おすすめツイート

관심가는 이슈) 크립토 업계가 밀고 잇던 ai-web3-블록체인 3자 프레임워크에 대한 두 대형 플레이어의 엇갈린 해석이 눈에 띔. Jeremy Allaire (CIRCLE CEO) : AI와 블록체인은 서로를 위해 만들어졋다. 크립토 VC Paradigm : 홈페이지에서 크립토/web3 삭제하며 AI 등 프론티어 테크놀로지 강조.

진행 모멘텀) - 마켓메이킹 대형 VC 들의 사업 후퇴 종료 모멘텀) - 뱅크런/구제금융 반사이익 bearish.

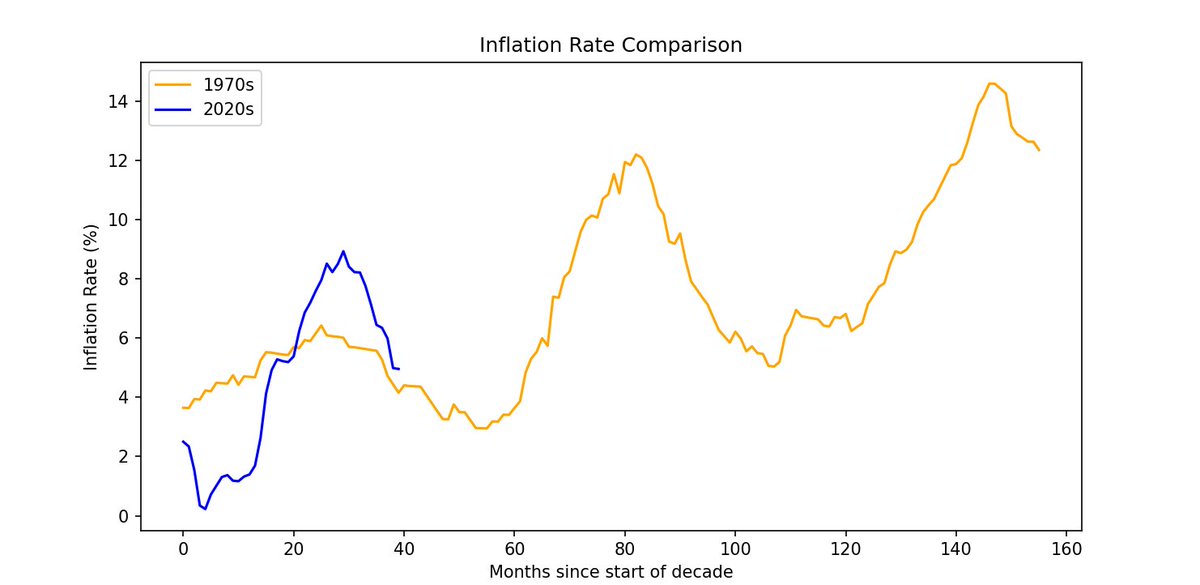

Comparing the 2020's inflation cycle with the 1970s, shows were off to a solid correlation. Get ready for 2024 🚀, lots of volatility, and keep debt at a minimum.

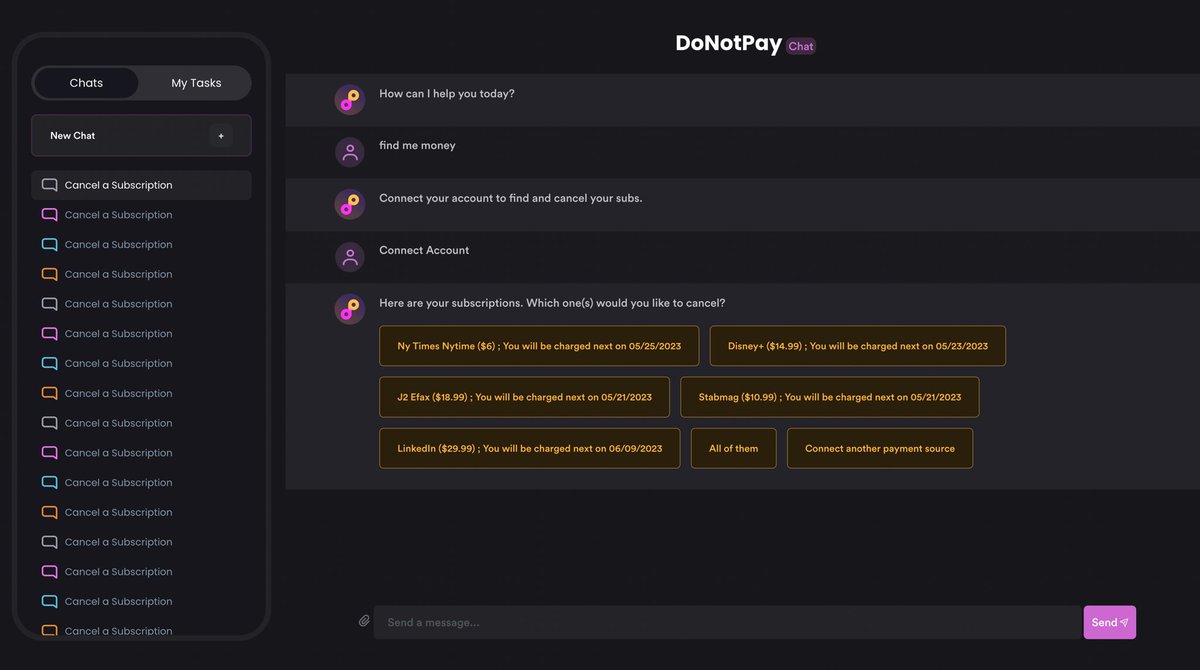

I decided to outsource my entire personal financial life to GPT-4 (via the @donotpay chat we are building). I gave AutoGPT access to my bank, financial statements, credit report, and email. Here’s how it’s going so far (+$217.85) and the strange ways it’s saving money. (1/n):

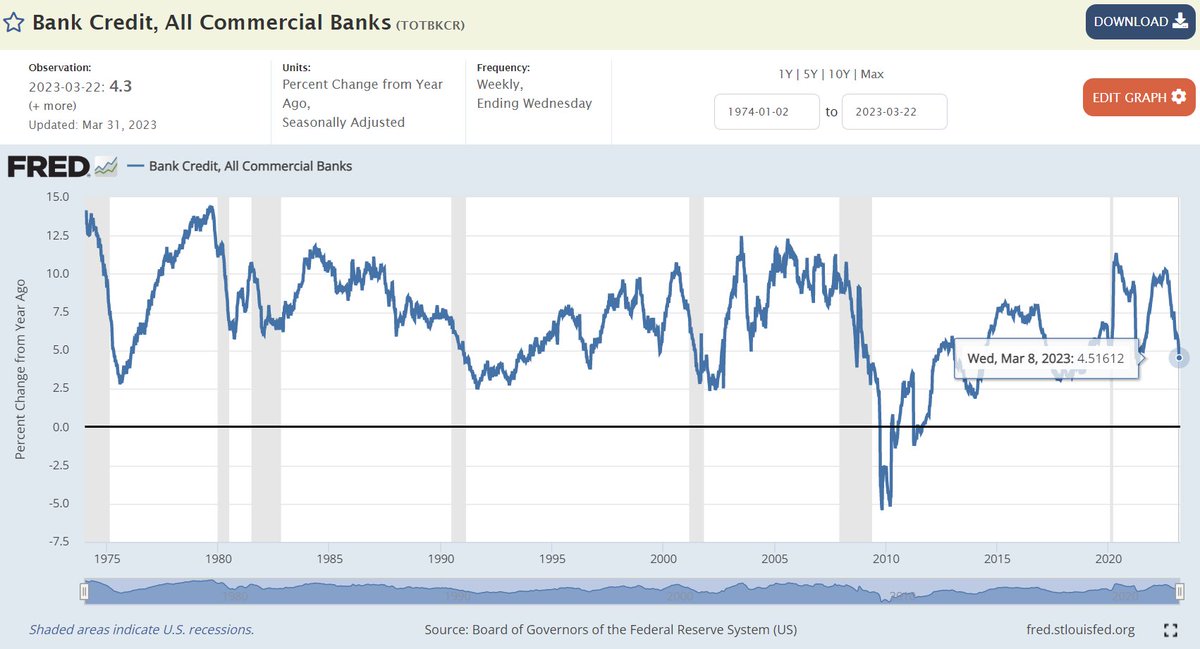

9) The thing you should be tracking is BANK CREDIT. (the assets on bank balance sheets incl loans and securities held) Growth in Bank Credit has decelerated to 4.5% YoY. If there truly is a credit crunch, that figure will keep decelerating. And go negative like in 2009.

Conclusion: BTCs risk-adjusted returns make a solid case for asset allocation inclusion. Its volatility has ⬇️ as global assets have become riskier. We see BTCs volatility as the inverse of the fiat-based financial system, which will likely become more unstable with time.

Being @CNBC refuses to mention this and curious why @liesman hates the truth, I am showing you this: During high inflation: Year S&P500 PE Ratio 1916 6.3 1917 5.7 1918 7.9 1941 8.0 1948 6.6 1949 7.2 1950 7.5 1978 7.9 1979 7.4 Spread this, I think I'm shadowbanned

The Ethereum blockchain has deployed a feature known as “account abstraction,” formally known as ERC-4337, seen as a key enhancement that could make it easier for users to recover crypto if they lose private keys to an online wallet. coindesk.com/tech/2023/03/0…

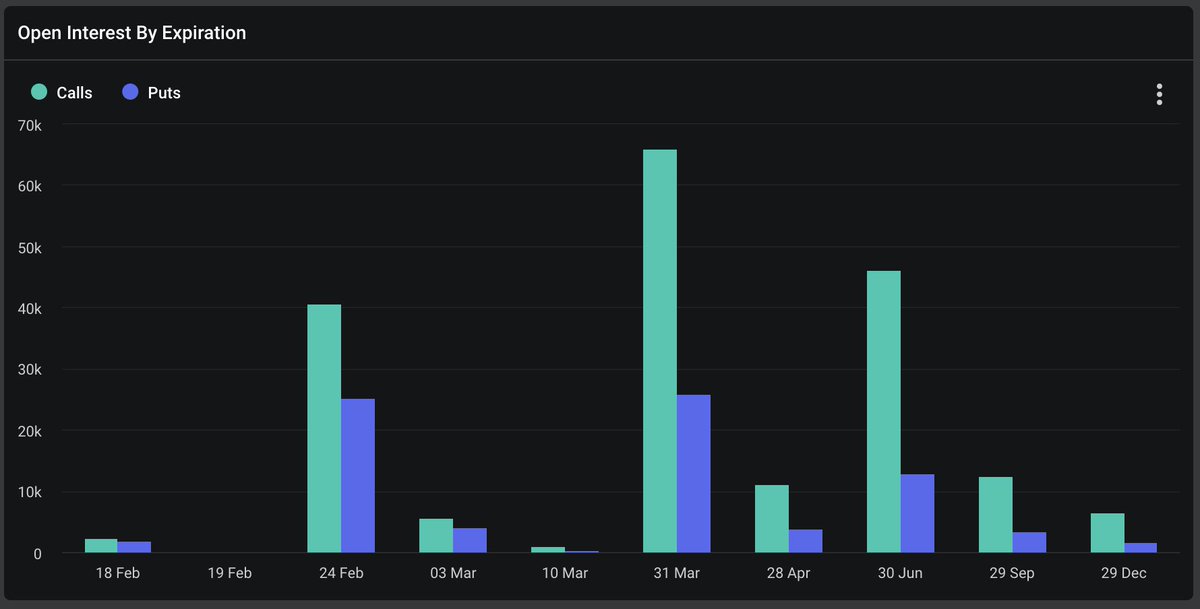

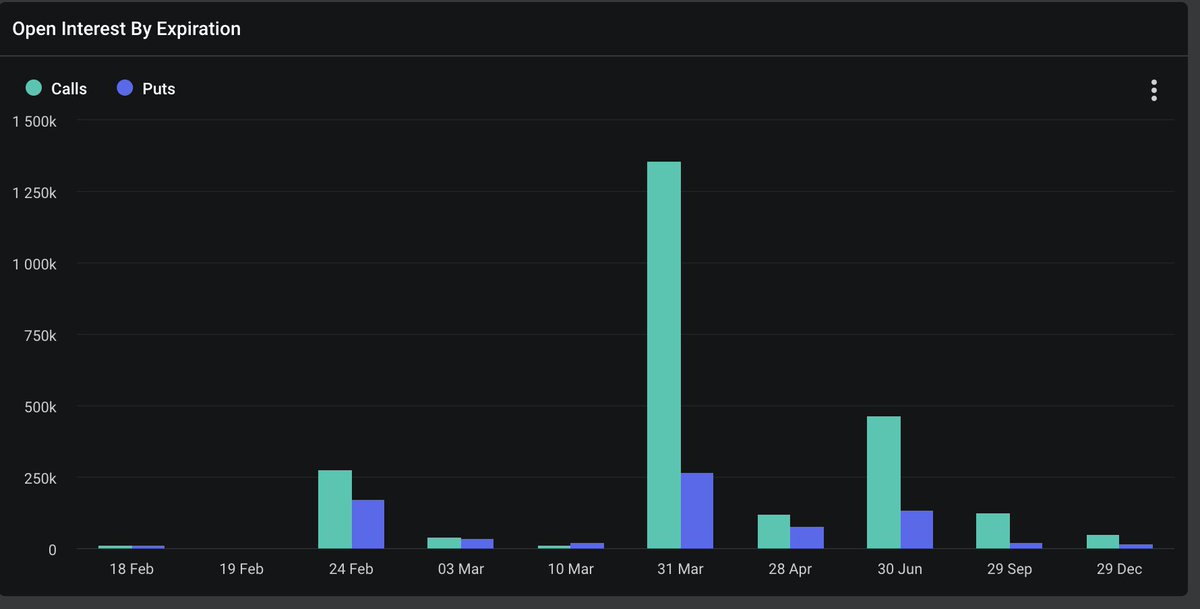

Interesting call-put ratio for BTC/ETH options on Deribit. The market appears to be very bullish on BTC/ETH. As of March 31st BTC call open interest (OI) is twice as high as the put OI. ETH call OI is four times as high as the put OI.

So in actual fact Ethereum was the only network that grew in the bear market. There's no better example of a competitive moat in the asset class, reinforcing the community's decision to prioritize scalability only after decentralization and security were firmly enshrined

Fed governor Philip Jefferson: Changing the 2% inflation target could call "into question the FOMC's commitment to stabilizing inflation at any level." "It might lead people to suspect that the target could be changed opportunistically in the future." federalreserve.gov/newsevents/spe…

Global housing prices with some regional exceptions are holding up, but sales volumes have collapsed. Soon the combined impact of $2 trillion student loan debt, epic housing collapse, stock market wipeout and mass layoffs will land on them like a ton of brick🚨 Ht:…

Ritz Crackers, 300g to 227g, still $3.50 AUD #shrinkflation = stealth inflation

So buying $300mil worth of 0dte calls can shift what $300bil of market cap? That's not 10x leverage but 1000x. That's nuts and shouldn't be the case on short dated options.

In order to start winning, you must fail first. In order to be a profitable trader, you must learn how to lose & deal with losing trades. -Learn when to cut your losses strategically -Learn how to accept your losses Without this, you'll revenge trade until you lose everything.

United States トレンド

- 1. #hazbinhotelseason2 63.9K posts

- 2. Good Wednesday 21.4K posts

- 3. Peggy 20.5K posts

- 4. #hazbinhotelspoilers 4,290 posts

- 5. LeBron 89K posts

- 6. #InternationalMensDay 27.3K posts

- 7. #DWTS 54.9K posts

- 8. Dearborn 252K posts

- 9. Baxter 2,491 posts

- 10. Kwara 188K posts

- 11. #HazbinHotelVox 19.8K posts

- 12. Patrick Stump N/A

- 13. Whitney 16.6K posts

- 14. Grayson 7,272 posts

- 15. Tinubu 156K posts

- 16. Orioles 7,483 posts

- 17. Cory Mills 10.8K posts

- 18. Ward 27.1K posts

- 19. MC - 13 1,142 posts

- 20. Sewing 5,268 posts

おすすめツイート

Something went wrong.

Something went wrong.