Hines

@Hines

Intelligent Real Estate Investments. We build smart investments on decades of real estate experience. #Hines

You might like

This week, Hines Co-CEO Laura Hines Pierce joined fellow leaders at the @WEF annual meeting in Davos to discuss key trends impacting investors like the rise of AI, new frontiers for public-private cooperation, and how demand for real assets is blurring lines between traditional…

Are we looking at a new era of value growth for real estate in Europe? As the chart below shows, capital appreciation in the recent past has largely been due to rent growth, and Hines Research believes high employment levels and acute supply constraints should help that growth…

How can investors identify the right time to act in complex real estate cycles? Hines Research’s Buy-Hold-Sell framework offers a data-driven perspective on market conditions, intended to enable investors to pinpoint opportunities with conviction. Michael C. Hudgins of Hines…

Advanced AI may represent “a new input into the economy,” says our Global Chief Investment Officer David Steinbach. He spoke with @Reuters this week about how we believe the real estate industry could help this burgeoning technology reach its full potential:…

Our research team believes that deglobalization, e-commerce and other global economic and geopolitical trends are converging to make this an exciting time to invest in warehouse and logistics. Read more from @DianaOlick in @CNBC Property Plays: cnbc.com/2025/11/28/war…

The era of fragmented real estate portfolios, endless handoffs, and sluggish execution is ending. Here’s what’s rising in its place: bit.ly/4ivwPlh

It’s no secret that in an era characterized by a 6.5-million-unit housing shortage, we see opportunities in the living sector. We believe the time is ripe to put insights into action, particularly in Europe. In @NewsGreenStreet this week, our Global Head of Real Estate Steve…

For too long, landlord consolidation was misunderstood as a cost-cutting tactic. The truth? It’s a competitive weapon. In a new article, our Global Head of Client Partnerships Whitney Burns explains how Hines is reimagining partnerships and transforming portfolios into platforms:…

The future of industrial real estate is here. These are just three of the trends that have spurred its rapid evolution from a staid, income play into a high-conviction, long-term growth story for global investors who are agile enough to find opportunities on the ground. Read our…

Stabilizing interest rates, positive demographic trends, and the AI-fueled growth in data centers all bode well for real estate in Asia. Co-Head of Investment Management Chiang Ling Ng joined @MartinSoong on @CNBCi Squawk Box Asia to discuss the rising opportunities:…

Creating sustainable value for the long term is key to Hines’ strategy for the future and our ratings from GRESB underscore the market-leading efforts of our funds. In the 2025 GRESB benchmark, Hines has continued to excel with 11 of our funds and direct investments awarded the…

Hines U.S. Property Partners has surpassed $3 billion in gross asset value after five recent transactions. They speak to the strength of the fund's strategy of acquiring demand-resilient, operations-led assets in leading U.S. submarkets with clear pathways for value creation.…

New this week: Hines has acquired the Marienhöfe residential quarter in Berlin as part of an off-market forward funding transaction for Hines European Core Fund (HECF). Read more in IREI with a subscription: irei.com/news/hines-dou… #MarketingCommunication #Hines #RealEstate

Is it time to build or buy? The latest report from our research team suggests it might be time for both. Read it in full on our website: bit.ly/4mJ4NTM #Hines #Research #RealEstate

Today, we’re unveiling the now-completed South Station Tower in Boston, a shining example of a true public-private partnership and a new standard for best-in-class live, work and play developments. While the project is a nod to the historical importance of the South Station…

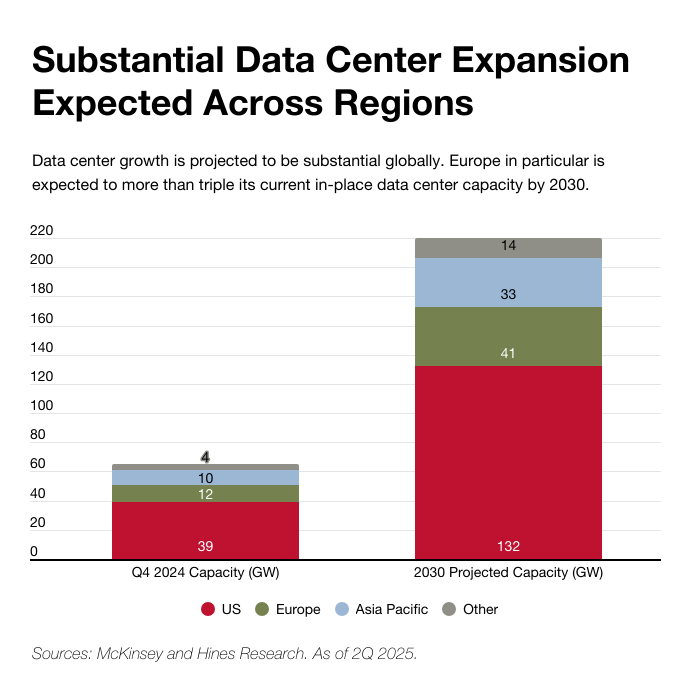

Hines Research estimates that 40,000 acres of powered land—almost 2 billion square feet—are needed to support current projections for data center growth over the next 5 years. In a recent report we present evidence that there’s significant (and one could argue challenging)…

How well do you understand the powered land investment opportunity? Read more in the latest Perspectives piece from Hines Research: bit.ly/4n7gqVu #RealEstate #PoweredLand #Investing

United States Trends

- 1. Skubal N/A

- 2. #AEWDynamite N/A

- 3. Jokic N/A

- 4. Knicks N/A

- 5. Brunson N/A

- 6. Tigers N/A

- 7. Andrade N/A

- 8. Trey Murphy N/A

- 9. Bridges N/A

- 10. Framber N/A

- 11. NASCAR N/A

- 12. Ryan Preece N/A

- 13. Brandon Garrison N/A

- 14. Double OT N/A

- 15. Mitchell Robinson N/A

- 16. Brody King N/A

- 17. Jamal Murray N/A

- 18. Daytona N/A

- 19. #SistasOnBET N/A

- 20. #TheMuppetShow N/A

You might like

-

Commercial Property Executive

Commercial Property Executive

@CPExecutive -

JLL

JLL

@JLL -

Bisnow

Bisnow

@Bisnow -

NAIOP Corporate

NAIOP Corporate

@NAIOP -

GlobeSt.com

GlobeSt.com

@GlobeStcom -

Colliers

Colliers

@Colliers -

Nareit

Nareit

@REITs_Nareit -

Marcus & Millichap

Marcus & Millichap

@MMREIS -

Prologis

Prologis

@Prologis -

France Media, Inc.

France Media, Inc.

@REBusiness -

Berkadia

Berkadia

@Berkadia -

ICSC

ICSC

@ICSC -

Transwestern

Transwestern

@Transwestern -

CREW Network

CREW Network

@CREW_Network -

Inland Group

Inland Group

@InlandGroup

Something went wrong.

Something went wrong.