Jack

@jackanthonyhere

Foil Lord 5000

You might like

This is bang on. The roundabout theory is that, currently only Wall Street happy. But initial feeling after news atm is - Wall Street wig out, Wall Street sell. Main Street starts to improve, Wall Street buy, both camps happy.

David Friedberg Predicts Trump's Master Plan On E218, the besties debated Trump's economic strategy, and what his endgame could be. @friedberg's most optimistic theory: the three-legged stool leg 1) tariffs -- encourages on-shoring of manufacturing -- increases supply chain…

Let him cook.

RFK Jr. breaks down the MAHA plan to reform USDA in 2 minutes: “We’re going to give farmers an off-ramp from the current system that destroys their health, wrecks the soil, makes Americans sick, and destroys family farms.” 1. “We’re going to REWRITE the regulations to give…

Elon’s purchase of Twitter was the single most consequential act of the last decade. It restored free speech, broke the Overton window, and enabled the second American revolution.

Hard hitting

In this market again….

Spirit Airlines $SAVE soars 30% in after hours trading

IQ200 Balaji mic drop

ALL IT TAKES IS ALL YOU GOT Wow, I love this so much. First, the debt didn't matter. Now, it still doesn't matter... Because the state can take all your assets to pay it! Here's the graph Brent cites: Below is that same graph with titles and labels[1]. See how it says balance…

![balajis's tweet image. ALL IT TAKES IS ALL YOU GOT

Wow, I love this so much.

First, the debt didn't matter.

Now, it still doesn't matter...

Because the state can take all your assets to pay it!

Here's the graph Brent cites:

Below is that same graph with titles and labels[1]. See how it says balance…](https://pbs.twimg.com/media/GJx4-zEakAA4trz.png)

![balajis's tweet image. ALL IT TAKES IS ALL YOU GOT

Wow, I love this so much.

First, the debt didn't matter.

Now, it still doesn't matter...

Because the state can take all your assets to pay it!

Here's the graph Brent cites:

Below is that same graph with titles and labels[1]. See how it says balance…](https://pbs.twimg.com/media/GJx54doakAEmYXM.png)

![balajis's tweet image. ALL IT TAKES IS ALL YOU GOT

Wow, I love this so much.

First, the debt didn't matter.

Now, it still doesn't matter...

Because the state can take all your assets to pay it!

Here's the graph Brent cites:

Below is that same graph with titles and labels[1]. See how it says balance…](https://pbs.twimg.com/media/GJx7nDdakAEbTfo.jpg)

![balajis's tweet image. ALL IT TAKES IS ALL YOU GOT

Wow, I love this so much.

First, the debt didn't matter.

Now, it still doesn't matter...

Because the state can take all your assets to pay it!

Here's the graph Brent cites:

Below is that same graph with titles and labels[1]. See how it says balance…](https://pbs.twimg.com/media/GJyAQnHbYAAak9h.jpg)

This was classified as technology in 1940. Today we assume tech as computer based

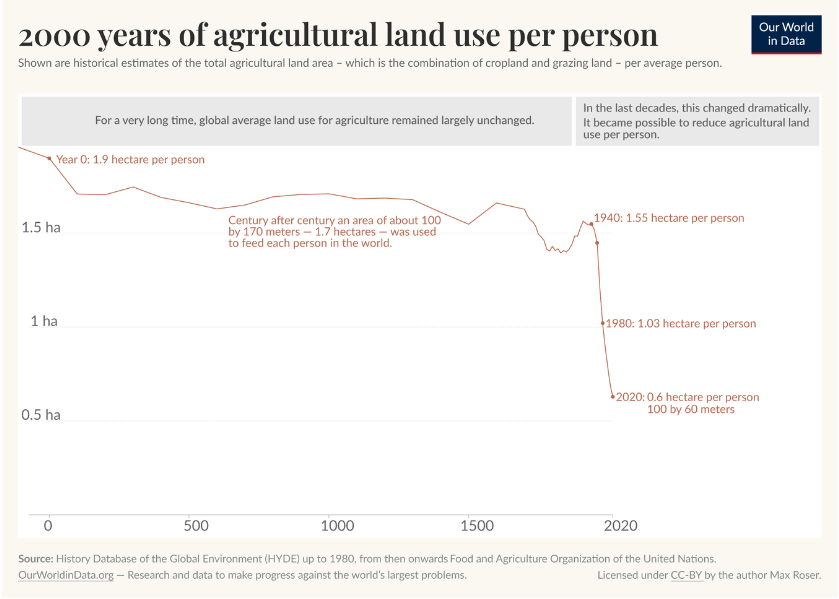

Usually in long-term graphs like this, you see the inflection point at the Industrial Revolution, but with agricultural land use it happens in 1940.

Just had one of the most profound experiences of my life… Just finished an incredible book The Maniac about genius John von Neumann and then spent an hour chatting naturally and verbally with ChatGPT about von Neumann, AI, the origins of RNA, computational biology, Directed…

When the lens of a camera tilts so that it is no longer parallel to the camera's image sensor, it shifts the plane of focus and alters the depth of field. This is a tilt shift viedw of the deserts and hills of Azerbaijan. [📹 Joerg Daiber]

Anyone know if there is any truth to this?

Charles Schwab owes 130% of their total equity capital to short duration FHLB loans that have to be paid back soon. Total assets $350 billion... There's your September Lehman Brothers.

Milestone: went unconditional on a commercial property transaction today. The GR is 8 figures. I’m quite risk adverse in the current climate, and I think this property transaction will return 40% on land cost within 4 months, whilst being within the allowable risk profile. Boom!

Cutting rates is not stimulus. It leads us to believe it is. Which might be actually stimulating, though. It’s actually admission to deflationary risk. Credit contraction likely follows at the lord creator of money, the banks, will be less likely to lend.

Property valuation and trends are always justified by the narrative of the time. Increased immigration, low levels of new stock being built due to the construction cost escalation. But this chart shows something different. Thoughts?

The fundamental problem in today's Housing Market is simple: Home Prices are growing way faster than Incomes. Real Home Prices up +102% since 1970. Real Incomes only up +26%. Something changed starting in early 2000s.

United States Trends

- 1. Porzingis N/A

- 2. Kuminga N/A

- 3. Skubal N/A

- 4. Warriors N/A

- 5. #AEWDynamite N/A

- 6. Jokic N/A

- 7. Hield N/A

- 8. Gonzaga N/A

- 9. Tigers N/A

- 10. Knicks N/A

- 11. Brunson N/A

- 12. Andrade N/A

- 13. Brandon Garrison N/A

- 14. Trey Murphy N/A

- 15. Valdez N/A

- 16. Bridges N/A

- 17. Double OT N/A

- 18. Fears N/A

- 19. Tingus Pingus N/A

- 20. Brody King N/A

You might like

Something went wrong.

Something went wrong.