mudchute fox

@mudchutefox

personal trading diary. talking to myself so... you got it

You might like

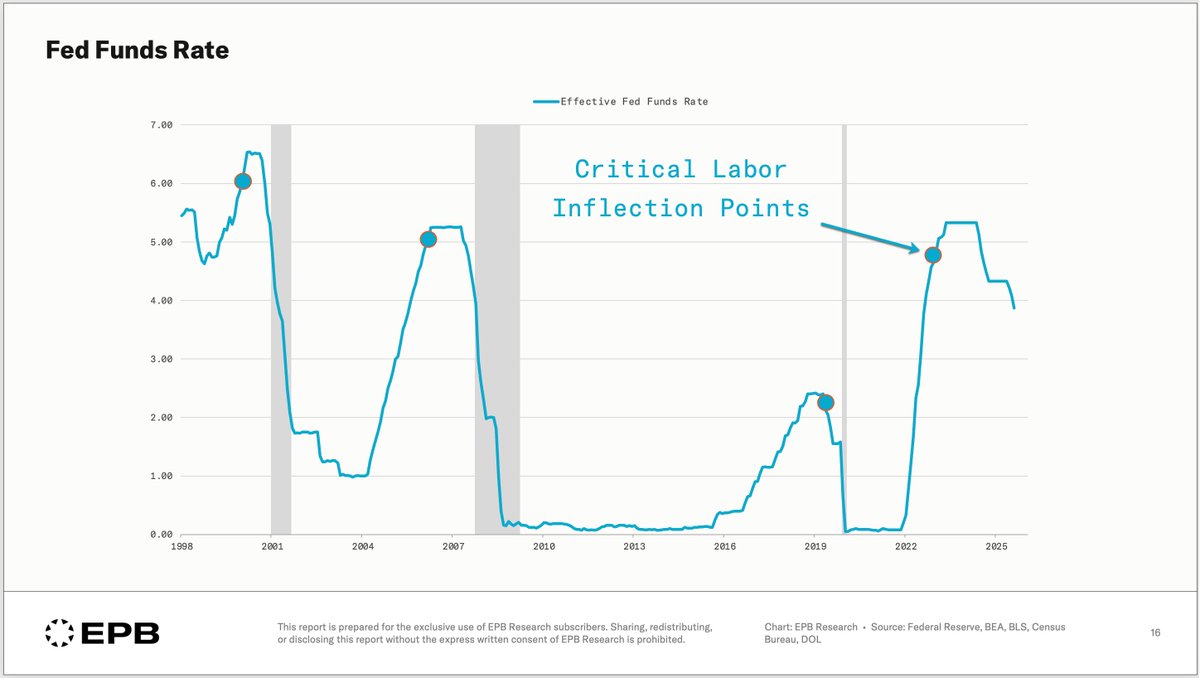

How to Read the Jobs Report: A Data-Driven Approach A systematic approach for analyzing labor data within the full Business Cycle Sequence. epbresearch.substack.com/p/how-to-read-…

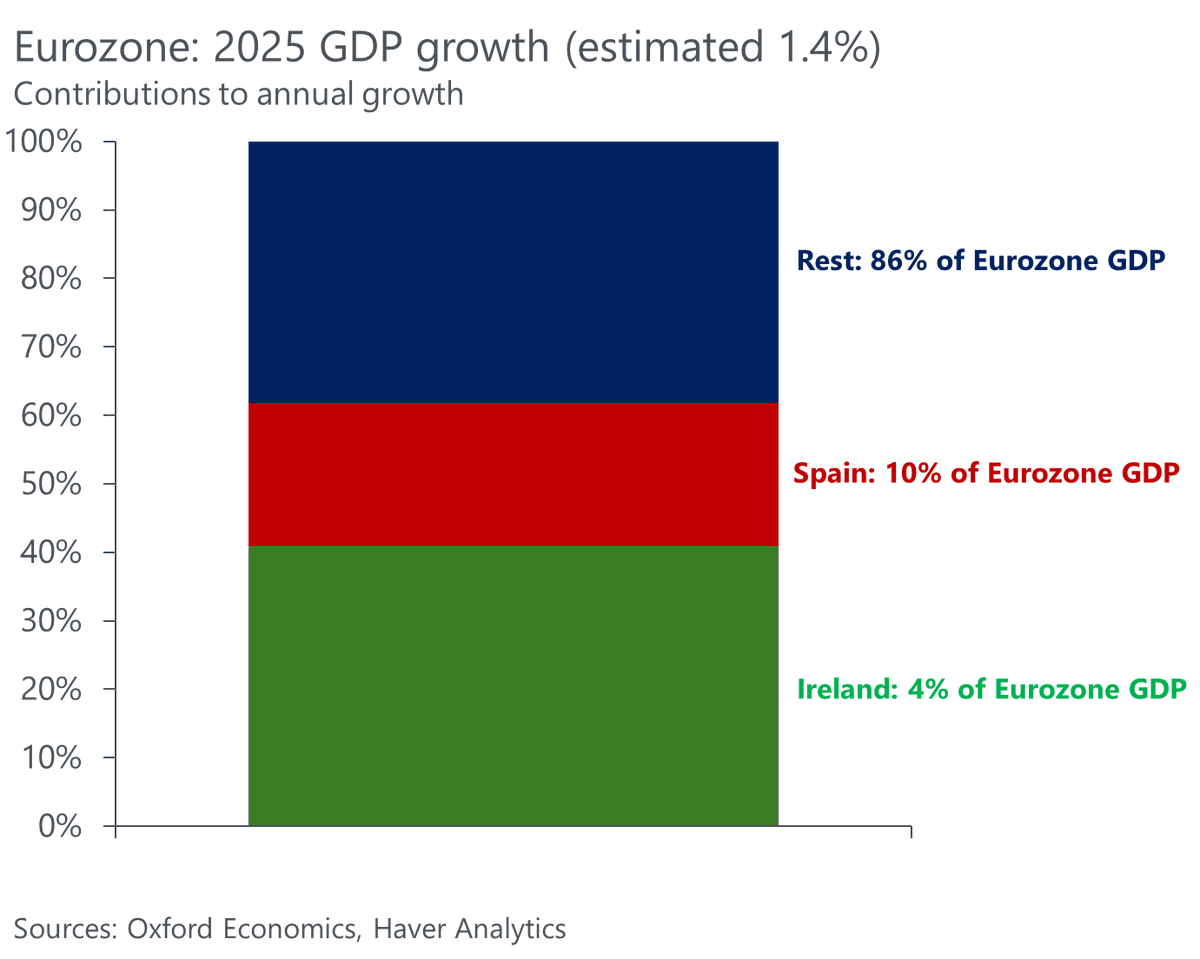

On the surface, Eurozone growth looks pretty decent all things considered. But when looking under the hood, the picture worsens considerably: - Ireland (4% of the EZ) accounts for 40% of growth - Spain (10%) accounts for 20% - Half of the Eurozone is growing at 0.5% or below

The Carry Trade Unwinds for investors that borrowed JPY at ~0%, bought USD assets, and hedged via USDJPY x-ccy swaps. A BOJ rate hike raises the future cost of JPY funding. This forces unwinds of: •JPY shorts •USD longs •Treasuries hedged in USD •USD debt of banks/insurers

The important question to ask is IF a change in the Yen and cross-border flows begins to drag on equities, how will this show up? Every time we have seen a carry trade unwind in the Yen it has been with JGBs rallying (yields falling), a stronger yield, and the Nikkei leading…

Buffett knew what was coming with Google whose TAUs have murdered the NVDA GAU based ecosystem.

WARREN BUFFETT JUST BOUGHT THE COMPANY THAT KILLED NVIDIA On November 14th, Berkshire Hathaway disclosed a $5.1 billion stake in Alphabet. Thirteen days earlier, Google launched Ironwood … a chip that does what Nvidia’s GPUs do at one-fifth the cost. Six days after the…

And a reminder that Japan has a lot of tools to stabilize the yen if it wants to do so -- BoJ obviously could hike, but MoF could intervene/ commit to selling its fx interest income (not a small number) going forward, GPIF could start to hedge or change its allocation, regs…

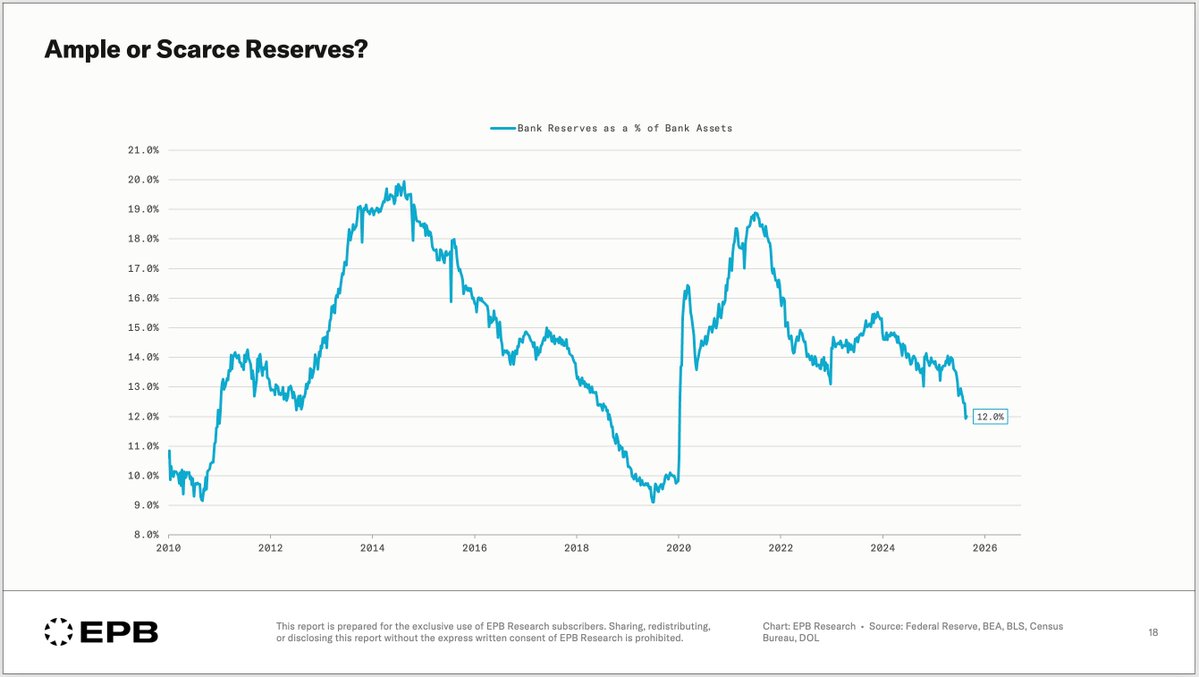

Federal Reserve members have suggested that when bank reserves fall below 12%-13% of total bank assets, reserves become "scarce." We are now at the very low end of that range.

Hedge funds often augment their investment positions using leverage. The leverage sources can be divided into three categories: prime brokerage, repo, and other secured borrowing. Prime brokerage and repo borrowing have increased rapidly over the past few years, as shown in this…

Funding currencies (the yen, the dollar in 07/08) tend to rally into stress, destination currencies (the relatively high yielding dollaw now) do not ... 6/6

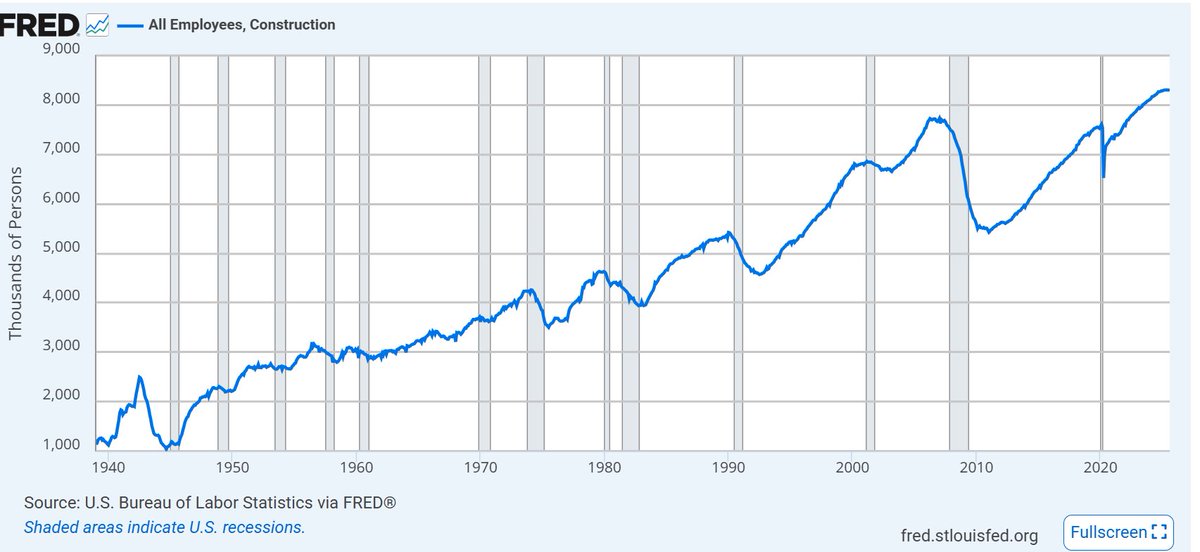

For those who don’t know what they are talking about, Resi new builds is 2.5 m jobs and commercial (offices, retail, etc…) is another 1.5 m - that’s circa half of all construction employment

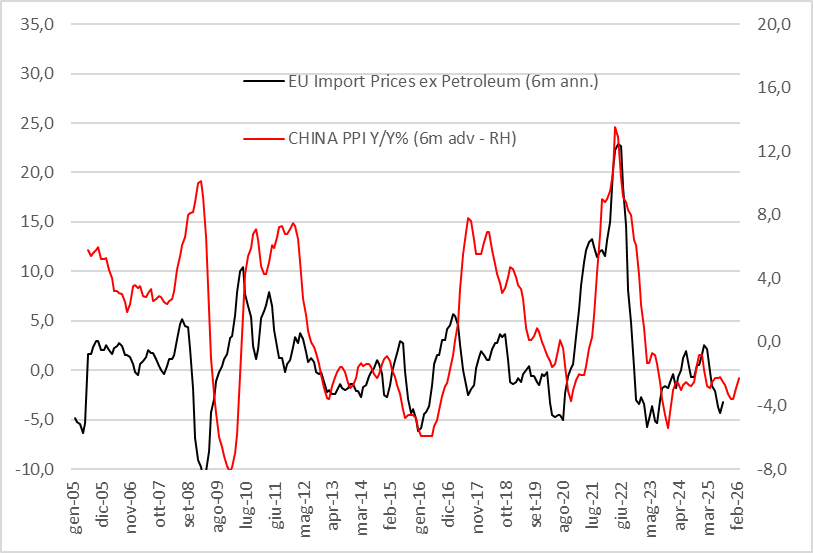

This is fueled by the persistent disinflation from China, coupled with the strong EUR appreciation. To get a meaningful reverse we need: 1. stronger USD 2. broken supply-chain 3. inflation coming from China While the first could happen in next 3-6 months the other risks are low

Exactly. Beijing’s austere policy is, in effect, doing the world — particularly the United States — a favor by keeping commodity prices, and therefore inflation, in check. I’ve long argued that the true economic nuclear weapon Beijing could deploy to inflict pain on US households…

What happens to commodities if China so much as shows a sign of life? Chinese has not mattered for commodities since the pandemic. The growth catalyst shifted from TSF to US fiscal policy. If China (and other non-US economies) so much as put a floor in growth, look out!

For further context, “US life insurers have ramped up private debt investments over the past few years, allocating close to one-third of their $5.6T.“ insurancejournal.com/news/internati…

Either insurers are stressed by collateral transformation losses as major contributors to NDFI repo borrowers, causing them to pull back on lending assets, or they’re getting burned by defaults on fraudulent private credit investments on 30% of their assets.

Big update to our US Tariffs Paper: 📦 Pass-through ≈20% (using applied tariff rates, accounting for exemptions) 💸 “Cheapflation”: cheaper goods within categories saw 2× higher inflation 📈 Cumulative CPI impact: +0.7 percentage points More details pricinglab.org/files/Tracking…

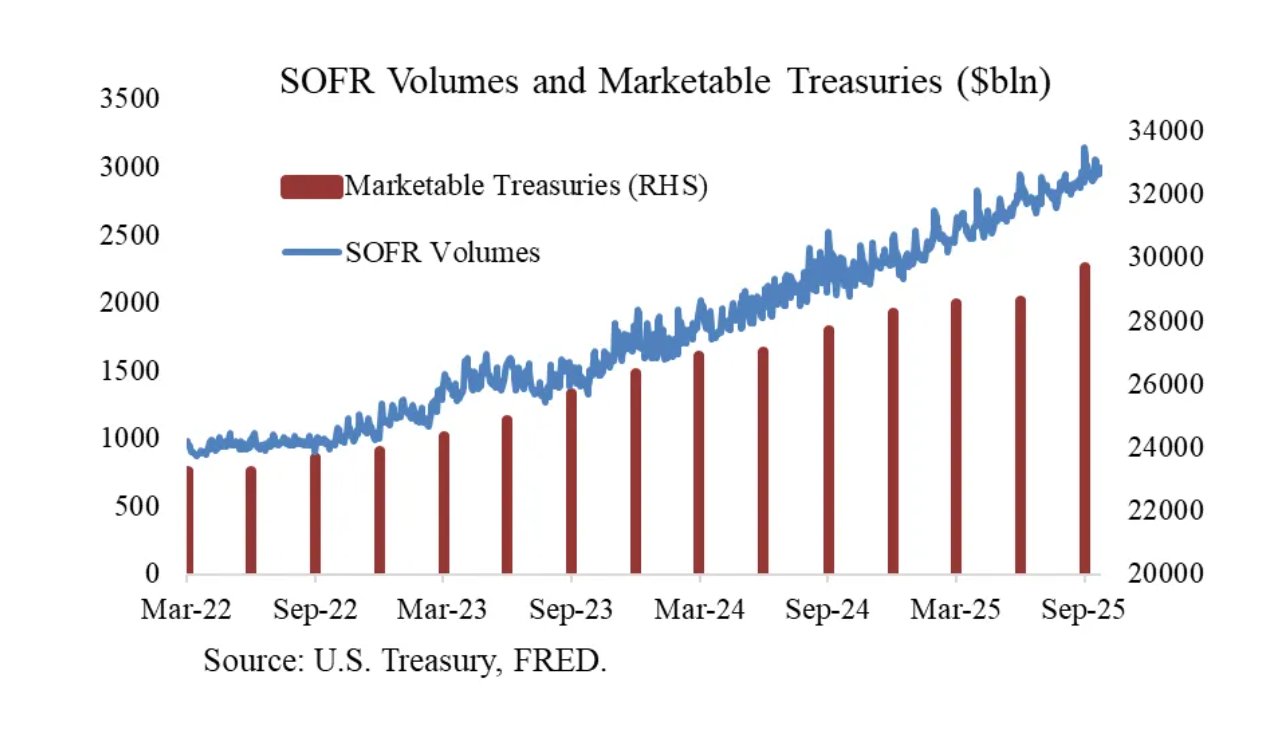

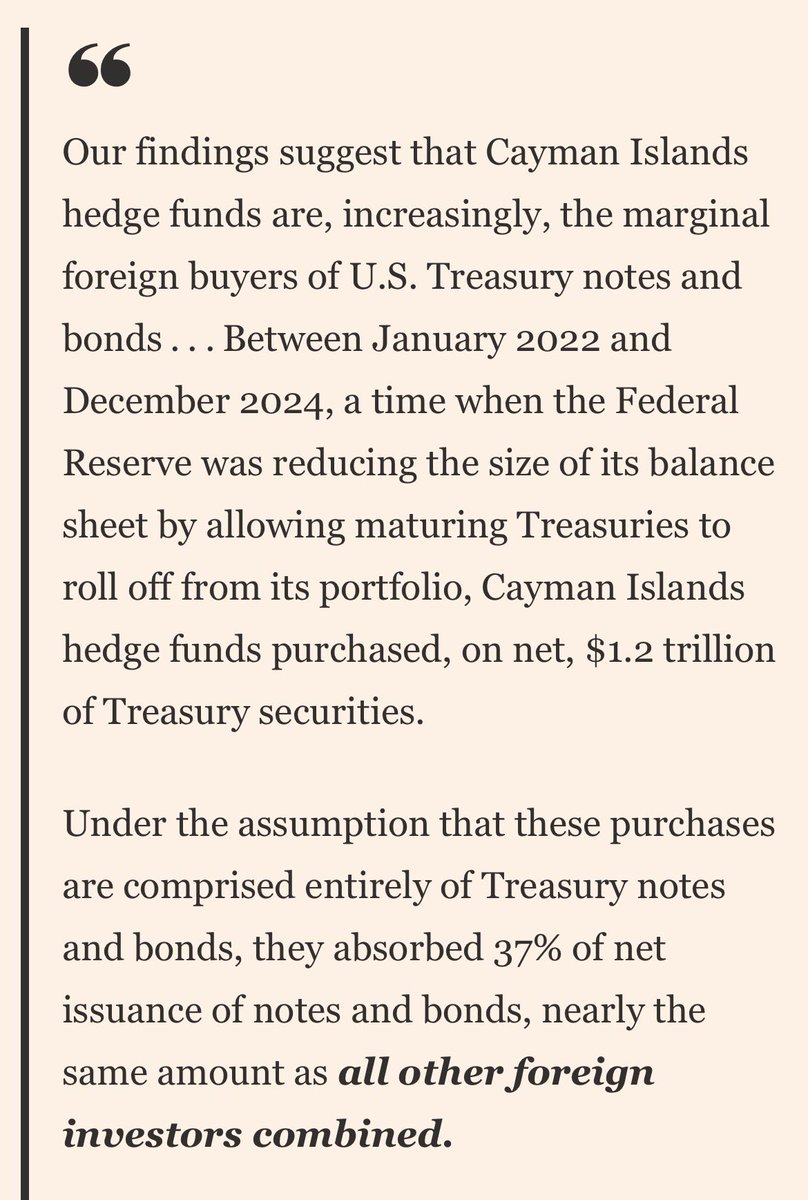

By using repo rates as a warning signal for when to stop shrinking its balance sheet, the Fed may be accommodating the net supply of USTR. Repos are used on a massive scale by levered investors ("basis trade") such as HFs to absorb the issuance of USTR. (see work by @jstatistic…

Fed's focus on repo rates effectively cedes control of its balance sheet to the fiscal authorities. This post explains the factors driving repo rates higher and suggests that the end of QT will shortly be followed by more expansion. fedguy.com/balance-sheet-… [FREE post]

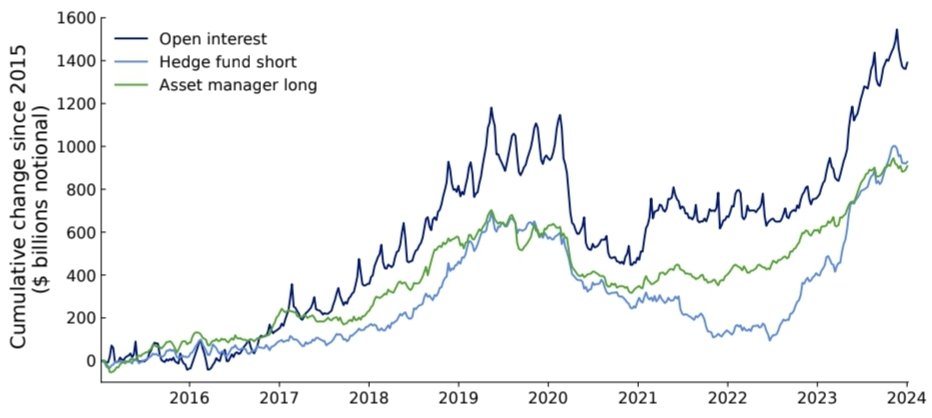

Seeing some renewed guessing about who holds the long duration in Treasury futures, the other side of trades like basis trades. No need to guess! We mapped it out in detail in our earlier paper. 👇

1/🧵 We just put out a new paper putting numbers to a mystery I've been working on since 2020: who is behind the almost $2 trillion increase in long Treasury futures positions? Spoiler alert: it's mostly mutual funds but the cool thing is why. Link here: papers.ssrn.com/sol3/papers.cf…

Warning: The US Treasury market is more fragile than it looks. * Huge holdings are hidden: Official data is missing $1.4 trillion in bonds held by hedge funds. The real number is ~$1.85T, not $440B. *Holdings correspond to a bet that is huge and one-sided: This massive, hidden…

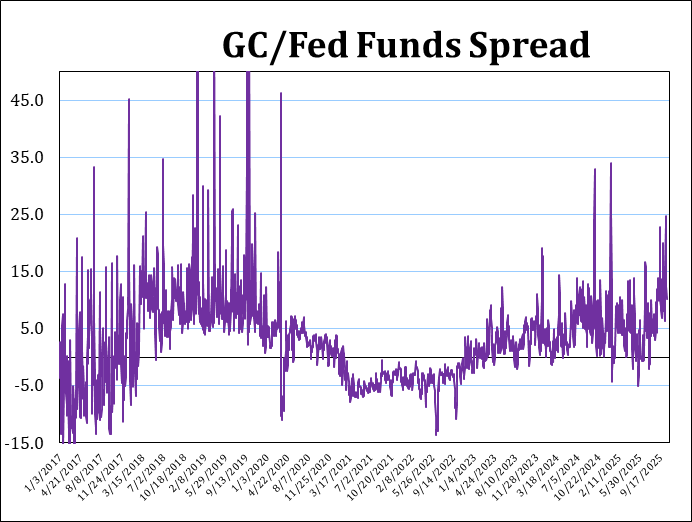

The spread between GC and fed funds is an indication of conditions in the Repo market. When there's stress, the spread is wider and more volatile. In general, during times of large Treasury issuance and Balance sheet Runoff, the spread widens. During times of QE and zero rates

During times of QE and zero percent rates, the spread narrows. During 2017-2019, the last period of Balance Sheet Runoff, GC averaged 6.1 bps above fed funds. Between 2020and 2022, it averaged 1.4 bps BELOW fed funds. In 2025, GC is back above fed funds, averaging +5.8 bps

I wrote a full (free) piece on that open.substack.com/pub/creditfrom…

United States Trends

- 1. Thanksgiving 2.47M posts

- 2. Post Malone 3,251 posts

- 3. Packers 67.9K posts

- 4. Dan Campbell 7,525 posts

- 5. #GoPackGo 11.2K posts

- 6. Malik Davis 1,853 posts

- 7. Wicks 11.6K posts

- 8. Jordan Love 17.7K posts

- 9. Micah Parsons 13K posts

- 10. #ChiefsKingdom 4,351 posts

- 11. #KCvsDAL 4,065 posts

- 12. Kenneth Murray N/A

- 13. Goff 11.5K posts

- 14. Tony Romo 1,042 posts

- 15. Jack White 10.3K posts

- 16. Kelce 12.5K posts

- 17. McDuffie 3,051 posts

- 18. Turkey 313K posts

- 19. Caleb Wilson 1,537 posts

- 20. Thankful 512K posts

Something went wrong.

Something went wrong.