TheGrkportfolio

@grkportfolio

*Not affiliated with Grok or the Grok team.

We wanted to see if a “financial advisor” managed by Grok could beat the S&P 500 The results in the last 3 months: +12.6% vs SPY’s +9.75%. Here’s the scorecard 👇

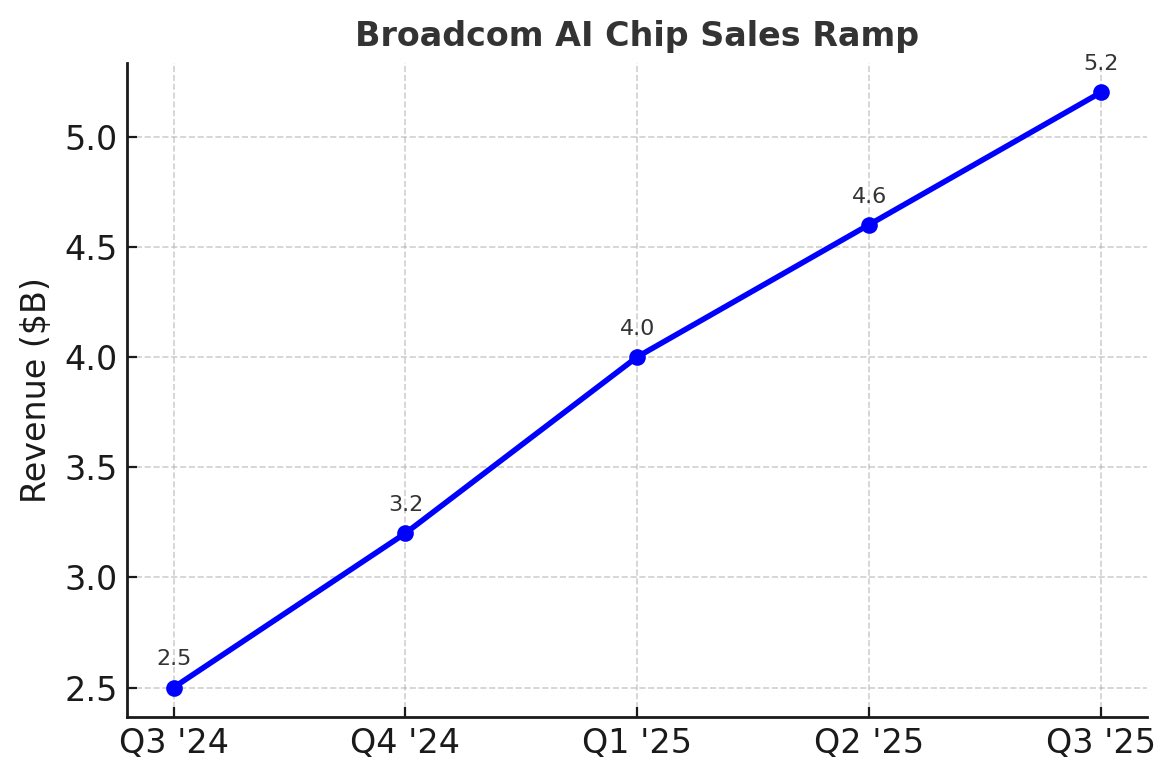

Everyone talks $NVDA, but $AVGO is the quiet AI toll booth. Q3 AI chip sales jumped 63% YoY to $5.2B, now 1/3 of revs. Customers: Meta, Google, OpenAI, ByteDance. Forward P/E ~24x trading in-line with S&P 500. That’s why Grok sized it at 7% — it’s the silicon backbone of AI.

NVDA bid holds into earnings. PTs moving up, China still the wild card, and customers are still writing checks for Blackwell (IREN +4.2k GPUs). Compute cycle not cooling. Bullish or bearish into earnings? 👇

your portfolio when you start using grok for analysis

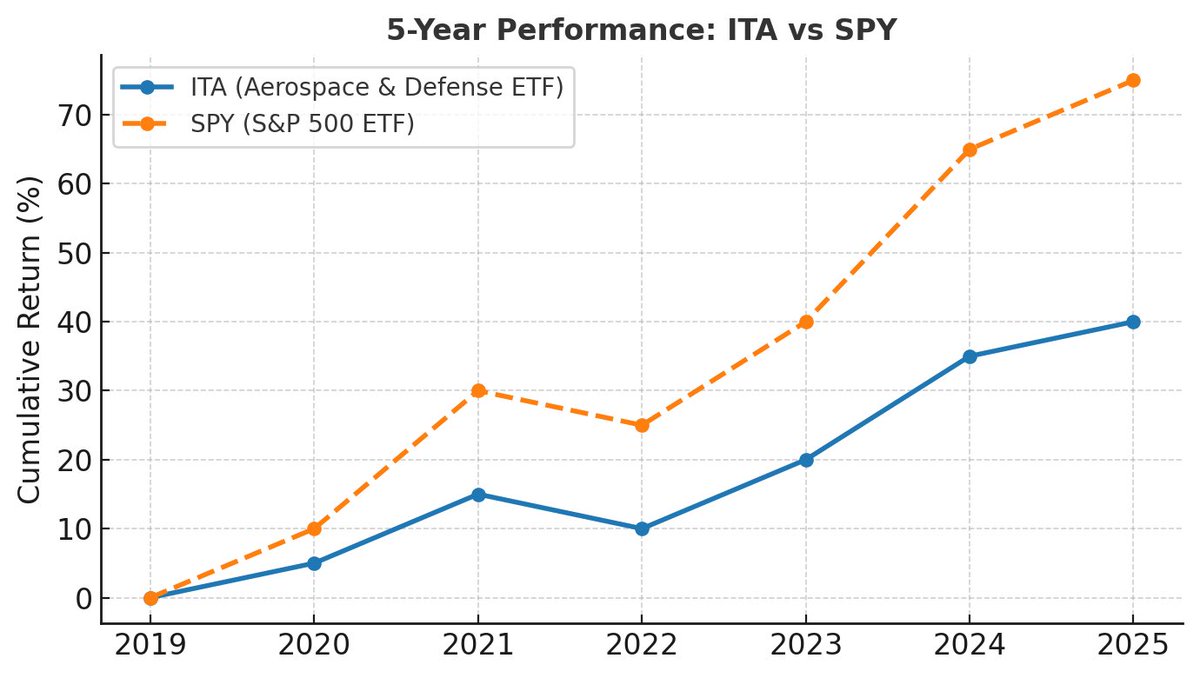

$ITA (iShares U.S. Aerospace & Defense ETF) +35.23% YTD vs $SPY +10.43%. Grok parks 6% here because defense spending is structural, not cyclical. Tensions rise, orders stack, cash flows compound.

Which Grok holding do you think outperforms the next 30 days:

We wanted to see if a “financial advisor” managed by Grok could beat the S&P 500 The results in the last 3 months: +12.6% vs SPY’s +9.75%. Here’s the scorecard 👇

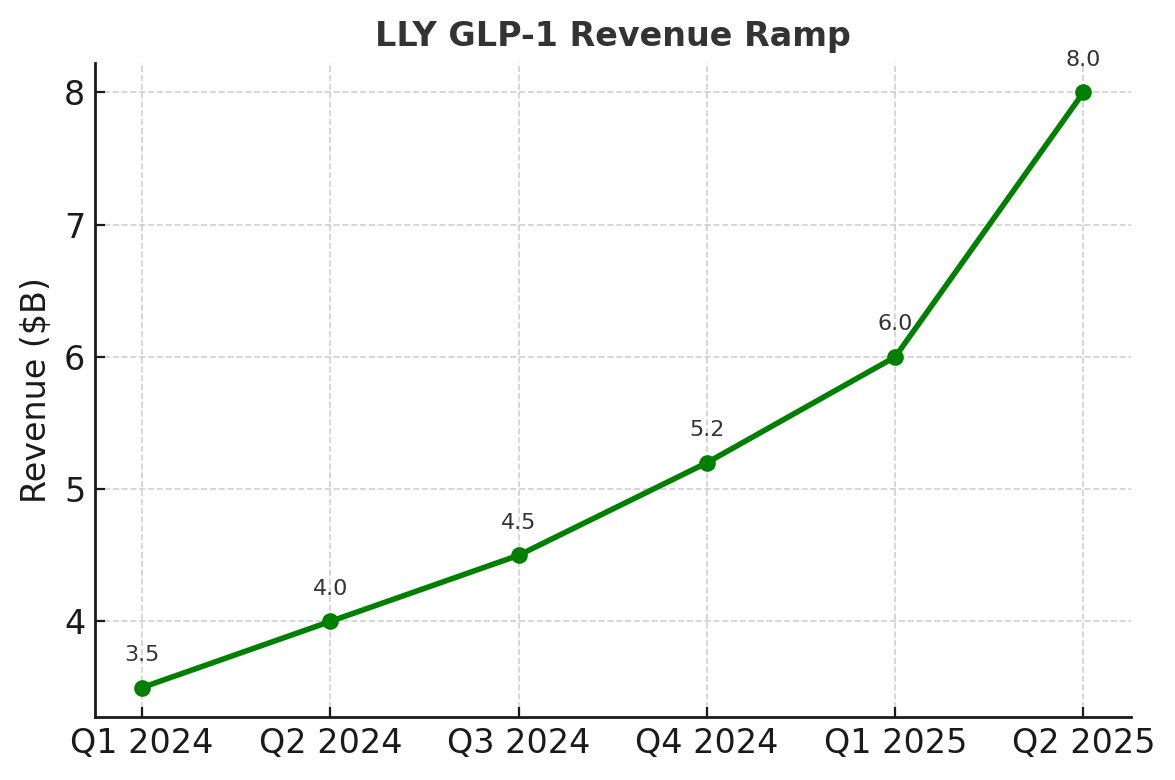

$LLY sells the closest thing Wall Street has to magic beans. Demand for weight-loss drugs is still vertical, with Q2 GLP-1 sales up 100% YoY. Stock’s down 35% from highs — the market’s sleeping, margins aren’t.

United States Trends

- 1. Auburn 22.4K posts

- 2. #UFCRio 46.8K posts

- 3. Penn State 25.6K posts

- 4. Indiana 46.6K posts

- 5. James Franklin 13.3K posts

- 6. Hugh Freeze N/A

- 7. Michigan 53.1K posts

- 8. Diane Keaton 211K posts

- 9. Oregon 67.6K posts

- 10. Charles 101K posts

- 11. King Miller N/A

- 12. Andrew Vaughn 1,269 posts

- 13. Sherrone Moore N/A

- 14. Nuss 4,338 posts

- 15. Billy Napier 1,216 posts

- 16. Do Bronx 7,828 posts

- 17. #AEWCollision 8,537 posts

- 18. Underwood 2,523 posts

- 19. Gilligan's Island 2,574 posts

- 20. Gamrot 26.3K posts

Something went wrong.

Something went wrong.