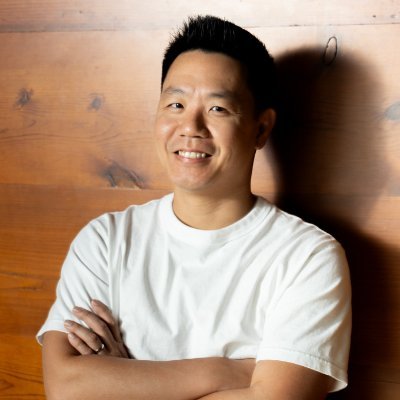

John Juba

@msgjuba

In-house lawyer. Insurance industry exec. *Views expressed are my own.*

You might like

Thank you, Canada 🇺🇦🤝🇨🇦 #UkraineSaysThankYou #UkraineIndependenceDay

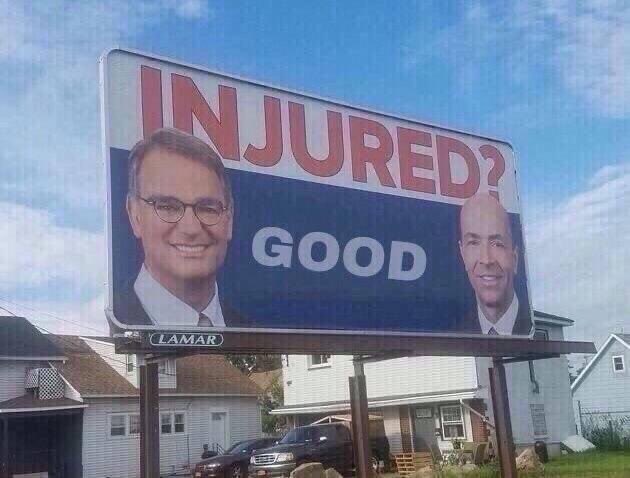

The obvious problem here is weak regulation of lawyers and law firms.

How Lawyers Sank Florida Carriers — and Target ‘Travellers’ With SEO carriermanagement.com/features/2023/…

carriermanagement.com

How Lawyers Sank Florida Carriers — and Target 'Travellers' With SEO - Carrier Management

A troubling phone exchange reveals a problem for insurance carriers that started in Florida and is expanding beyond the state's borders, according to an

When a company does this, it is telling you exactly what it values out of its legal function.

I don’t claim (at all) to be an expert in marketing my business, but this seems questionable:

This is catering to their clients who either have CEOs who drank ESG Kool Aid or are afraid of activists who are "terrorizing" them in the media. Insurers are umpires. They should never, ever have an agenda. Their job is to set a fair price for risk.

the time to hire counsel was when you started the second best time was before you committed a bunch of crimes the third best time was before you wrote all the crimes down

Insurance nerds: is there a limit to how much surplus you can accumulate or can you keep going on forever?

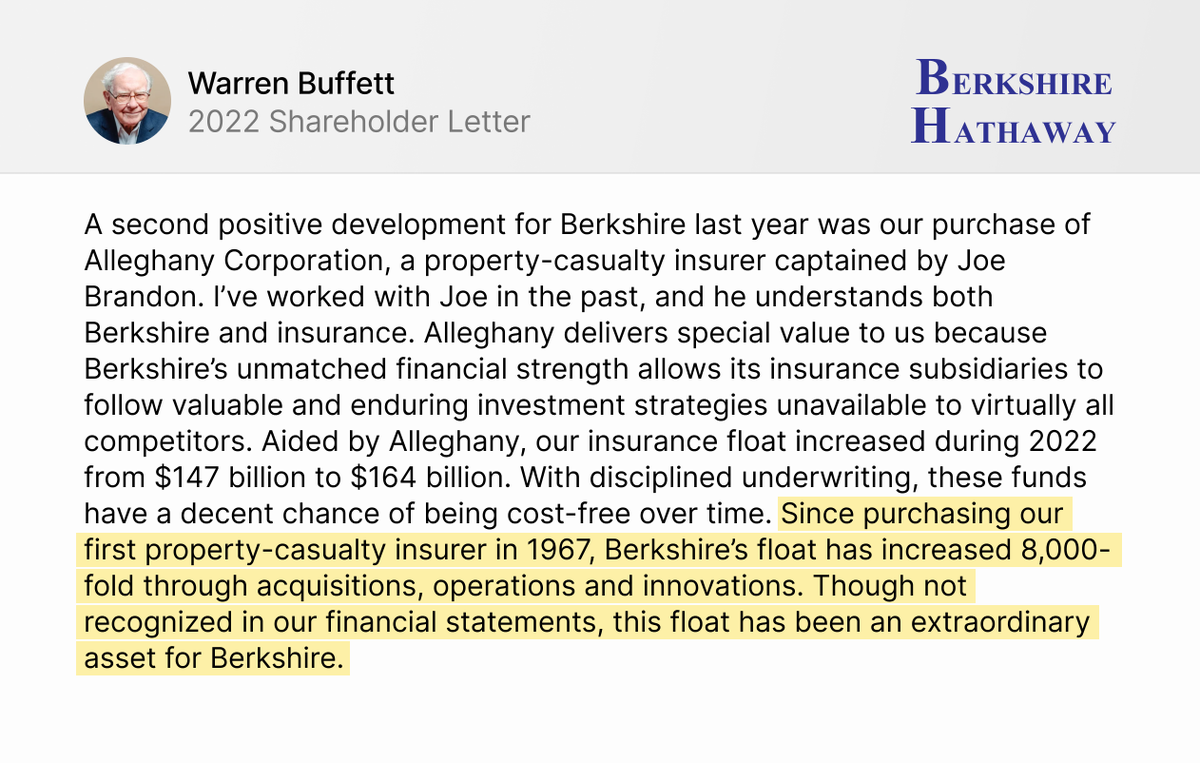

3. $BRK's float has increased 8000x since entering the insurance business in 1967:

Discussion here dominated by #legaltech, #legalops, #alsp, etc. which I get. Need to be efficient. But who's talking about taking the services out of legal altogether? Best and highest use of legal would be work on business process to get outcomes it wants, e.g. like compliance.

Like a good neighbor...Jake from State Farm is there

This explains so much of the disconnect between firms and their clients.

4/ Why was there such a disconnect btw legal and biz? I’m still not sure. Maybe it’s the law firm training that teaches you to believe that imperfect legal docs are unacceptable. Obsession w/ perfection has economic value at law firms, but not in house.

Now I have a framework for understanding my 3 year old.

The world is easier to understand when you realize some people have high reactance - they just don’t like being told what to do & if they feel restricted by rules, they do the opposite. If you make people high in reactance sign an agreement not to cheat, they actually cheat more

Really, really, really applicable to insurance.

Biggest Fintech lesson I’ve learned in the last 5 years. Incumbent financial institutions are slow, not stupid. If your main advantage is acquiring consumers banks don’t want, there’s probably a good reason they didn’t want them. Your biz model should account for that reason.

It's baffling to read courts still haven't adopted standard tech that could save everyone so much time and effort. Especially when access to justice is so strained. It's indefensible.

1/16 If you've ever been involved in a civil lawsuit, you know that the process can be long, drawn out, and expensive. Inefficiencies in the system lead to delays, continuances, and ultimately higher costs for everyone involved. But it doesn't have to be this way.

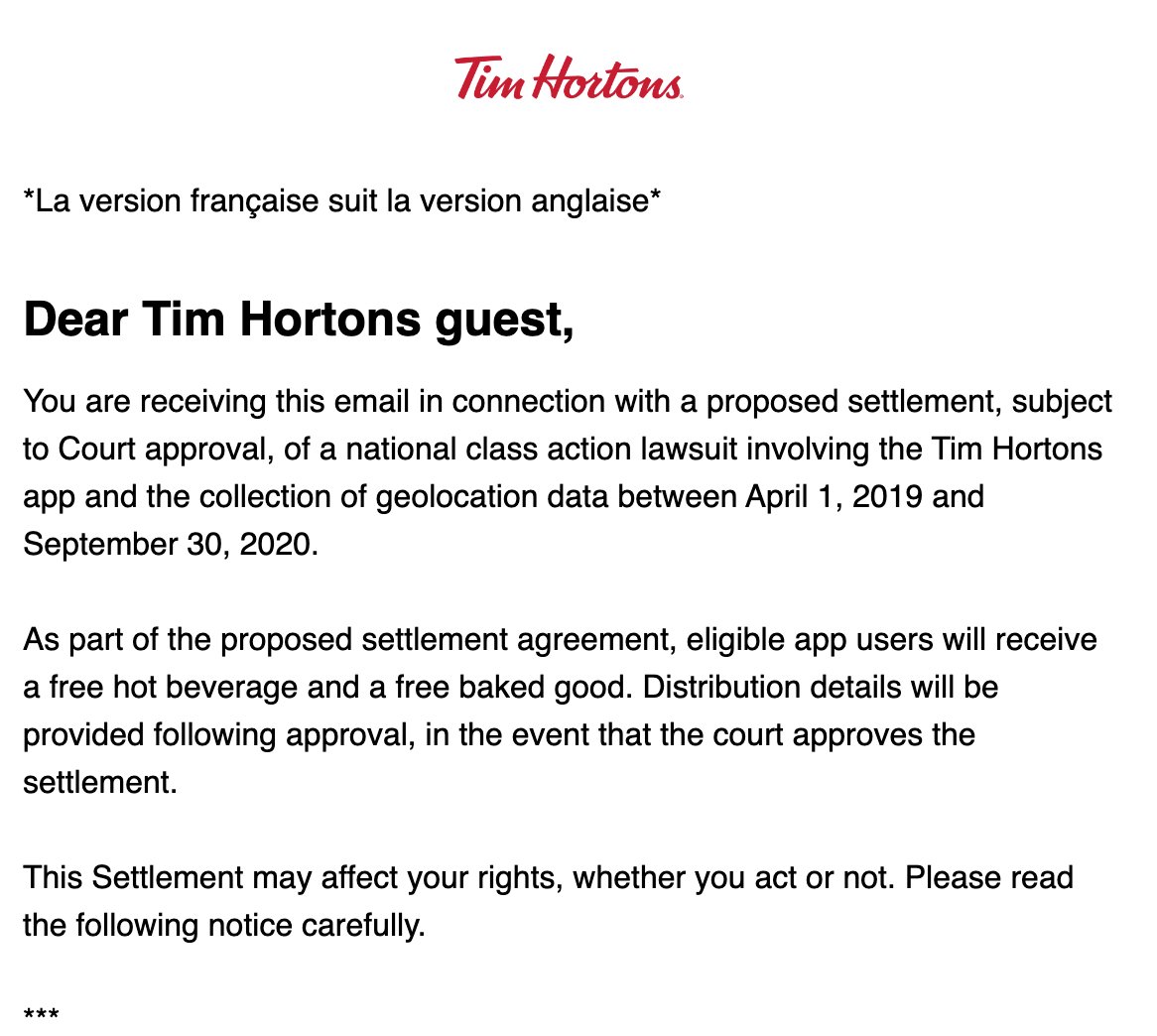

Perhaps the most Canadian settlement ever.

Ok so Tim Hortons spent more than a year silently and illegally tracking users through their mobile app, and the proposed class action settlement is ... a free coffee and a donut. I swear to fucking god. This is real.

Nailed it.

The safe bet is the work will move in-house, but no one will be adding to head count. The result will be do less law, but it won't be intentional.

The model that lives on today. And will continue to live on. As much as tech wants to think disruption is just about getting internet sales right.

Donald McLennan introduced the "concept of a broker acting as a buyer of insurance representing the client, rather than as a seller of insurance."

United States Trends

- 1. Happy Thanksgiving Eve N/A

- 2. Luka 63.5K posts

- 3. Clippers 18.4K posts

- 4. Lakers 49.6K posts

- 5. Good Wednesday 19.1K posts

- 6. #DWTS 96.2K posts

- 7. #LakeShow 3,553 posts

- 8. Jaxson Hayes 2,527 posts

- 9. Kris Dunn 2,746 posts

- 10. Collar 45.5K posts

- 11. Robert 138K posts

- 12. Reaves 12.8K posts

- 13. Kawhi 6,383 posts

- 14. Jordan 113K posts

- 15. Ty Lue 1,636 posts

- 16. Alix 15.1K posts

- 17. Colorado State 2,516 posts

- 18. TOP CALL 14.5K posts

- 19. Elaine 46.3K posts

- 20. Zubac 2,297 posts

Something went wrong.

Something went wrong.