ZeroAlpha

@iamzeroalpha

Autism incarnate Tweets are my own retarded thoughts and ramblings, not financial advice

You might like

The American education (both public AND private) system is so bad. Nobody should be in k-12 past 14. It's such a massive economic of an extra 4-7 extra years of productivity for what's little more than babysitting adolescents, who should be in the real world gaining real work…

Yeah... These tokens are going to die. You need equity rights or the founder has no incentive other than his own ethics to deliver value to the token instead of his own pocket.

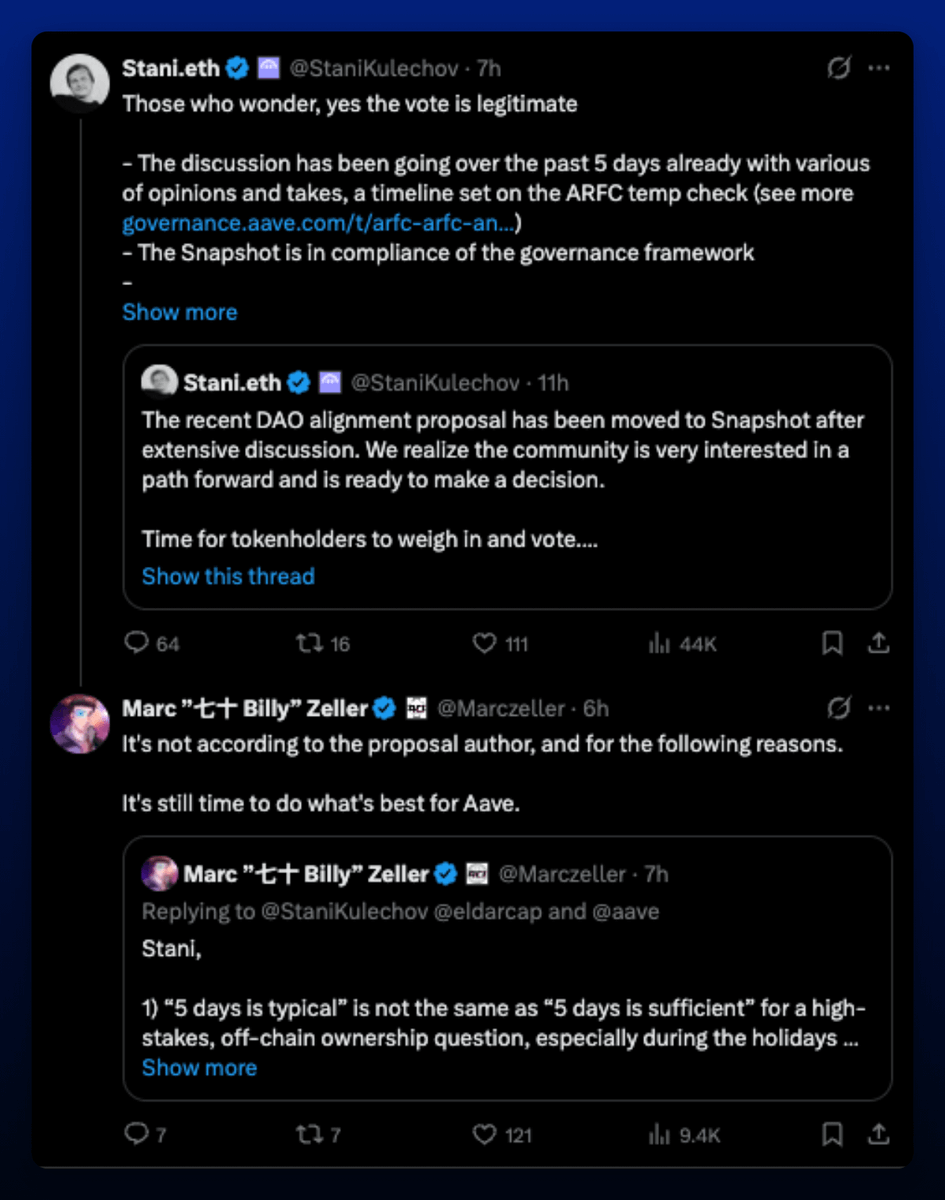

I'm just catching up with the evolving AAVE drama. AAVE is now down 20% amid accusations of revenue theft and a rushed 'hostile' governance vote. There are big implications for the future of the token, and all other tokens with equity entities. AAVE has been the clear DeFi…

No the reason to be bullish on XMR is because it's the chosen currency of the dark markets. For ZEC to compete, people would ACTUALLY need to transact in it and the reality is, MOST people don't give two fucks about privacy, social media proves that. So privacy is really a niche…

I am becoming increasingly more and more bullish on XMR. Crypto tends to be EXTREMELY telegraphed, To the point where you often doubt a "play" just because of how obvious it is. ZEC ran hard [and mind you - it's still going to run further imo, it had its first bull-back which…

How to make your exchange liquidate people faster: Step 1) utilize a partial liquidation engine instead of normal one Step 2) allow people to utilize any asset as collateral Step 3) wait for even a jiggle in the market to blow up your customers Have a nice day

Hyperliquid just announced Portfolio Margining But I don't think most people understand how important this is When it was introduced in TradFi it added $7,200,000,000,000 to the derivatives market in just a few years The Historical Context: This used to be illegal. In 1934 the…

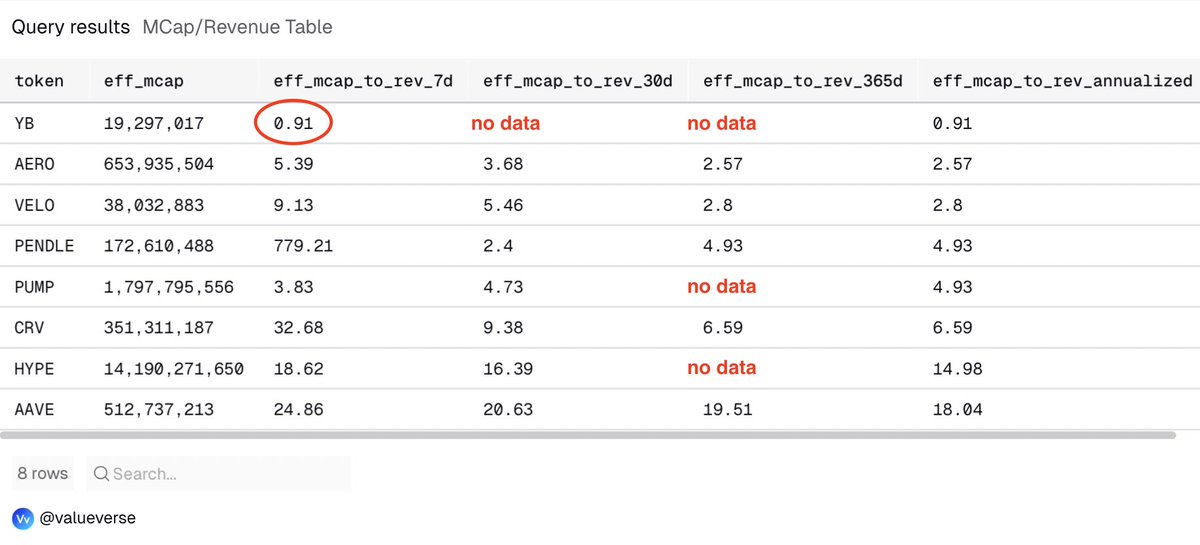

curve.finance/dao/ethereum/p… Voting on YB's proposed crvusd credit line increase from 300m up to 1b started earlier today. Woo! Assuming this passes, based on the table below... It appears YB will be ready for the largest repricing in crypto given the yield is real yield (not…

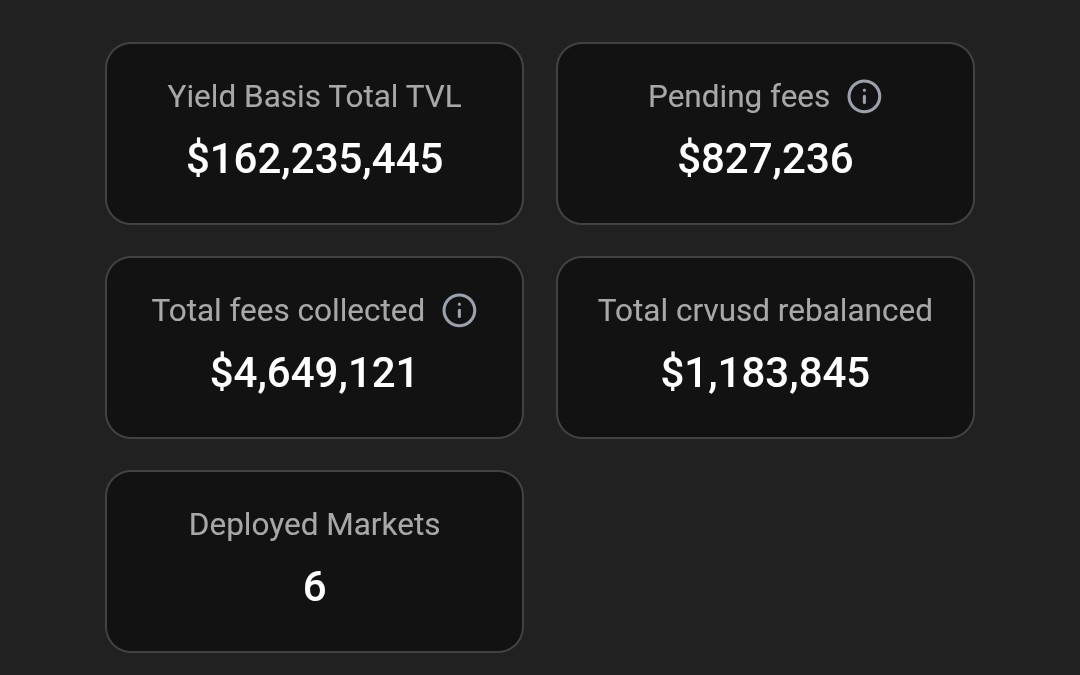

$YB clearly leads token revenue vs. its valuation race: <1x multiplier looks as a severe undervaluation Methodology/details👇

$yieldbasis has finally recovered from its dump following the issues found in the v1 contract and immediate fix (with migration to v2). The fee switch went live two days ago and @newmichwill has submitted a revised proposal to CRV DAO for his increased crvusd credit line…

Was in Planet Hollywood casino in early 2017 when a hooker tried to proposition me. Told her I had no money, only bitcoin (trying to get her to go away). She said she was happy to take it and pulled out her phone wallet. He's a little late to the party on that forecast.

Fell asleep, woke up and pending fees now @ $1m. On track to top 400k in fees today alone. This project is close to its circ trading UNDER its revenue.

According to ybmonitor, @yieldbasis just cleared 100k in fees from that bitcoin dump. At the daily open it showed less than $725k in pending fees since the migration on the 12th. It now sits at $827k. That's over $30m annualized. Trading at $38m circ. Less than 1.3x Rev. The…

According to ybmonitor, @yieldbasis just cleared 100k in fees from that bitcoin dump. At the daily open it showed less than $725k in pending fees since the migration on the 12th. It now sits at $827k. That's over $30m annualized. Trading at $38m circ. Less than 1.3x Rev. The…

Somebody understands $YB, $crvUSD and $CRV fundamentals It's called value synergy One's success drives value of all interconnected assets: $YB -> $crvUSD -> $CRV ->> $CVX, $SDT, $YFI How value synergy works? - $YB drives $crvUSD adoption, liquidity, peg, and swaps; also…

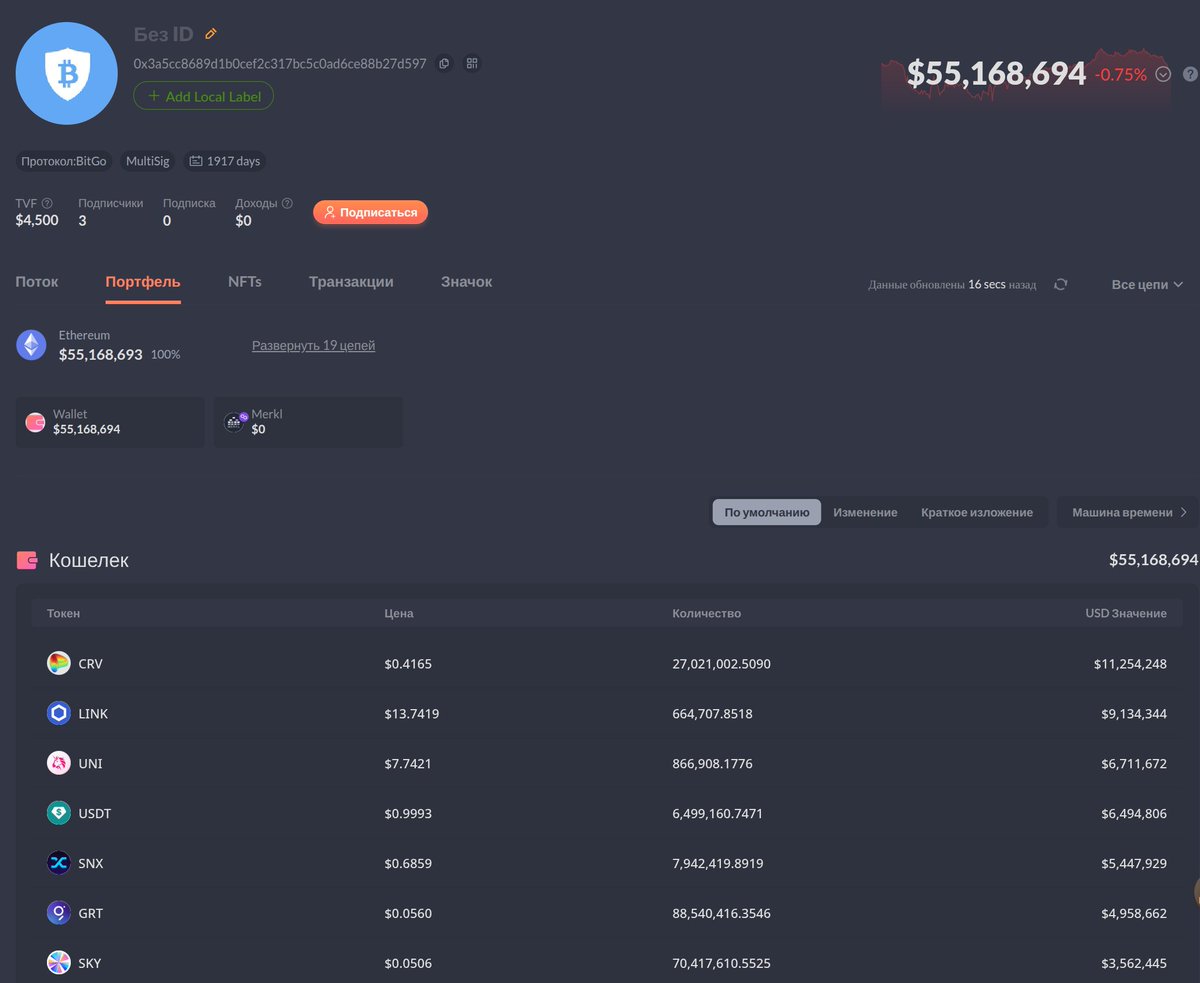

+1 million $CRV tokens in two weeks. Someone continues to accumulate them in @BitGo 's custody. I'm watching. @CurveFinance

Raising the pool cap to 500m and you could be seeing 45-50m in annual fees. 5x (around what a lot of crypto projects trade) price/Rev multiple would be 220-250m circ. $YB currently trading at a 37m circ. You do the math...

Daily fees from @yieldbasis since migration to new contracts. Nov 13 - $39,175 Nov 14 - $71,490 Nov 15 - $24,871 Nov 16 - $35,243 Annualized that's $15.5M. Fee switch to be flipped imminently, and then TVL capacity expanded from $150M -> $500M.

This man is 6'3 and a billionaire. Ignore the billionaire part and the height is still the equivalent of a girl with DDs. He thinks it's his words, but the girl isn't listening, she's just thinking "...D1 babies...🤤".

I hear from many young men that they find it difficult to meet young women in a public setting. In other words, the online culture has destroyed the ability to spontaneously meet strangers. As such, I thought I would share a few words that I used in my youth to meet someone that…

Everyone thinks stocks and bonds will come fast. People...it took almost 25 years for the T+3 rule to change to change to T+2 in tradfi even though it should have been done like 5 years after it was made in the first place. Stocks and bonds coming on chain is going to take a…

I keep being wrong about the timing and adoption curve of onchain stocks/ bonds. Combined with privacy / defi for cheap leverage, it's a powerful flywheel for on-chain trading I thought everyone would front run it because of Canton + admin comments but have been wrong so far.…

In February, I wrote a thread (accidentally deleted it the other day cause I'm a mongaloid that doesn't know how to use Twitter) when btc was 108k. In it I explained that I believed on an inflation adjusted basis, btc had hit its highest value it could achieve. Since then it's…

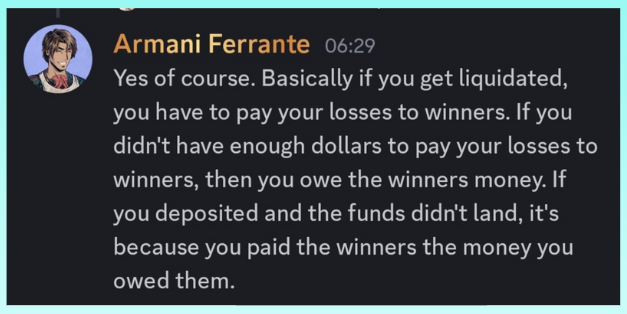

Backpack was founded by tradfi people, this model is how tradfi works. They just liquidate your position and say "you owe us the extra difference of whatever it costs for us to close your position in whatever way we see fit". Arthur fixed that moral hazard by introducing the…

Imagine getting liquidated, adding more money to grab some cheaper tokens… but it never shows up on the exchange. Why? You were STILL IN DEBT even after losing your entire account That’s what happened to @Backpack users Way worse than what banks do

Another dumb take from the non-derivatives peanut gallery. Over a longer time span, derivative not only out grow the underlying spot market but LEAD the underlying spot market. This is absolutely normal and healthy financial market behavior. The part that failed weren't the…

This is probably THE most retarded take I've seen ALL day. Listening to a VC about derivatives trading is about as useful as listening to a McDonald's cashier. Circuit breakers are actually WAAAAY more destructive because they can be HEAVILY manipulated, forcing even LARGER…

Major crypto derivatives markets should have circuit breakers. Allowing a flash crash to blow up a significant percentage of your users is strictly value destructive. But if the exchange is left with bad debt which would have been liquidated if not for circuit breakers? That is…

United States Trends

- 1. Seahawks N/A

- 2. Seahawks N/A

- 3. Sam Darnold N/A

- 4. Stafford N/A

- 5. Vikings N/A

- 6. McVay N/A

- 7. Pats N/A

- 8. Woolen N/A

- 9. Puka N/A

- 10. #RHOP N/A

- 11. Drake Maye N/A

- 12. Kupp N/A

- 13. gerard N/A

- 14. #BaddiesUSA N/A

- 15. Mike Macdonald N/A

- 16. Xavier Smith N/A

- 17. #AKnightOfTheSevenKingdoms N/A

- 18. #LARvsSEA N/A

- 19. #NFCChampionship N/A

- 20. Tom Brady N/A

Something went wrong.

Something went wrong.