JainMatrix Investments by Punit Jain

@jainmatrix

Punit Jain is a SEBI Registered Research Analyst. He started JainMatrix Investments, Reg. INH200002747 mail [email protected] cell 9886110032

You might like

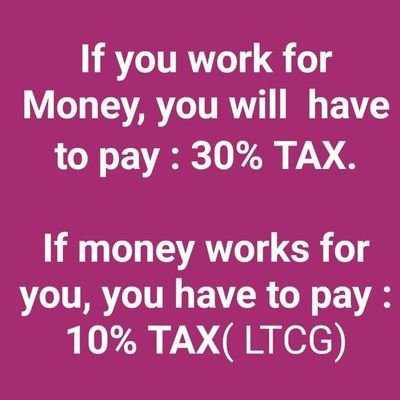

Superb, excellent video. The other way to see this is - If equity investors imagine that they are business owners, with just a few investment options, and need to let the good businesses flourish, these are the great returns possible.

Check out my latest article: Tata Capital IPO – Emerging Player linkedin.com/pulse/tata-cap… via @LinkedIn

2/n Who made these rules? Who the heck would be interested in Indian aviation unless he already had some airline operations? Would you let an industry expert start a new firm or prefer someone totally new to the sector?

1/n How to improve Ease of Doing Business in India. Here is an example. Till some time back, we had aviation sector investment rules that said - anyone can invest in Indian aviation firms except those that are already in Airlines sector. How does this work?

During a talk with Stanford last year, Jensen Huang was asked about how he has dealt with Nvidia’s multiple stock drawdowns of 50% or more…his answer:

*Ratan Tata ...* *In His Own Words !* “I had a happy childhood, but as my brother & I got older, we faced ragging because of our parent’s divorce, which in those days wasn’t as common. My grandmom brought us up. "Soon after, when my mother remarried, the boys at school started…

Check out my latest article: Aadhar Housing Finance IPO – Constructive linkedin.com/pulse/aadhar-h… via @LinkedIn

In power generation, the problem that every government has to solve is How do we transition from coal, fossil fuels and nuclear, to renewables, at fair cost and system reliability. Power storage being very expensive, we have to balance the options. Elimination is not necessary.

JainMatrix Investments shares a report on Banking Sector. When the Indian economy is doing well, the sector accelerates. Indian Banking Investment Report - Sep 2023 jainmatrix.com/2023/09/04/jai…

Rule#7 Pitfalls – If you want to invest in Indian markets, start NOW Read more on this - jainmatrix.com/2023/06/20/rul… @jainmatrix #staytuned, #equityresearch, #indianstockmarket, #investmentadvisory, #JainMatrixInvestments, #Portfoliostrategy, #SEBIResearchAnalyst, #wealthmanagement

Rule # 6 Pitfalls – To be a good investor, do things differently Visit our website to read more on this approach - jainmatrix.com/2023/06/14/rul… #staytuned, #equityresearch, #indianstockmarket, #investmentadvisory, #Portfoliostrategy, #SEBIResearchAnalyst, #wealthmanagement

Rule # 5 Pitfalls – Do you have too many stocks in your equity Portfolio? Visit our website for a short note on this topic - jainmatrix.com/2023/06/10/rul… #staytuned, #equityresearch, #indianstockmarket, #investmentadvisory, #Portfoliostrategy, #SEBIResearchAnalyst, #wealthmanagement

Rule # 4 – To Win Big in Investing, you have to Deal with Losses Visit our website to read more about this - jainmatrix.com/2023/06/08/rul… #pitfalls, #staytuned, #equityresearch, #indianstockmarket, #investmentadvisory, #Portfoliostrategy, #SEBIResearchAnalyst

Rule #3 Investing timeframes One of the biggest hurdles for Investors is patience. Visit our website to read our note and message jainmatrix.com/2023/06/06/rul… #pitfalls, #staytuned, #equityresearch, #indianstockmarket, #investmentadvisory, #Portfoliostrategy, #SEBIResearchAnalyst

Long Term Equity Investments must be made using your savings or available cash surpluses. For details, visit website jainmatrix.com/2023/06/02/rul… #pitfalls, #staytuned, #equityresearch, #indianstockmarket, #investmentadvisory, #Portfoliostrategy, #SEBIResearchAnalyst

In my Research Analyst advisory practice, I often found that investors can fall in love with a particular stock, and overinvest in it, rather than taking a basket or portfolio approach. This exposes investors to this risk. Visit to find out more. jainmatrix.com/2023/06/01/pit…

As JainMatrix Investments completes 10 years we are happy to share our learnings and experience. We will look at some Pitfalls you must avoid in order to succeed as an investor. Visit our website jainmatrix.com/2023/05/31/cel…

United States Trends

- 1. #WWERaw 93.8K posts

- 2. Packers 56.3K posts

- 3. Packers 56.3K posts

- 4. Jordan Love 8,413 posts

- 5. John Cena 81.4K posts

- 6. Jalen 17.9K posts

- 7. Patullo 4,314 posts

- 8. #GoPackGo 5,773 posts

- 9. #RawOnNetflix 2,319 posts

- 10. Jenkins 4,813 posts

- 11. Nikki Bella 5,466 posts

- 12. #MondayNightFootball 1,394 posts

- 13. Lane Johnson 1,572 posts

- 14. Pistons 12.9K posts

- 15. Desmond Bane 3,058 posts

- 16. Matt LaFleur 1,847 posts

- 17. Green Bay 13.1K posts

- 18. Grand Slam Champion 25.5K posts

- 19. Gunther 5,725 posts

- 20. Sam Merrill N/A

You might like

-

ARVIND BAJAJ

ARVIND BAJAJ

@arvindshyam -

we will grow together

we will grow together

@Valivetimrl -

Turnaround

Turnaround

@sandeepraop1 -

Vishal Mittal

Vishal Mittal

@vishalmittal22 -

Hedgehog Investing

Hedgehog Investing

@hedgehog7invest -

Hi₹al G

Hi₹al G

@gogrithekhabri -

TokiChiKiTo

TokiChiKiTo

@BigNitin -

SAINIK

SAINIK

@sainik636 -

Singaraju Ram

Singaraju Ram

@Singaraju_R -

TN Investors' Assn

TN Investors' Assn

@TIA_Investors -

Ragavendhra perumall

Ragavendhra perumall

@caprichinvest -

Puneet Khurana

Puneet Khurana

@PuneetK009 -

V.P. Nandakumar

V.P. Nandakumar

@MDManappuram -

Dhaval Shah

Dhaval Shah

@DhavalShahC -

Gautam Shah

Gautam Shah

@gshah26

Something went wrong.

Something went wrong.