Kyle Schell

@kylecschell

go follow @Hiive_HQ, I’m just going to retweet whatever they post.

你可能会喜欢

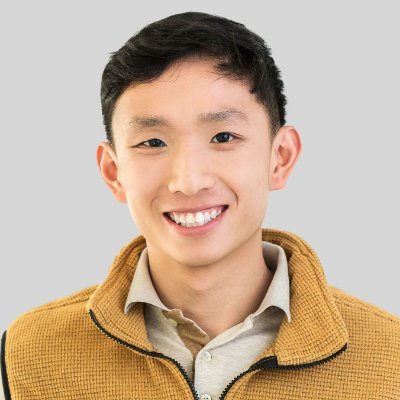

Company execs often justify prohibitions on secondaries based on concerns about the impact on their 409A valuation. Because the strike price of option grants to employees is priced at the 409A valuation, some executives are obsessed with keeping it low. They believe that they…

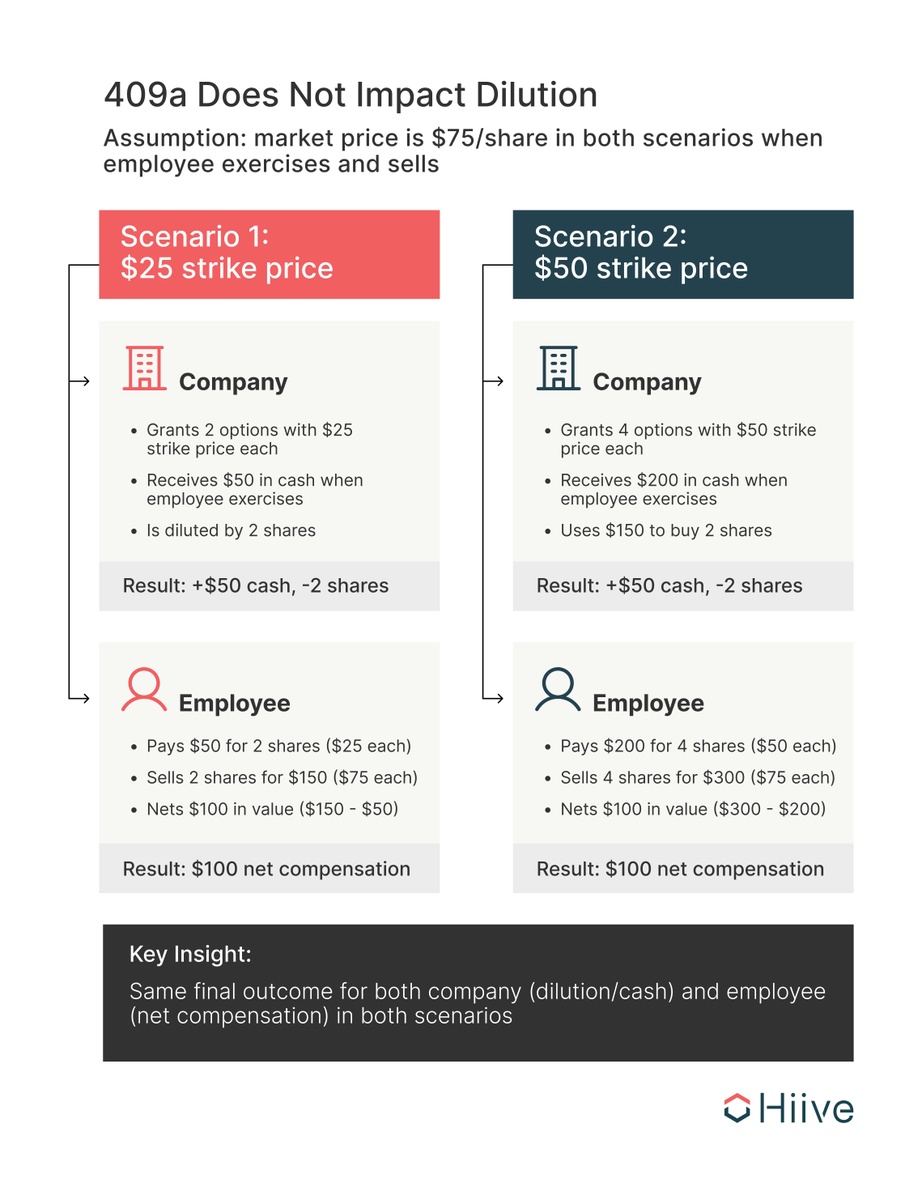

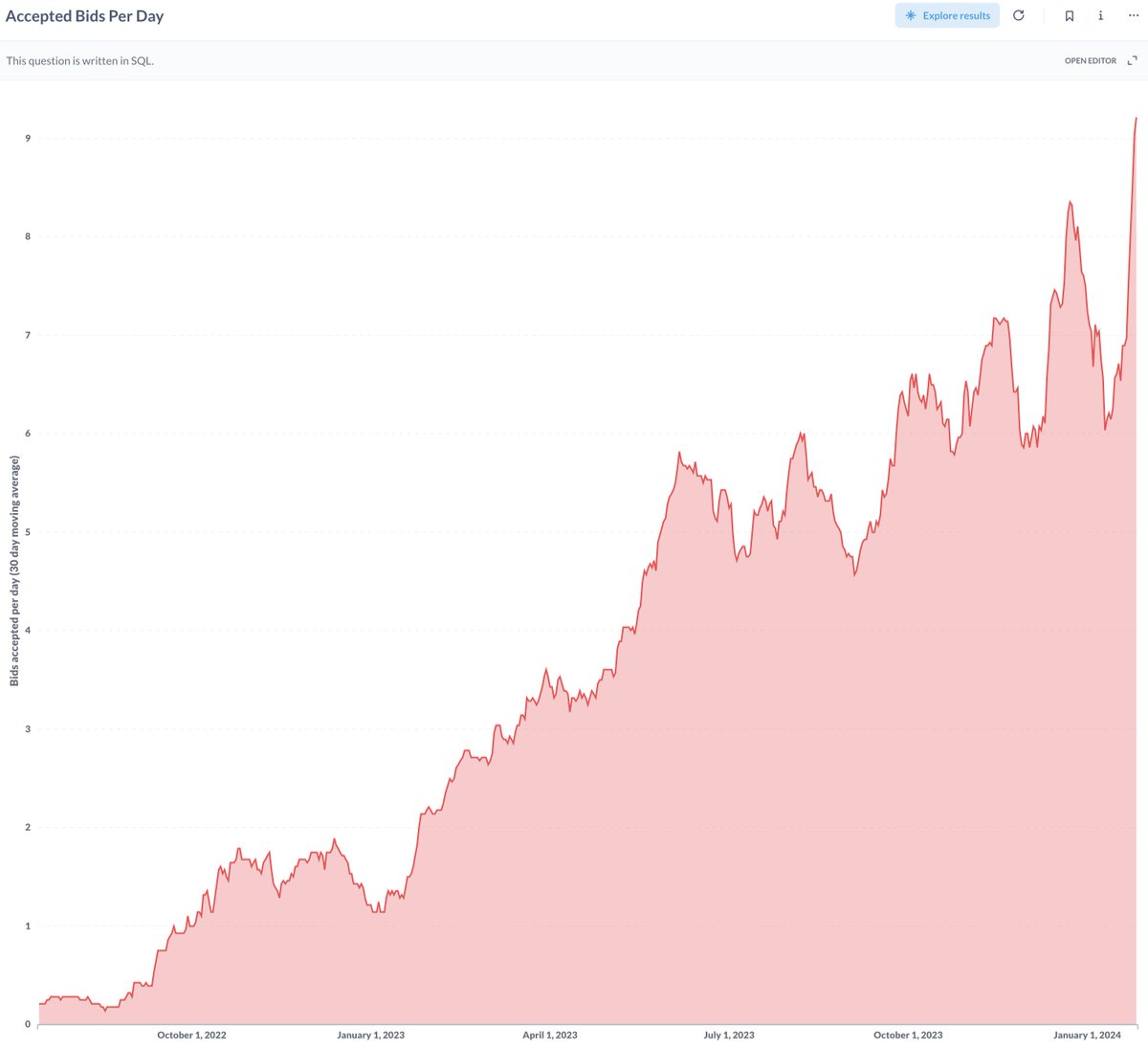

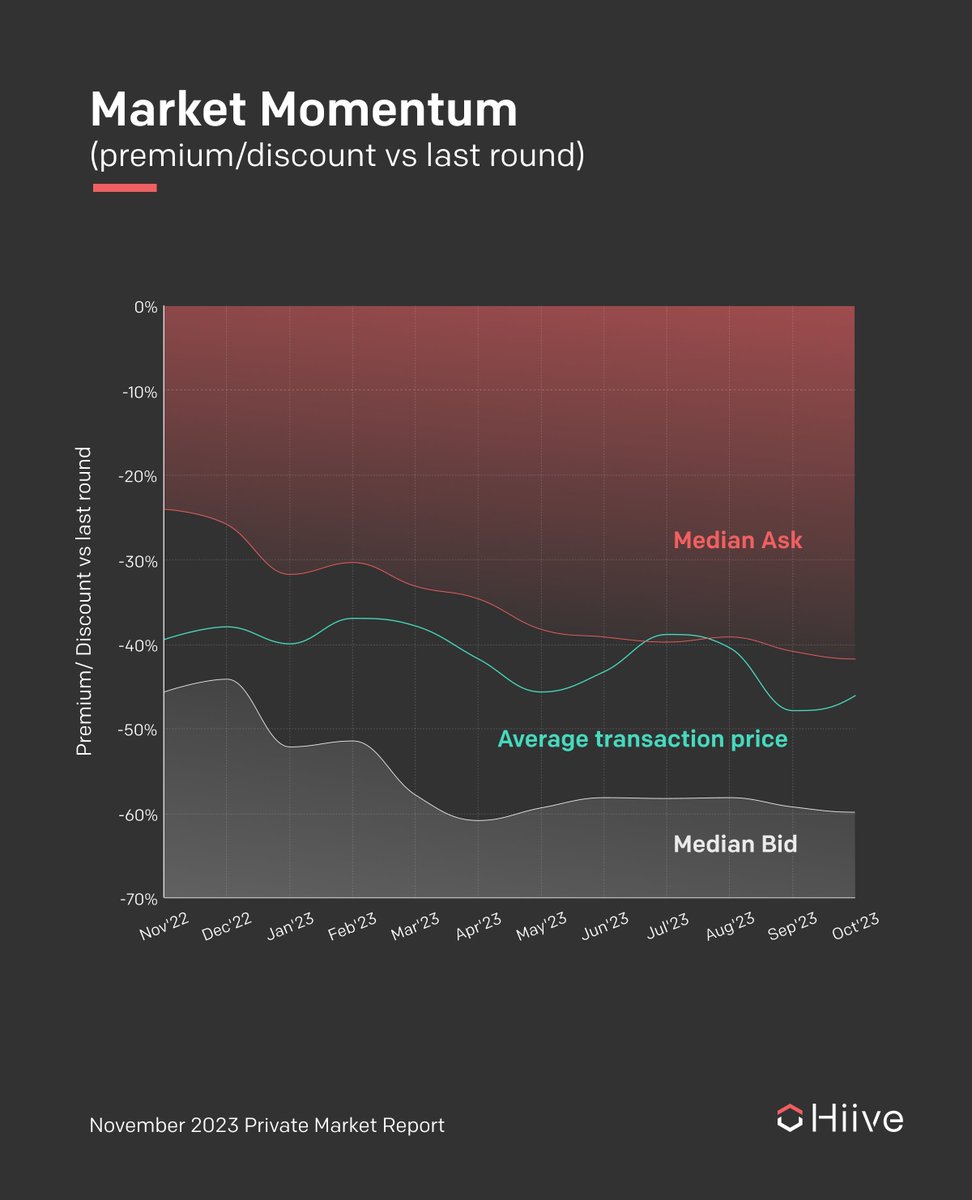

Employees and early-stage funds seem to decreasingly be waiting for natural exits, as these traditional liquidity events have become less frequent. We’re seeing this trend reflected directly in Hiive marketplace data. Read the full report on our website. See disclosures in the…

Hiive brings a strategic approach to shareholder liquidity, offering valuable insights and expertly managing transactions from start to finish.

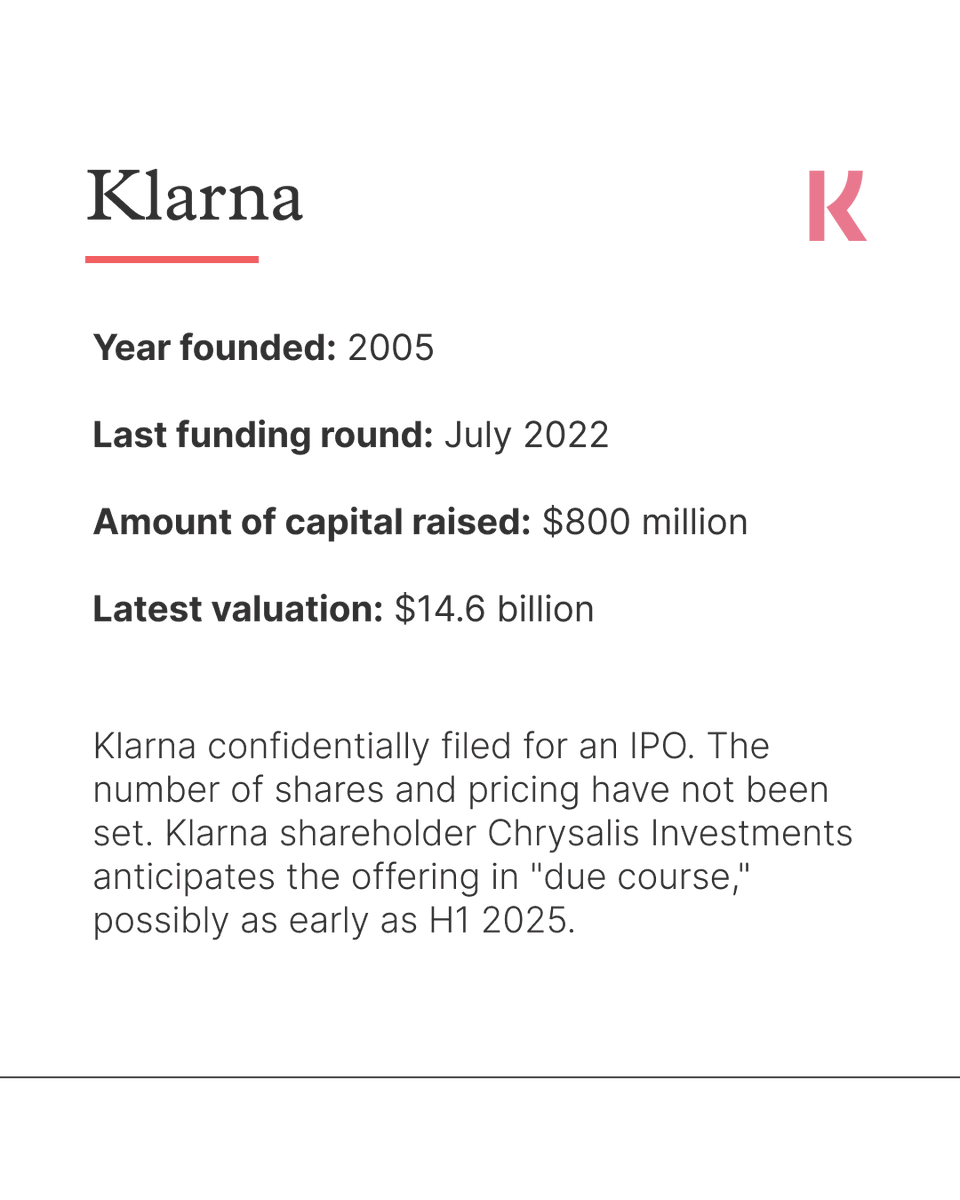

Several prominent tech companies are eyeing potential IPOs in 2025. Scroll to learn more about @Klarna, @CerebrasSystems, @Chime, @CoreWeave and @databricks.

We're excited to announce that Sarah Huggins, our Co-Founder, COO, and GC, has been recognized by Parity in this year's Top 100 Women in FinTech report. This honor highlights Sarah's leadership and dedication to driving innovation in the industry. Congratulations, Sarah!

The mechanisms of the private market have long been considered a black box. The founders of Hiive recognized that technology could unlock its potential and bring transparency to issuers, investors, and sellers. Find out how they did it.

This marks an important milestone in Hiive's mission to unlock the value of the private market. We are now closing over $100 million in transaction volume per month. Congratulations and thank you to everyone who helped make this possible.

The Hiive50 index is a broad indicator of the direction and momentum in the pre-IPO market, bringing even greater transparency to startup investing. Welcome to a new era of liquidity. hiive.info/4cSYPeK #Hiive50 #PreIPO #VC

A trading platform allows certain investors to buy and sell shares of pre-IPO unicorns. @SimDesai, CEO and Founder of @Hiive_HQ joins @KellyCNBC to discuss trends in the space.

New charts launched: You can now dive deeper into our 2,500 open orders in the private markets to see things like different transaction types, share types and a smattering of all our market activity. Check them out and see what insights you can find!

Dear venture capitalists: You're blowing it axios.com/2024/04/24/ven…

What’s one thing that all of the most actively traded unicorns have in common?

📈

How's this for transparency into the private market? This is the 28-day moving average of the number of bids accepted per day (including weekends) by sellers on the @Hiive_HQ platform since launch in July of 2022. We actually submit about 60-65% of these matches to the…

It’s been 10 years since the original unicorn analysis (when we accidentally coined the term)🦄 So, our @CowboyVC team dug into new data. The tech industry has changed a TON! ✨ From 39 to 532 unicorns ✨ Pendulum swung HARD from consumer to enterprise ✨ Business types,…

Thinking of joining a startup and getting valuable stock options as part of your compensation package? THINK AGAIN. You might know that those stock options will "vest" over time, typically four years. The idea is that you earn your way into ownership of these options and that…

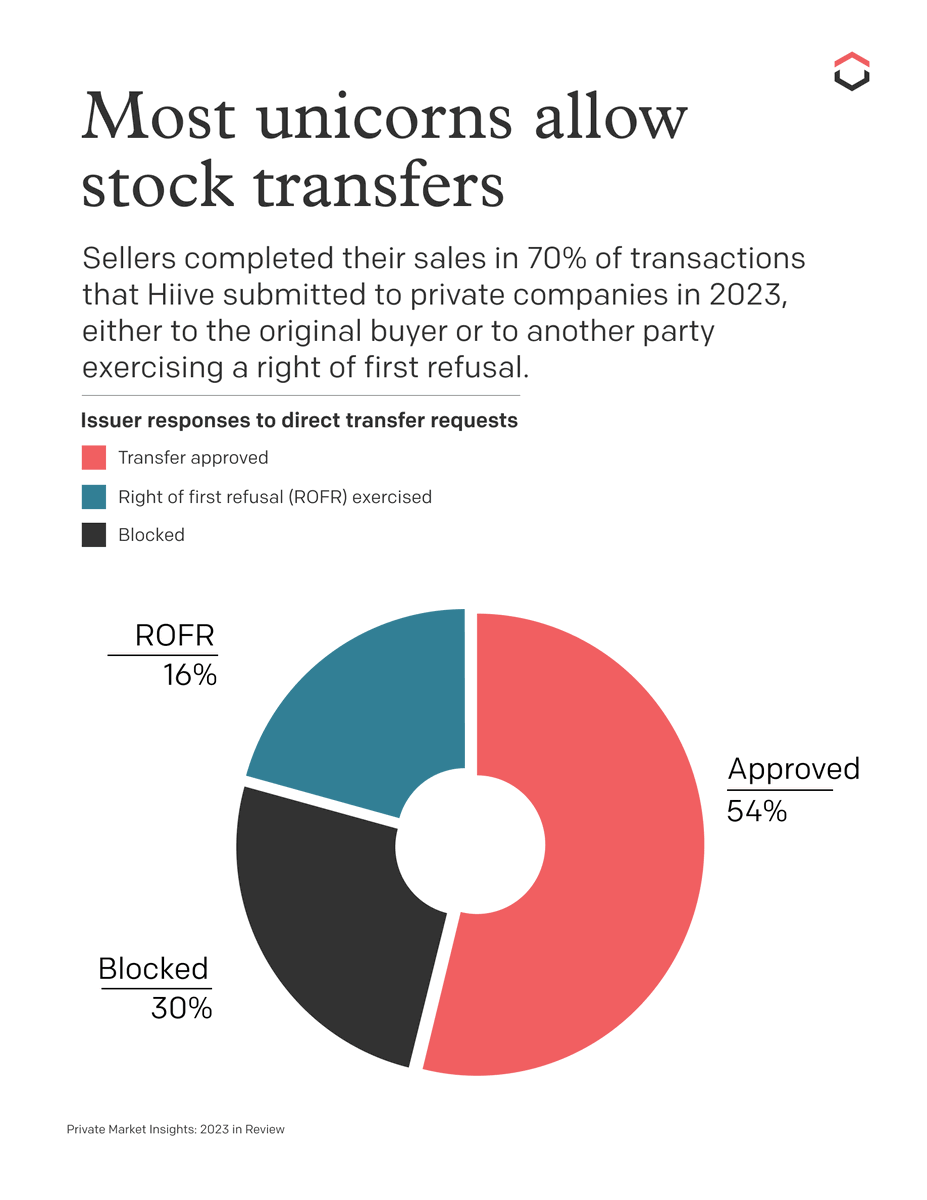

Do most venture-backed private companies ban secondary share sales by their employees and investors? The short answer is no According to Hiive data for the full year of 2023, issuers (the companies) approved 54% of the direct transfer requests we submitted to them, and they or…

In the last few months, I have seen the demonization of founder secondaries. This is BS. Responsible and proportional founder secondary sales aligns incentives of founders and VCs effectively. It can totally change downside protection mindset and enable truly going long.

This might be the end of @cartainc as the trusted platform for startups. As a founder it feels kind shitty that Carta, who I trust to manage our cap table, is now doing cold outreach to our angel investors about selling Linear shares to their buyers.

Liquidity in the private market remains scarce. In October, Hiive saw: 1⃣Bid/ask ratio hit an all-time low at 0.34, with listings vastly outnumbering bids. 2⃣Average transaction prices stayed at 53.9% of the last valuation, indicating limited market changes. 3⃣Bid/ask…

United States 趋势

- 1. #AEWDynamite 18.8K posts

- 2. JUNGWOO 50.1K posts

- 3. Snell 12K posts

- 4. doyoung 47K posts

- 5. Trey Yesavage 7,763 posts

- 6. #Survivor49 3,041 posts

- 7. Donovan Mitchell 5,036 posts

- 8. #LoveIsBlindS9 2,369 posts

- 9. Cavs 8,844 posts

- 10. Kacie 1,214 posts

- 11. Anthony Davis 2,867 posts

- 12. #SistasOnBET 1,898 posts

- 13. #LoveIsBlindReunion N/A

- 14. Mobley 2,043 posts

- 15. Trae Young 2,714 posts

- 16. Josh Minott 1,321 posts

- 17. Game 5 58.2K posts

- 18. Trey Murphy N/A

- 19. Aminata 1,512 posts

- 20. Blood and Guts 1,008 posts

你可能会喜欢

-

Emmie

Emmie

@mamangtest -

Hiive

Hiive

@Hiive_HQ -

Naoko / にしなお

Naoko / にしなお

@nnnnnishimura -

Zahed Musawi

Zahed Musawi

@zahedmusawi -

$ANDY.Millionaire

$ANDY.Millionaire

@MassiBART197881 -

panfi padayhag 💹🧲

panfi padayhag 💹🧲

@pampie08 -

Mo Money Moat Problems

Mo Money Moat Problems

@RopeCapital -

LTN

LTN

@ThanhNhtL1 -

Poacher

Poacher

@Poacher243 -

Minh Hải

Minh Hải

@haitrinh36 -

Atul Vinayak

Atul Vinayak

@atulvinayak -

Markus69

Markus69

@mark28656499 -

MoonLander

MoonLander

@xemltil

Something went wrong.

Something went wrong.