Andrea Manzi

@hackmanzi

Quant Fund Manager VC scout & more

where are u located atm and how do you find that startup environment?

Does a Blockchain backed VC exist? I mean a VC where they create a startup's token and LPs buy it, instead of capital called and raised as the classical way. Something similar?

Imagine VC structured like a protocol where capital calls clear through on chain liquidity and startups ship tokens as vesting primitives. At that point fund management looks more like MEV than finance.

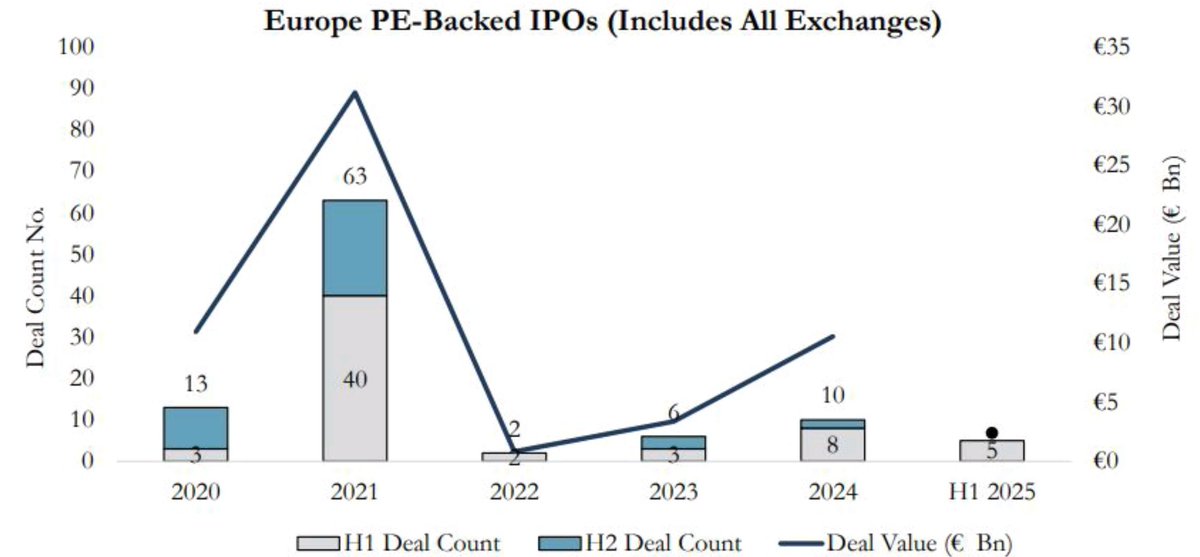

In terms of IPOs, the European stock markets do not look good: 28 IPOs for a total of 4bn in H1-25: dwarfed by Asian and US statistics. PE-backed IPOs shows a glimmer of light since 22: - consistent growth in deal value - number of deals expected to increase for full year

China launched a new vault in Hong Kong and introduced two contracts designed for global investors. After 8 months, no suitable candidate has been found. Domestic talent falls short of Chinese lenders’ requirements, while internationals are being taken away by competition.

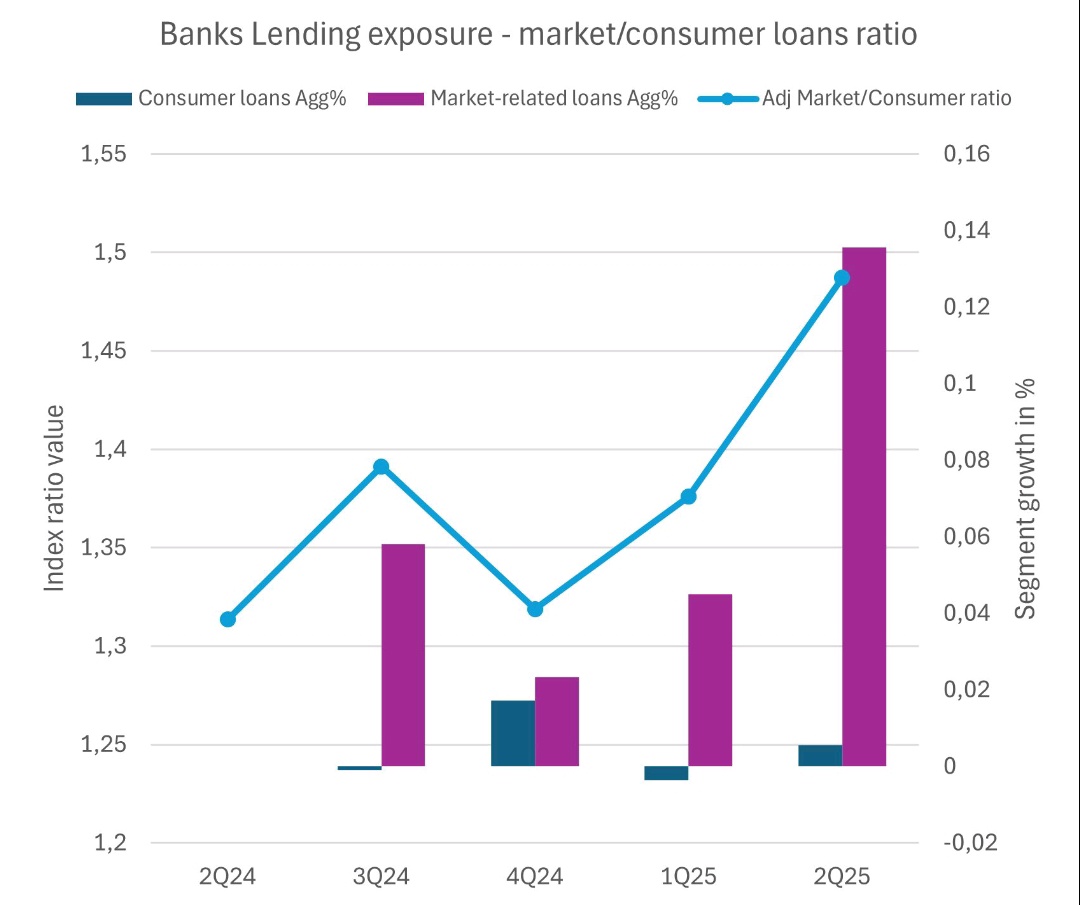

🤯Considering banks that account for 56% of total assets in the US, with $4.3 trillion in loans on their balance sheets: Q2 2025 shows that they far outweigh non-consumer loans, and consumer-related loans didn't grow last year (0.92% aggregate growth). #bankstock #Markets

United States Trends

- 1. Kalani 5,336 posts

- 2. Milagro 29.4K posts

- 3. REAL ID 6,758 posts

- 4. Cyber Monday 60K posts

- 5. Vanguard 11.3K posts

- 6. Admiral Bradley 10.1K posts

- 7. TOP CALL 12.1K posts

- 8. Penn State 8,880 posts

- 9. MRIs 4,473 posts

- 10. Hartline 3,818 posts

- 11. #GivingTuesday 3,958 posts

- 12. Jason Lee 2,428 posts

- 13. Merry Christmas 49K posts

- 14. #OTGala11 94.4K posts

- 15. Shakur 8,213 posts

- 16. Brent 10.3K posts

- 17. Check Analyze 1,183 posts

- 18. Token Signal 4,540 posts

- 19. #jimromeonx N/A

- 20. Jay Hill N/A

Something went wrong.

Something went wrong.