Eekeyguy

@eekeyguyy

Decoding web3 through the lens of data || Data @DFlow

You might like

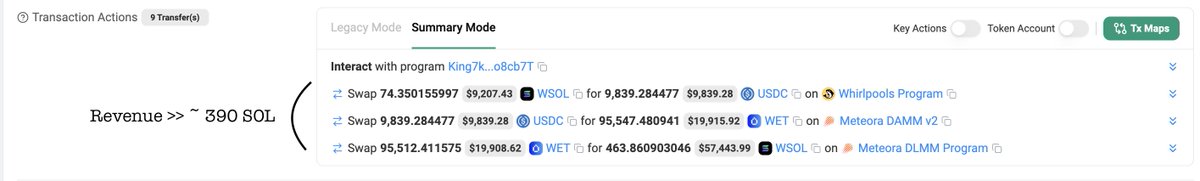

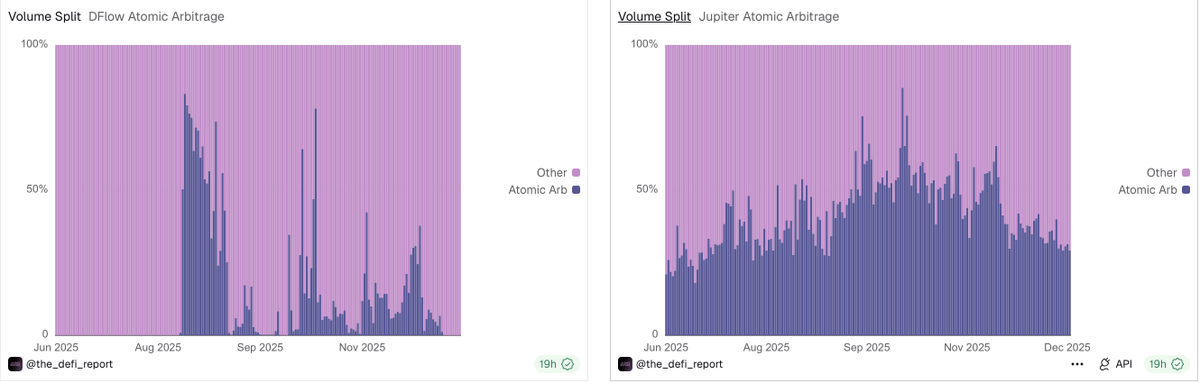

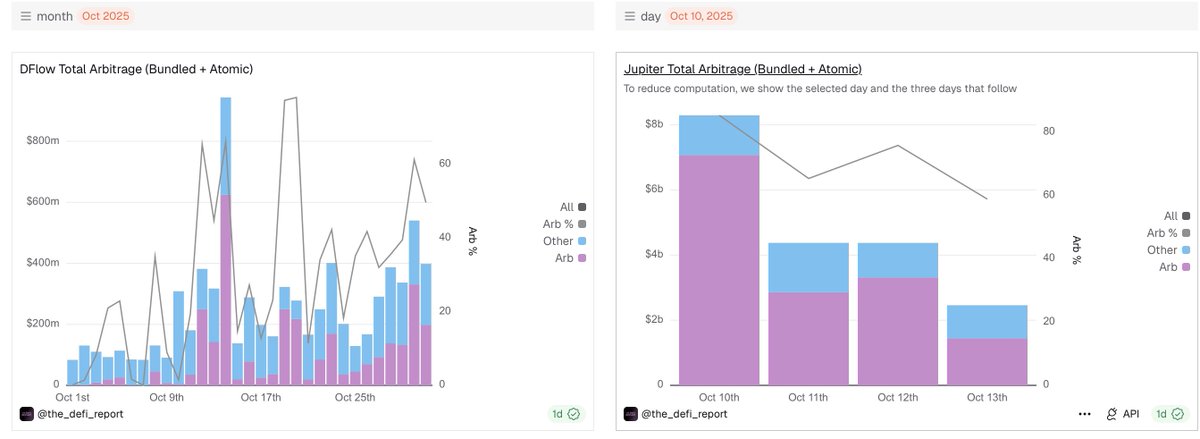

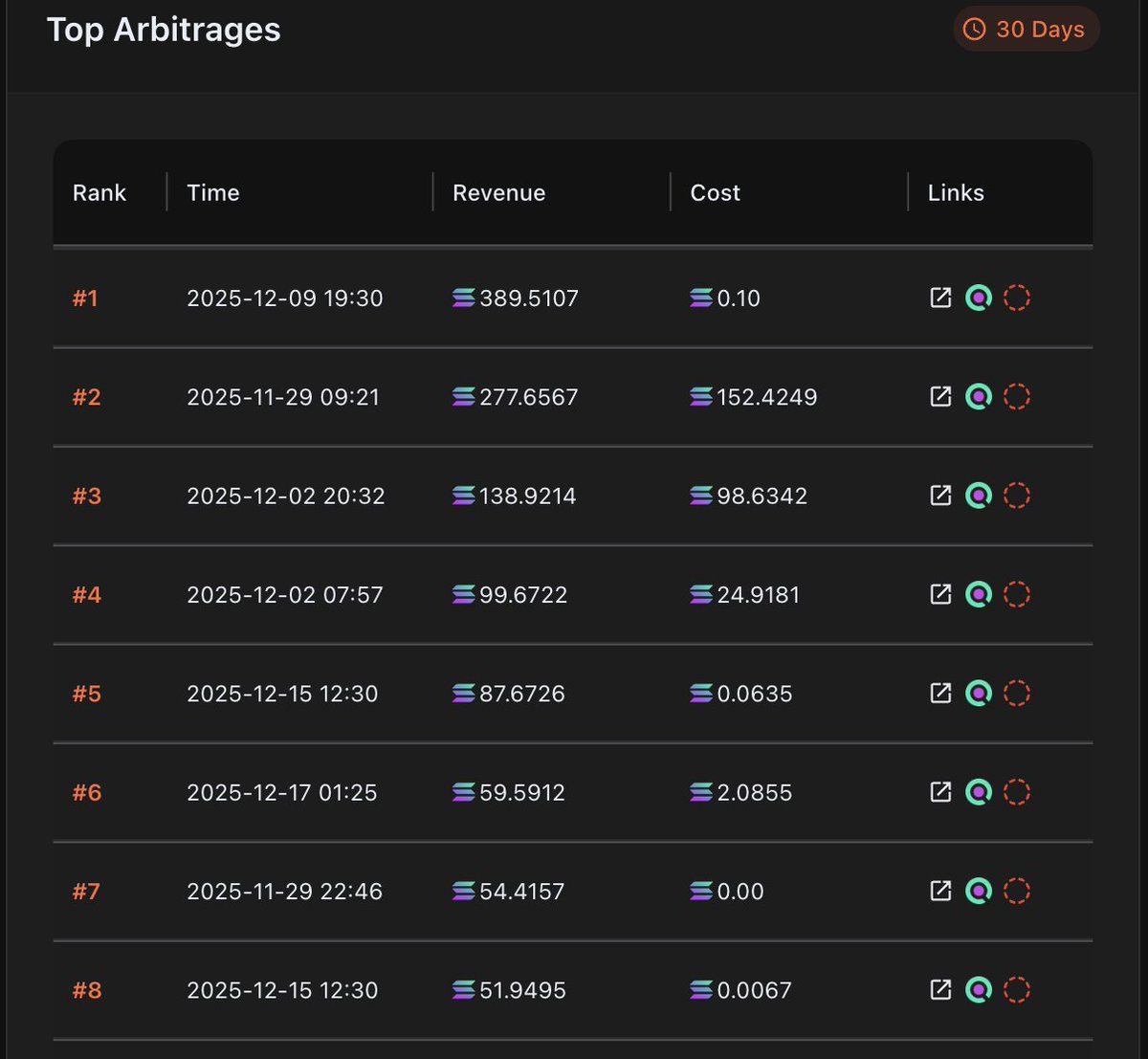

How Much of Solana's DEX Volume Is Actually Arbitrage? I have been digging into this question for a while now, and the numbers are pretty wild. Quick primer: arbitrage on Solana happens in a few different flavors. Atomic arbs execute within a single transaction—> buy low on one…

2025 was the best year in DFlow’s history From pioneering JIT Routing on @Solana to bringing tokenized @Kalshi markets onchain for the first time DFlow scaled across a growing ecosystem of apps and paid out 10s of millions in revenue to partners The 2025 files, in review 📁

PreStocks are now live in DFlow, and listed under the Equities tab. @PreStocks bring the world's hottest pre-IPO stocks to @Solana, including SpaceX, OpenAI, Anthropic, xAI, and Anduril. With PreStocks, retail investors can finally access private markets, with 24/7 instant…

Built on DFlow // Powered by DFlow

Better execution. Less slippage. Lower latency. Across spot and prediction markets (coming soon) on Solana. Light Terminal is now powered by @Dflow .

Before to book your flight to DevConnect, check out this @dune dashy on the state of @ethereum Operating performance, fundamentals, stablecoins, efficiency KPIs, tokenonomics, DeFi, Layer 2s, ETH reserves, and more. Built by @0xEekeyguy and @JustDeauIt dune.com/the_defi_repor…

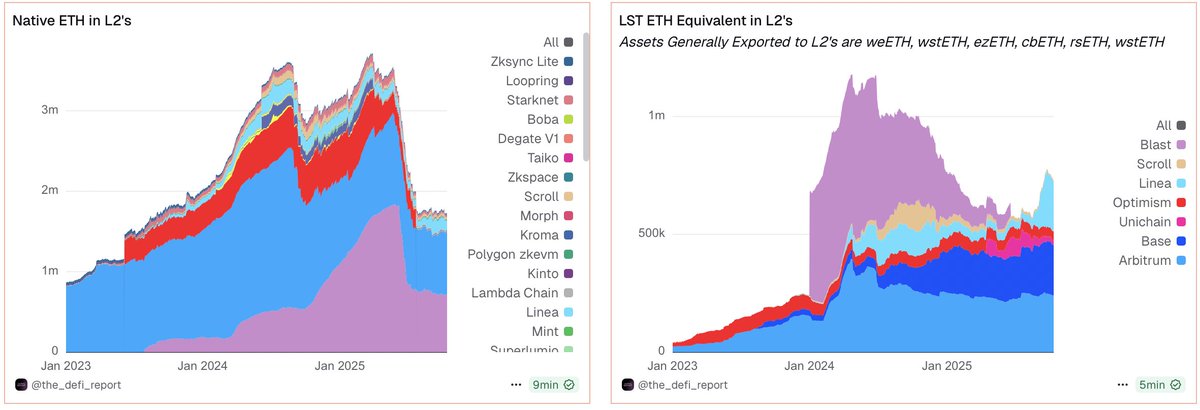

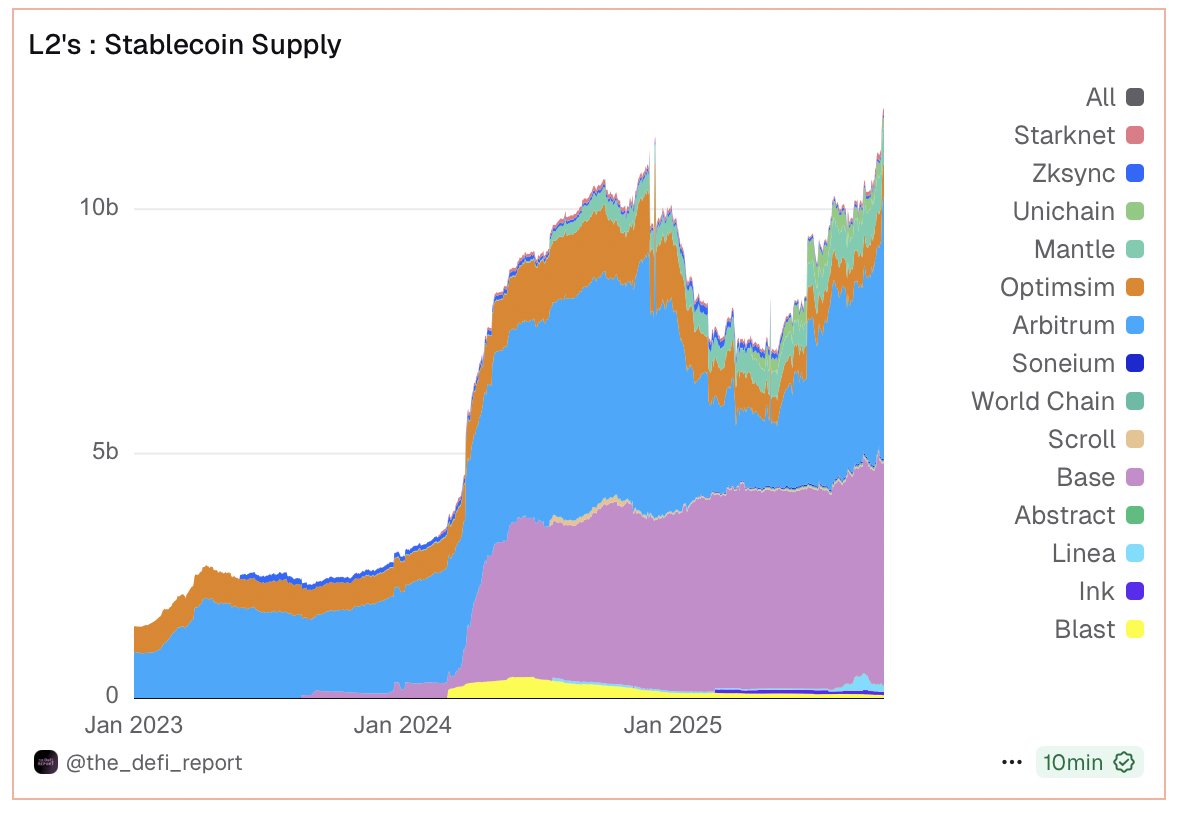

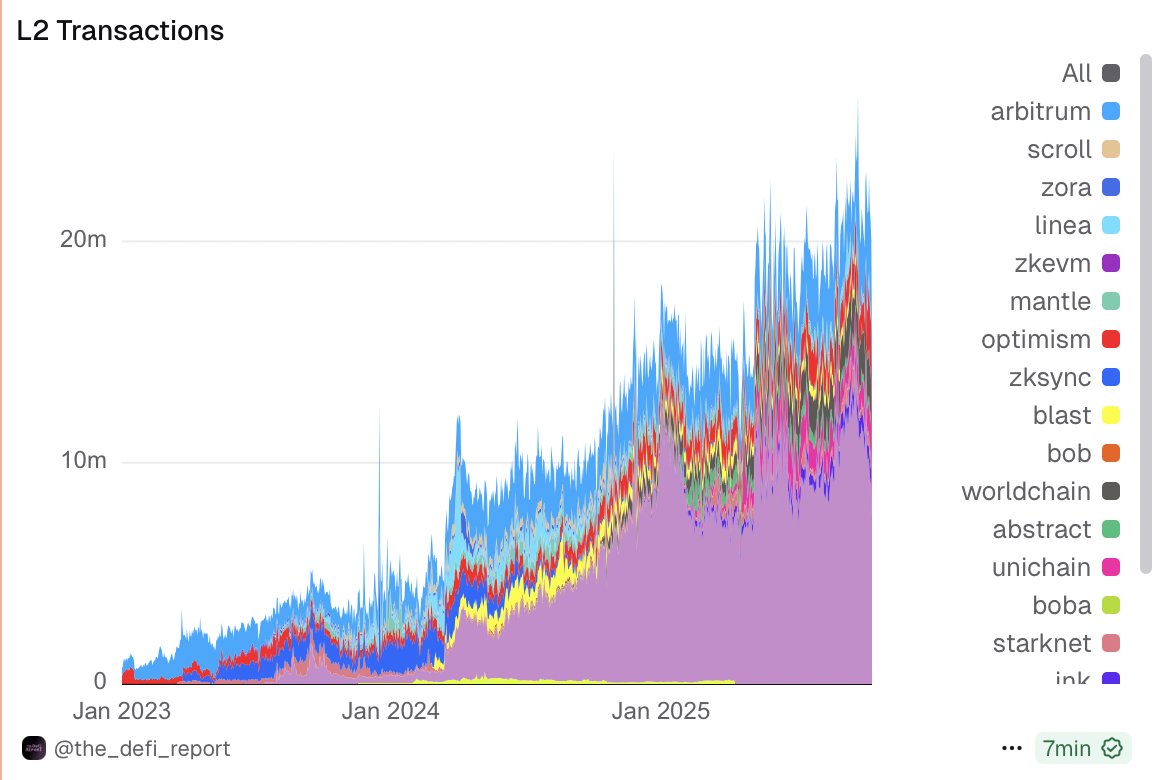

What we’re seeing on L2s → 🔹For months now, native ETH balances on L2s have hovered near lows. 🔹ETH derivatives supply has shifted toward L1 (with Linea and, to a lesser extent, Base as partial exceptions). 🔹Over the same period, stablecoin supply/use on L2s has grown fast.…

Stakeflow gives a full view of @solana staking ecosystem: rewards, validators, LSTs, and more. My fave part is the Validator Network Map built from real data center coordinates 🗺️ Amazing work by @0xEekeyguy from @the_defi_report @dune dashy 👇 dune.com/the_defi_repor…

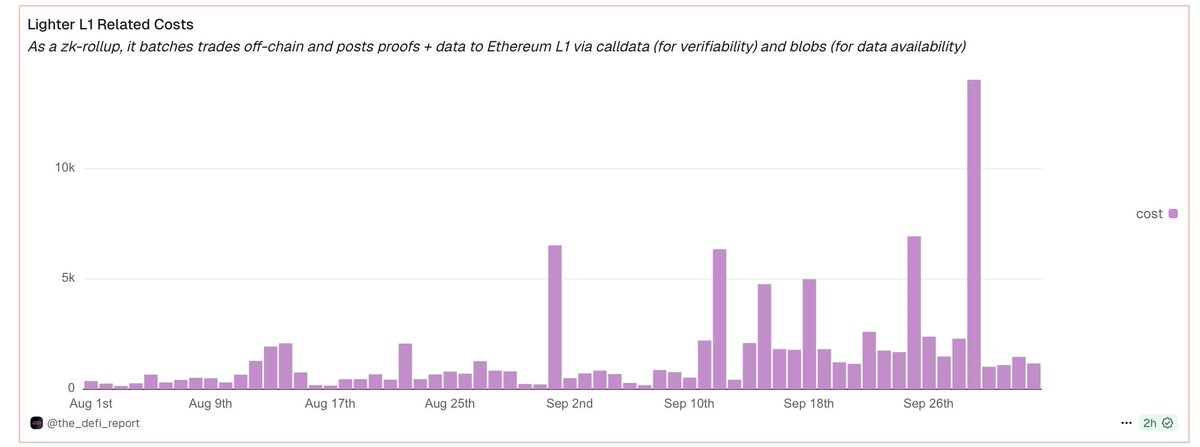

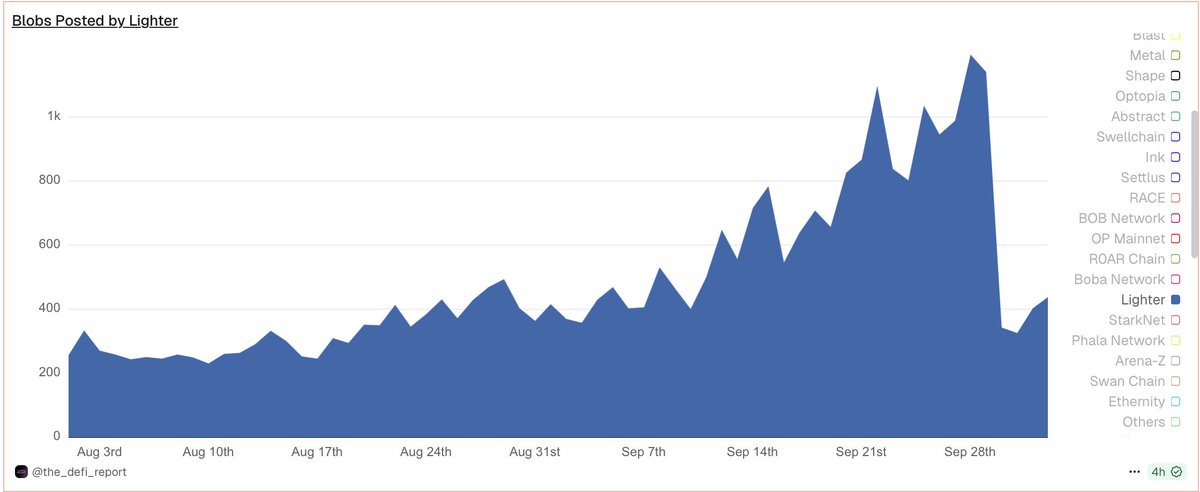

Lighter is demonstrating just how powerful and efficient a zk-rollup L2 can be. Amid surging trading activity and over $1B TVL, @Lighter_xyz estimated cost to utilize Ethereum L1 for security and data availability is just $1K–$5K per day. This means it reaps the core security…

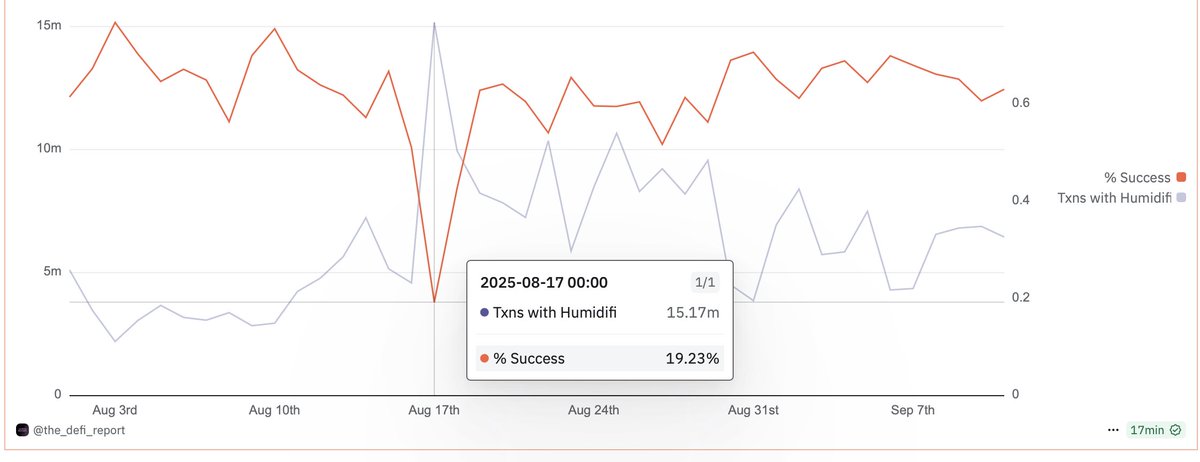

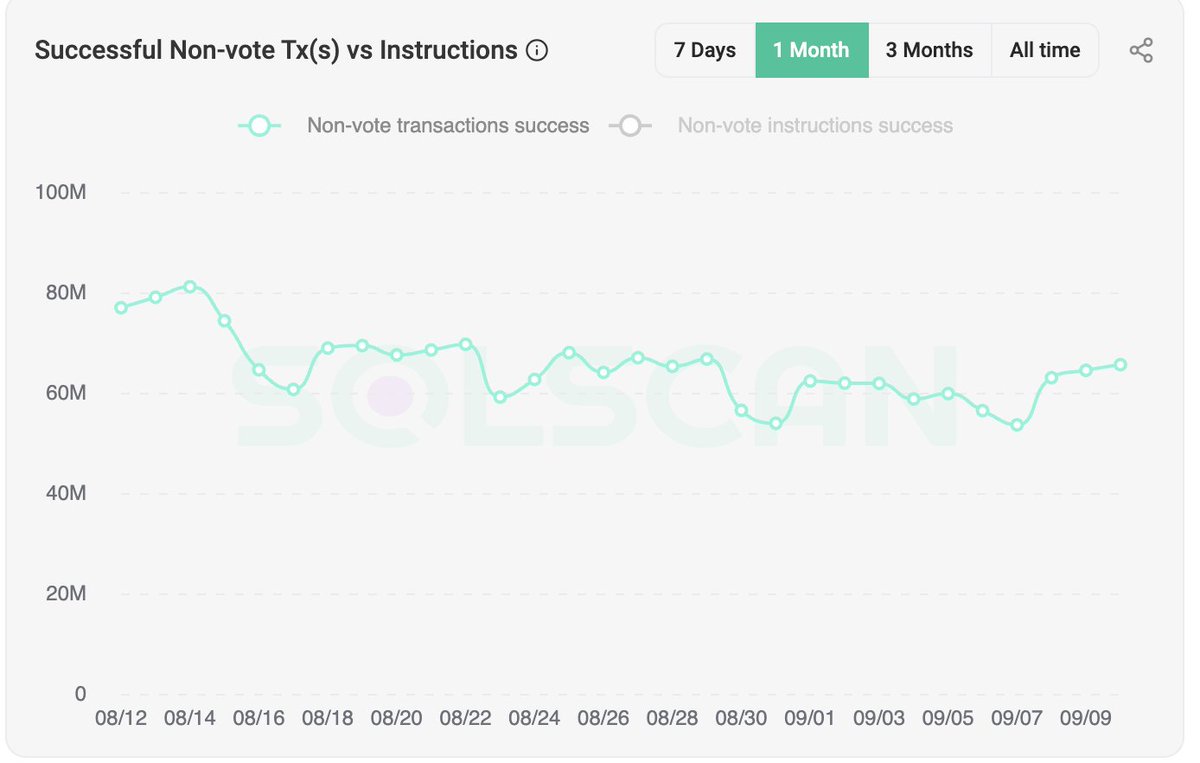

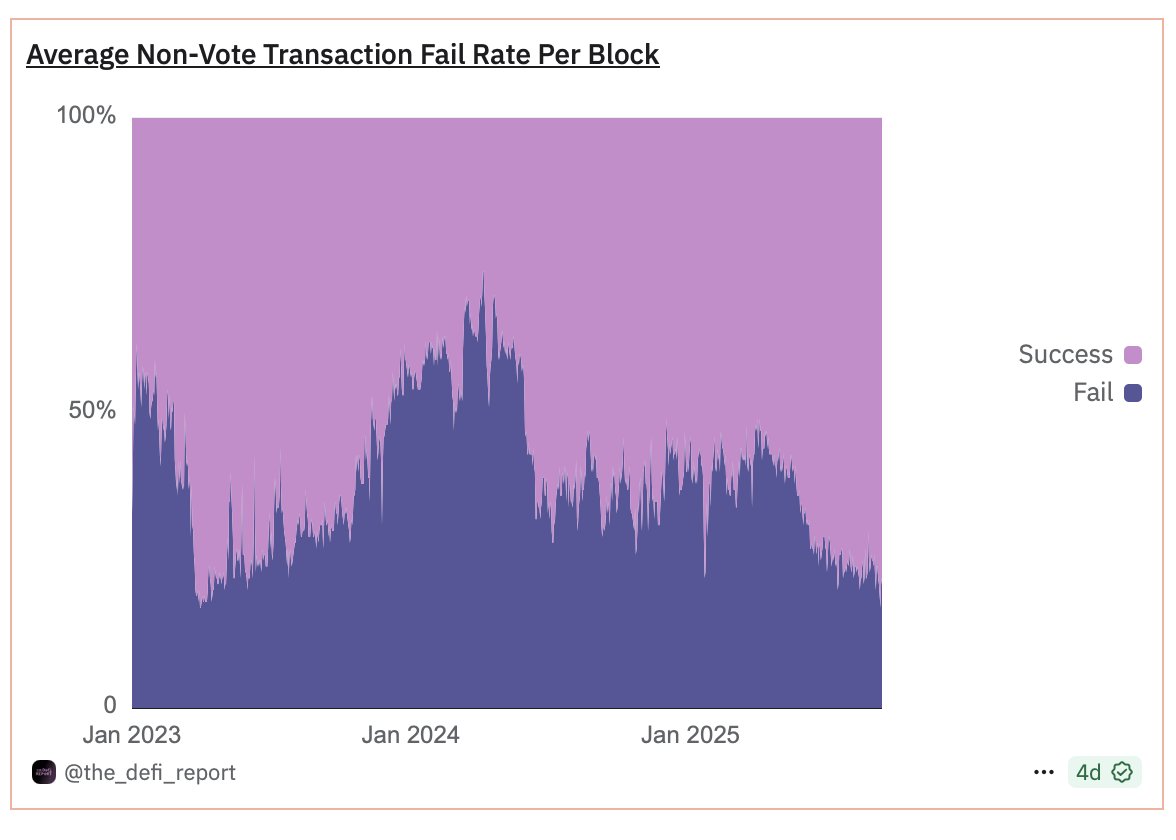

Interesting to see that on 17 Aug Humidifi program showed up in 15M txns (about 17% of all transactions), of which 80% of them failed. As we know on Solana Prop AMMs like HumidiFi send lots of tiny onchain updates every few seconds to keep prices fresh. On typical days: 5–7M…

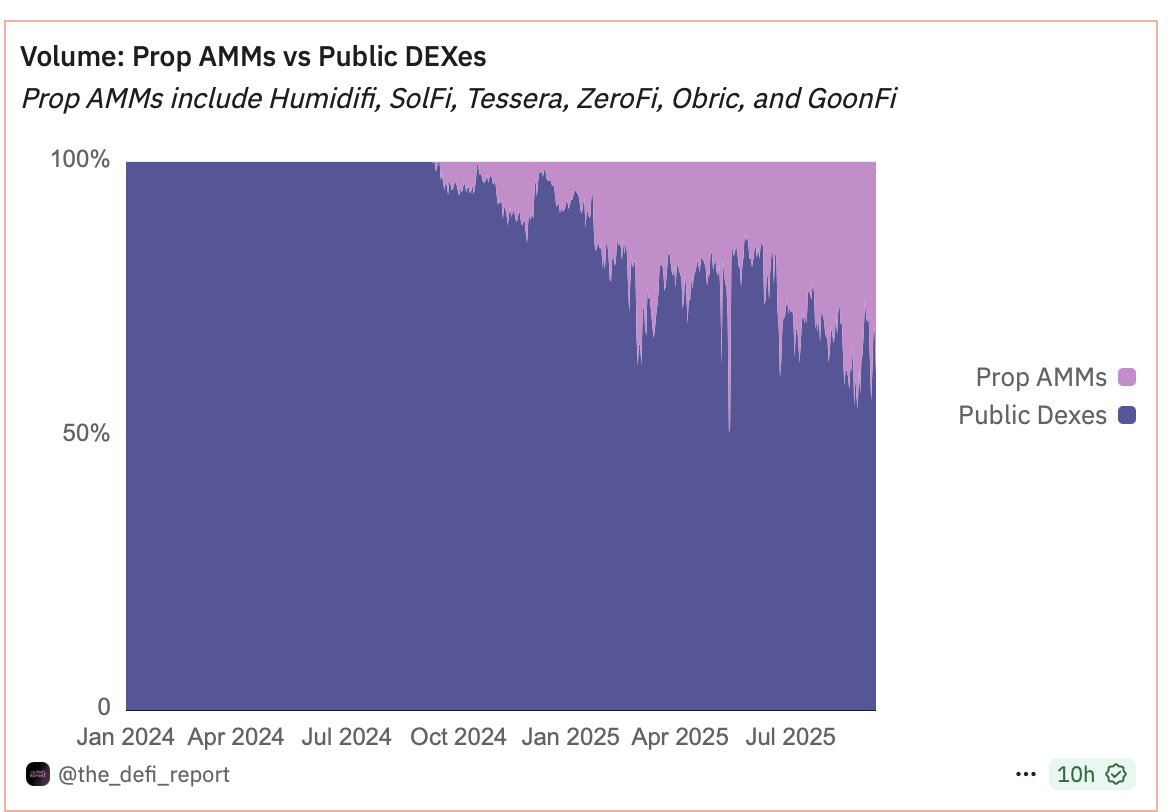

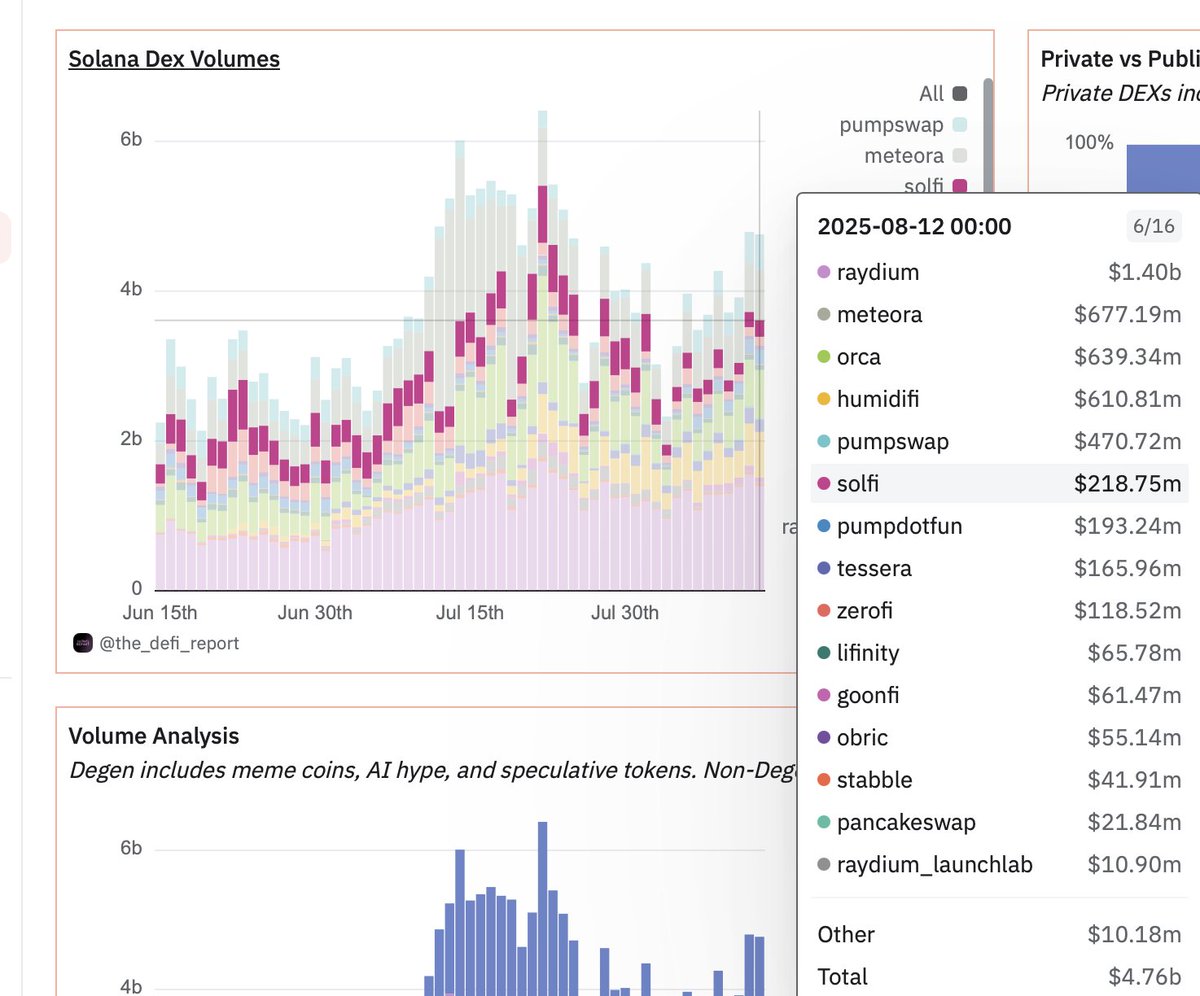

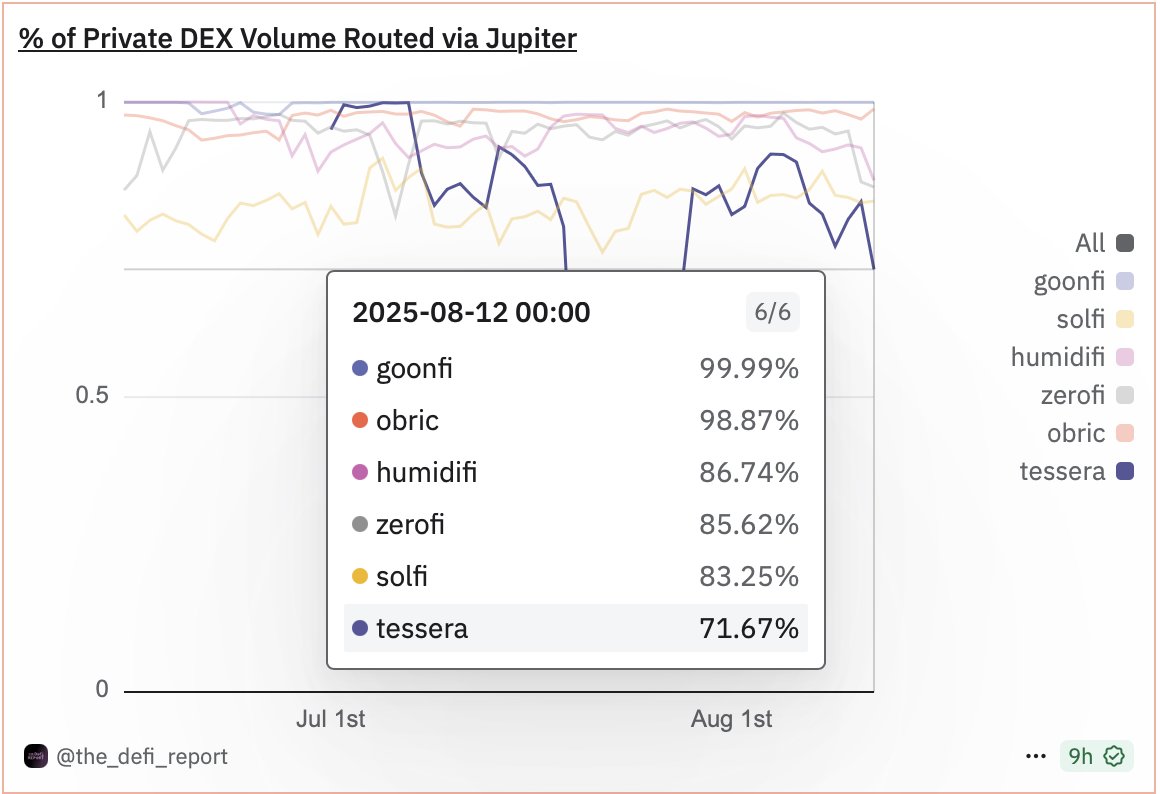

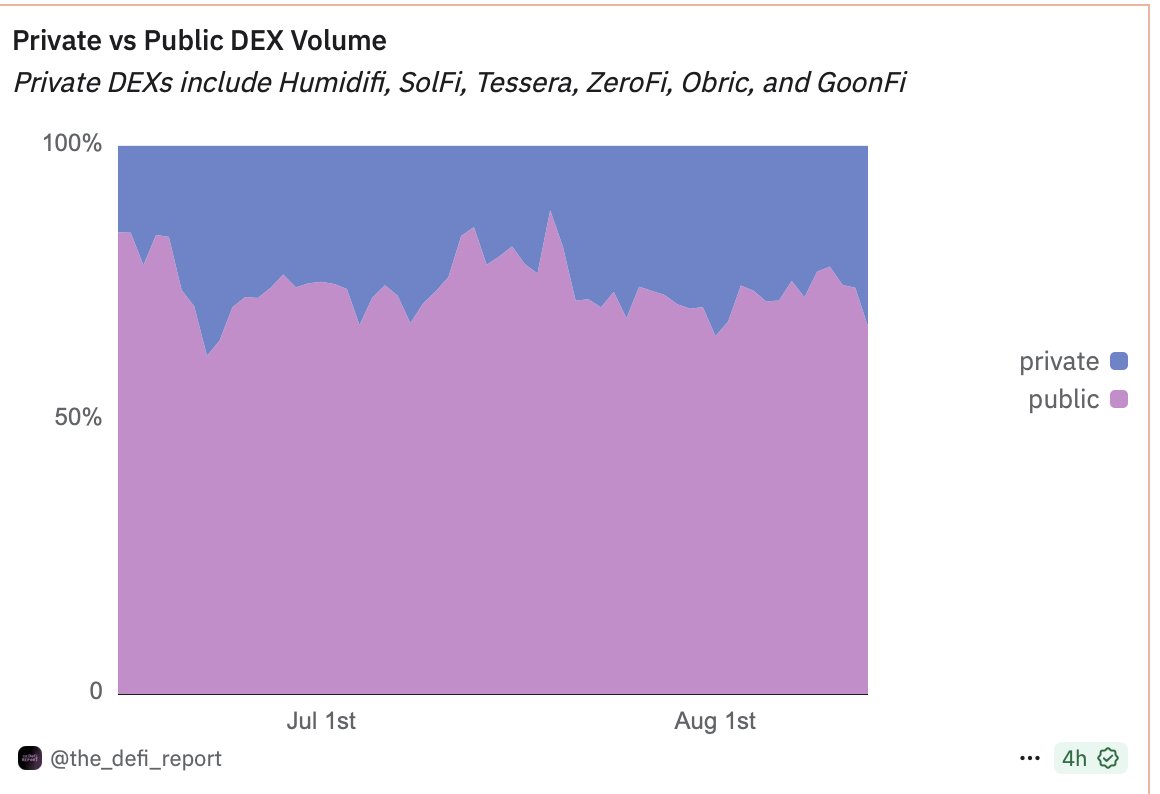

On Aug 13, prop AMMs handled a bit over a third of all DEX trading. Around 80-85 % of their flow goes through Jupiter, and together they account for more than 55 percent of Jupiter’s volume. The main players are Humidifi, SolFi, Tessera, Zerofi, Goonfi and Obric, with more…

United States Trends

- 1. Super Bowl N/A

- 2. Super Bowl N/A

- 3. Super Bowl N/A

- 4. Rams N/A

- 5. Pats N/A

- 6. Drake Maye N/A

- 7. Sean Payton N/A

- 8. Stidham N/A

- 9. Kenneth Walker N/A

- 10. Vrabel N/A

- 11. #AFCChampionshipGame N/A

- 12. Puka N/A

- 13. Darnold N/A

- 14. #NEvsDEN N/A

- 15. Diggs N/A

- 16. Shaheed N/A

- 17. #LARvsSEA N/A

- 18. Tony Romo N/A

- 19. Stiddy N/A

- 20. Travis Scott N/A

You might like

-

Dexter ⚡

Dexter ⚡

@dexterart_eth -

Zordie.eth \z/

Zordie.eth \z/

@Zordie_ -

Zo House Dubai

Zo House Dubai

@DXBxZo -

PVR

PVR

@Pvrrat -

GK

GK

@GKHODL -

Sanchit

Sanchit

@0xsindbad -

Tanme Srivastav

Tanme Srivastav

@TanZoCharlie -

Poojakp

Poojakp

@poojakp07 -

Ishaan Rawat

Ishaan Rawat

@IshaanRawat -

Mippo 🟪

Mippo 🟪

@MikeIppolito_ -

Thyborg

Thyborg

@Thyborg_ -

Westie (rev/acc) 🟪

Westie (rev/acc) 🟪

@WestieCapital -

Zo House SF

Zo House SF

@SFOxZo -

Manas Choubal

Manas Choubal

@manas_27__ -

Zirius \z/

Zirius \z/

@ziriuszz

Something went wrong.

Something went wrong.