The Institutional Limited Partner

@holistic_pm

Institutional Investor. Private Markets (PE, PD, Infra, Real Estate): €1Bn+ invested. Primaries & direct Secondaries. Sharing insights on markets, deals & GPs

Bạn có thể thích

This is the story of the most profitable private equity buyout of all time and it’s French 🇫🇷 Company : Polyplus-Transfection Sector : Healthcare 💊 Sponsor : Archimed Here is a thread on how Archimed achieved a 300x MOIC on its initial investment 🧵👇

Anyone involved in financing secondary deals? Would need a small NAV loan (approx $10million) (25-35% LTV) on a diversified collateral (100% buyout).

That’s 100% true. We sold a direct lending fund earlier this year at 99, 5% of NAV. The problem with private debt secondaries is that the remaining duration is very short, and you don’t have any upside, which means your ultimate multiple is made of 1 or 2 years of interest…

Great article on the state of private credit secondaries market (when funds buy assets from other funds) TLDR: - private credit secondaries are booming (volume expected to triple by EOY from 2023) - discounts are shrinking - don't expect home run returns (due to high entry…

📈H1 2025 Portfolio Performances 💵Private Equity: -0, 8% 🚝Infrastructures : +3.5% 🏢Real Estate: +0, 2% (o/w 3% cash yield / -2, 8% NAV decrease) 💰Private Credit: +2, 25% ( o/w 3.25% Cash yield, -1% NAV decrease) Not a good first half of the year.

I attended a private market conference last week, and I can tell you that the frontier between public and private markets is becoming increasingly blurred. For instance, Blackstone is aggressively pitching its “Private Investment Grade” solution. They originate IG private loans…

🚨Opportunity - Direct co-investment opportunity (no fee, no carried interest) in a company we invested in 3 years ago. Key characteristics : Maritime / Shipping industry 🚢 Modern and eco fleet of Gas Carriers and Offshore Wind Service vessels long-term chartered to IG blue…

The current state of the secondary market is summed up by a broker in his Q3 market update 👉”For years, venerable institutional secondary managers have enjoyed rich returns, underpinned by disciplined underwriting. Those times are over. Performance has been sacrificed on the…

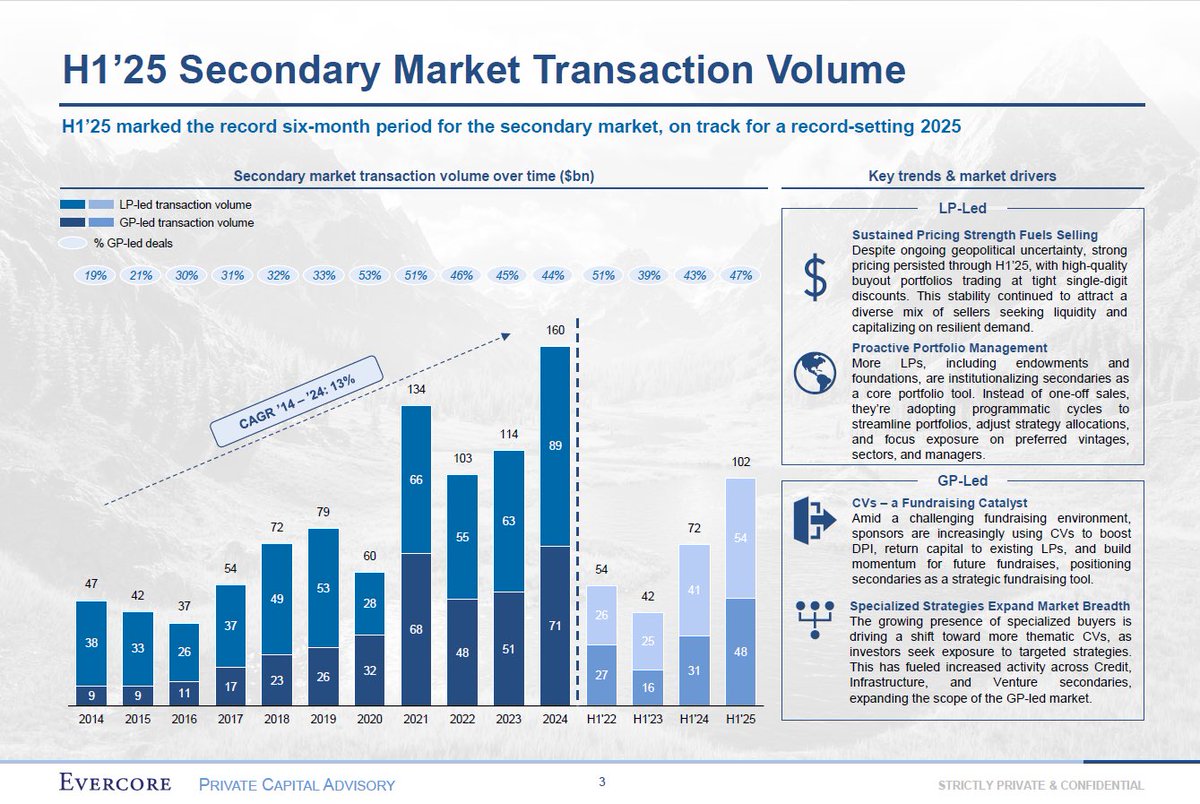

I’ve often said that evergreen funds are distorting secondary pricing and overpaying, especially for LP-led deals. But here is the evidence from Evercore. Evergreens are overbidding by up to 25% point above traditional closed-end secondary players. That is going to end in very…

Thanks god, the market is healing!

In the last 12/18 months, I’ve also noticed a clear trend regarding GP-led. It is the penetration of continuation vehicles in the lower end of the market. Once reserved for UMM/ large cap companies, they’re now adopted by MM or LMM players.

Evercore H1 2025 Secondary report has some interesting data about the market. Some that caught my attention 👇 1Record volumes totalling clearing more than $100Bn with a balance between LP and GP-led deals 2As discussed often on my account and confirmed by Evercore’s data,…

Apollo is buying Athletico Madrid from Ares, which makes a stellar return on its 2021 investment. Here are some peers comp deals in the European Football universe

Secondaries fundraising broke a record in H1 2025, $80Bn were raised!

I will add that endowments mostly invest in brand-name GPs, which are « flow names » in the secondary market. They are literally priced by all the market participants. People have no clue how competitive the market is for this type of LP stakes. There are secondary players out…

This is just non-sense. Below are the pricing for secondary buyout trades in 2024. Sure there is a discount. But it is pretty small. I also have a hypothesis that most sellers are selling the GPs they no longer want to work with. So likely there is a bias towards the less…

A STORY OF LEVERAGE—I attended the AGM of a lower mid-cap PE fund today and had a fascinating talk with the founder of one of the portfolio companies. He told me how being unlevered allowed him to crush his competition during a market downturn. In 2010, the guy founded a…

I know a guy who owns a bunch of good quality real estate in Paris, portfolio appraised by « independent valuation » firms like CBRE, JLL… Needed liquidity —> gave sell mandate to CBRE and others… The best bid he received was 20% below the lowest mark…

PAI Partners exiting Froneri through a second continuation fund A CV on a CV…

United States Xu hướng

- 1. Good Sunday 52.5K posts

- 2. Discussing Web3 N/A

- 3. #sundayvibes 4,625 posts

- 4. #HealingFromMozambique 19.6K posts

- 5. Wordle 1,576 X N/A

- 6. Miary Zo N/A

- 7. Blessed Sunday 17.2K posts

- 8. Trump's FBI 11.5K posts

- 9. Biden FBI 18K posts

- 10. Coco 47.7K posts

- 11. KenPom N/A

- 12. #ChicagoMarathon N/A

- 13. Macrohard 9,567 posts

- 14. Gilligan 7,070 posts

- 15. The CDC 32.4K posts

- 16. Dissidia 7,641 posts

- 17. God is Good 47K posts

- 18. Go Broncos 1,290 posts

- 19. Nor'easter 1,715 posts

- 20. Pegula 5,678 posts

Bạn có thể thích

-

Timothy Lewis - Compound Ventures

Timothy Lewis - Compound Ventures

@TheTimLewis_ -

iPROTECTinsurance

iPROTECTinsurance

@iPROTECTinsured -

JB - Fractional CFO

JB - Fractional CFO

@NetWorthFocus -

ExcessDefaults

ExcessDefaults

@ExcessDefaults -

Ross J Brown

Ross J Brown

@RJB_Financial -

John Lovell

John Lovell

@John_Lovell_III -

MarkETR

MarkETR

@mdsmaldon -

Andrew Coye

Andrew Coye

@andrewcoye -

C.S. Garrand

C.S. Garrand

@Econghost -

Garrett Arms

Garrett Arms

@ArmsGarrett -

Rob Kelly

Rob Kelly

@RobertKelly32 -

Andrew Glisson

Andrew Glisson

@AndrewGlisson -

Flume Cap

Flume Cap

@flumecap -

SMD

SMD

@VCDaBear -

Steve Stephens

Steve Stephens

@SteveSt73126236

Something went wrong.

Something went wrong.