Step 1: Bank lends to private credit fund Step 2: Bank offloads own loan risk via SRT Step 3: Private credit fund buys the protection Step 4: Using leverage from that same bank Fed: “Risk not actually leaving banking system as it appears”

If I could point to one concept that has generally led to the downfall of the single manager hedge fund community, it the religious adherence to traditional valuation benchmarks - which is a fancy way of saying overweighting the value factor and shorting the growth factor.…

David explains why markets struggle to price sustained growth: "Above 30% growth, the market still doesn't fully value the growth rate. It is so hard for any investor to build a 5 or 10-year model where high growth persists. It's just not natural. No one built a financial…

Eurooppalaisenkin median bitcoin-uutisoinnissa alkaa näkymään selkeää muutosta. Ei se vielä ole kääntynyt positiiviseksi, mutta positiivisempaan suuntaan. Samankaltainen käännös tapahtui amerikkalaisessa mediassa noin neljä vuotta sitten. Neljän vuoden päästä meilläkin siis…

BlackRockin Larry Fink AI-kuplasta: "Käyn keskusteluja hyperscaler-johtajien kanssa ja he eivät ole varmoja yli- vai ali-investoivatko he tällä hetkellä tekoälyyn. Yhdestä asiasta he ovat varmoja: heillä on liian vähän laskentatehoa ja se ei riitä heidän kysyntäänsä."

It's the K-shaped economy. We need a robust economic plan to deal with our left-behind AI companies, which are now not even worth 10 trillion dollars collectively.

A perfectly timed article from Reuters. “AI is killing consulting.” What’s truly fascinating is this part: “For example, if a company performs a project in-house, it costs around $1 million, but consulting firms like Accenture have been offering the same service for $200,000.…

🚨 JUST IN: President Trump says he’d be allowed to serve a 3RD TERM in 2028 via running for vice president, then the president stepping down But, “I wouldn't do that. I think it's too cute.” 😂

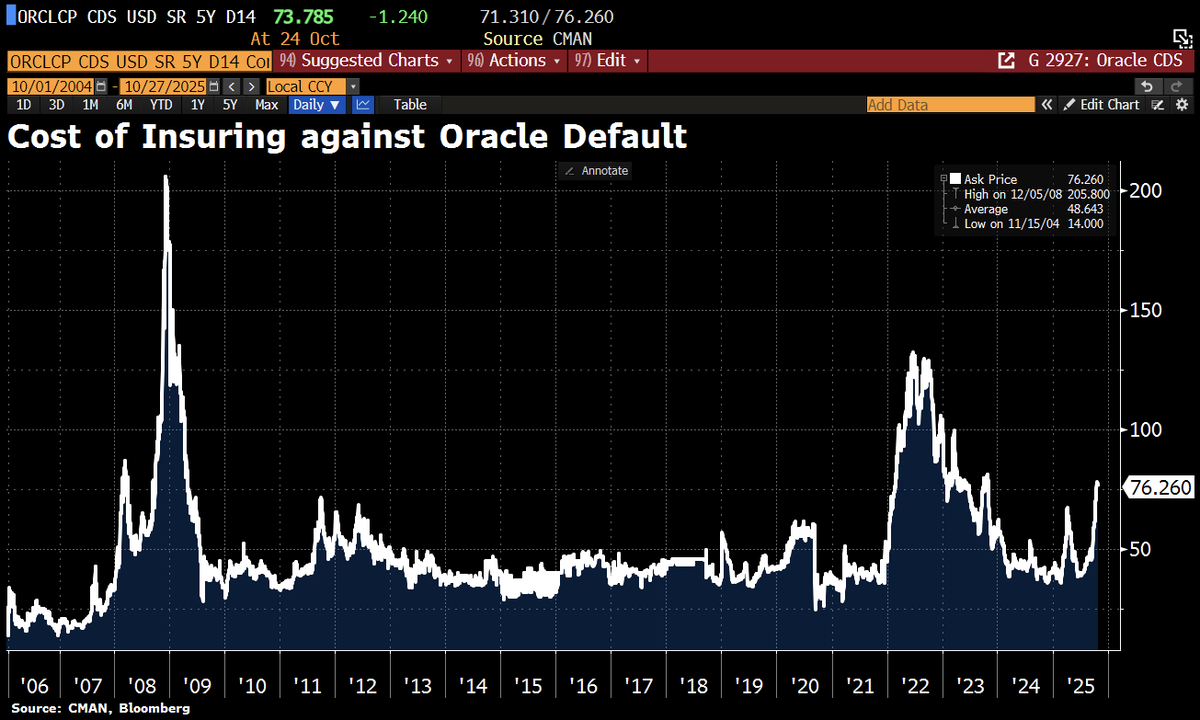

The cost of insuring against an Oracle default has surged following the company’s massive Q3 AI investment announcements – reaching levels not seen outside periods of major macro stress. Acc to Goldman, Oracle’s CDS spreads have become a key sentiment indicator for the market’s…

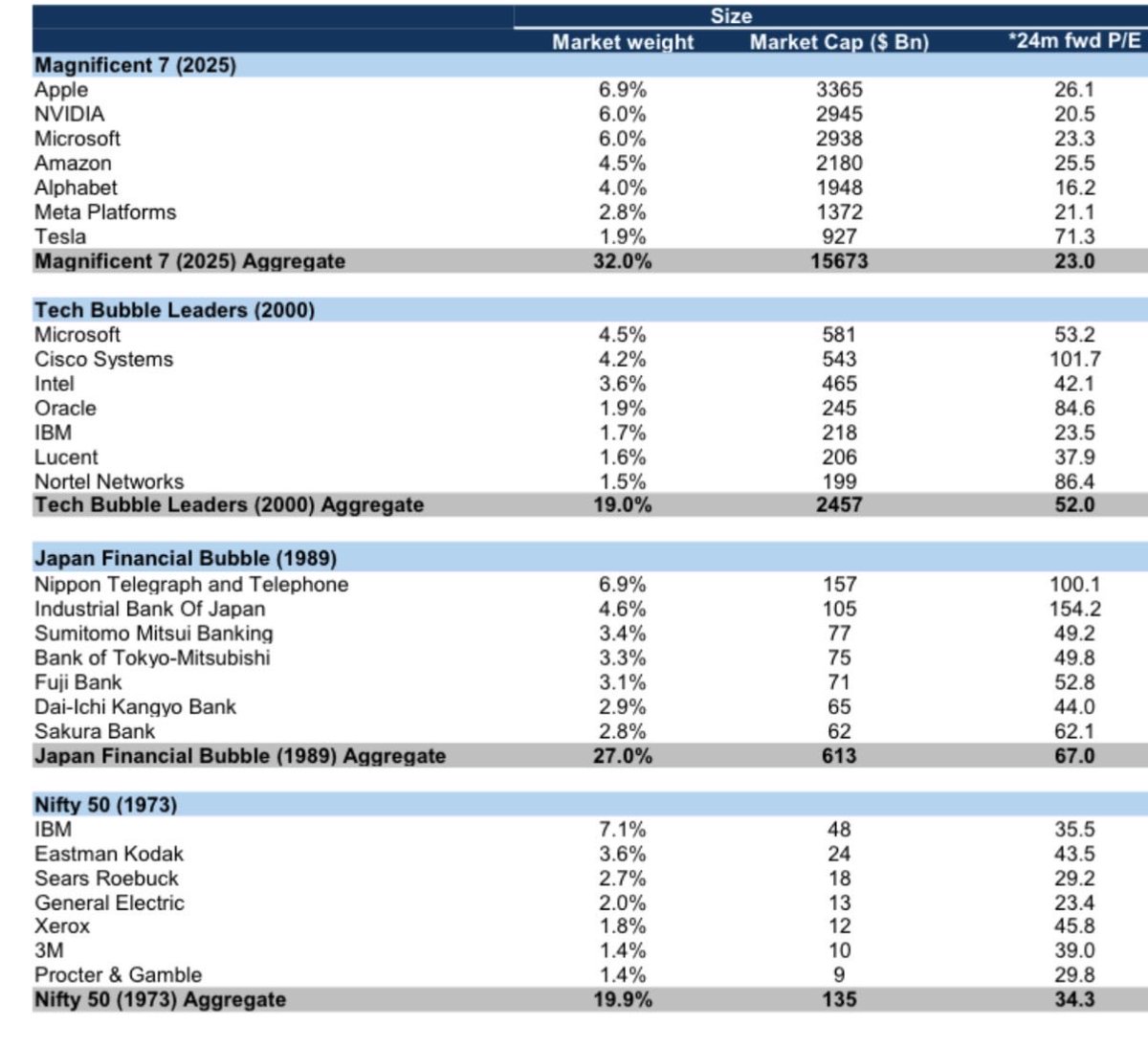

I'm once again asking you to stop comparing today's PE multiples against the dot com bubble Why? Earnings quality is absolute shit because of trillions of dollars in rountripping fuggazi AI revenue Look at the free cash flow, which cuts through the noise of non-cash vendor…

Great comparison of valuation of the largest companies today vs. previous bubbles

AI-boomi on tehnyt hyvää ydinvoimahankkeille USA:ssa. Iso infrarahasto Brookfield neuvottelee kahden kesken jääneen reaktorin haltuunotosta. Varainhoitaja omistaa toisen rahastonsa kautta enemmistön ydinreaktoreita tekevästä Westinghousesta. wsj.com/business/energ… via @WSJ

wsj.com

Exclusive | Brookfield in Advanced Talks for Massive Nuclear Project in South Carolina

Nuclear energy is having a comeback as big tech’s AI push stokes demand.

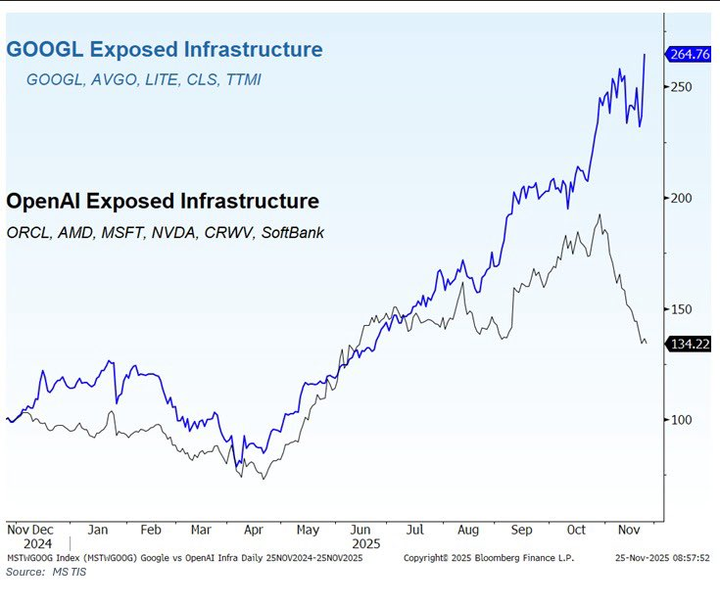

These graphs look very similar to railroad companies in the 1800s.

Almost unbelievable how much CAPEX has grown for the big tech companies in the last decade. Roughly 10x for each of these, and close to 20x for $META

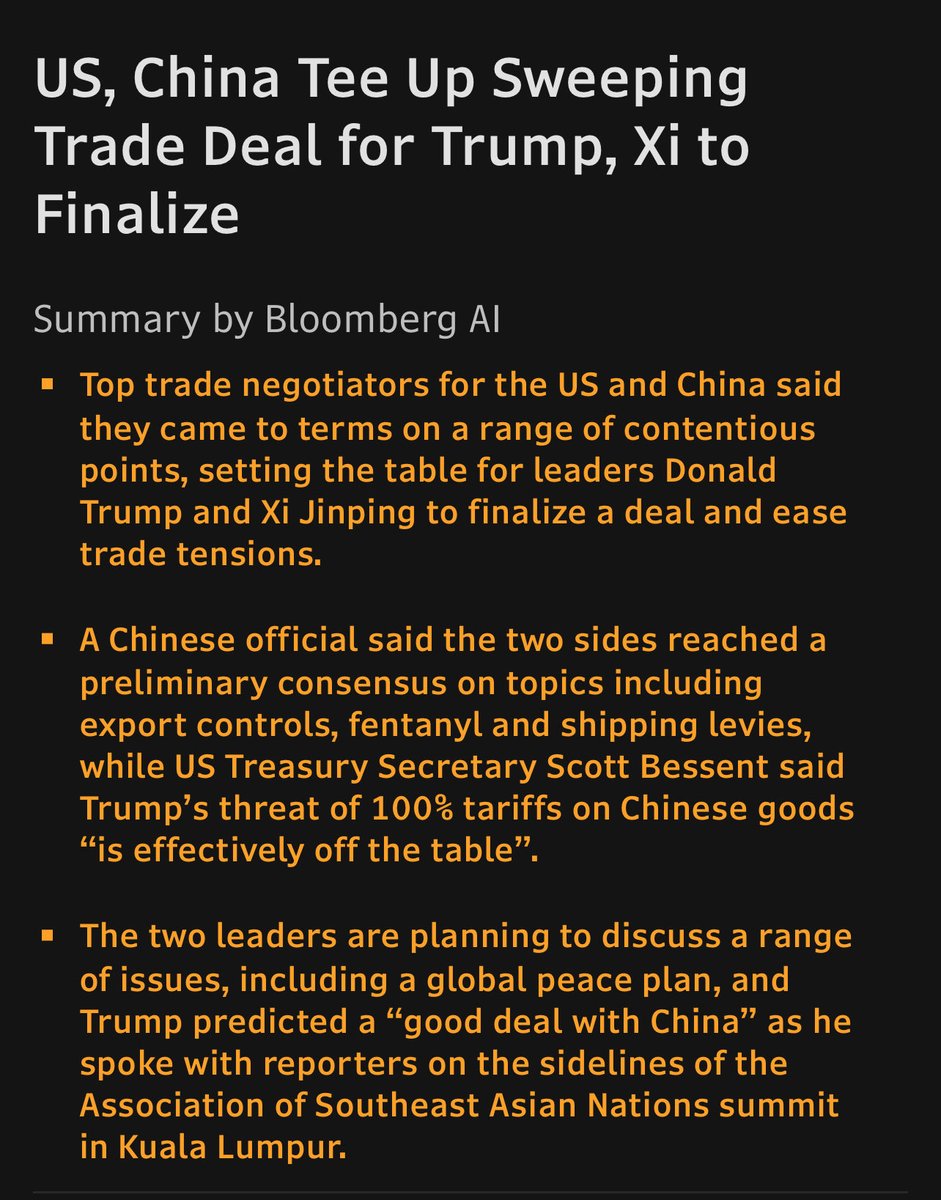

Jep, USA ja Kiina hierovat rauhaa, mutta heitän nyt villin veikkauksen tähän kuitenkin: maiden välinen kauppasota ei ollut tässä, vaan Trump herättää sen vielä uudestaan. Ehkä jo ensi viikolla, ehkä vasta vuoden päästä, sitä en osaa ennustaa. Maiden intressit ovat mielestäni…

Maailmanlopun odottajat joutuvat taas pettymään, kun osakemarkkinat jatkavat maanantaina kaikkien aikojen huippujen tehtailua. USA-Kiina kauppadiilistä on päästy sopuun.

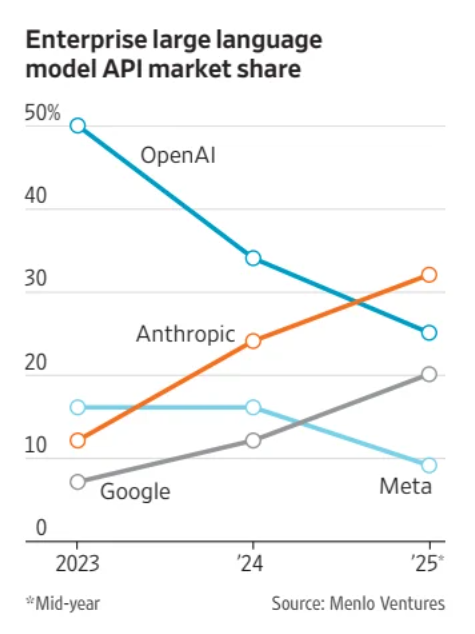

Anthropic has overtaken OpenAI in enterprise large language model API market share

Owning a house is like driving Porsche. Doesn’t make financial sense, but it feels really good.

The global debt crisis - like all crises - advances in fits and starts. Yesterday, longer-term yields globally rose because of a sharp spike in Japanese yields on news of a fiscal dove as likely new prime minister. There's just too much debt everywhere... robinjbrooks.substack.com/p/the-global-d…

Impressive work.

My brain broke when I read this paper. A tiny 7 Million parameter model just beat DeepSeek-R1, Gemini 2.5 pro, and o3-mini at reasoning on both ARG-AGI 1 and ARC-AGI 2. It's called Tiny Recursive Model (TRM) from Samsung. How can a model 10,000x smaller be smarter? Here's how…

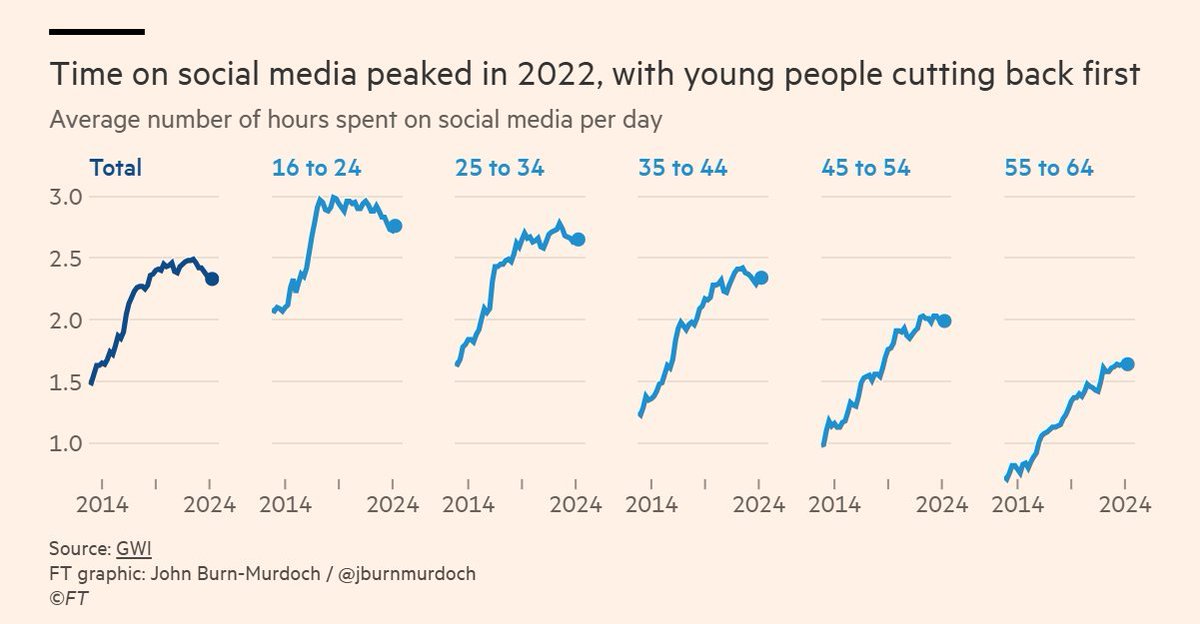

Syytä optimismiin: ihmisten sosiaalisessa mediassa käyttämä aika on laskussa. Nuoret etunenässä.

Kuluttajien luottamus omaan talouteen oli kolmannella vuosineljänneksellä korkeimmillaan sitten Venäjän 2022 hyökkäyksen Ukrainaan ja palautunut kevään "liberation day" -järkytyksestä. Kyllä se siitä. PS. korttidata käy yksiin tuon käyrän kanssa.

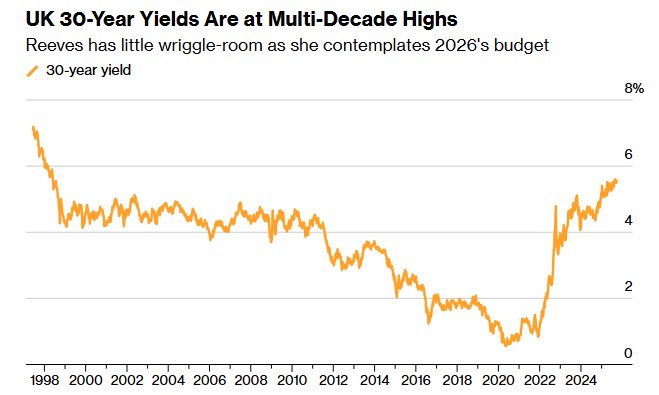

It’s difficult to imagine how the UK government will avoid a debt crisis. Labor left wing will prevent any reasonable reforms of welfare & government waste, leaving only bad options like higher taxes on the table. They will further throttle growth potential & reduce tax revenues.

United States Trends

- 1. Good Thursday N/A

- 2. #thursdayvibes N/A

- 3. #AgendaEnergética N/A

- 4. Happy Friday Eve N/A

- 5. #DareYouToDeathEP8 N/A

- 6. LINGORM EMDISTRICT CNY2026 N/A

- 7. JUNGKOOK N/A

- 8. #EMDISTRICTCNY2026xLingOrm N/A

- 9. Jessie Diggins N/A

- 10. #12Feb N/A

- 11. Timo N/A

- 12. Día de la Juventud N/A

- 13. Richard Gere N/A

- 14. ICE Custody N/A

- 15. Scott Jennings N/A

- 16. Vote YES N/A

- 17. The IOC N/A

- 18. Leon Black N/A

- 19. $NBIS N/A

- 20. The Dow N/A

Something went wrong.

Something went wrong.