is fractured. The crisis is already unfolding. Read my latest take here: linkedin.com/pulse/bolivias…

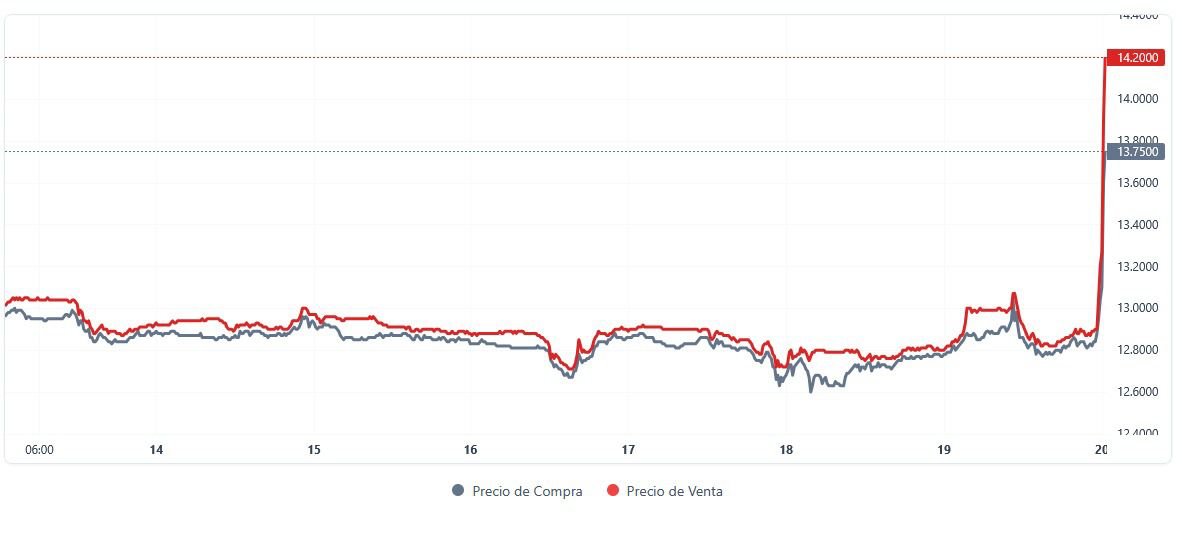

The tiny Bolivian market welcoming the newly elected president Paz. Complete lack of credibility in his economic plan

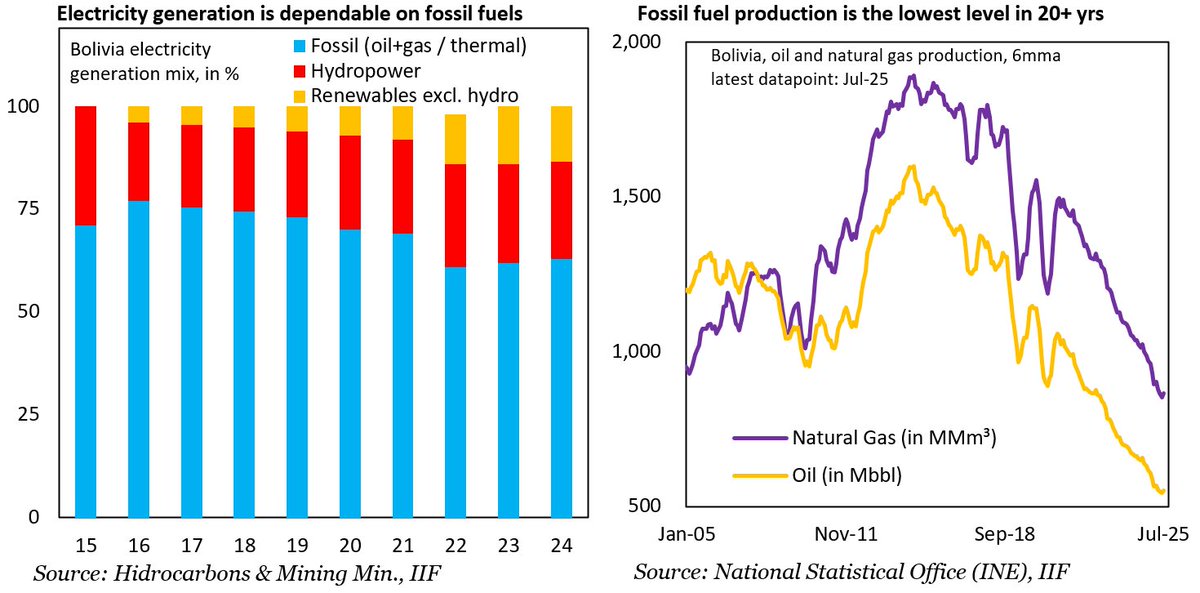

Bolivia está a 7 días del balotaje, pero la próxima crisis ya comenzó. No es inflación ni deuda. Es energía. El gas se acaba. El diésel es impagable. La red eléctrica está al límite. Parte V de la serie Zombie: La Frontera del Apagón linkedin.com/pulse/bolivias…

Bolivia is T-7 from a runoff but the next crisis is already here This one is not about inflation or debt It's about energy. Gas is running out. Diesel is unaffordable. The grid is exposed. Blackouts are coming Bolivia Apocalypse V: The Blackout Frontier linkedin.com/pulse/bolivias…

El Instituto de Finanzas Internacionales (IIF) advirtió que el modelo económico de Bolivia se ha agotado, con un modelo de financiamiento agotado, reservas mínimas y déficit persistente, según reportó Bloomberg brujuladigital.net/economia/2025/…

brujuladigital.net

Informe del IIF: “el modelo de Bolivia ha llegado a su fin, el próximo gobierno debe navegar una...

El Instituto de Finanzas Internacionales (IIF) advirtió que el modelo económico de Bolivia se ha agotado, con un modelo de financiamiento agotado, reservas mínimas y déficit persistente, según...

Quien gobierne lo hará en un sistema que esta en una fase avanzada de deterioro bloomberglinea.com/mercados/el-mo…

bloomberglinea.com

El modelo económico de Bolivia se ha agotado, afirma el IIF en su último informe

El Instituto de Finanzas Internacionales advierte que Bolivia registra uno de los mayores déficits fiscales en economías emergentes y proyecta una ruptura del tipo de cambio fijo en los próximos doce...

En la antesala de la segunda vuelta electoral el informe señala que el próximo gobierno de Bolivia recibirá un panorama fiscal, externo y financiero marcado por desequilibrios persistentes y restricciones severas. Más detalles bit.ly/4h52sS7 📷 Marcelo Perez del Carpio

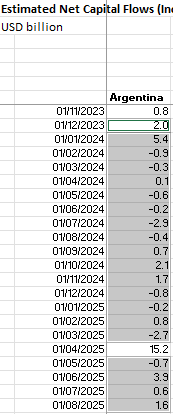

Per IIF data @econchart Arg attracted only $9.1bn in non-IMF flows since Milei was elected, but is now burning $200m-$500m a day holding an overvalued FX peg... This is Macri's second coming.

The insult grows: Bolivia's apparent increase in reserves is only a byproduct of gold sales. Which in turn is being monetized and adding to the inflation spiral...

#BCB | Comunicado de Prensa EL BANCO CENTRAL DE BOLIVIA PRESENTA RESULTADOS DE LAS RIN A SEPTIEMBRE DE 2025 Lee el comunicado completo en: bcb.gob.bo/webdocs/files_… #2025BicentenarioDeBolivia #UnPaisUnidoEsUnPaisFuerte

IIF's Jonathan Fortun's @econchart comments on Argent. He also has a really good series of articles on Bolivia. linkedin.com/posts/jfortun_…

IIF UPDATE 📢 Portfolio flows to emerging markets #EM hit $44.8 bn in August, a rise from $38.1 bn in July, but we see rising fragility, as while #debt flows hit $41.5 bn, equity inflows fell sharply to just $3.3 bn 📉 @econchart Read More: ow.ly/gzj150WV8NG

Ecuador ended diesel subsidies on Sep 12 By the weekend, protests had begun Bolivia is next. A 16% deficit and vanishing reserves make subsidies unsustainable Both candidates promise to end them. Event studies show what follows: inflation jumps FX collapse linkedin.com/pulse/bolivias…

EMs FX used to sell off when US term premia rose That was the rule. For years, it worked. But in 25, something broke. Higher premia→stronger EMFX The relationship has flipped. This is not positioning. It is structural. Credibility is being priced Beta trade is being retired.

The labor market is not gliding toward equilibrium. It is fracturing. Participation is falling in key states. U3 is distorted by disappearing supply. The migration shock amplified the break. Aggregates mislead. The weakness is already here.

United States Trends

- 1. FINALLY DID IT 570 B posts

- 2. The Jupiter 342 B posts

- 3. Brigitte Bardot 139 B posts

- 4. namjoon 65 B posts

- 5. Good Sunday 68,1 B posts

- 6. #sundayvibes 4.611 posts

- 7. Sunday of 2025 14,6 B posts

- 8. #AskFFT N/A

- 9. #quartz 3.338 posts

- 10. Tonges 1.040 posts

- 11. #caramel 3.436 posts

- 12. Cyclops 11,5 B posts

- 13. #query 3.067 posts

- 14. X-Men 30 B posts

- 15. Sunday Funday 2.455 posts

- 16. Phrases for Telephone Calls N/A

- 17. Sunderland 29,2 B posts

- 18. Nick Shirley 283 B posts

- 19. Muhammad Qasim 26,9 B posts

- 20. Learing 22 B posts

You might like

-

Martin Castellano

Martin Castellano

@mcastellano44 -

Robin Brooks

Robin Brooks

@robin_j_brooks -

IIF

IIF

@IIF -

Hyun Song Shin

Hyun Song Shin

@HyunSongShin -

St. Louis Fed

St. Louis Fed

@stlouisfed -

Brad Setser

Brad Setser

@Brad_Setser -

Patrick Zweifel

Patrick Zweifel

@PkZweifel -

Vitor Constâncio

Vitor Constâncio

@VMRConstancio -

Barry Eichengreen

@B_Eichengreen -

Paola Figueroa Guscoff

Paola Figueroa Guscoff

@PaolaGuscoffIIF -

zeibars

zeibars

@zeibars -

Dario Perkins

Dario Perkins

@darioperkins -

Frederik Ducrozet

Frederik Ducrozet

@fwred -

Erica Xuewei Jiang

Erica Xuewei Jiang

@EXjiang -

Jens Nordvig

Jens Nordvig

@jnordvig

Something went wrong.

Something went wrong.