Michael Duke

@michaeldukeid

I build portfolios & underwrite real assets. Contributor @SeekingAlpha | Founder, Blue Panther Capital | Focused on yield, leverage, and asymmetric returns

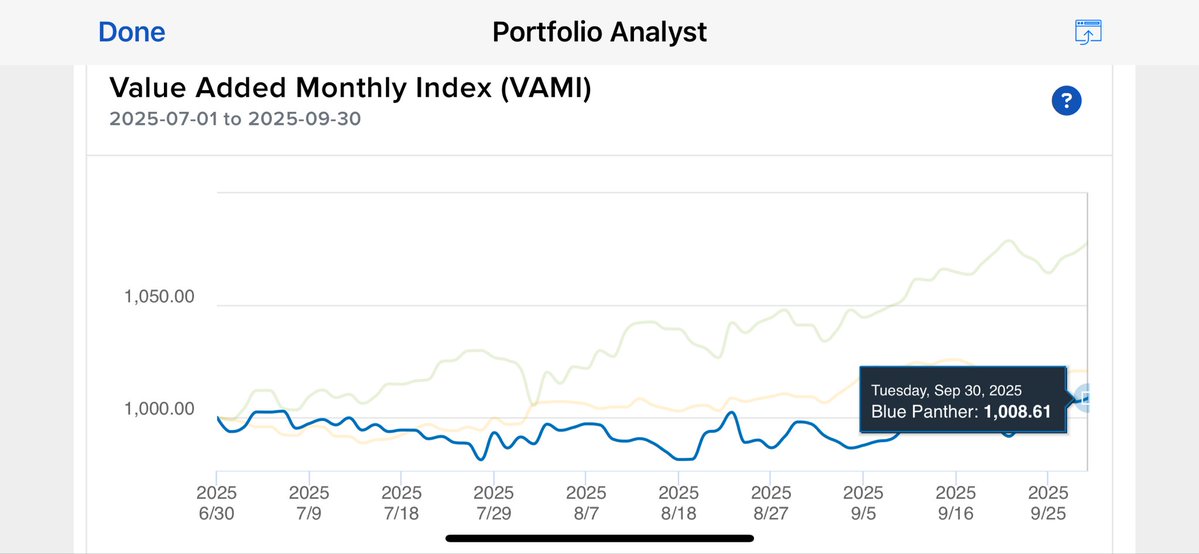

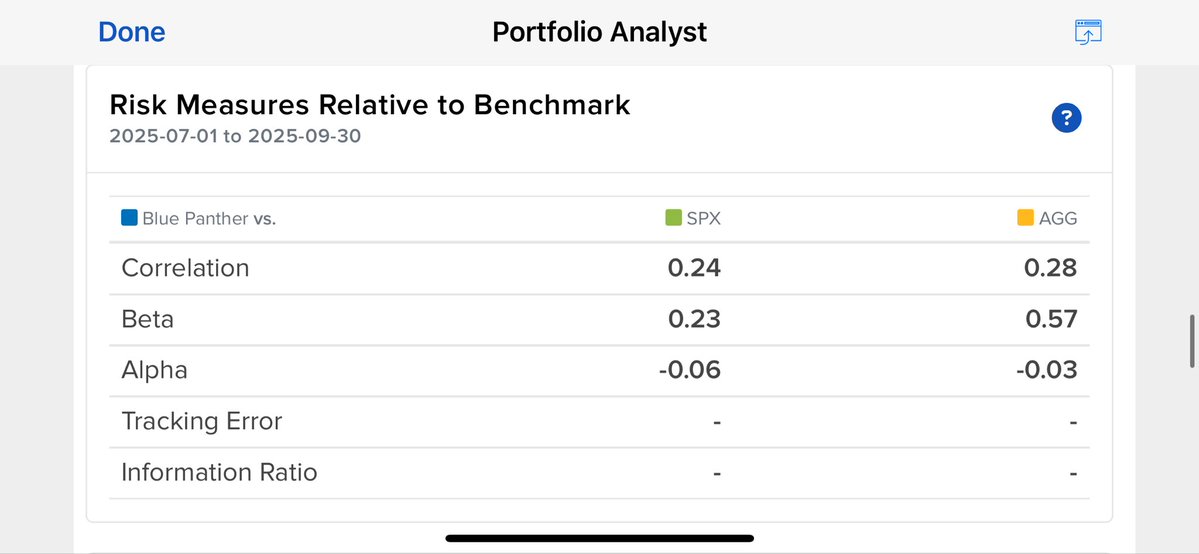

📊 Q3 2025 Portfolio Recap: Total Return: +0.86% Sharpe Ratio: –0.05 Max Drawdown: 2.16% YTD Return: +10.86% Sharpe YTD: 0.76 Top 5 Holdings: $PM $WPM $MPLX $ET $ARLP Q3 lagged both $SPX and $AGG as I executed a major capital reallocation, using a margin loan to acquire Duke…

I’m no chips expert but I find it hard to believe that these assets aren’t useful for longer than 2-3 years. Just because they keep buying more that quick doesn’t mean they become worthless in as much time... Also, Depreciation is a non cash expense so… one can easily use EBITDA

Understating depreciation by extending useful life of assets artificially boosts earnings -one of the more common frauds of the modern era. Massively ramping capex through purchase of Nvidia chips/servers on a 2-3 yr product cycle should not result in the extension of useful…

Lots of staples stocks have been sounding the alarm on macro factors but honestly, I don’t fully buy it. Heinz ketchup is at a huge premium to store brands for example… that’s micro consumer sentiment, not macro. What about Philadelphia cream cheese vs store brand? $KHC

Kraft Heinz CEO Warns of Worst Consumer Sentiment in Decades

I love Chipotle. I always get a double protein bowl, add queso and guacamole and eat with chips and a drink. It’s expensive but so is eating out anywhere… it’s the best QSR $CMG

It was my wedding day

can yall pls tell me the lore behind your profile pictures

Finally, a betting scandal not involving Shohei Ohtani

There were a few days this week that all major asset classes were getting bid up while Oil was red for the day… that gives me an idea of where value might be in these markets right now.

Having this much wealth and holding 100% of it in levered crypto is incredibly poor risk management.

Is there anything worse than a lawn? They look great, sure… but so much land is misappropriated to such a non productive use…

Something I don’t understand here is when I see stuff like this because the productivity gains I have achieved from AI are insane. Maybe it’s just hard to quantify in dollar terms?

95% of organizations in a new MIT study found zero return despite enterprise investment of $30 billion to $40 billion into GenAI, per Axios.

America is a culture of hard work. Many work so hard that they forget to map out their future. Being busy is not being productive.

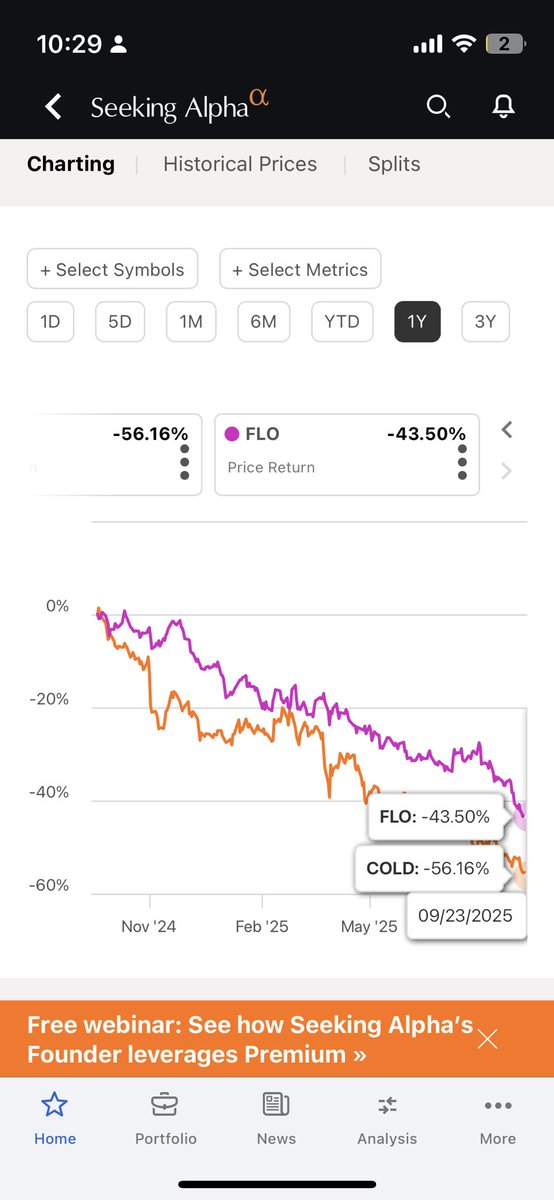

These two tickers have had a phenomenally smooth ride down over the last year. Low volatility, like an escalator moving down a floor. Fascinating $COLD $FLO

United States الاتجاهات

- 1. Packers 96.9K posts

- 2. Eagles 125K posts

- 3. Jordan Love 14.9K posts

- 4. #WWERaw 128K posts

- 5. Matt LaFleur 8,397 posts

- 6. $MONTA 1,303 posts

- 7. Benítez 9,723 posts

- 8. AJ Brown 6,871 posts

- 9. Jaelan Phillips 7,721 posts

- 10. Jalen 23.8K posts

- 11. Patullo 12.2K posts

- 12. McManus 4,310 posts

- 13. Sirianni 4,969 posts

- 14. Smitty 5,473 posts

- 15. #GoPackGo 7,862 posts

- 16. Grayson Allen 3,519 posts

- 17. James Harden 1,714 posts

- 18. Cavs 11.2K posts

- 19. #MondayNightFootball 1,930 posts

- 20. Vit Krejci N/A

Something went wrong.

Something went wrong.