Jem

@jem_hrs

Making HR and Communication easier for everyone using WhatsApp. #JemHR

You might like

We are thrilled to launch 𝗧𝗵𝗲 𝗙𝘂𝘁𝘂𝗿𝗲 𝗼𝗳 𝗣𝗮𝘆 𝗣𝗼𝗱𝗰𝗮𝘀𝘁 𝗦𝗲𝗿𝗶𝗲𝘀 with @CliffCentralCom, @GarethCliff, @Simon_R_Ellis and Caroline van der Merwe! Listen to the first episode here: cliffcentral.com/podcasts/the-f… #TheFutureOfPay #Podcast #SmartWage #CliffCentral

Why should you wait to be paid? Whether it's the 25th or 27th, it doesn't matter. You should be able to access what you've earned when you've earned it. Would you agree? @SmartWageSA

The main reason why our users take advances on their salaries is to pay for transport to get to work. In celebration of Nelson Mandela day, we helped 67 of our users do exactly this, by giving them R67 to pay for their transport for the day. Happy Nelson Mandela Day! #MadibaDay

We are incredibly proud to announce the release of our Annual Social Impact Report! This report measures and articulates the difference SmartWage is making on both employers and employees. View the full report here: bit.ly/3q216gj

Today we released our Annual Social Impact Report! This report measures and articulates the difference SmartWage is making on both employers and employees. View the full report here: bit.ly/3q216gj

Don't take our word for it, take hers! Listen to one of our loyal customers explain how SmartWage was made available to her when she needed it the most. #SmartWage #loyalcustomer #FinancialFreedom

One of the benefits of offering Earned Wage Access to employees is the increased loyalty they show their employer. Visa found that 89% of workers would work longer for a company that provides the service, while 79% would be willing to switch to a company who offered it.

A recent study by Iemas Financial Services, found that on average, employees are spending 13 hours a month (in some cases, more than 20 hours) worrying about their finances. Imagine your employees spent that time focussing on their work and not on stressing about money matters?

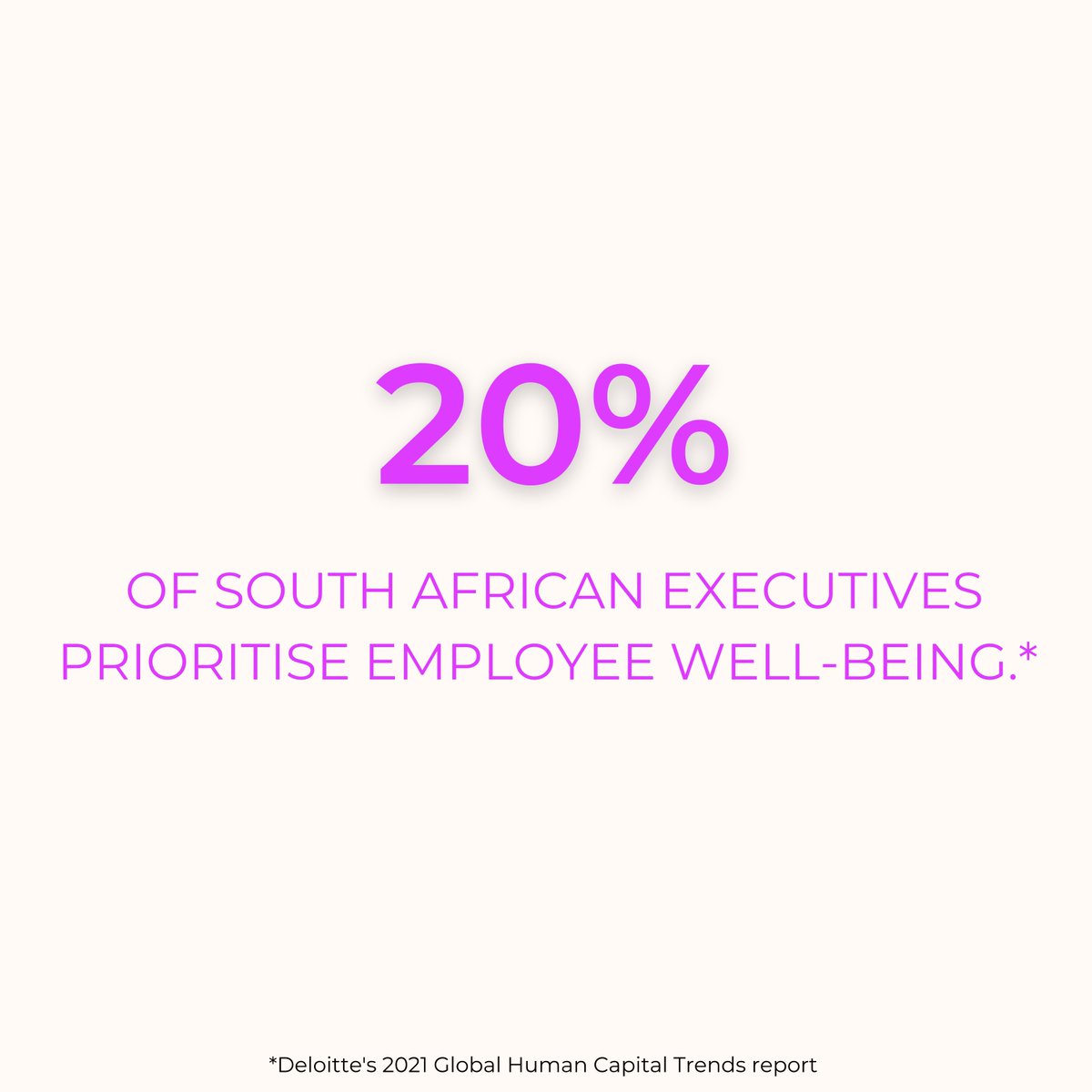

Deloitte's 2021 Human Capital Trends reported that only 20% of South African executives aim to prioritise their workers' well-being in 2021. To shift the focus from surviving to thriving, employers must ensure that their employees' well-being is central, instead of secondary.

How the world's employees get paid is fundamentally flawed. How do we expect employees to wait until the end of the month, to get paid for the work they have already done? Let's break the archaic payday poverty cycle. #EWA #paycycle #SouthAfrica #SmartWage #povertycycle

It's not only the South Africans living hand to mouth that are drowning in debt. Those taking home over R20,000 per month need to spend 60% of their monthly net income to repay debt, according to DebtBuster's Q4 2020 Debt Index. ow.ly/3bng50DBfuF #WageAccess #Debt #Income

This evening, don't miss @SAfmnews's market update with @nompu300 where SmartWage's CEO, @Simon_R_Ellis will discuss how technology can give employees what they deserve: #earnedwageaccess. Tune in tonight between 18:00pm and 19:00pm CAT: safm.co.za/digital/player…

Off the back of #SONA2021, it's important to ask these questions: Is the R350 #Covid19 grant enough to help workers make it to the end of the month? Are these funds actually landing in the hands of the people that need it most? What more can be done? thesouthafrican.com/news/sona-2021…

SmartWage is the most affordable and accessible wage access software in South Africa. But what does the term "wage-access software" actually mean? #SmartWage #SouthAfrica #Blog #WageAccess smartwage.co.za/earned-wage-ac…

Stay tuned for our “Future of Pay” podcast which goes live in a few weeks.

Just recorded Episode two of our ‘Future of Pay’ podcast with @CliffCentralCom & @SmartWageSA. Starting to love these sessions - and audio is such a great way to consume content. Stay tuned, it goes live in a few weeks.

No need to wait. Access your earnings through our easy-to-use WhatsApp Chatbot or USSD line. #SmartWage #SouthAfrica #Bernie #WageAccess #Meme

What concerns you the most when thinking about your personal finances? #SmartWage #SouthAfrica #Poll #PersonalFinance

Isn't it frightening that South Africa's consumer debt amounts to R1.5 trillion, yet money remains a taboo subject amongst South Africans? #SmartWage #MoneyTalk iol.co.za/personal-finan…

We couldn’t agree more. Time to empower our consumers by giving them access to what they’ve earned, instead of going to predatory loan sharks and Mashonisa’s. @janedutton

The National Credit Regulator is urging consumers to borrow wisely and to avoid loan sharks. @janedutton talks to Roy Stocker, a senior legal advisor at the regulator. #eNCA Courtesy #DStv403

The National Credit Regulator is urging consumers to borrow wisely and to avoid loan sharks. @janedutton talks to Roy Stocker, a senior legal advisor at the regulator. #eNCA Courtesy #DStv403

United States Trends

- 1. Branch 36.7K posts

- 2. Chiefs 111K posts

- 3. Red Cross 49.5K posts

- 4. Mahomes 34.6K posts

- 5. Exceeded 5,964 posts

- 6. Binance DEX 5,163 posts

- 7. #LaGranjaVIP 81.7K posts

- 8. #njkopw 4,772 posts

- 9. Air Force One 55.3K posts

- 10. Rod Wave 1,600 posts

- 11. #TNABoundForGlory 58.9K posts

- 12. #LoveCabin 1,357 posts

- 13. Tel Aviv 58.3K posts

- 14. Bryce Miller 4,592 posts

- 15. Alon Ohel 15.2K posts

- 16. Omri Miran 15.1K posts

- 17. Eitan Mor 14.8K posts

- 18. LaPorta 12K posts

- 19. Matan Angrest 14.3K posts

- 20. Goff 13.9K posts

You might like

Something went wrong.

Something went wrong.