Microcap_Value

@microcap_value

AU and NZ microcaps. Opinions should not be considered advice. http://strawman.com/MicrocapValue

You might like

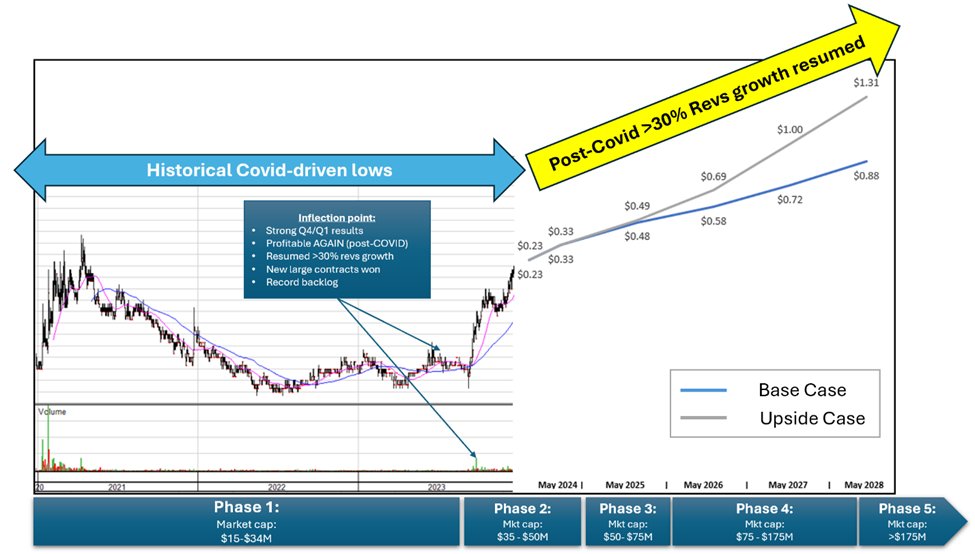

$TMG.V is my prime candidate for studying Discovery Process of a small cap Co. Why? 1. Small, profitable, non-diluting, >30%/y revs growth 2. Low institutional ownership 3. Entering $50-$100M sweet spot for institutions 5-phase discover process & price targets ⬇️

$CV1 CV Check cash flow positive in first half of FY22, set for further growth tinyurl.com/y5o379g6 @CVCheckLtd #CV1

$MSG.AX wins contract with Vicinity Centres to supply security services to all 13 of their shopping centres in Western Australia. themarketherald.com.au/mcs-services-a… via @themarketherald

themarketonline.com.au

MCS Services (ASX:MSG) wins contract to service 13 WA shopping centres

MCS Services (ASX:MSG) wins a contract to supply security services to 13 shopping centres in Western Australia.

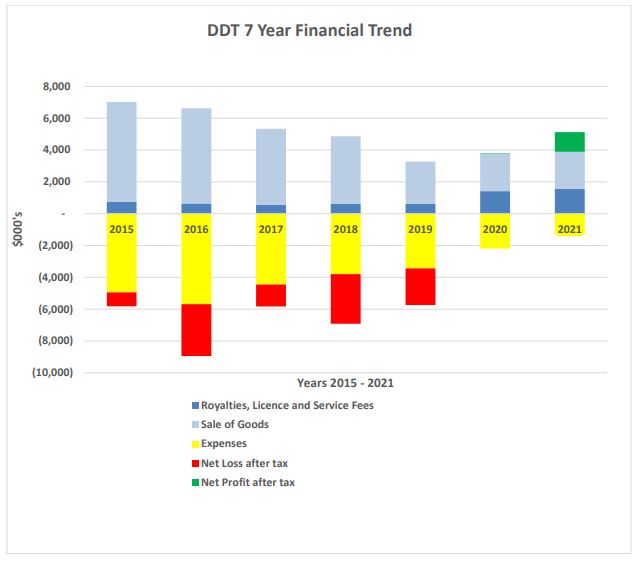

Datadot $DDT.AX starting to see the benefits from an extensive restructure following the appointment of a new Chair and Managing Director in 2019. The story since has been a higher portion of revenue from royalties & license fees while lowering expenses. MC 15m, PE 12, CF +ve.

$qccu $qccu.v is absurdly undervalued. 2bb lbs of #copper (probably 3-4bb post add'l drilling) in a premier jurisdiction with existing infrastructure in place. That plus 15mm of marketable securities $find and cash. All yours for $42mm market cap -should valued closer to $420mm

Hopped aboard $QCCU.V overnight. Large copper and gold deposit (with room to expand) plus excellent on-site infrastructure in place. Has had a good run in the last few days but still looks pretty cheap with a MC of CAD40m.

$EPY Annual Report out. Digital transformation looks to be well advanced with Board confident of "significant growth in revenues and 40%+ NPATA growth in the 2022 financial year." Current MC 126.42M FY21 NPAT 8.74m Div yield 5% Looks a good hold.

And a selection for the speculative portfolio: $evz (entry 17 cents) $fos (entry 24.5 cents) $pre Pensana PLC (entry 74p) $rap (entry 8.2 cents) $zno (entry 44 cents)

The starting portfolio: $AVA (entry 46 cents) $DSE (entry 19 cents) $EPY (entry 45.5 cents) $GUL (entry 9.2 cents) $JCS (entry 5.9 cents) $JYC (entry $3.22) $MSG (entry 5.8 cents) $SEQ (entry 65 cents) $TEK (entry 46.5 cents) $XRF (entry 64 cents)

United States Trends

- 1. Ryan Garcia N/A

- 2. Ryan N/A

- 3. #UFCHouston N/A

- 4. Strickland N/A

- 5. Rondale Moore N/A

- 6. Rockets N/A

- 7. Knicks N/A

- 8. Duke N/A

- 9. Brunson N/A

- 10. Greenland N/A

- 11. Auburn N/A

- 12. AJ Dybantsa N/A

- 13. Fluffy N/A

- 14. UCLA N/A

- 15. Michigan N/A

- 16. Chandler N/A

- 17. Mark Pope N/A

- 18. Jose Alvarado N/A

- 19. #Boxing N/A

- 20. Frank Martin N/A

You might like

-

Crash

Crash

@Noicewon11 -

Amateur Capital

Amateur Capital

@AmatuerCapital -

Martin Pretty

Martin Pretty

@martinpretty -

Macro Quant Sloth

Macro Quant Sloth

@MacroQuantSloth -

Meezaa

Meezaa

@Meezaaninvestm1 -

Nobody.

Nobody.

@Nobody_But_M3 -

Alex Hammond

Alex Hammond

@Goat_Hammond -

Juan Varela

Juan Varela

@Juan_Varela_Cao -

Ryan and the crazy stock markets

Ryan and the crazy stock markets

@ryan_markets -

Asymmetric ventures 🇪🇺🇪🇸

Asymmetric ventures 🇪🇺🇪🇸

@Value_Europe

Something went wrong.

Something went wrong.