Hyperithm

@hyperithm

Crypto-native digital asset manager based in Tokyo and Seoul | Backed by @hashed_official @coinbase @SamsungNext | Curating on @morpholabs

You might like

You can now deposit @strata_money x @pendle_fi assets and borrow USDC on our @MorphoLabs Vault! More to come. Stay tuned :)

Season 1: the 🦋 effect begins Strata x @pendle_fi assets are LIVE on the @MorphoLabs Hyperithm USDC Vault. Borrow USDC against: ✦ PT-srUSDe ✦ LP-srUSDe ✦ LP-jrUSDe ✦ jrUSDe Explore our Morpho markets, curated by @hyperithm 🧵👇

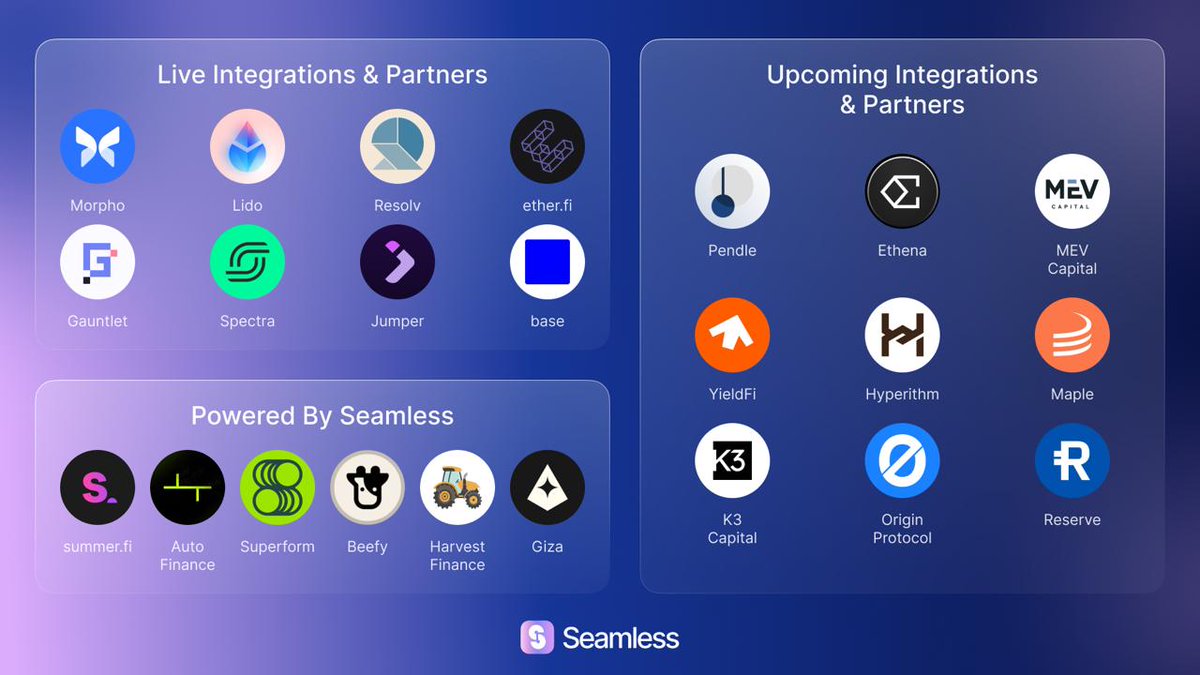

Thank you to our many partners helping bring Leverage Tokens alive! w/ audits from @cantinaxyz and @sherlockdefi ✅ Plus an ongoing live bug bounty with Sherlock 👾 @MorphoLabs @LidoFinance @ResolvLabs @ether_fi @gauntlet_xyz @spectra_finance @JumperExchange @base @pendle_fi…

Looking for an easy way to lend on @WildcatFi? 👀 Without the hassle of selecting each borrower and rebalancing your loans? Look no further, check out our new vault powered by @upshift_fi app.upshift.finance/pools/1/0x18EE… Earn competitive yield by financing credit lines to @SeliniCapital…

Babe wake up! A new Clearstar vault just launched! Tired of earning less than 10% lending against BTC and ETH? Wildcat solves this by bringing uncollateralized loans onchain, where borrowers can source capital without being at risk of liquidation. To most that would sound…

Today, DeFi & TradFi converge into a new primitive. Strata mainnet is LIVE✨ app.strata.money Strata democratizes access to crypto-native returns via scalable, composable structured products designed for tailored risk-reward exposure. From @ethena_labs USDe to beyond.

$mHYPER remains unaffected by market volatility After thorough analysis and investigation, we confirm there has been no decrease in value of $mHYPER following yesterday’s market volatility. This stability was only possible thanks to Hyperithm’s disciplined risk management and…

The past 10 hours have been a huge test of the resilience of our curation model. All markets that Hyperithm-curated vaults on @MorphoLabs allocate into remained healthy — 0 bad debt, and all lenders kept whole. This is another testament of our effective risk management and…

You can use PT-mHYPER as collateral on @MorphoLabs Arbitrum :)

PT-mHYPER (20 Nov 2025) expands to @arbitrum via @pendle_fi cross-chain PT bridge. Now listed as collateral on @MorphoLabs Arbitrum, with USDC liquidity available from @hyperithm vault.

4/ From day one, NUSD and sNUSD will launch on @pendle_fi, @MorphoLabs, and @eulerfinance, giving users instant access to trading, lending, and borrowing. Neutrl is also working with respected curators: @k3_capital, @MEVCapital, and @hyperithm.

Cap has passed $200M in total value locked! TVL breakdown: $183M in $USDC collateral for cUSD $30M in @symbioticfi delegations from @hyperithm @MEVCapital @RenzoProtocol @ConcreteXYZ and @Re7Labs

GmHyper 💪

gmHyper 🫡 PT-mHyper is now live on Arbitrum Chain. 💪 You can now bridge your PT to supported chains (ETH <-> ARB) on @pendle_fi Borrow USDC against your PT-mHyper, using liquidity from PT-mHyper/USDC market. Link : app.morpho.org/arbitrum/marke… More to come. Stay tuned :)

United States Trends

- 1. John Bolton 71.4K posts

- 2. #NationalBreadDay 1,169 posts

- 3. Asheville 5,379 posts

- 4. Ace Frehley 2,298 posts

- 5. Putin 183K posts

- 6. #KonamiWorldSeriesSweepstakes 2,027 posts

- 7. Steelers 25.3K posts

- 8. Mitch 51.4K posts

- 9. Curt Cignetti 5,812 posts

- 10. Term 195K posts

- 11. Andrade 12K posts

- 12. Espionage Act 11K posts

- 13. #2025MAMAVOTE 1.7M posts

- 14. Former Trump 21.8K posts

- 15. Carter Hart 4,343 posts

- 16. Smartmatic 2,954 posts

- 17. AJ Green 1,241 posts

- 18. Nissan 4,997 posts

- 19. Dairy Bird N/A

- 20. Jaylen Warren 1,312 posts

Something went wrong.

Something went wrong.