Intermarket Flow

@intermarketflow

Markets move. We read the story behind it. Macro, intermarket & technical analysis — all in one. Real setups. Real trades. Real edge We love this. Join us!

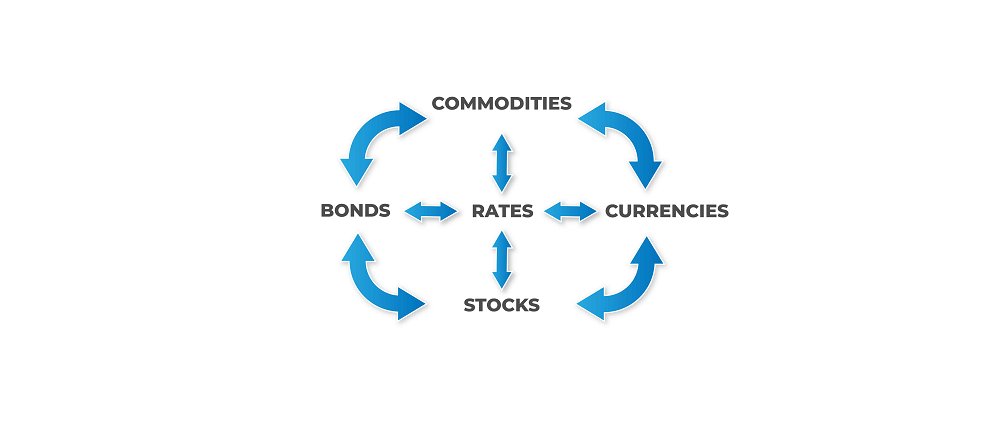

This account is for you if you understand that capital doesn’t move in isolation—and its likely destinations within financial markets are few: equities, bonds, commodities, and currencies. All linked through interest rates. Jump in. We love this stuff.

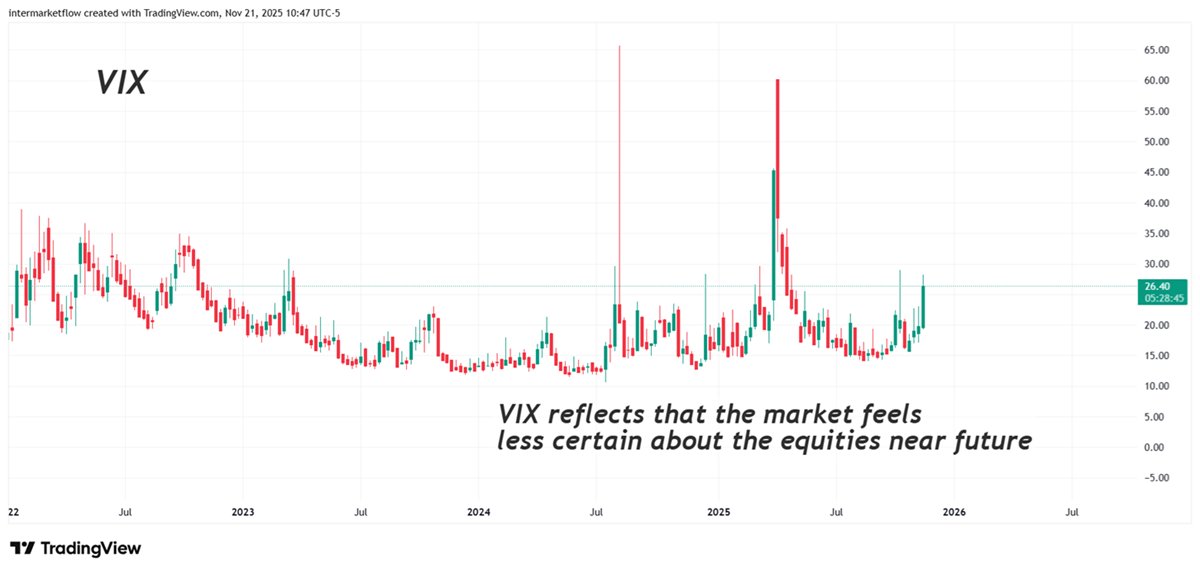

Uncertainty can’t be touched. Fortunately, the market gives us plenty of tools to figure out where it is. Is it broad-based? Is it limited to a single asset class? Is it systemic? The market has the tools to help you understand exactly that — and we’ll break them down here…

Recession and stagflation look similar, but trading them is a different game. A recession has a clear playbook; stagflation doesn’t—because the “right” approach keeps shifting as each sector gets hit in its own way. More on this here intermarketflow.com/77-the-macro-s… #bigbanks #spy…

Trading means constantly choosing the right vehicles. One methodology that helps is breaking them down by profile: small vs. large caps, high-beta or not, the sector they operate in, and the income level of their target consumer. More on this here intermarketflow.com/4-technical-an……

Another great chart. It would be a shame to let a chart die in a folder without giving others the chance to see it. Remember, Discretionary stocks are the most exposed in a Stagflation environment, especially those targeting the low and middle-income sector. #spycorrection…

Another chart from the same setup — beautiful. Subscribe to receive the full setups. intermarketflow.com/newsletter/?ut…

It would be a shame to let these charts fade into the background. This one is beautiful — we looked at it earlier this week. We’re still building out the full technical setup. There’s work ahead. Subscribe here and let’s learn together intermarketflow.com/newsletter/?ut… #five…

At this stage, the challenge for every trader is recognizing whether we’re in a deceleration, a recession, or stagflation. It matters, because all three phases are traded completely differently. Here’s this week’s inter-sector view — volume and returns. Subscribe here for more…

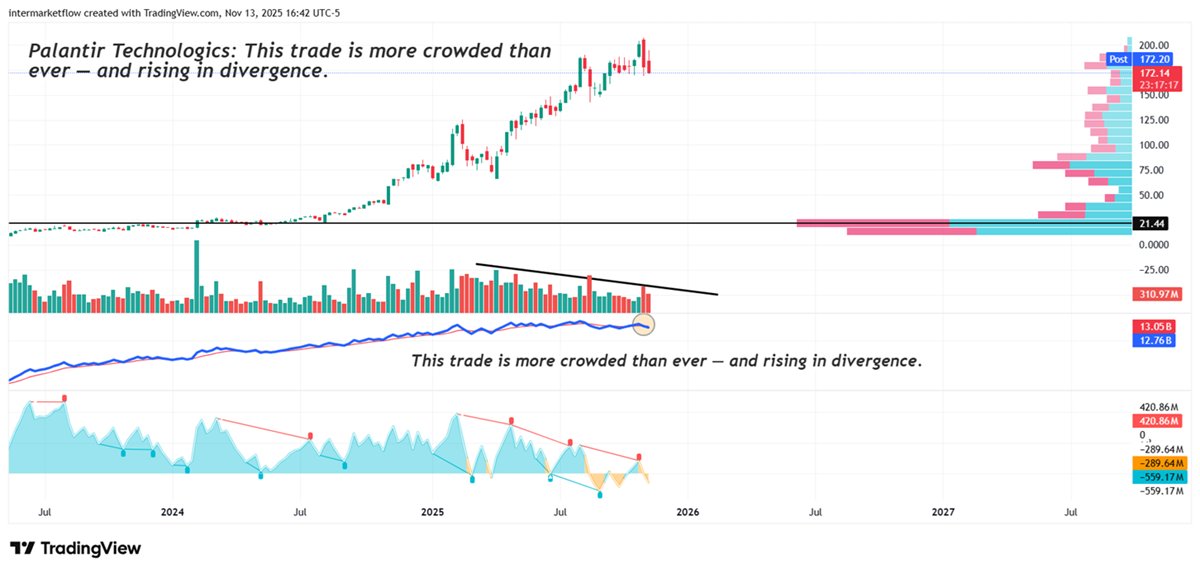

Updated Burry’s trade. We broke it down a few days ago from a technical perspective — and it’s a gem. I don’t think Burry is the kind of trader who relies on technical analysis, but the setup is absolutely beautiful. #barryshort #bigshort #technicalanalysis

"to drive a 10% return on our modeled AI investments through 2030 would require $650 billion of annual revenue into perpetuity which is an astonishingly large number. For context that equates to $180/month from every NFLX subscriber"- JPM That's why Sam is begging for a bailout

It’s Friday… you can tell... Have a great weekend

We’re continuing to analyze Michael Burry’s trade from a technical standpoint. I don’t think I’ve ever seen oscillators this beautiful. Miles ahead — we stopped to rest and eat. As if that weren’t enough, they’re also in divergence. They’re simply sexy.

United States Trends

- 1. #GMMTV2026 3.03M posts

- 2. Good Tuesday 31.2K posts

- 3. MILKLOVE BORN TO SHINE 468K posts

- 4. #tuesdayvibe 2,358 posts

- 5. WILLIAMEST MAGIC VIBES 62.8K posts

- 6. Mark Kelly 221K posts

- 7. Barcelona 170K posts

- 8. #DittoSeries 86K posts

- 9. TOP CALL 9,770 posts

- 10. JOSSGAWIN MAGIC VIBES 27.1K posts

- 11. Alan Dershowitz 3,537 posts

- 12. MAGIC VIBES WITH JIMMYSEA 81.1K posts

- 13. AI Alert 8,536 posts

- 14. #ONEPIECE1167 9,004 posts

- 15. #JoongDunk 123K posts

- 16. Maddow 16.2K posts

- 17. Hegseth 102K posts

- 18. Naps 2,987 posts

- 19. Unforgiven 1,236 posts

- 20. Check Analyze 2,590 posts

Something went wrong.

Something went wrong.