𝐁𝐢𝐠 𝐬𝐚𝐯𝐢𝐧𝐠𝐬 𝐨𝐧 𝐞𝐯𝐞𝐫𝐲𝐝𝐚𝐲 𝐞𝐬𝐬𝐞𝐧𝐭𝐢𝐚𝐥𝐬 𝐰𝐢𝐭𝐡 #𝐍𝐞𝐱𝐭𝐆𝐞𝐧𝐆𝐒𝐓! With GST 2.0, taxes on common food items and household products have been reduced, making them more affordable. From milk and butter to biscuits, noodles, and even packed…

Some FMCG companies, as well as Quick Commerce platforms, are not passing GST benefits to consumers. Prices of daily use products remain the same as before GST implementation, with no reduction applied.

Stream, call, game, and work in even the most remote locations. Order online in minutes

प्रचार तो हो रहा पर उपभोक्ता को कोई लाभ नहीं मिल रहा.. यहां निचे...?

Atleast @jagograhakjago exists & tweeted even of for the Govt publicity. You never respond or take action against the consumer complaints which your dept is created for 😄

khud to pehle jag jao .... koi bhi consumer forum main complaint dalta hai to bona padhe hi dispose kar dete ho aur yahan @Flipkart jaise company consumer ko exploit karte rehte hain.. jo kaam hai wo karna nahin bas PR chalte rahe

Still cost of paneer/milk (packed ) by Amul/mother dairy on quick delivery apps are same as before implementation of GST 2

You forgot to mention, you have also reduced GST on notebooks from 12% to 0% . But then, notebooks became more expensive. You know, what scam you have done in this, and hence you want to hide this.

Amul gold buffalo milk on same price in old and new rate And show 0% gst Is before new slab GSTwas 0% on Amul gold and buffalo milk

Not as a professional, but as a common citizen and consumer, I truly believe that essentials like milk, ghee, biscuits, coconut water, and bottled water should be taxed at 0% under GST. In a country like India, where a large section of the population can barely afford these…

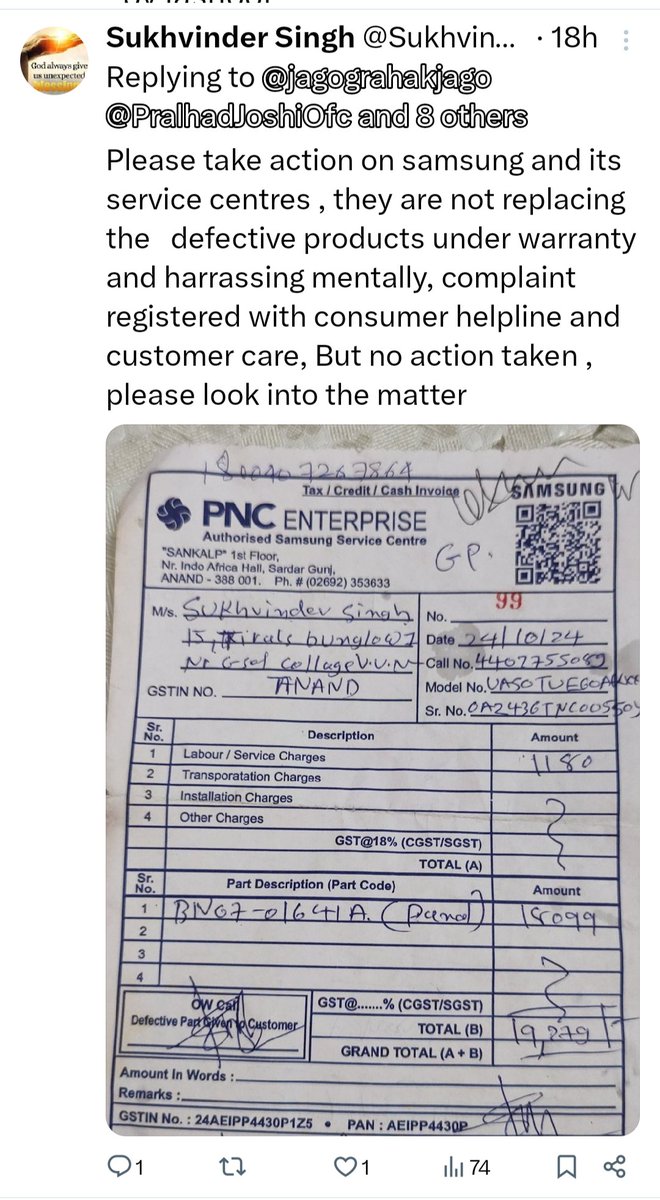

Samsung India is a fraud company, boycott samsung products

Did you know this? Medicines are sold at MRP in retail shops. 12% GST was applicable. Now, same medicine - same MRP, but less GST (5%). So retailer earns that 7% profit. How to get benefit of this?

But the selling prices of several products except for 4 wheelers or 2 wheelers have not decreased. Some of the product manufacturers increased the base price slightly to reap partial benefits of tax drop. Market reality. Some planning for increasing base price after Deepawali

Most consumable items by middle and lower class group Rice 1-25kg pack still 5% gst Aata 1-25kg pack still 5% gst

कुछ भी सस्ता नही हुआ है सब झूठ है ,इस सरकार ने पूंजीपतियों को खुश करने के लिए private कंपनी में कार्य करने वाले मजदूरों की आर्थिक रूप से हत्या की है..DA ( मंहगाई भरते को रोक कर रख दिया है..जिससे पूंजीपतियों को सीधे लाभ मिल है..और मजदूर त्रस्त हो गए है

In Mumbai building are not passing GST benefit to customer ..not reducing the flat price.. GST 2.0 helping big building owners

@FinMinIndia @narendramodi the gst benefit should pass to consumer from businessman who r not registered in gst , because cost is reduced so Govt should strictly try that benefit passes to consumer or not

Why not GST on Alcohol? Items which is eatable items for a human and good for health, GST charging so that a common man think lakhs of time to buy food items. But No GST on Alcohol, which is harm for health. Govt promoting to Alcohol in Market for damage of public health,.....

No benefits extended to consumer by online distributors moreover instead of increasing the quantity in packages reduced to make more profits. No Govt rules for packed quantity packages. No standard units are given in weights and measures act/rules. Thus No consumer is protected

yes kudos these are industry changing percentages @RBI @nsitharaman . I wish the entire india took notice of this when paying taxes. Be ethical. @PMOIndia @NITIAayog @GoIStats .

But rates are not decreased at all on most of the things including Milk also Public are not getting the benefits

Appreciating these GST cuts on essentials—great step for families! For 0% items like paneer & milk, hope vendors pass on full savings despite input tax challenges. True relief needs strong anti-profiteering enforcement. #JagoGrahakJago #GSTReform #ConsumerSavings

Mamra Badam rates have been increased instead of decreasing. Please check Sir.

Dmart n other bade supermarts me to kuch bhi sasta nai hua..pahle bhi paneer mrp se bahut sasta milta tha but ab pahle se thoda jada hi mahnga ho gya hai..u can chk

सिर्फ फेंकना हैं, स्मार्ट सिटी,नमामि गंगा, काला धन वापस, की तरह तुम लोग की फेंकू योजना ताकि कुछ करोड़ इधर डकार लिया जाए, जापान से आगे जाओगे तुम लोग सिर्फ, देश नहीं जाएगा,

I do not see any difference except your id and was chart sheet you share. All sellers raised ther product based price and compensated the older price and even more than the older price.

Sir why dahi i. e. Curd left out from reform? May be because South Indians are major consumers. Similarly 18% GST not removed on Members contribution in Cooperative housing societies even though it is unconstitutional as held by Kerala HC.

Prices are still same . What is your ministry doing to implement the same with companies?

Sir please ensure the real benefits are passed on to the end consumer

I paid a higher price Lays MRP 50 used to be at ₹33 in reliance Smart point ,but now ₹42. Will share the bill. Or live video if needed.

Many items are not daily essentials. Also, fuels - petrol & diesel are predominantly required to be included in daily essentials although not food item but common to everyone, incl Modiji's favorite Kisan & Machuaare. GoI can proceed Petrol with GST in BJP ruled states for sure.

Thanks plz share for house construction related material list also

United States Tren

- 1. Diane Keaton 133K posts

- 2. Annie Hall 30.7K posts

- 3. Bama 16.1K posts

- 4. #UFCRio 12.5K posts

- 5. Mateer 6,367 posts

- 6. Tim Banks N/A

- 7. Oregon 52.4K posts

- 8. #iufb 3,040 posts

- 9. Norvell 5,601 posts

- 10. Mizzou 13.3K posts

- 11. Indiana 25.2K posts

- 12. Baby Boom 2,783 posts

- 13. Raiola 1,076 posts

- 14. Sark 2,957 posts

- 15. First Wives Club 9,559 posts

- 16. Florida State 22.3K posts

- 17. UCLA 14.5K posts

- 18. Father of the Bride 9,482 posts

- 19. Ole Miss 4,761 posts

- 20. Ty Simpson 6,077 posts

Something went wrong.

Something went wrong.