Nick Bourke

@nibosays

Advisor to institutions, gov't, think tanks. Comments strictly my own.

You might like

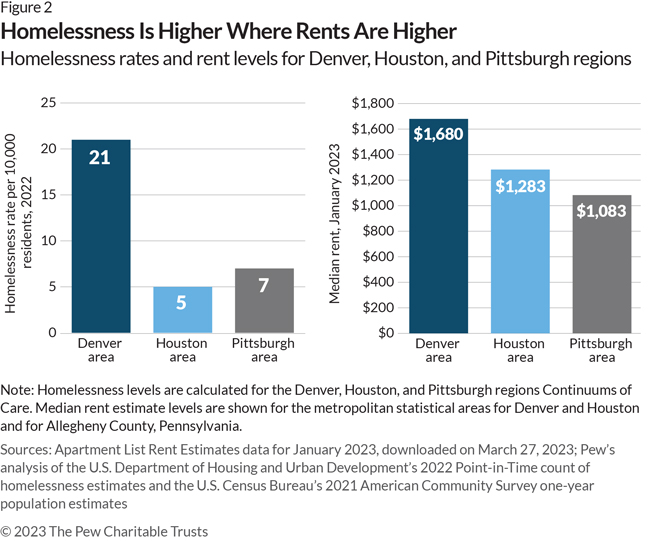

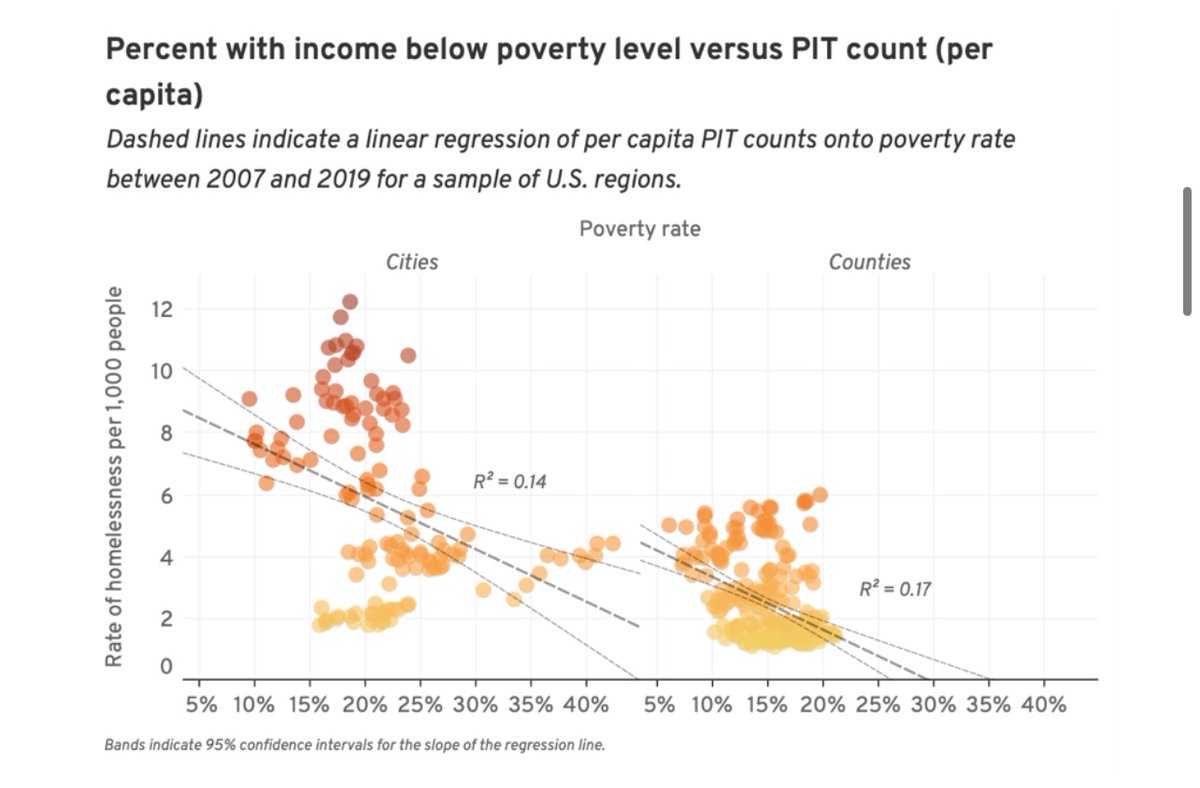

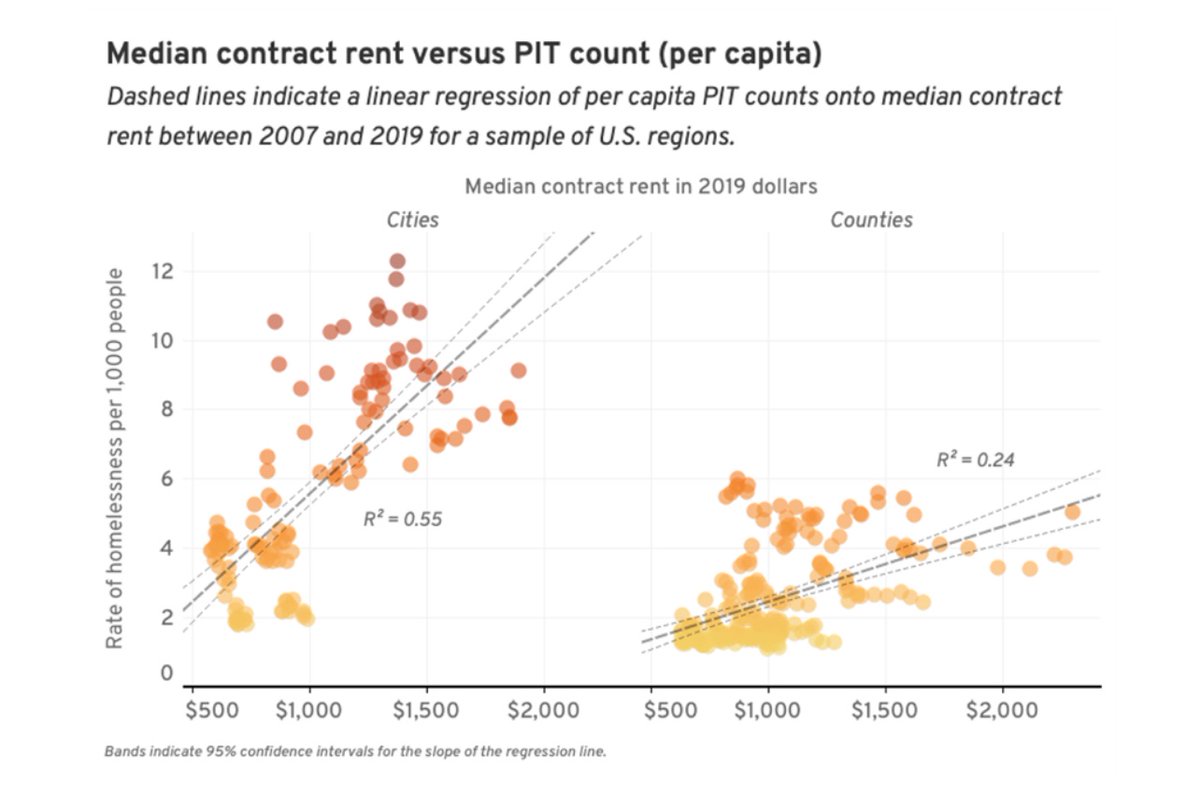

High rents --> high homelessness. Allow more housing to be built --> lower rents --> lower homelessness. It seems obvious to some. But it's essential to have this kind of sober analysis to drive real change.

Homelessness is higher in areas where rents are higher, new research shows. What’s more is cities are finding ways to keep housing costs and homelessness low. How? Making enough housing available—especially lower-cost options. pew.org/4282yjb

“Payday loan reform has saved consumers over $1 billion in interest and fees.” Here's how. pew.org/3XG2AML via @@pewtrusts

pew.org

Reforming Payday Loans Can Save Consumers Billions

Payday loan reform has saved consumers over $1 billion in interest and fees. Unaffordable payday loans have negatively affected millions of people in the United States—often costing borrowers more...

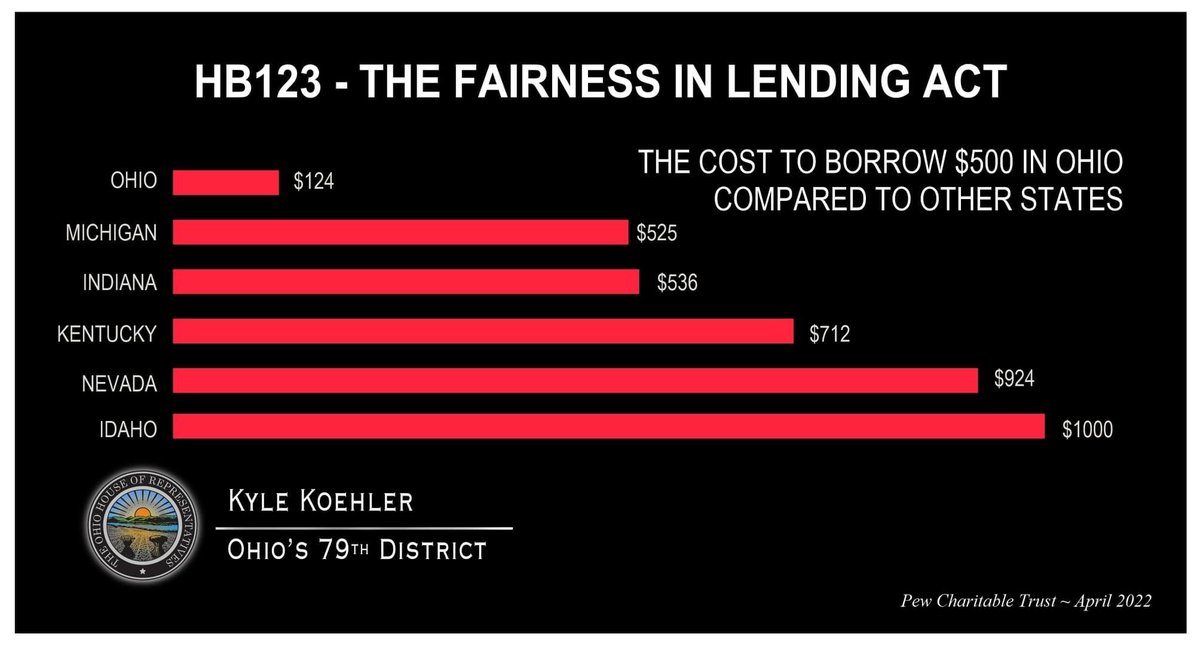

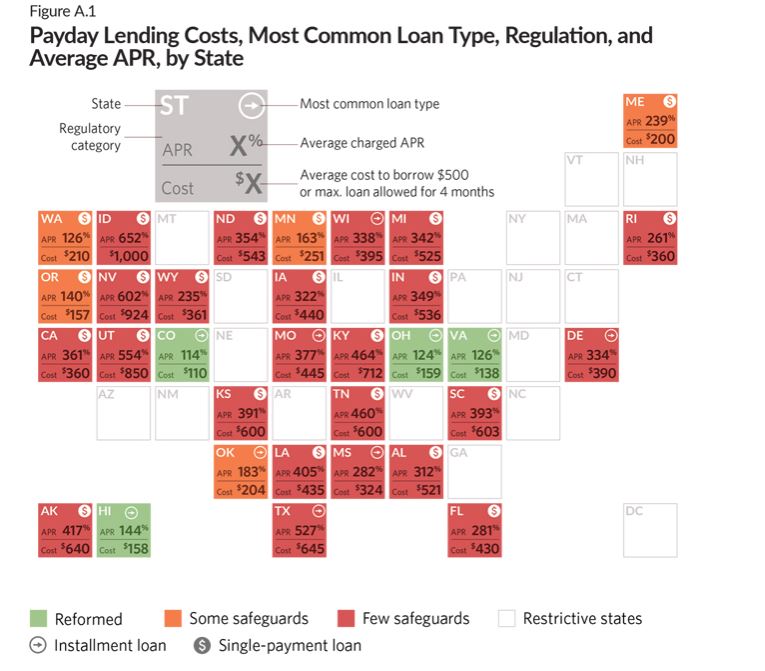

Cool comparison tool for cost of small loans - some states much better than others! pewtrusts.org/en/research-an…

Hannah news report shows that payday lenders in Ohio that embraced the reform passed in 2018 have 250% more business (compared to other states) while saving borrowers hundreds of thousands of dollars compared to states like Indiana, Michigan and Kentucky. hannah.com/DesktopDefault…

The same payday loan companies charge 2x-3x more in Wisconsin than they do in states that have passed well-designed reforms. Payday loan markets are not competitive on price, and good policy recognizes that.

Wisconsin residents taking out short-term payday loans face some of the highest costs in the U.S. according to a report from @pewtrusts. wpr.org/report-wiscons…

Colorado is one of four states with comprehensive payday loan reforms, saving consumers millions of dollars in fees while maintaining broad access to safer small credit. I am proud to have supported this effort in Colorado. pewtrusts.org/en/research-an…

This state led the way on payday loan reform. The result? Colorado borrowers have saved more than $500 million since 2010 and kept access to small loans. #COLeg

Colorado is one of four states with comprehensive payday loan reforms, saving consumers millions of dollars in fees while maintaining broad access to safer small credit. I am proud to have supported this effort in Colorado. pewtrusts.org/en/research-an…

WATCH: Many families in less expensive regions struggle to buy a home because small mortgages are hard to obtain. The Home Financing Project @pewresearch looks at what happens when people use risky mortgage financing. @nibosays @AlexHrwtz youtu.be/Hwah2SppR5c

youtube.com

YouTube

Why Do Millions of U.S. Homebuyers Use Risky Financing Options?

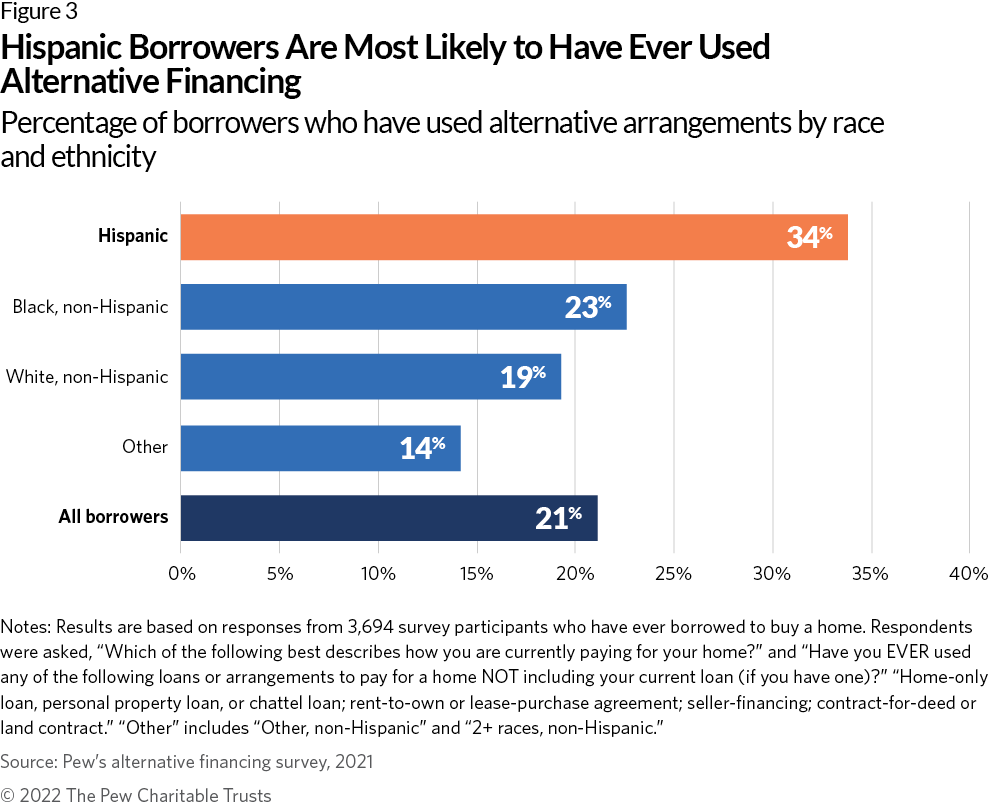

Groundbreaking new research from @pewtrusts about the millions of Americans who have used something other than traditional mortgages to buy homes: pew.org/38BDDxV #mortgages #housing

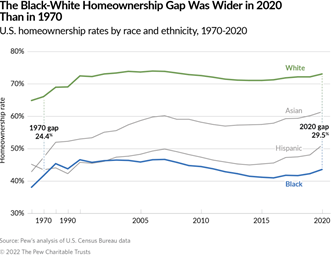

Pew's new survey finds 36 million Americans have used alternative financing, which is often riskier, costlier, less protected than mortgages. Also deep disparities by race, ethnicity: Black, Hispanic, & Indigenous home borrowers more likely to have used alternative financing.

Evidence suggests that limited access to small mortgages is driving many homebuyers to riskier financing that often lacks protections. Importantly, my colleagues also share the history of alternative financing and its impacts for borrowers of color. pew.org/36OoQzl

Surprise ending: Payday lenders warned that Colorado’s reform would put them out of business. 11 years later, 4 of largest U.S. payday loan chains are still in business there. Reform protects consumers *and* preserves access to credit. #COPolitics pew.org/3LNdBpC

Homeownership among Black Americans is as low as it was when the Fair Housing Act became law in 1968. What's more, people of color are more likely to use alternative home financing products—which have higher costs and weaker protections than mortgages. pew.org/36OoQzl

How much does it cost to borrow $500 for 4 months from a payday lender? Depends where you live: •Idaho ($1,000) •Nevada ($924) •Utah ($850) •Texas ($645) •Kentucky $712) … •Virginia ($138) •Ohio ($159) •Colorado ($110) •Hawaii ($158) pew.org/3Kcwths

In Kentucky, a state with few payday loan safeguards, @pewtrusts found an average APR of 464%, the 5th highest in the country. pewtrusts.org/en/research-an…

New @pewtrusts literature review on non-mortgage home financing alternatives: pew.org/36OoQzl via @pewtrusts

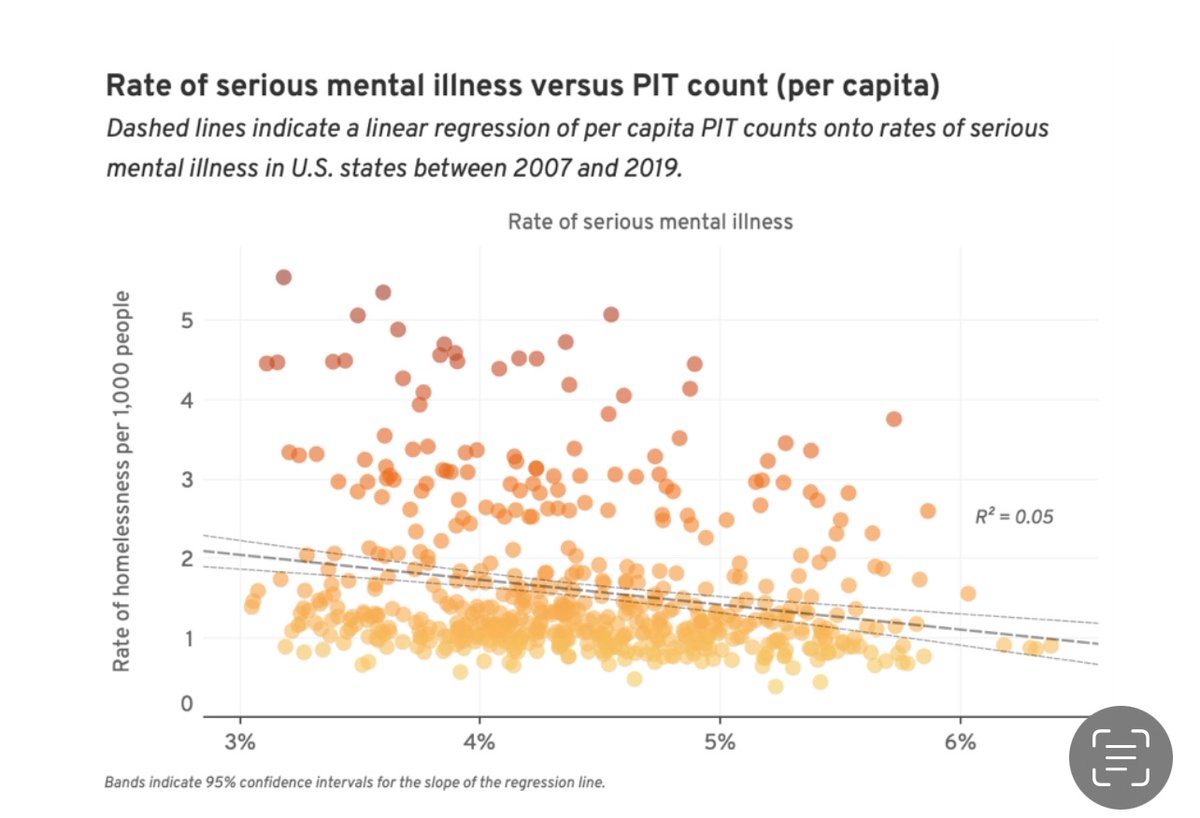

Root cause alert!

Places w/ higher rates of poverty, don’t have more homelessness (left) Places w/ higher rates of mental illness, don’t have more homelessness (top right) Places w/ higher rents, *DO* have more homelessness (bottom right) Bottom line: The root cause of homelessness is housing.

United States Trends

- 1. Thanksgiving 325K posts

- 2. Good Wednesday 29.1K posts

- 3. #wednesdaymotivation 4,689 posts

- 4. #PuebloEnBatallaYVictoria 1,943 posts

- 5. #Wednesdayvibe 2,349 posts

- 6. Trumplican N/A

- 7. Colorado State 3,347 posts

- 8. Nuns 7,876 posts

- 9. Mora 22K posts

- 10. Stranger Things Day 3,315 posts

- 11. Hong Kong 55.5K posts

- 12. #BurnoutSyndromeSeriesEP1 164K posts

- 13. Karoline Leavitt 26.6K posts

- 14. Hump Day 11.8K posts

- 15. Food Network N/A

- 16. Happy Hump 7,882 posts

- 17. Gretzky N/A

- 18. Brett Favre 1,088 posts

- 19. Witkoff 186K posts

- 20. Kimmel 5,262 posts

Something went wrong.

Something went wrong.

![WPR's tweet card. Wisconsin residents taking out short-term payday loans face some of the highest costs in the U.S. according to a report from The Pew Charitable Trusts. A Pew issue brief found […]](https://pbs.twimg.com/card_img/1992998423746744321/037QrL_v?format=jpg&name=orig)