M Group CPA

@mgroupca

M Group CPA LLP is a full-service accounting firm providing a wide range of services including accounting, tax, consulting, business valuation

You might like

If you have self-employment income but have not filed your 2020 personal tax return, there is still time! Your return is due on June 15, 2021. But, please get it to your accountant by Monday, June 7, so they have time to prepare it.

If there is one thing I would advise every client, it is to file your taxes on time, even if you can't pay them on time. Just ask this investment advisor. ow.ly/SWTJ50E3nE1 So far, this year's personal tax filing deadline remains unchanged at Friday, April 30, 2021.

Stuck working from home in 2020 and wondering if you can claim home office expenses? A new flat rate method of $2 per day is perfect for those who don't want to keep records. You don't even need a form from your employer. ow.ly/zS4I50DLDvG

If your business has not yet applied for the Canada Emergency Wage Subsidy, time is running out! Deadline for periods 1 to 5 is January 31, 2021. See if you qualify here: ow.ly/xWJi50D6ENh

If you own a business, you probably know your T4s and T5s are due at CRA by Monday, March 2, 2020. Penalties for being even one day late! If you are an employee, you should have your T4 by then.

It turns out meals with your spouse are NOT deductible. Something we tell clients regularly. Yes, even if you discuss business! ow.ly/p7NQ30ppwzX

If you have self-employment income, your personal tax return is due on June 15. But since that falls on a weekend in 2019, you have until Monday, June 17, 2019 to file. Be sure to file on time, as CRA's late-filing penalties can be from 5% to 50% of your taxes owed!

Thanks to everyone who filed their personal tax returns with M Group this year. Want to check on your tax owing or refund? Sign up for CRA's My Account. ow.ly/ba2m50u0HnK Accountant-approved!

Friday, April 12, 2019 is M Group's last call for 2018 personal tax returns. Please have your information into us by then, to ensure on time filing. Be kind to your accountant and don't send it on April 30th! You can upload your information here: ow.ly/NdF250pSPol

There are only 30 days left to file your 2018 personal tax return. Get your information to your CPA this week! Here is our checklist to get started. ow.ly/N03n30ohcY3

Believe it or not, you have only 7 weeks to file your 2018 personal tax returns! You should have most of your slips by now. Here is a checklist to get you started. ow.ly/a8ke30o0ZEE

T4s and T5s are due on Thursday, February 28, 2019. So, if you pay your employees or take dividends out of your company, be sure to file this week. For those who receive T4s and T5s, you should get them this week. So, you can start working on your personal taxes soon!

It is officially the start of tax season, as CRA has re-opened E-File for 2018 returns. Get your information to your accountant as soon as you are have it - no need to wait until the last week of April! ow.ly/ZFQw30nNtoL

M Group is looking for great people to work with us in both Winnipeg and Vancouver. If you are looking for a great place to work, apply here: ow.ly/D3R930m0Z0t

Restaurant owners and servers beware! CRA is coming after tips. Best to report all of your income. ow.ly/o1jF30kpeBU

Bill Morneau released his third budget this week - a big event for CPAs. Yes, the income splitting rules came into effect January 1, 2018. You can read our summary here. ow.ly/wloV30iIecF

It's personal tax time again. CRA opens their e-file service for 2017 returns on Monday, February 26, 2018. Happy filing! ow.ly/miI730izXoq

CRA recently disallowed ALL employment expenses for employees who are also shareholders. In a rare turnaround, they are reversing these reassessments for employee/shareholders. New guidance coming for 2019.

Finance has finally come out with their "simplified" legislation to address income sprinkling. Professionals and other service businesses get no relief, but other non-services businesses do! ow.ly/Ic1630hibMT

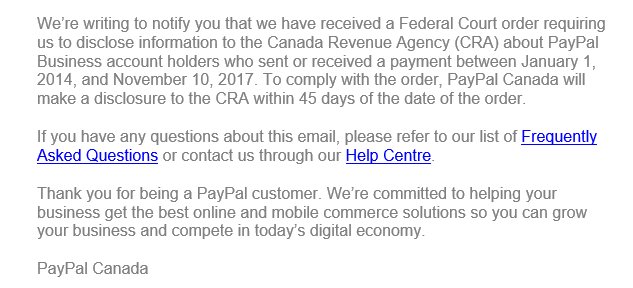

PayPal is working with CRA to turn over names of people with business accounts. If you made money and were paid by PayPal, make sure that you reported it on your tax returns. If you forgot, adjust your returns now! ow.ly/oblL30gDRsg

United States Trends

- 1. McDermott N/A

- 2. Beane N/A

- 3. #MLKDay N/A

- 4. Don Lemon N/A

- 5. Dr. King N/A

- 6. Dr. Martin Luther King Jr. N/A

- 7. Daboll N/A

- 8. Happy MLK N/A

- 9. KKK Act N/A

- 10. Pegula N/A

- 11. Joe Brady N/A

- 12. Sherwood N/A

- 13. Buffalo N/A

- 14. Valentino Garavani N/A

- 15. Norway N/A

- 16. Nobel Peace Prize N/A

- 17. MLK Jr. N/A

- 18. Pete Nance N/A

- 19. Dolly N/A

- 20. #NationalChampionship N/A

You might like

Something went wrong.

Something went wrong.