Jim Kopas

@jimkopas

Dad x4, Coach, Partner at Pring Turner, @pringturner, Investing enthusiast NOT advice,

You might like

Optimism is associated with a longer life. Stay positive.

Reminder: the hardest part of investing isn’t buying right... it’s not selling your winners too soon.

Interesting thread on Constellation's M&A advantages...

Extremely interesting insights from ex Head of M&A at $CSU.TO (Vencora, part of Volaris operating group) ...AI, competition, churn, organic growth, multiples paid, bonus structures, disruption risk, investment modelling and many more... 🔥🔥👀 Tune in, more below 1/x

CEO with -18% share price CAGR since going public, decides against selling at a higher valuation to a CEO that has a +18% share price CAGR since becoming CEO.

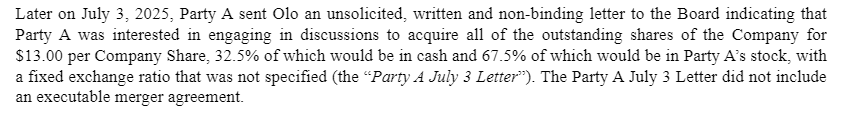

Hunh, well $OLO apparently preferred a $10.25 all cash offer from Thoma Bravo than a $13 offer from "Party A", whose identity is found in "party".

Hunh, well $OLO apparently preferred a $10.25 all cash offer from Thoma Bravo than a $13 offer from "Party A", whose identity is found in "party".

tRADE tHE mARKET iN fRONT oF yOU

Spearing the whale!

$OLO sold for $10.25.

Today, we announced a definitive agreement to be acquired by@thomabravo. This transaction represents the strength of our enterprise restaurant offerings, our talented team, and our network of 750+ customers and 400+ ecosystem partners. Read more: investors.olo.com/news/news-deta…

Note to self, when thinking of averaging up or averaging down an investment never forget: "Losers hang around with losers and winners hang around with winners."

Similar profile to $ALTG

A current John Deere dealership owner on dealership economics $DE : "It's interesting. 70% of our revenue dollars come from new and used sales, roughly split in half with 35% used and 35% new. Parts make up 20% of our business, and service accounts for 10% in terms of revenue.…

“The best investors in the world weren’t investors at all. They were entrepreneurs who never sold.” - Nick Sleep

I may be mistaken, but these numbers suggest that Chamath would have made billions more by just leaving his money in Facebook stock?

“Contrary to popular myths, Warren Buffett invests in people first, businesses second. If the management of the business doesn't meet his very high standards, then, no matter how appealing the business is, he won't invest.” - Robert Miles #business_is_people

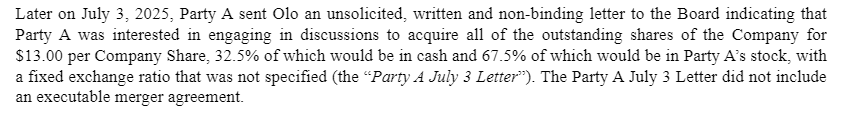

Adam was a couple steps ahead…

Mentions $TOST and $PAR as potential suitors.

$OLO is reportedly considering a sale. A deal would significantly alter the restaurant tech landscape: More than 700 restaurant chains use Olo. restaurantbusinessonline.com/technology/res…

Missed the earnings report… looks like a nice beat and raise for $QQQ. Looking forward to reading the transcript.

"Singh is intent on continuing the company’s acquisition spree, perhaps even this year, given a “very active pipeline” of potential targets, he said. He has been increasingly interested in back-office software" - $PAR paymentsdive.com/news/par-techn…

paymentsdive.com

PAR Technology fuels software strategy with acquisitions

The company has pivoted to a software strategy, by buying up other companies and building on its point-of-sale hardware beginnings.

The best combination is a genius running a business that a dummy could run.

ARR growth of 21%, gross profit 30% growth, adjusted ebitda $5.8MM, locations 140k! Read our thoughts on Q4 2024 at $PAR 📷

Advice from Charlie Munger:

Nice post on current market valuation from the Brooklyn Investor.

United States Trends

- 1. Araujo 135K posts

- 2. Chelsea 460K posts

- 3. Estevao 140K posts

- 4. Ferran 61.6K posts

- 5. Barcelona 342K posts

- 6. Yamal 115K posts

- 7. Rashford 21.5K posts

- 8. #CHEBAR 13.2K posts

- 9. Kounde 31.8K posts

- 10. Cucurella 46.9K posts

- 11. Flick 32.5K posts

- 12. Enzo 47.1K posts

- 13. Oklahoma State 3,062 posts

- 14. Godzilla 23.1K posts

- 15. Pedri 44.8K posts

- 16. Rush Hour 4 17.4K posts

- 17. Eric Morris 1,724 posts

- 18. #AskTems 4,439 posts

- 19. Caicedo 25.1K posts

- 20. Balde 10.6K posts

You might like

-

Greenhaven Road

Greenhaven Road

@GreenhavenRoad -

Adam Wilk

Adam Wilk

@AKWilk -

WTCM

WTCM

@WTCM3 -

Andy 🍕🏔️

Andy 🍕🏔️

@bizalmanac -

Ernest Wong

Ernest Wong

@ErnestWongBWM -

Global Value Hunter

Global Value Hunter

@stockjock84 -

Steven Kiel

Steven Kiel

@Steven_Kiel -

Colin King

Colin King

@valuedontlie -

Aaron Sallen

Aaron Sallen

@aaronjsallen -

Ry🅰️n O'Connor

Ry🅰️n O'Connor

@AboveAvgOdds -

Doug Ott

Doug Ott

@yesandnotyes -

komrade

komrade

@komrade_kapital -

Ari Sass

Ari Sass

@FullySynergized -

Jon Hook

Jon Hook

@jonrice80 -

El_Duderino

El_Duderino

@Baup0stGOAT

Something went wrong.

Something went wrong.