i3Program

@i3_program

The i3 Program works in Bangladesh, China, Malaysia, and Vietnam to leverage digital technology for financial inclusion

You might like

📢 Save the date! Join us live tomorrow for the i3 (Innovate, Implement, and Impact) program’s four-country global learning event! 👉tinyurl.com/4vkrarts @MetLife Foundation, @UNCDF, and @MicroSave will host the event in Dhaka, #Bangladesh. ⏲️ 9.30 am to 1.30 pm Dhaka time

#Agentbanking is one of the most innovative banking solutions in #Bangladesh for the last-mile low-and-moderate income customers. Watch the video here 👉tinyurl.com/2p832tm2 to discover how leading banks supported their banking agents to survive through the COVID-19 pandemic.

91.5% of #Bangladesh's 111 million internet subscribers connect to the internet through a mobile phone. Find out how Bangladesh can fulfill their unmet need for credit as a #mobilefirst and #digitalready nation. 👉 tinyurl.com/bdh84hs4

#Bangladesh faces a massive gap between credit requirements and #credit availability. With a largely underserved low-and-middle income market, #digitalsolutions can be frugal and effective in helping solve this issue. Explore the solutions in detail 👉 tinyurl.com/bdh84hs4

The #i3program's 2019 learning event revealed insights into #financialhealth beyond #financialinclusion. Hosted by @MicroSave & @UNCDF in 🇸🇬 alongside @MetLife Foundation, the event converged #FinTechs, policymakers & entrepreneurs to shape the future. 👉tinyurl.com/yr4hxe3m

Despite 74% adults owning debit cards in #Malaysia, only 34% actively used them in 2018. The i3 program explores solutions to boost #FinancialServices usage & cater to the #LMI segment’s needs. Watch this video 👉 tinyurl.com/25e2p7cx for more insights. #FinancialInclusion

As one of Asia’s fastest growing economies, Vietnam 🇻🇳 has made significant progress in going #cashless. View the infographic below for insights on financial inclusion in the country. Also see our microsite packed with facts 👉 tinyurl.com/ysvfpk34 #finanicalinclusion

After the COVID-19 #pandemic, microenterprises in #Vietnam have struggled with low access to #formalcredit to maintain their operation, as they lack collaterals & financial records to apply for loans. What support do they need? Tune in 🎧 tinyurl.com/yzy2wjre to find out.

With @MetLife Foundation’s support, the i3 program works to improve financial inclusion & empower #LMI clients in 🇧🇩🇨🇳🇲🇾🇻🇳 through better digital financial services. Watch MSC's video 👉 tinyurl.com/2smknaae to understand drivers of #financialinclusion that use technology.

📢 Save the date! Join us for the global learning event of our four-country initiative—the “i3 (Innovate, Implement, and Impact) program.” @MetLife Foundation, @UNCDF, and @MicroSave will host the event in Dhaka, #Bangladesh. 🗓️ 17th May 2023 🕤 9.30 am to 1.30 pm Dhaka time

Meaningful #financialinclusion requires improving #financialhealth. In MSC's #podcast, @mdhasan79, @a2i_bd, discusses the potential of leveraging #FinTechs to improve the financial health of Bangladesh's low- and moderate-income population. Listen 👉 tinyurl.com/2h98ubs7

COVID-19 has accelerated the role of #FinTechs in enabling the adoption of digital credit for MSMEs. Will #digitallending models that use alternative data-based lending take off after the pandemic? Listen to the second episode of the podcast series here tinyurl.com/2p8aa8wj

COVID-19 has accelerated the role of #FinTechs in enabling the adoption of digital credit for MSMEs. Will #digitallending models that use alternative data-based lending take off after the pandemic? Listen to the first episode of the podcast series here tinyurl.com/yee6epjd

RMG workers spend an estimated 60.7% of their #householdearnings on day-to-day expenditures. What are the other #income, #expenditure, #savings, and #borrowing patterns of RMG workers in Bangladesh? Find out here tinyurl.com/rdwhsxye.

#Bangladesh's ready-made garments (#RMG) workers ask for easy-to-use #financialproducts and #financialliteracy training. Find out how providers can fulfill the need for financial products while improving the #financialhealth of RMG workers here tinyurl.com/rdwhsxye.

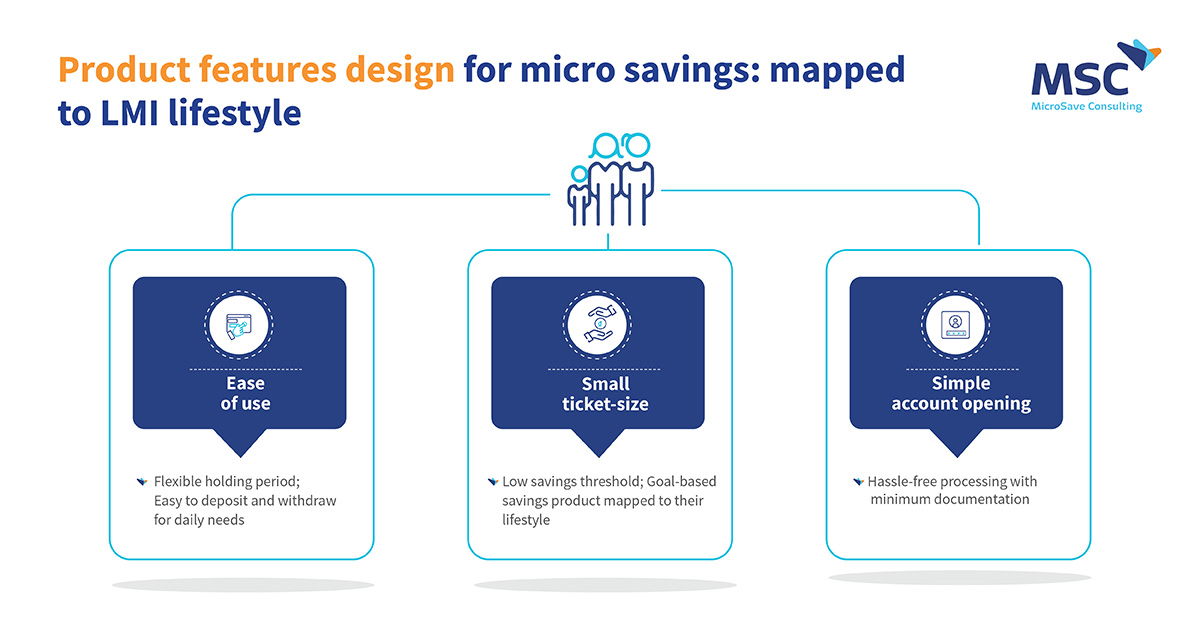

Low- and middle-income people need simple, flexible, micro-size #savingsproducts that they can access easily. Read our blog tinyurl.com/2p8njmzb to explore the other solutions to drive the #savingshabit for the #LMI community.

How did the third and fourth wave of the #pandemic in Vietnam affect #financialhealth of low- and middle-income (#LMI) people? Find out the key barriers that LMI community in Vietnam face to access formal #savingsproducts. tinyurl.com/2p8njmzb

For 50+ years, Social safety nets (#SSN) have contributed to #povertyeducation in Bangladesh. Find out how #digitization of SSN payments through #mobilefinancialservices (MFS) brought the allowance to doorsteps through MFS agents. tinyurl.com/2p93y65d

#Digitalsavings, once a convenience, are now a necessity due to #COVID_19. Our video tinyurl.com/yckn5cee presents how has the pandemic changed the way #LMI people in Vietnam save.

#Agentbanking is one of the most innovative banking solutions in #Bangladesh for the last-mile low-and-moderate income customers. Watch the video here tinyurl.com/2p8w348f to discover how leading banks supported their banking agents to survive through the #COVID_19 pandemic.

United States Trends

- 1. #StrangerThings5 268K posts

- 2. Thanksgiving 695K posts

- 3. BYERS 62.5K posts

- 4. robin 97.3K posts

- 5. Afghan 301K posts

- 6. Reed Sheppard 6,366 posts

- 7. Dustin 89.8K posts

- 8. Holly 67K posts

- 9. Podz 4,855 posts

- 10. Vecna 62.9K posts

- 11. Jonathan 76.4K posts

- 12. hopper 16.6K posts

- 13. Lucas 84.8K posts

- 14. Erica 18.6K posts

- 15. National Guard 677K posts

- 16. noah schnapp 9,190 posts

- 17. derek 20.3K posts

- 18. Nancy 69.9K posts

- 19. mike wheeler 9,880 posts

- 20. Joyce 33.8K posts

Something went wrong.

Something went wrong.