Kaushik Anand

@kaush_anand

Partner @A91Partners

Talvez você curta

Delighted to co-lead Moengage's round along with Goldman Sachs. Have seen them consistently expand product capabilities and over achieve their goals over the last 7-8 years. Look fwd to working with @raviteja2007 and team. @A91Partners shorturl.at/ZSt3S

Atomberg Technologies is gearing up for its Dalal Street debut next year! On #YoungTurksReloaded, Founder & CEO Manoj Meena and Co-Founder & COO Sibabrata Das reveal IPO plans and their next big bet - India’s first domestically made AC compressors. A market currently dominated…

WestBridge leads $40 million round in Flipkart-backed Finbox to expand B2B digital lending platform moneycontrol.com/news/business/…

Discover what's next for the red-hot MSME lending space? Join industry stalwarts Anup Agarwal, Utpal Isser, Deepak Jain, Sayali Karanjkar and Kaushik Anand as they deep-dive into challenges and opportunities in MSME lending at #MCFintechConclave 2024. Mark your calendars:…

Last few years have taught us that anything is possible in ed tech but the villain of a Rajnikanth/Amitabh film being modelled on an edtech founder was not on my bingo card!

Congratulations to the Go Digit team! First of hopefully many IPOs for us at @A91Partners

MSME Lending firm Aye Finance raises Rs 310 crore led by British International Investment moneycontrol.com/news/technolog… @BhavyaDKumar reports

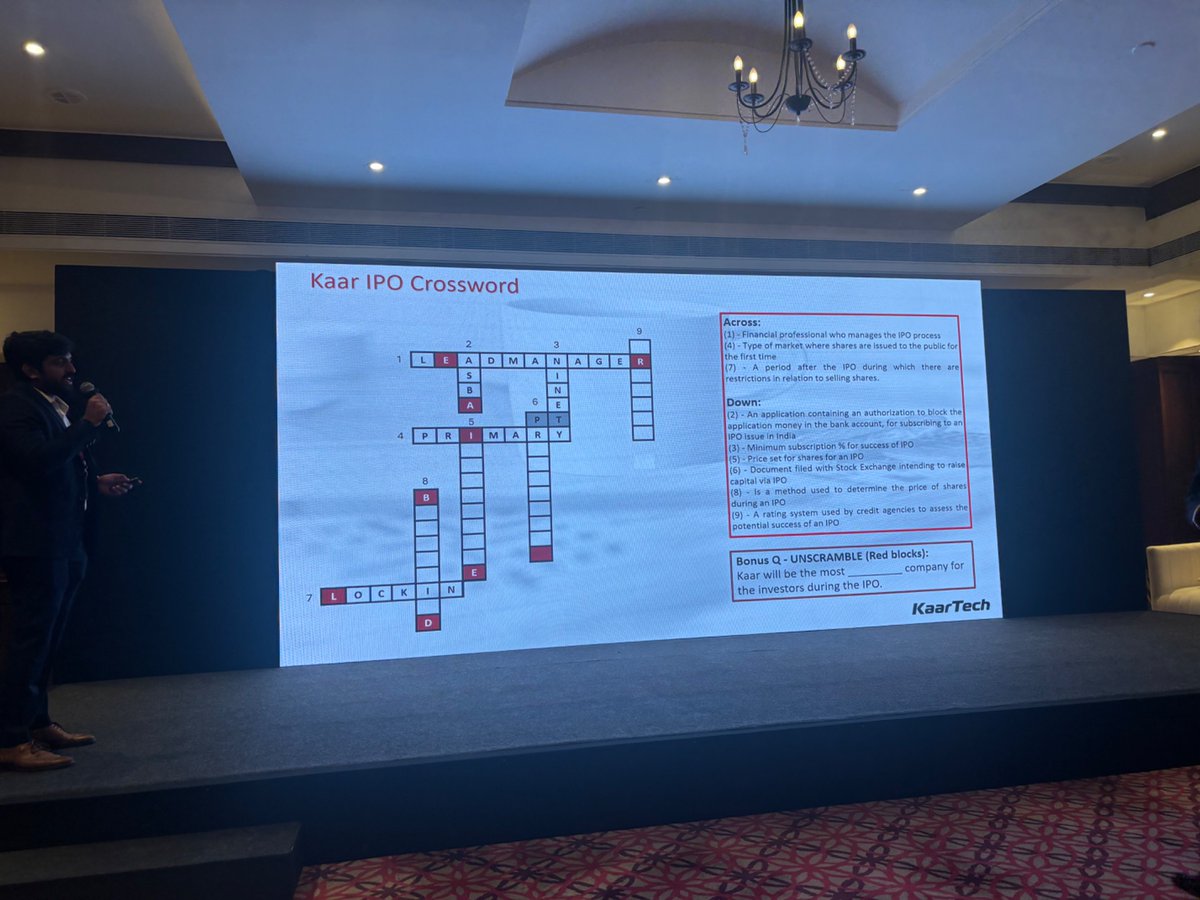

Digital transformation startup @kaartech raises $30 million in first external #funding As a part of the transaction, @gautammago & @kaush_anand from A91 Partners will join the KaarTech board. Read more at: economictimes.indiatimes.com/tech/funding/d… By @Ta_rush

Watching 5 hrs of rain with no mobile connectivity in a stadium is strangely therapeutic

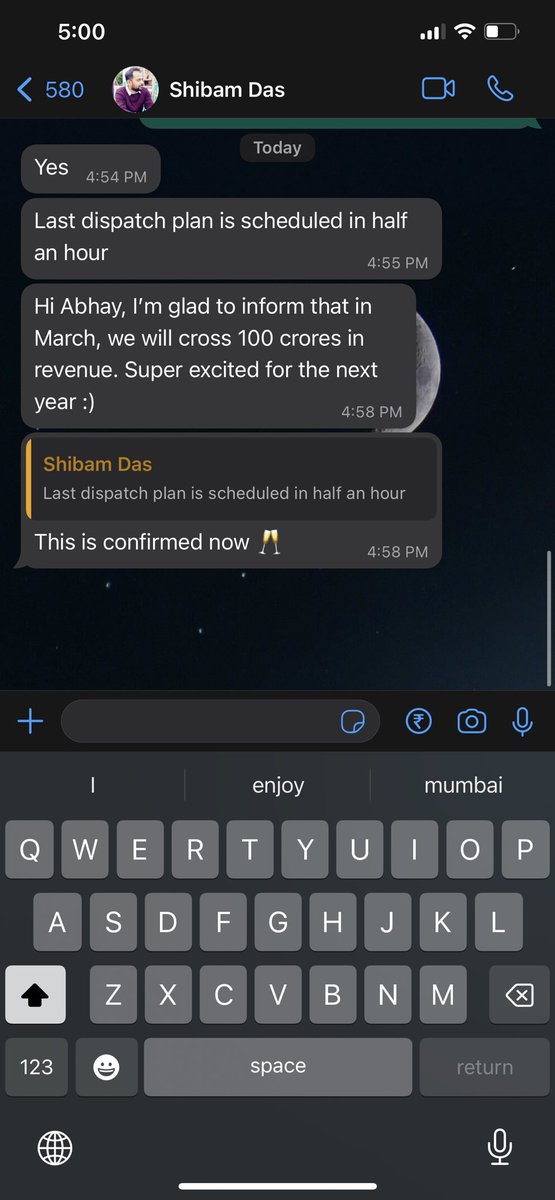

Two messages separated by 4 years - 37cr/annum to 100cr/month. These are most satisfying moments as an investor. Congratulations @atomberg_tech @Shibam3 Manoj Meena

In the clearest sign of startups moving to profitability, VC/banker events to meet them seem to be moving to Mumbai from Bangalore.

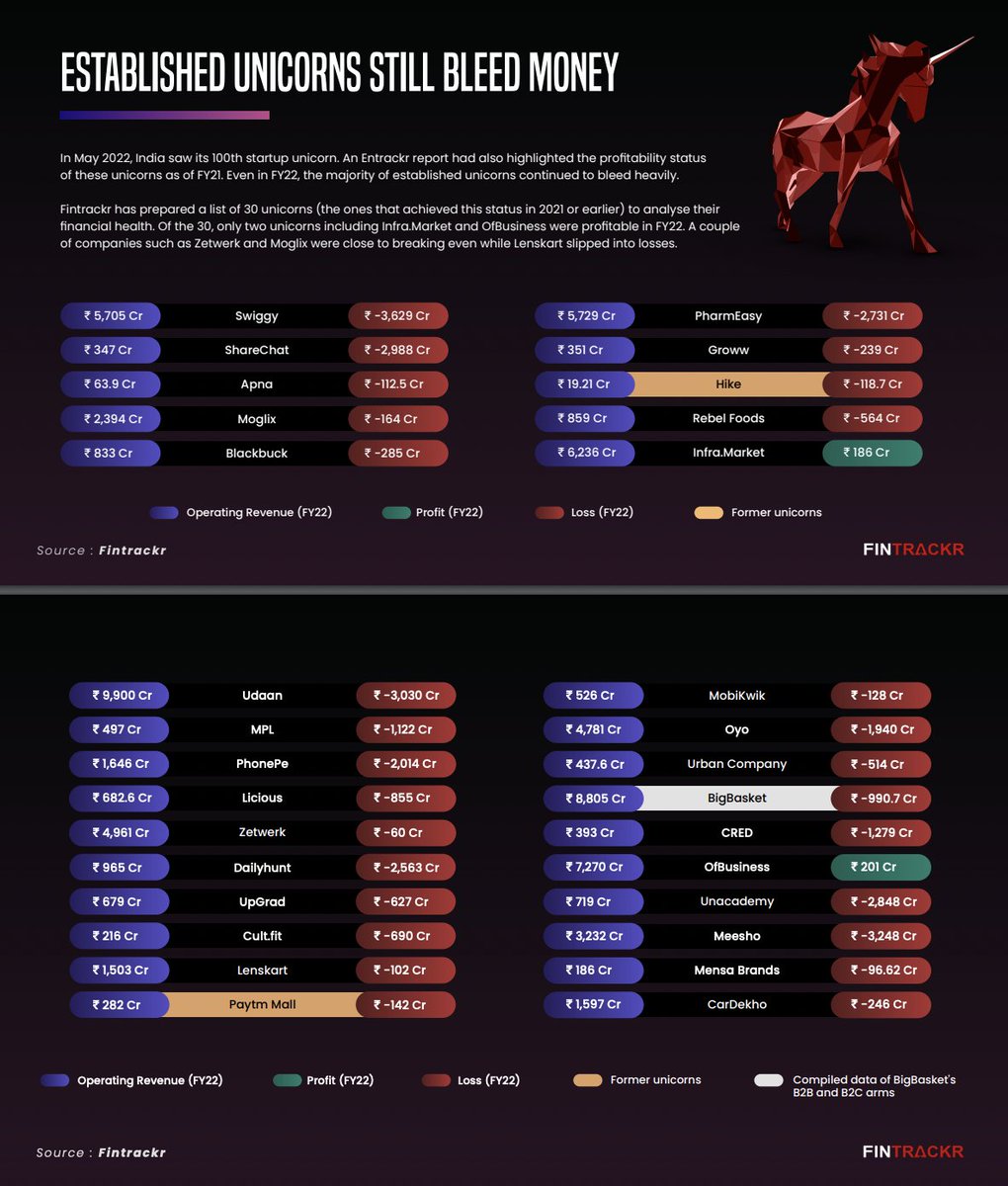

~$9B of revenues (thanks to B2B commerce) and ~$4B of losses.....and these are some of the best we have. We have collectively massively oversold the India promise and lost focus on real metrics and value. Time to 'Get Real'!

We completed 4 years and launched our revamped website (a91partners.com). Our missions of “Partnering with exceptional founders to build enduring businesses for tomorrow’s India” continues steadily with 👇 that we are proud of. a91partners.com/partnerships

Contracted ARR is the GMV equivalent for SaaS companies

Been in Mumbai for 6 years now and still feel surprised every time the auto/taxi drivers return change

Last year, companies in many sectors suffixed a tech to their category to raise capital at high prices. This need to look like a tech company has resulted in companies which should have zero engineers having hundreds of engineers instead.

After reading a bunch of threads/articles on FTX, the insight seems to be the obvious: in a ponzi scheme, liquidity is important

United States Tendências

- 1. #WWERaw 24.8K posts

- 2. #GoPackGo 3,700 posts

- 3. Packers 35.1K posts

- 4. Packers 35.1K posts

- 5. Cade Horton N/A

- 6. Go Birds 16.5K posts

- 7. Drake Baldwin 3,583 posts

- 8. #RawOnNetflix N/A

- 9. John Cena 23.3K posts

- 10. Triple H 3,805 posts

- 11. Monday Night Football 5,637 posts

- 12. Nick Kurtz 2,248 posts

- 13. Dirty Dom N/A

- 14. McRib 2,710 posts

- 15. NL Rookie of the Year N/A

- 16. Pond 248K posts

- 17. Downshift N/A

- 18. Adoree Jackson N/A

- 19. #BravesCountry N/A

- 20. Jimmy Olsen 4,524 posts

Talvez você curta

-

Bejul Somaia

Bejul Somaia

@bsomaia -

G V Ravi Shankar

G V Ravi Shankar

@gvravishankar -

Ishaan Mittal

Ishaan Mittal

@Ishaanmittal2 -

Rahul Chowdhri

Rahul Chowdhri

@rchowdhri -

Tejeshwi Sharma 🇮🇳

Tejeshwi Sharma 🇮🇳

@tejeshwi_sharma -

Gagan Goyal 🇮🇳

Gagan Goyal 🇮🇳

@Goyal4Gagan -

Pratik Poddar

Pratik Poddar

@pratikpoddar -

Anand Daniel

Anand Daniel

@_AnandDaniel -

Abhay Pandey

Abhay Pandey

@Abhay__Pandey -

Prayank Swaroop

Prayank Swaroop

@prayanks -

Alok Goyal

Alok Goyal

@alokgoyal1971 -

Tarun Davda

Tarun Davda

@tarun_davda -

Mukul Arora

Mukul Arora

@mukularora -

Ashish Agrawal

Ashish Agrawal

@dvbydt -

Prashanth Prakash

Prashanth Prakash

@prashanthp

Something went wrong.

Something went wrong.