James Sinks

@jamessinks

Helping Oregonians lead more secure lives via #FinLit & #FinEd, dad, soccer fan, wannabe runner, bad joke teller, writer, former journalist. Opinions are my own

You might like

We're excited to announce the recipients of the 2025 Financial Empowerment Awards! In celebration of #FinancialLiteracyMonth, these awards honor educators and community champions for their dedication to advancing financial empowerment in Oregon. Read here: bit.ly/4lUEBq0

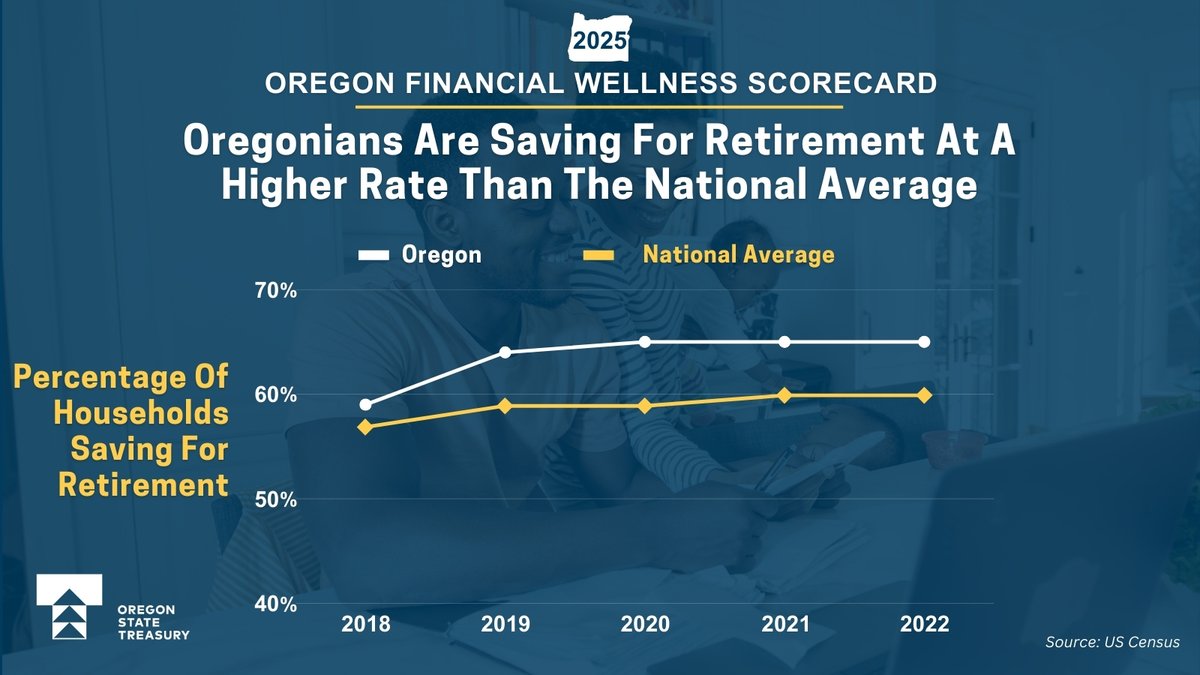

How are Oregonians faring financially? Whether you're a data nerd like me, or just curious about how we're saving and coping with money stress (spoiler alert: could be better) our annual @OregonTreasury Financial Wellness Scorecard has the skinny #finlit #FinancialLiteracyMonth

Our #FinancialLiteracyMonth fact of the day is more Oregon households are saving for retirement than the national average! As Oregonians pursue their financial dreams, our Financial Wellness Scorecard offers a snapshot of Oregon's financial health: bit.ly/4jOH4By

How healthy are Oregonians’ finances? Our 2025 Financial Wellness Scorecard captures all this and more! The annual scorecard shows households are earning more, yet many families are still struggling to save and make ends meet. Learn more here: bit.ly/40OYN2R

Our newly expanded online financial wellness hub on Oregon’s @211info is free and connects you to an array of counseling, savings, debt consolidation, and low-cost banking programs. Visit 211info.org/financial-well… to discover tools to navigate your finances with confidence!

Today we released our 2024 Oregon Financial Wellness Scorecard. This wide-ranging resource provides a snapshot of how Oregonians are faring financially and captures data from local and national organizations. Read more about today's announcement here: bit.ly/ORscorecard

It appears somebody was skipping on the sidewalk outside the office today. (If Uno, Uno) #uno #salem

Last week, Oregon joined the 22 other states mandating a financial literacy course in high school to total 23 states nationwide. Nearly half of states are helping to build the financial skills young adults need before they leave the classroom. Could your state be next?

.@johncanzanobft Footnote to the #Pac12 collapse? How shortsighted were Apple and Amazon? Absolutely blame collusion by ESPN/Fox, but by also lowballing, the supposedly forward thinking tech giants squandered the potential to own CFB in the entire West and gave it to the networks

Oregonians are learning to be more vigilant today at #OregonScamJam in the Dalles, presented by #financialempowerment leaders⚠️🚨 Thank you to @ORDOJ @AARPOR @OregonDCBS @FTC @ORHumanServices and Wasco County Sheriff Lane McGill.

Join us in The Dalles on 8/4 to fight back against scams! Go to events.aarp.org/ScamJamSummer to register. doj.state.or.us/media-home/new…

doj.state.or.us

You're Invited to Scam Jam in the Gorge - Oregon Department of Justice

Con-artists are targeting you and the people you care about. Learn how to fight back and spot the crooks before they spot you. When: Friday, August 4, 2023 9:00 a.m. to 12:00 p.m. Doors open at 8:30...

Unfortunately, scams happen everywhere. Oregonians are learning to be more vigilant today at #OregonScamJam in The Dalles, presented by an array of financial empowerment partners. Thank you to @ORDOJ @AARPOR @OregonDCBS @FTC @ORHumanServices and Wasco County Sheriff Lane McGill

In partnership with @OregonCSP and the Oregon Treasury Savings Network, @211info provides easier access to financial resources and educational materials that can help you make more confident financial decisions! Explore their resource center today: 211info.org/financial-well…

It can be hard to get ahead financially, and even tougher when you don’t know how to start, where to start or even which direction to go. That’s why more leaders are embracing the imperative of #fined. It works! Learn about our @OregonTreasury efforts: oregon.gov/treasury/finan…

Do financial education programs affect financial knowledge and behaviors? Check out our issue brief with @NEFE_ORG showing that #FinEd improves both financial knowledge and financial behavior. Further, we see that financial education is cost-effective. bit.ly/3x9SYQD

@TreasurerRead releases first-ever Oregon #financialwellness scorecard. Capturing dozens of data points, scorecard spotlights statewide financial capability; guiding policymakers & nonprofits on how to help Oregonians achieve long-term #financialsecurity ow.ly/JuA250MTowi

If you file a tax return, Oregon provides several tax credits for families that can reduce the taxes you owe and even increase your refund. Find out more on the @ORRevenue website at ow.ly/MYPJ50Mzm8I

Take some credit. DYK Oregon provides a #taxcredit up to $300 for contributions made to an @OregonCSP account? oregoncollegesavings.com/tax-benefits Get started early and see how saving for your kid's future can help come tax season.

Reducing financial stress is a powerful reason to bolster financial empowerment and promote savings. In the 2021 @FINRAFoundation survey, Oregonians were more likely than the national average to say they are "just getting by" financially. #financialsecurity #finlit

More #financialsecurity and #financialinclusion helps every Oregonian. Under the leadership of @TreasurerRead, Treasury is highlighting and advancing financial capability statewide. Interested? The Financial Empowerment Advisory Team meets today oregon.gov/treasury/finan…

Resources to help you build #financialsecurity. @OregonCSP is partnering with @211info to connect you to programs and materials that improve your confidence with financial decision-making 211info.org/financial-well… #financialwellness is within reach.

More financial capability will help everyone. I’m excited about this pilot effort that we launched via @OregonTreasury’s Financial Empowerment Initiative to connect more Oregonians with tools to build more secure futures. (Thank you to @oregoncsp and @FinBegOR) #finlit @oregoncsp

Get a $50 boost and free finance classes. @OregonCSP is partnering with @finbeg to help you learn about #personalfinance, plan for the future, and budget for education. Complete an interactive course and get $50 in an Oregon College Savings Plan account oregoncollegesavings.com/faqs/financial…

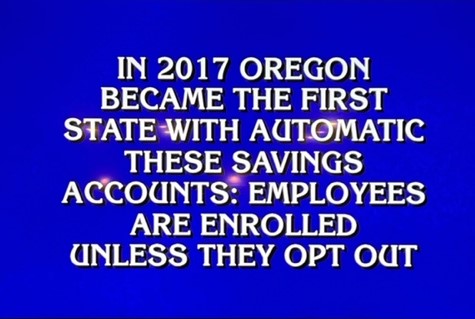

It's working! Understanding that retirement security was in jeopardy for an estimated 1 million workers (see what I did there?), @OregonTreasury led the nation with @ORSaves, allowing mostly first-time savers to set aside more than $150 million and counting #FinLit @TreasurerRead

OK, @oregonsaves @TobiasRead - you made @Jeopardy today! WOW (and the contestant actually knew they were for #retirement - #IRAs even!) #youknowyoumadeitwhen @calsavers @ILSecureChoice @marylandsaves @nmworkandsave @RetirePathVA @ColoTreasurer @MyCTSavings @fionama @ILTreasurer

United States Trends

- 1. #SmackDown 21.2K posts

- 2. Melo 11.5K posts

- 3. Jordan Poole N/A

- 4. Sixers 4,442 posts

- 5. Embiid 3,969 posts

- 6. Maxey 2,387 posts

- 7. Minnesota 467K posts

- 8. Jalen Smith 1,280 posts

- 9. UTSA 2,293 posts

- 10. Nick Nurse N/A

- 11. Crosby 13.8K posts

- 12. Kwanzaa 49.4K posts

- 13. Utah 37.6K posts

- 14. Jalen Duren N/A

- 15. FDNY 11.5K posts

- 16. Ilja 3,316 posts

- 17. Paolo 8,459 posts

- 18. Jaylen Brown 3,302 posts

- 19. #Dateline N/A

- 20. Drew McIntyre 2,851 posts

Something went wrong.

Something went wrong.