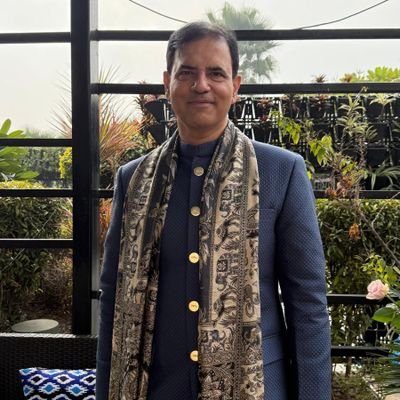

Anirudh Garg

@garganirudh

Fund Manager, INVasset PMS.

你可能會喜歡

youtu.be/9PUzt8-6t-A I recently shared my thoughts with @moneycontrolcom on the current market sentiment, and how AI and rate cuts will influence India’s economy in the coming months. Key takeaways: -Nifty at all-time highs, but lack of momentum in small and mid-caps is…

The Great Rate-Cut Reset: Liquidity Is About to Rewrite India’s Market Map 🚀 A rate cut isn’t just a policy move. It’s a reset button. And this time, the reset is big. Global central banks are finally stepping off the brake. Yields are cooling. Inflation is bending. Liquidity…

moneycontrol.com/news/business/… Shared my insights with Moneycontrol on why income growth and job stability will be central to sustaining India’s earnings and economic momentum. While affordability has improved through tax reliefs and lower rates, long-term consumption depends on how…

moneycontrol.com

Daily Voice: Wage growth, jobs will drive earnings and economic momentum, says INVasset’s Anirudh...

For corporates, the steady wage and employment trends directly support top-line growth and improve visibility in sectors such as FMCG, autos, real estate and discretionary spending, Anirudh Garg said.

youtube.com/watch?v=KiVQCs… Recently had the opportunity to share my views with CNBC Awaaz on the current market setup. While the market continues to trade near lifetime highs, momentum has clearly softened across mid and small caps — a technical cooling rather than a fundamental…

moneycontrol.com/news/business/… Shared my insights with Moneycontrol on how a potential India–US trade deal before Christmas could revive global investor confidence and act as a catalyst for sustained market momentum. With inflation contained, corporate earnings stable, and the rupee…

news.abplive.com/business/perso… Shared my insights with ABP Live on how India is entering a new phase of economic expansion, powered by policy stability, easing interest rates, and deepening capital markets. The upcoming rate-cut cycle is likely to catalyse credit demand across…

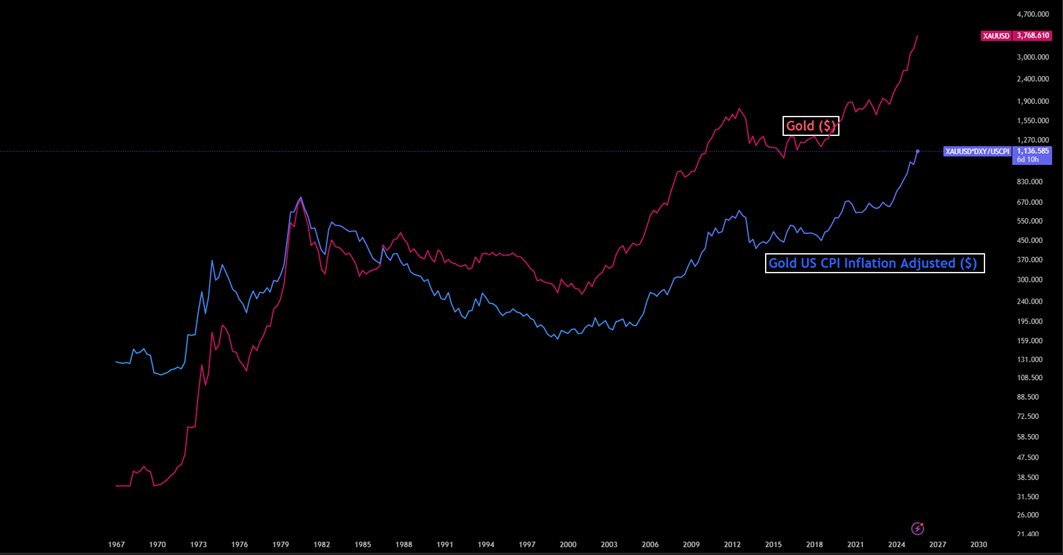

m.economictimes.com/wealth/invest/… Shared my insights with The Economic Times on how record gold prices are impacting India’s financial and consumer sectors. Rising bullion values are positive for gold-backed lenders, enhancing collateral quality and reducing credit risks. However,…

economictimes.indiatimes.com

Rise in gold prices boosts lending companies but jewellery firms struggle - The Economic Times

The year 2025 witnessed a dazzling rise in gold prices, far outpacing the performance of equity markets. This growth served as a boon for gold loan NBFCs like Muthoot Finance and Manappuram Finance,...

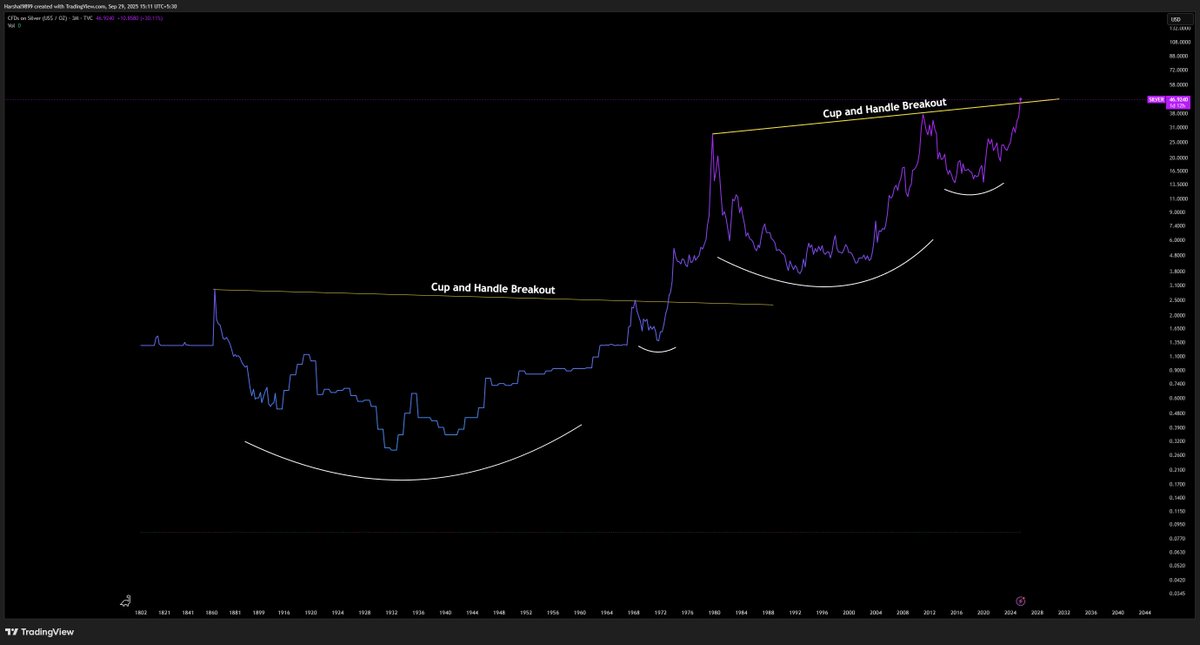

Puzzled why Silver BeES are falling even though silver prices remain steady. Silver BeES, being exchange-traded, behave like regular stocks — driven by market demand and liquidity. During early October, as silver surged nearly 18% (₹45.9 → ₹54.5), Silver BeES jumped an even…

This Diwali, let’s light up our portfolios — not just our homes. Markets, like life, move through cycles of light and shadow. What matters is staying invested through both. As we celebrate wealth, wisdom, and new beginnings, let’s remember that real prosperity isn’t found in…

SILVER update: The SILVER shortage is REAL. “Australia’s Perth Mint, trusted worldwide, has fully suspended all sales of silver products. Not a single coin or bar leaves the facility—effectively erasing one of the world’s key sources of new physical supply. In INDIA, the…

India’s Gold Rush: How the Yellow Metal Is Quietly Rebalancing Household Wealth India’s love affair with gold has entered a record-breaking phase. According to a recent Morgan Stanley report, the market value of gold owned by Indian households has soared to nearly $3.8 trillion…

economictimes.indiatimes.com/wealth/invest/… Shared my insights with The Economic Times on the importance of aligning corporate earnings with macroeconomic trends. Companies that consistently deliver profit growth above India’s nominal GDP stand out as durable long-term performers. This filter not…

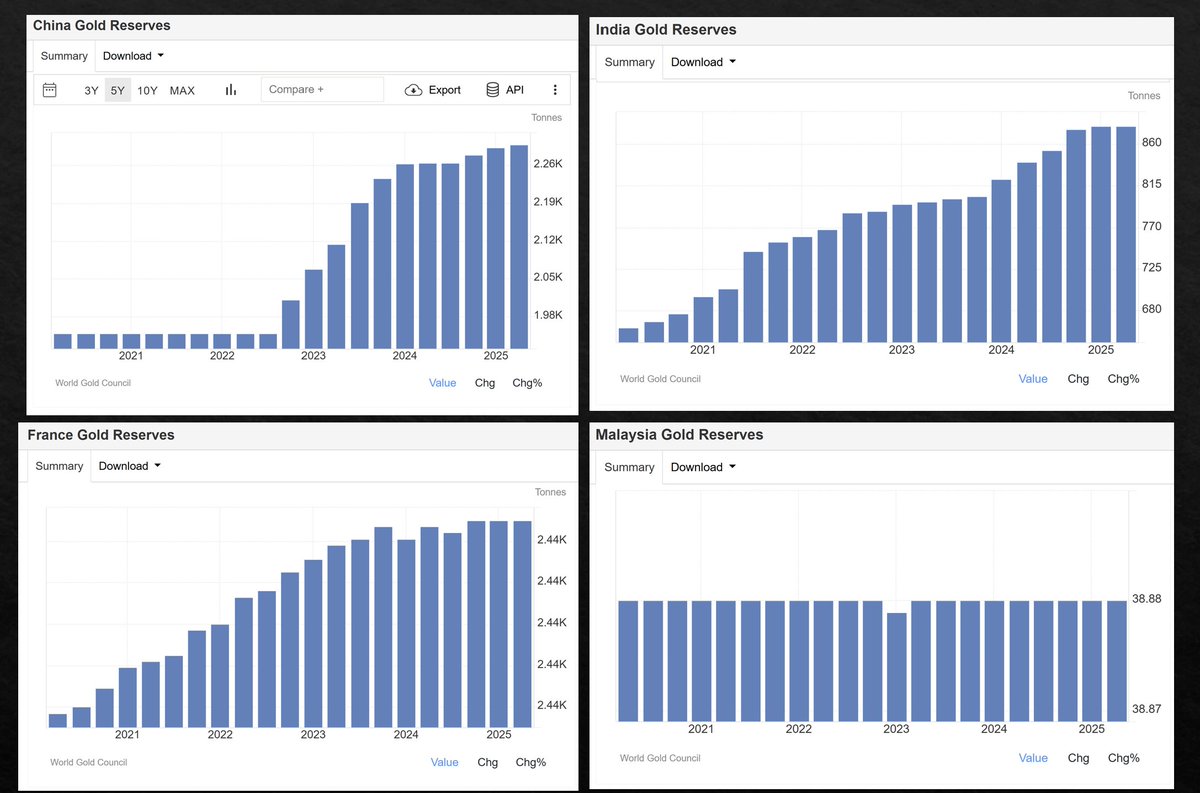

Why is this happening? Central banks around the world (mainly China) are buying heavily. In efforts to reduce reliance on the dollar, China has bought gold for the 10th straight month in August. It currently has 2.3 million KGs, worth $305 billion.

moneycontrol.com/news/business/… Shared my insights with Moneycontrol on the outlook for the September quarter earnings season. India enters Q2 FY26 with a supportive backdrop: GDP growth of 7.8% in Q1, CPI at 2.07%, and robust PMI prints all point to resilience. I expect earnings…

moneycontrol.com

Daily Voice: US-India trade deal could be a catalyst for sustained market uptrend, says this fund...

The domestic story remains supportive, but a robust rebound toward record highs will likely require a strong trade agreement to ease market concerns, Anirudh Garg of INVasset PMS said.

Every time there is a #Gold slam, this is actually what’s happening:

When people ask me how long will gold prices keep rising, my answer is simple: as long as central banks keep printing currency, gold will rise. And if they ever stop, the bubble will burst and eventually people will shift back to gold. We have reached a stage where print or don’t…

United States 趨勢

- 1. Giannis 50.6K posts

- 2. Tosin 53.6K posts

- 3. Spotify 1.44M posts

- 4. Leeds 81.7K posts

- 5. Maresca 43.4K posts

- 6. Bucks 33.2K posts

- 7. DANNY PHANTOM 5,173 posts

- 8. Wirtz 29.7K posts

- 9. #WhyIChime 1,850 posts

- 10. Milwaukee 16K posts

- 11. Sunderland 39.8K posts

- 12. Delap 14.7K posts

- 13. Chiesa 8,908 posts

- 14. #LEECHE 19.9K posts

- 15. Merino 36.1K posts

- 16. Joao Pedro 7,068 posts

- 17. Mike Lindell 9,992 posts

- 18. Badiashile 6,227 posts

- 19. Candace 96.4K posts

- 20. Chris Paul 51.5K posts

Something went wrong.

Something went wrong.