Morten Penthin Svendsen

@mpenthin

Analyst at Nykredit C&I l PhD - Impact Investments, Bridging the gap between #impinv & Danish originality.

You might like

Danske investorer fortolker stadig impact-investeringer meget forskelligt. Hos @Finansdk, giver jeg mit bud på hvordan #dkfinans kan blive skrape på deres tilgang og praksis. Se også et uddrag på LinkedIn: linkedin.com/posts/morten-p… #dkpol #dkbiz #dkmedier #impinv

Hvem sætter du dine penge på? Følg med på #fmdk, når 3 virksomheder deler deres bidrag til en bedre fremtid✨Vi lancerer også undersøgelse om, hvor danskerne vil investere pengene bæredygtigt🌍 Livestream lørdag kl. 15.15: vimeo.com/event/1049907 #FM21 #iInvestGlobalGoals

Er du stødt på Impact Management Project i dit arbejde med impact-investeringer? IMP samler et globalt forum for at skabe en konsensus, og praksis, for arbejdet med 'impact' - for både investorer og virksomheder. Som en del af mine studier, har jeg i…lnkd.in/eeuEWWZ

Senest analyse fra @a2i_Network viser alvorlige mangler i #dkfinans økosystemet og #dkpol støtte til #dkbiz og #dkgreen eksport til udviklings- og vækstmarkeder. access2innovation.com/en/funding-gap… Udarbejdet m. @DanskIndustri @DanskErhverv @WWFdk @danskrodekors @noedhjaelp

Thank you for the opportunity to contribute to this timely article by Leslie Norton via @barronsonline. In the first bear market test, #ESG is proving to be quite effective at risk mitigation. @perigonwealth @LongviewStrat bit.ly/33O8osV

Smittespredning illustreret uden (tv.) og med (th.) social distancing. Hold nu afstand til hinanden folkens. Animationerne er tyvstjålet fra @washingtonpost og sat sammen af mig til en lille video. Kilde: washingtonpost.com/graphics/2020/… #COVID19dk

Read our report with the @impmgmt on Building an impact management process for a multi-asset class portfolio. #impinv #impactinvesting

Our co-authored report with @Snowball_IM provides a framework and guidance for anyone seeking to map their product or portfolio by its #impact on people and/or the planet. Available to download now: buff.ly/2URVqWo

New research from @PRI_News estimated that their "inevitable policy response" scenario could result in the 100 highest-emitting companies losing 43% of their market cap by 2025 ($1.4T), while the 100 best-performing firms could see their value increase by 33% ($700B). #ESG

“Abrupt” climate policies could see high-emitting firms lose 43% of their value, research claims. cnb.cx/38vpmOS

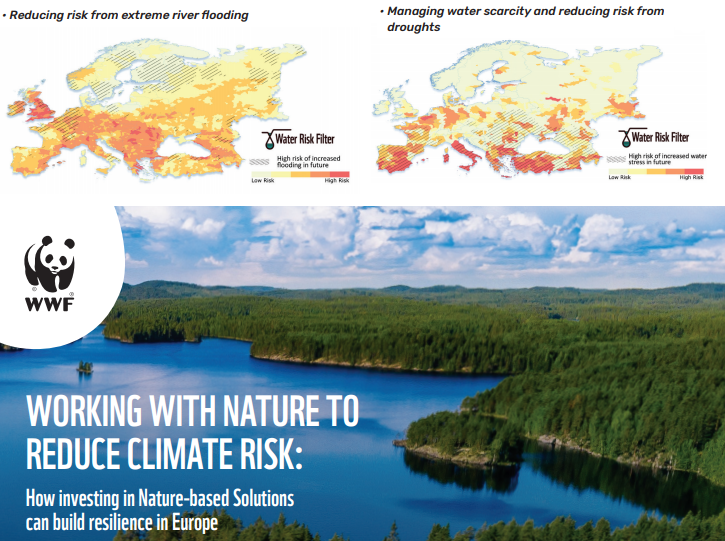

At #COP25, @WWF launched a NEW report on how investing in #NatureBasedSolutions can build resilience in the face of increasing #WaterRisks in Europe as illustrated with #WaterRiskFilter Maps wwf.panda.org/our_work/water…

Det er ikke er nok at investere grønt, men mindst lige så vigtigt at undgå de sorte investeringer i #dkpension siger @Fjalland blandt andet i dagens debat om grøn pension med @PKApension og @Matterpension på @radio4dk - lyt med kl. 13 #dkgreen #dkfinans

“Abrupt” climate policies could see high-emitting firms lose 43% of their value, research claims. cnb.cx/38vpmOS

Myth #2: An ESG strategy addresses climate solutions. Agreed and its needs to be debunked. #dkgreen #dkfinans #dksdg pocket.co/xdPHYt

Investor wake-up call: Global climate financing fell 11% last year. “This is simply not enough, especially as investments in polluting industries continue to effectively cancel out these efforts to address climate change,” said Barbara Buchner. impactalpha.com/investor-wake-…

impactalpha.com

Investor wake-up call: Global climate financing fell 11% last year

ImpactAlpha, Nov. 7 – At a time the world needs to be radically ramping up financing for the low-carbon transition, investment is dropping ...

Looking forward to be a part of @WWFLeadWater Water Summit 2019 in Frankfurt! Strong line-up of speakers talking on risk and opportunities to water. @WWFdk #impinv #dkfinans @ESG #dkaid #dkgreen

Two weeks until Water Summit 2019 on Nov 18th. Great list of speakers on water risks & opportunities for corporates & financial institutions in the era of #ClimateChange. Last few spaces available so find our more & register online wwf.panda.org/our_work/water…

Modtag 0.5 mio. kr. til udvikling og test af innovative løsninger / services - særligt til Afrika. @a2i_Networks søger konkrete ideer som søger funding. Er du interesseret, så kontakt gerne mig hurtigst muligt! access2innovation.com/news-from-2019… #dkbiz #dkgreen #dkaid

EU rules on responsible investments to kick in from 2021. #impinv #ESG #SRI #SocEnt uk.mobile.reuters.com/article/amp/id…

What does stewardship mean? What are the key trends? How to distinguish between good and bad companies? Find the answers in @BronaghWard's 5-minute interview with @ICGNCorpGov: ow.ly/XvEe50wOuR4

#ESG data is improving with ever greater speed. The work from @CeresNews looks at how food sector companies are responding to water risks. #dkfinans #SRI #dkgreen

NEW REPORT: #FeedingOurselvesThirsty gives investors a clear perspective on how well — or not— food & beverage companies are responding to water risk. See how 40 of the sector's largest companies rank. #ESG feedingourselvesthirsty.ceres.org

Investment banks have begun quietly sounding alarm bells about climate change. #dkmedier #dkgreen #dkfinans #dkpol bloomberg.com/news/articles/…

United States Trends

- 1. Mike McCarthy N/A

- 2. Armed N/A

- 3. Art Rooney N/A

- 4. Border Patrol N/A

- 5. #Minneapolis N/A

- 6. Abolish ICE N/A

- 7. #Rolex24 N/A

- 8. Another ICE N/A

- 9. Resisting N/A

- 10. Insurrection Act NOW N/A

- 11. Bournemouth N/A

- 12. #BOULIV N/A

- 13. Collin Chandler N/A

- 14. Wink N/A

- 15. Van Dijk N/A

- 16. Murdered N/A

- 17. #ICEOUT N/A

- 18. Omar Khan N/A

- 19. Minnesotans N/A

- 20. Tre Johnson N/A

You might like

Something went wrong.

Something went wrong.