HighRoller_

@highrollerrr

The Gods of the valley are not the Gods of the hills.

You might like

Tourists out, believers in. $PENGU

I survived the October 10 bear market ✅

I really don’t think people have grasped what the ramifications are of what just happened in the crypto markets.

They told us AI would revolutionise the world, but instead it gave us Steven Hawkings at the X games in 1997… $nvda $goog $meta

Do you believe in Pengu?

BNB is at 1000 dollars Today. Years ago you could get it for free by trading on Binance. Take it as a lesson. Never bet againt a founder who's ready to go to jail for his company and do infinite crime for your wealth.

Resolv Points Season 3: Stablecoinizing and Capturing Yield Across DeFi Season 2 ended on September 8, 23:59 UTC. Next Season started automatically with updated terms. Duration: September 9 – December 9, 2025 Allocation: 3% of total token supply

Resolv buybacks continue: • $60k in purchases executed • 420k $RESOLV acquired • Average price: $0.143 Backed by 77% of last week’s core protocol fee revenue.

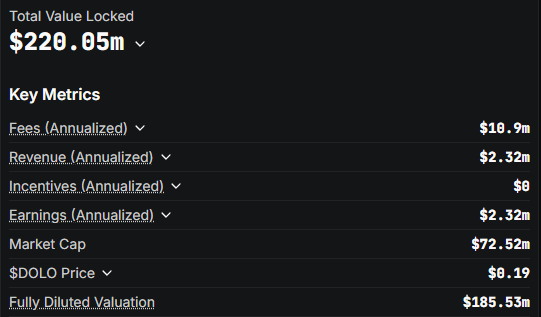

$RESOLV 542M$ TVL 4.08M$ annualized revenue MC 43.46M$ $DOLO 220M$ TVL 2.32M annualized revenue MC 72.52M$ Crime is happening in real time Many such cases, would take a thread to point them all out

Since April 23d 2025, $USR has been outperforming $USDE throughout the entire period to date, except June 28th, August 29,30,31st and September 1 & 2d for a total of 6 days. Thats 129 days or 95.56% of the times $RESOLV has offered slightly better APY than $ENA since that day

Resolv is here to stablecoinize everything. The next phase live: clusters. A modular way to integrate productive assets across DeFi and beyond, embedding their yields directly into stablecoin collateral. It begins with @0xfluid, where lending flows now power the stable rails.

maxiUSR vault is already delivering a solid native yield at 15+% APY (7d), with most strategies allocated on @0xfluid. On top: • 45x Resolv points • 8x Upshift points The strategy still has plenty of room to expand, meaning higher native yield as allocations scale across more…

This week, the Foundation executed another round of buybacks: 519,665 $RESOLV acquired for $75k at an average price of $0.14. That’s 90% of last week’s core protocol fees, directed to open-market purchases. More details: dune.com/resolv/resolv-…

The bridge from digital assets to institutions is still underbuilt. Resolv joined Hub71 in Abu Dhabi this week to help change that. Hub71 is a leading MENA tech hub for digital assets, connecting startups with sovereign funds, corporates and allocators, and providing the…

Cohort 17 is here 🚀 We’re thrilled to welcome 26 groundbreaking startups to the Hub71 ecosystem, each bringing bold ideas, innovation, and ambition to shape the future of tech. Get ready to meet the founders who are rewriting the rules💡 Learn more: shorturl.at/KXgJa…

Resolv is now live on @arbitrum, joining DeFi Renaissance. wstUSR and RLP are part of DRIP, the program designed to reward real DeFi utility with aligned incentives. Season 1 is focused on looping strategies: borrow, lend, and re-use capital to deepen liquidity across the chain.

United States Trends

- 1. Jets 89.3K posts

- 2. Jets 89.3K posts

- 3. Justin Fields 13.4K posts

- 4. Aaron Glenn 5,655 posts

- 5. Sean Payton 2,853 posts

- 6. London 206K posts

- 7. Garrett Wilson 3,755 posts

- 8. Bo Nix 3,858 posts

- 9. #HardRockBet 3,449 posts

- 10. #DENvsNYJ 2,404 posts

- 11. HAPPY BIRTHDAY JIMIN 163K posts

- 12. Tyrod 1,980 posts

- 13. #JetUp 2,227 posts

- 14. #OurMuseJimin 209K posts

- 15. Bam Knight N/A

- 16. #30YearsofLove 182K posts

- 17. Breece Hall 2,081 posts

- 18. Kurt Warner N/A

- 19. Peart 1,928 posts

- 20. Sutton 2,910 posts

Something went wrong.

Something went wrong.