strong team, strong product, strong wedge. yes its possible to raise onchain and make the best decisions to scale with quantum markets

Very proud of the @stardotfun and @surfcashx teams for a smooth token launch. Real work begins now. Raise capital onchain, secured by Combinator, and go build.

You can now trade to decide how much $ZC to sell to invest into @surfcashx. All projects on @combinatortrade will get the same treatment. Raise more with lower risk.

The token should provide utility to the target customer. At Combinator, markets determine how to use the token to invest into projects built on top of us, allowing them to be more comfortable raising. The quantum market to determine how much to invest into @surfcashx is LIVE.

Progress

The first ever Quantum Market in human history is live to determine how much minted $ZC should be rewarded to @OX_Katniss for her futarchy trading explainer. Want to see contributors win? Want more exposure for Combinator? Trade now: zcombinator.io/zc cc: @paradigm…

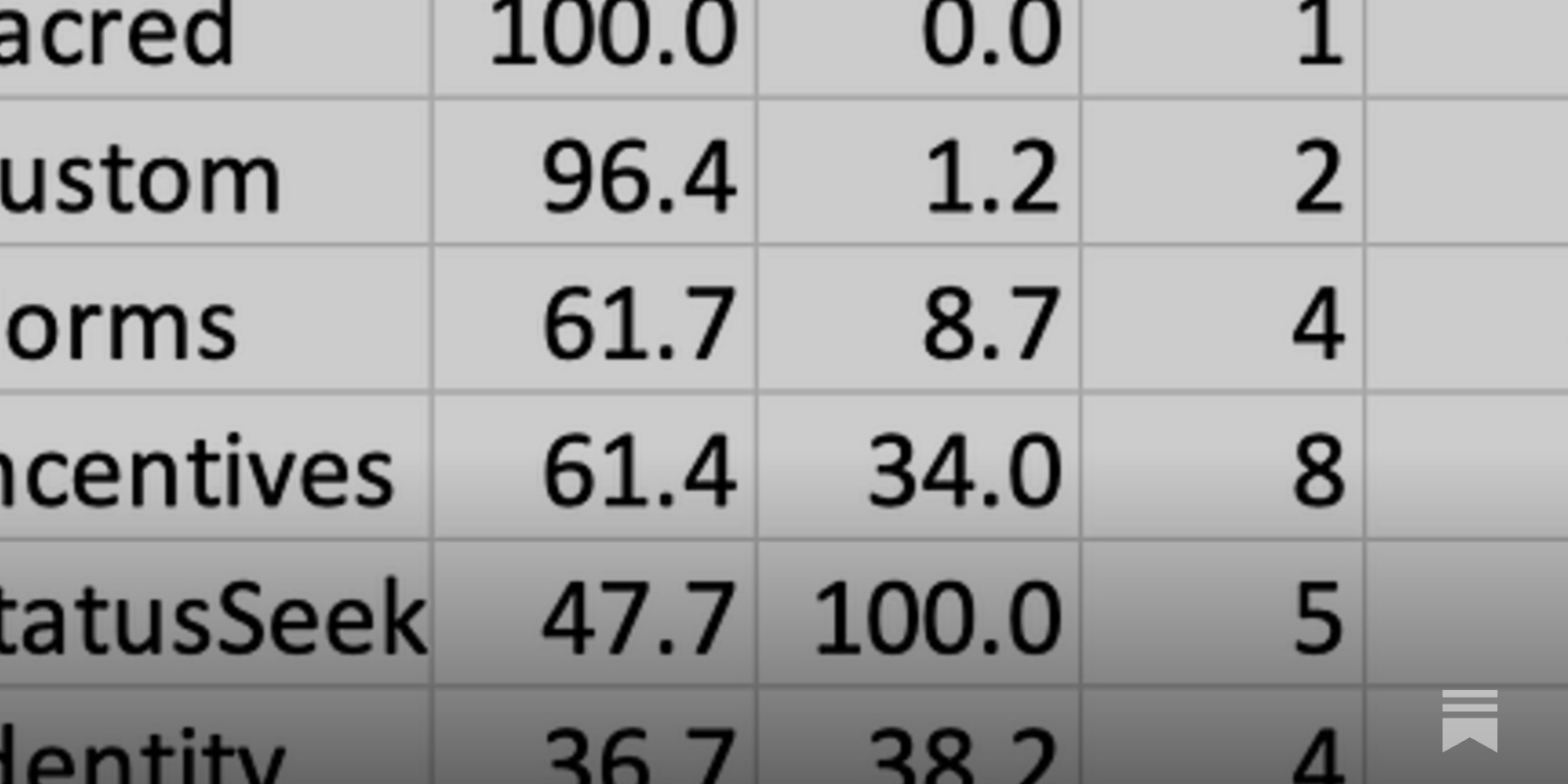

I suspect that incentives have become more of an organizing principle than things like religion / values since the world is increasingly connected and religion / values fail to scale as well as money

As we economists focus overwhelming on incentives, it is striking to me to see them rated here as greatly outclassed by other cultural forces. overcomingbias.com/p/cultural-for…

Very excited to announce that @bangitdotxyz is interested in being the next project using Combinator decision market tech. They're one of the most interesting experiments in crypto right now, using token incentives to bootstrap an X feed that delivers less slop and more…

The bottleneck is what to build, not how to build. Unironically decision markets solve this, but not as treasury managers.

like i get that ai might overvalued, capex etc but it is crazy how much faster you can just *do* things what we really lack is good ideas at this point

This is the correct stance. Spending all day and night on 'enshrined programmatic value'.

Where else would it go???

All $ of revenue will be used to reinvest into the protocol, or run the protocol, or returned to token holders.

Tokens shouldn’t need the founder to sign legal contracts to be worth something. What are we even doing if our primary push is to copy paste contractual obligations on chain? Some that have value without granting “legal rights to IP”: HYPE, ENA, SOL

Every robotics video currently out there involves a robot in an environment it's seen 1M times (i.e. overfitting). Behave accordingly.

The Sunday robot is the 1st robot thats made me say "wow". There's actual real footage of it doing chores Not tele-operated like those freaky NEO robots. They were AI trained with robot glove hands. Data was collected with humans who wear special training gloves while performing…

I think there's a big difference between token networks and equity tokens. MetaDAO is the latter. Products like BTC, ETH, Helium, HYPE, SOL are the former. Liquid funds love MetaDAO because they didn't have access to equity deals before. I'm not building in crypto to put…

every day I become more bullish MetaDAO and less bullish any token that isn't an ownership coin

you dont want to remove the middleman, you want to replace the middleman with decentralized decision making corporations are fundamentally communist ztorio futardio

if you want the benefits of launching a token, you need to tie token success to product success Otherwise you’re farming

Build & run a power plant onchain. Waitlist incoming... Notis 🔔 on

United States Trends

- 1. Sam Darnold 11.5K posts

- 2. Rams 51.2K posts

- 3. Stafford 12.6K posts

- 4. Seattle 21.9K posts

- 5. Portuguese 21.1K posts

- 6. Puka 32.8K posts

- 7. Shaheed 4,902 posts

- 8. #TNFonPrime 3,340 posts

- 9. Kenneth Walker 3,196 posts

- 10. Cooper Kupp 2,052 posts

- 11. McVay 3,924 posts

- 12. Kubiak 1,945 posts

- 13. Al Michaels N/A

- 14. #LARvsSEA 1,992 posts

- 15. Portugal 45.3K posts

- 16. Ben Shapiro 25.9K posts

- 17. Pelicans 3,093 posts

- 18. Charbonnet 2,340 posts

- 19. Chris Shula N/A

- 20. Rockets 12.6K posts

Something went wrong.

Something went wrong.