Season 2 is better than Season 1 because now you actually own the things you earn or collect. In Season 1, you could use items, points, or characters, but they didn’t fully belong to you. In Season 2, everything you unlock becomes yours, and no one can take it away not even the…

One thing people underestimate about EnsoFi is how seamlessly it blends simplicity with real depth. Most DeFi platforms overwhelm you with tools and dashboards, then expect you to magically become a full-time strategist. EnsoFi flips that mindset completely. You get fixed lending…

Every time I look around DeFi, it’s the same story , new platforms, same problems, no real progress. EnsoFi is one of the rare ones that actually breaks the cycle. Cross-chain fixed lending sounds simple, but the impact is huge. For once, you’re not chasing APR spikes or worrying…

Season 2 is better than Season 1 because now you actually own the things you earn or collect. In Season 1, you could use items, points, or characters, but they didn’t fully belong to you. In Season 2, everything you unlock becomes yours, and no one can take it away not even the…

X1 EcoChain is reshaping DePIN economics by shifting incentives away from idle hardware rewards and anchoring them directly to real network utility. Instead of paying nodes simply for being online, the system channels rewards to meaningful activity such as verifiable data…

The magic of @X1_EcoChain is simple: thousands of low-power nodes, real users, real locations, all securing a fast PoA chain. No giant rigs, no wasted power. Just a DePIN network that expands whenever someone plugs in. Adoption becomes the engine.

Most chains brag about hardware. @X1_EcoChain flips the script. Each node runs on just 3Wh, meaning anyone, homes, offices, can power a real DePIN network. Maculatus testnet already shows global, low-energy nodes creating speed, resilience, and true decentralization.

EnsoFi is integrating Monad for high-throughput EVM and Hyperliquid for advanced derivatives. It proves they are building the core financial layer for the most complex, high-speed trading products of the next cycle. With @Ensofi_xyz, Infrastructure must precede complexity.

The Metaverse demands an identity solution that is fast, verifiable, and user-controlled. @X1_EcoChain’s technical foundation strategically aligns it as a backbone for Self-Sovereign Identity (SSI) in immersive Web4 environments.

Most protocols chase attention. EnsoFi quietly rebuilt the part of DeFi that was fundamentally broken. @Ensofi_xyz is proving that the future of on-chain finance isn’t about bigger APYs it’s about smarter, cross-chain capital. The breakthrough is simple: 1. Unified Liquidity…

After reviewing hundreds of DeFi protocols, only a few actually push the industry forward. EnsoFi isn’t iterating on old models it’s redesigning the financial architecture DeFi should’ve had from the start. Three breakthroughs make this unmistakably clear: 1. Unified Liquidity…

. @X1_EcoChain global grant strategy makes a subtle but important point: the chain isn’t trying to attract just developers, but entire innovation ecosystems. This includes universities, grassroots labs, hardware collectives, and emerging-market builders who often get excluded…

. @X1_EcoChain validator model changes something subtle but important: coordination cost. Most L1s suffer from validator concentration because hardware, power, and maintenance costs centralize decision-making into a few hands. EcoChain flips this by designing validation so cheap…

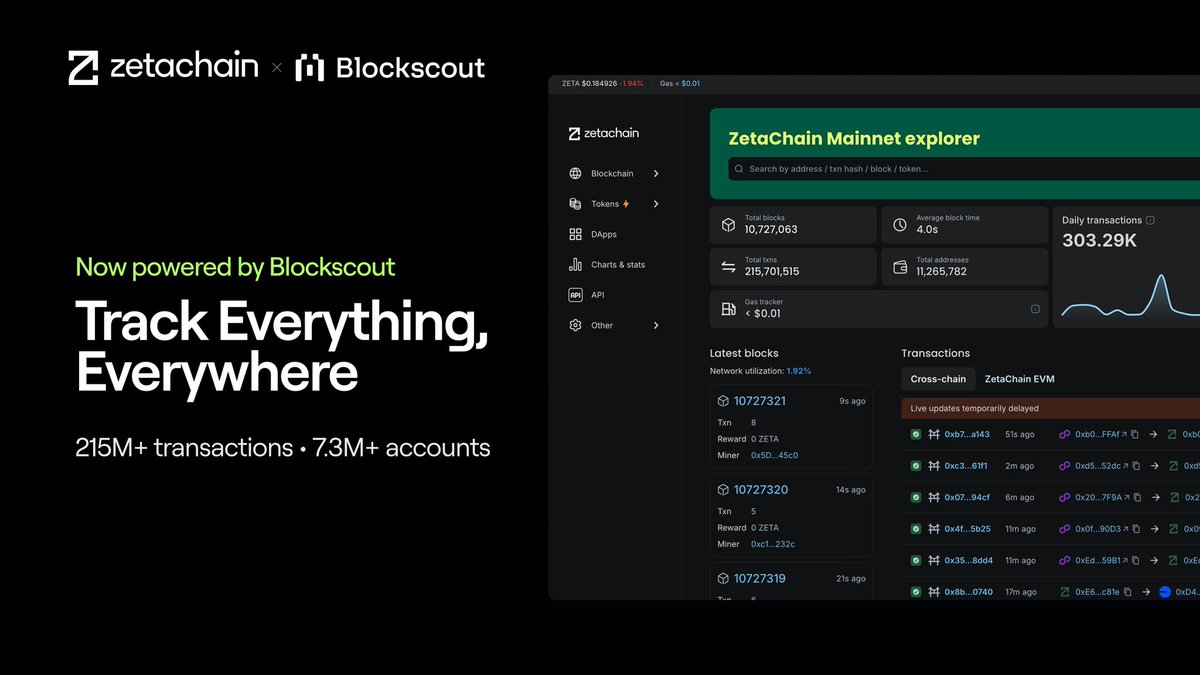

.@Zetachain creates a model where omnichain logic becomes part of everyday applications. Developers can design flows that reach across ecosystems without stitching together bridges or custom pathways.

The network focuses on precise coordination across chains. Instead of bridging as a one time action, @dango frames movement as an ongoing negotiation between state, computation, and liquidity.

Biggest non-DeFi use case? Verifiable Product Footprinting (EPDs). @X1_EcoChain integrates with LCA tools to track Scope 3 data immutably, letting manufacturers create verified product footprints 99% faster, boosting transparency, winning tenders, and meeting 2026 compliance.

Imagine telling 2021 DeFi degens you can supply on Sui, borrow on Ethereum, repay on Base, and still farm ENFI points + retro airdrops like it’s casual Tuesday. @Ensofi_xyz didn’t break composability, it made the whole chain jealous.

dear bitcoin you spent 15 years being the hardest money ever created then sat in wallets looking pretty while 20-year-old eth tokens farmed 40% yields but @TheTNetwork heard your cry and built tBTC(@tBTC_project : same virgin bitcoin, now with a side hustle, currently vibing in…

@inference_labs starts from the idea that AI becomes meaningful only when its outputs can be trusted. Computation is abundant; verifiable computation is scarce. By treating proofs as the fundamental unit of intelligence, they shift the bottleneck from generation to validation.

@inference_labs works from a premise most teams overlook: AI isn’t constrained by compute, it’s constrained by verification. Models can generate boundless outputs, but without a way to prove correctness, scale becomes noise.

🏆 @Ensofi_xyz recent progress isn’t about announcing tools it’s about tightening its infrastructure so decisions, execution, and movement happen with less friction. The improved routing in the Enso SDK shows this clearly: cross-chain actions become cleaner, paths become more

The Gate Wallet points on @Ensofi_xyz program looks superficial on the surface, but structurally it’s a distribution experiment. It measures how users enter, stay, and move when incentives are tied to participation rather than capital.

Ensofi is building a lending layer where liquidity doesn’t sit idle, it adapts. A system that reads risk, moves capital, and strengthens every chain it touches. That’s the shift @Ensofi_xyz is pushing: credit that behaves like intelligence.

EnsoFi is turning chain-hopping liquidity into a coordinated system. By syncing lenders, strategies, and execution across Solana, Sui, and Eclipse, @Ensofi_xyz is building a money layer where capital moves with intent, not friction.

I learned the hard way liquidity is an illusion trapped on one chain Finding EnsoFi, My capital is now truly liquid because it's omnichain accessible. I use it on Solana, while providing collateral for a loan on Sui True liquidity is functional, not just numerical. @Ensofi_xyz

.@Zetachain and @alibaba_cloud are backing builders with two hundred thousand dollars in grants for APAC teams creating Universal Apps powered by AI. Final reminder: the Universal AI Hackathon wraps uptomorrow Nov twenty three. Apply here intensivecolearn.ing/programs/Unive…

.@Zetachain allows cross chain smart contracts to share logic directly. Developers can build workflows that execute simultaneously across multiple networks, creating a truly composable multi chain experience.

tBTC is fundamentally a Distributed Key Generation scheme. The T network uses a Random Beacon and Sortition Pool to generate new, governable-sized threshold ECDSA Bitcoin wallets weekly. This prevents centralized key control @TheTNetwork

Trust in tBTC is auditable. Every action, mint, redemption, vault, is logged in a unified, on-chain 'My Activity' history. This immutable data stream provides the self-auditing function required for institutional compliance @TheTNetwork

The true breakthrough is less about the ZK math and more about the Inference Network becoming the coordination layer for verifiable agent identity. By integrating the Model Informatics Engine with emerging standards like ERC-8004, @inference_labs ensures that every AI output is…

The critical scaling challenge for decentralized AI is not speed, but cost: proving the integrity of a massive model is prohibitively expensive. The solution, pioneered by @inference_labs, lies in selective verification. By segmenting models and using the DSperse architecture to…

Most cross-chain systems treat the symptoms fragmented liquidity, logic, and users. @Zetachain targets the cause by treating blockchains as composable surfaces, not isolated endpoints. Its contracts can interact directly with networks like Bitcoin or Ethereum without replicas.

I’ve seen many cross-chain solutions, but @Zetachain is on another level. It doesn’t just bridge assets, it integrates chains at their foundation, even supporting native Bitcoin with no wrappers. True, seamless interoperability in a fragmented ecosystem.

United States 트렌드

- 1. Klay 21.3K posts

- 2. McLaren 72.8K posts

- 3. #AEWFullGear 71K posts

- 4. Lando 118K posts

- 5. #LasVegasGP 208K posts

- 6. Oscar 110K posts

- 7. Ja Morant 9,462 posts

- 8. Piastri 50.1K posts

- 9. Max Verstappen 58.2K posts

- 10. Hangman 10.2K posts

- 11. Samoa Joe 5,014 posts

- 12. gambino 2,686 posts

- 13. LAFC 15.9K posts

- 14. Swerve 6,480 posts

- 15. #Toonami 2,844 posts

- 16. Kimi 45.8K posts

- 17. Fresno State 1,015 posts

- 18. South Asia 35K posts

- 19. Utah 24K posts

- 20. Arsenal 144K posts

Something went wrong.

Something went wrong.