ɐɥdlɐɯopuɐɹuou

@nonrandomalpha

Absolute total pure alpha (5x inverse levered). Red Scare politics.

You might like

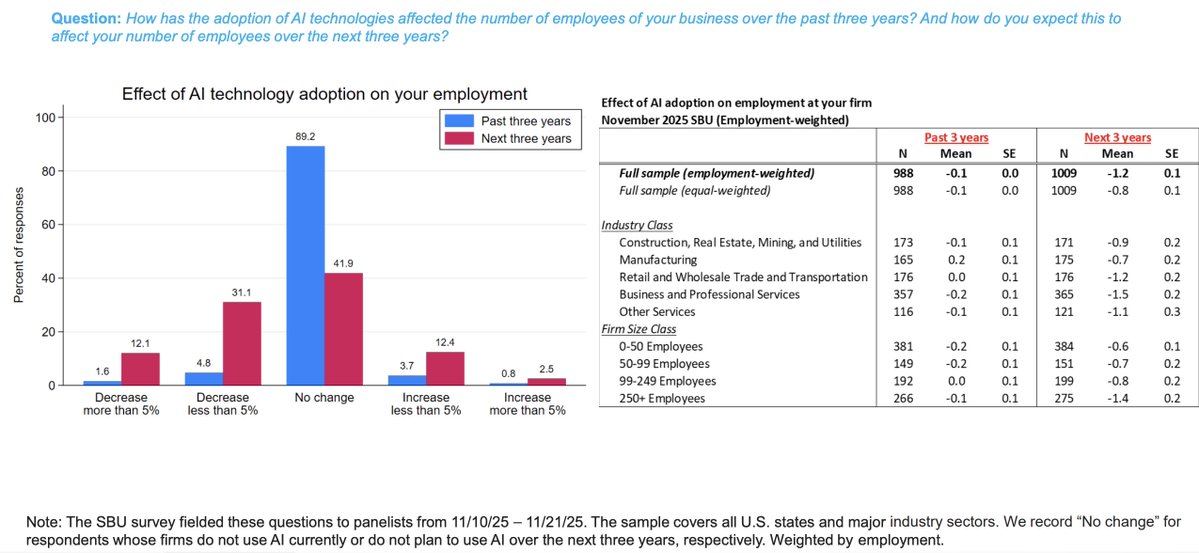

"Over 40% of business executives expect AI adoption to decrease their employment over the next three years. Over a tenth expect AI to decrease their employment by more than 5%." @AtlantaFed

Frontier AI data center capacity, based on data collected by @EpochAIResearch. It doesn't include every single one, as they focus on the largest ones. Few things stand out: - 2026 will have a huge amount of cpacity come online - Anthropic will lead at some early points in…

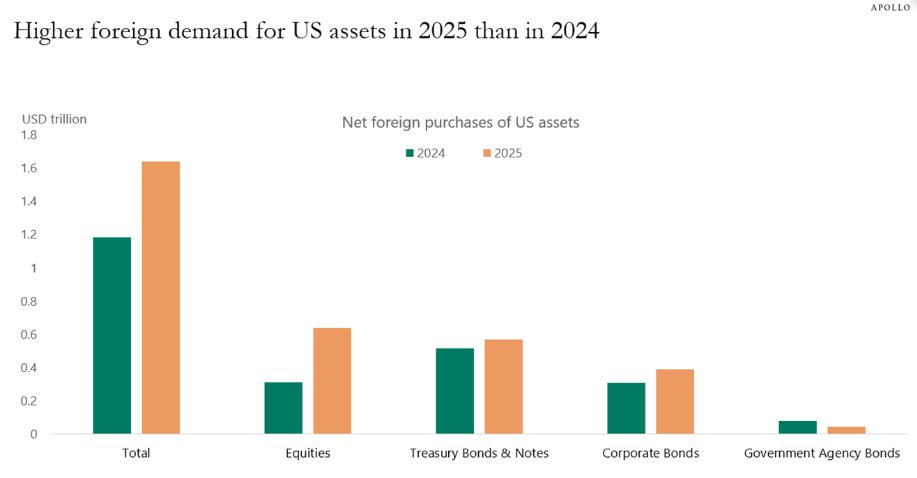

Apollo's Torsten Slok points out that foreign demand for US assets was more robust in 2025 than in 2024, despite fears of a mass exodus from the dollar. apolloacademy.com/continued-stro…

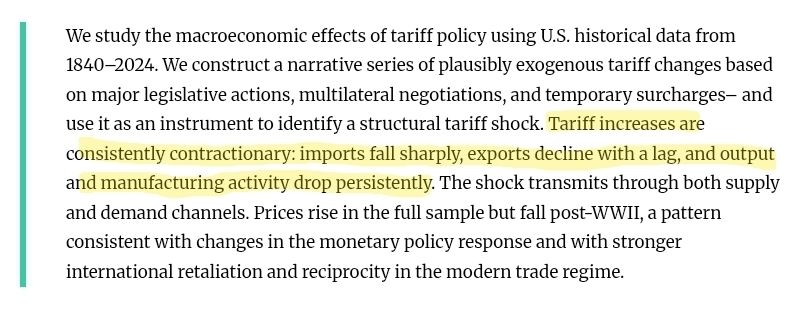

'The Macroeconomic Effects of Tariffs: Evidence From U.S. Historical Data" marginalrevolution.com/marginalrevolu…

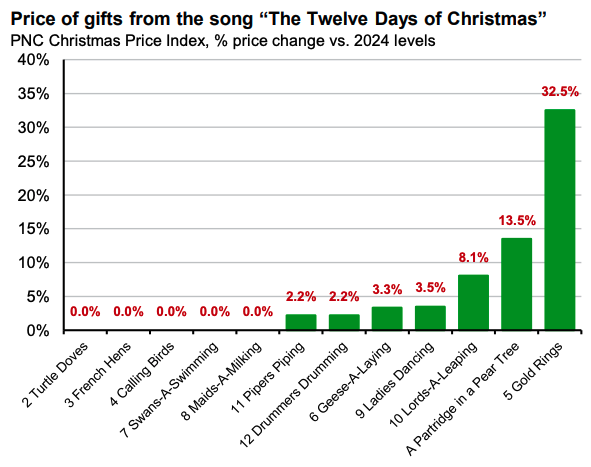

"As seen in PNC’s Christmas Price Index, which tracks the cost of each gift in the song “The Twelve Days of Christmas,” prices rose by 4.5% in 2025, down from 2024’s 5.4% gain." -JPMorgan AM

An instant interactive explainer from Claude for a frequent debate about correlation & causation. Prompt: “Create an interactive tool that explains all the ways two variables can be correlated (causation, random chance, reverse causation, etc)” Play it: claude.ai/public/artifac…

🚨 The energy crisis is intensifying in Germany: German chemical plants are running at just 70% capacity so far in 2025, the weakest level since the Great Financial Crisis. Capacity is well below the break-even threshold, signaling systemic financial stress. In other words,…

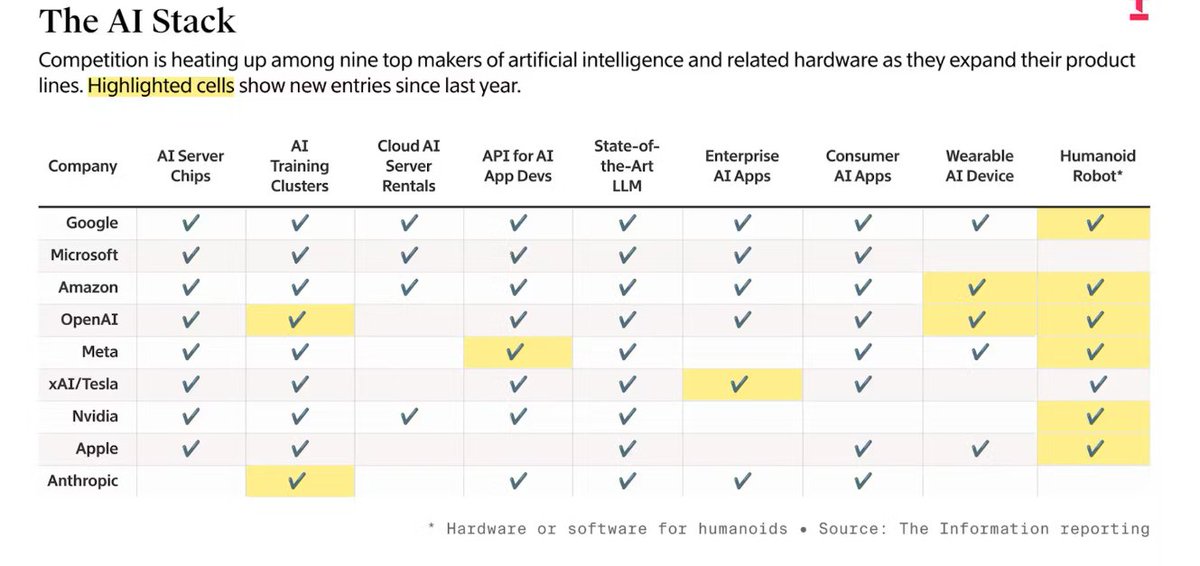

2025 is the year AI giants go all-in on humanoid robots while racing to own the full stack from chips to models to devices. Google strengthens its lead with TPUs and Gemini 3, Meta bets big on AI glasses, xAI climbs fast, and OpenAI, Microsoft, Amazon and others weave a dense…

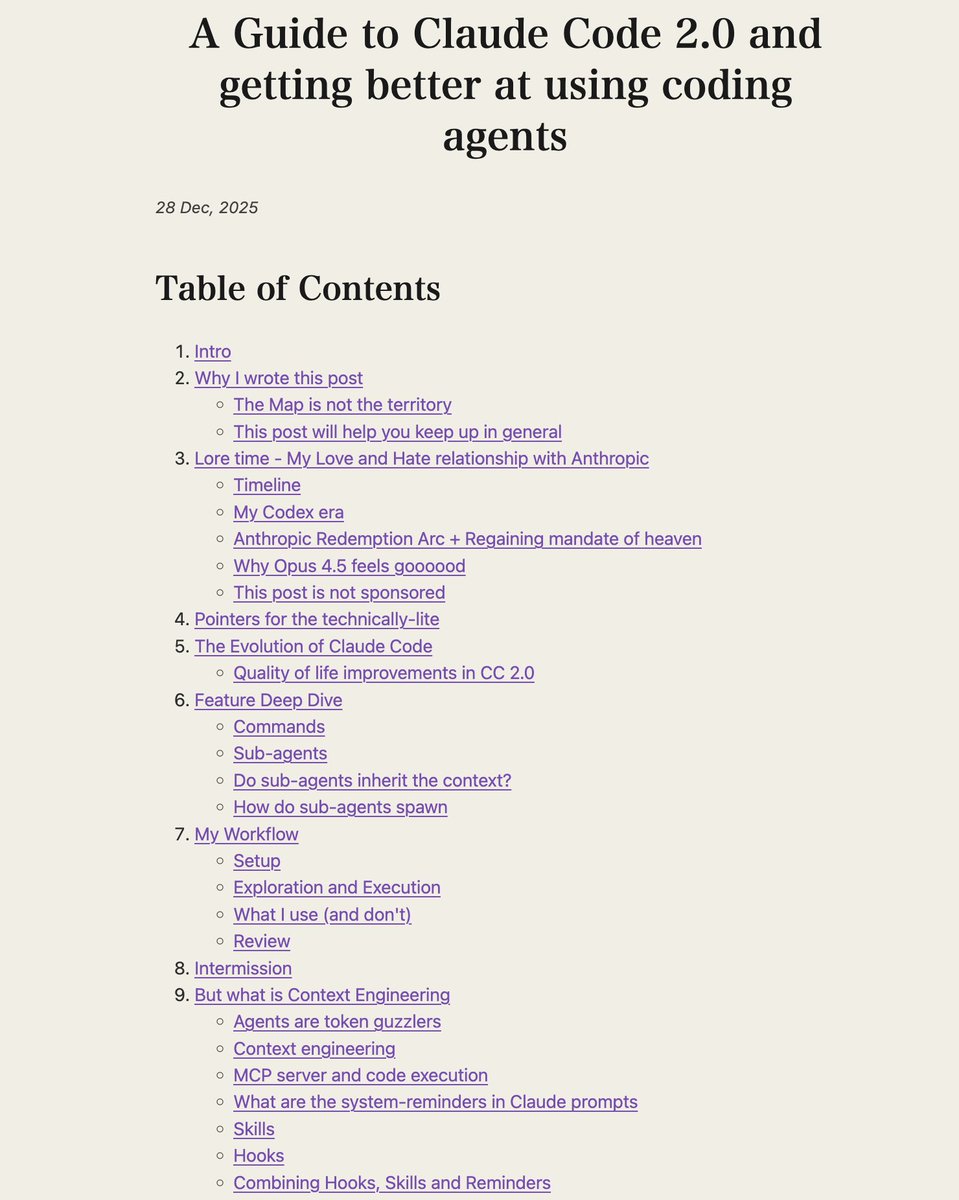

claude code is having it's cursor moment after karpathy sensei's post. never been a better time to try it. my latest blog on how to get the most out of claude code 2.0 and other agents in general is up now. grab a chai and have fun reading! sankalp.bearblog.dev/my-experience-…

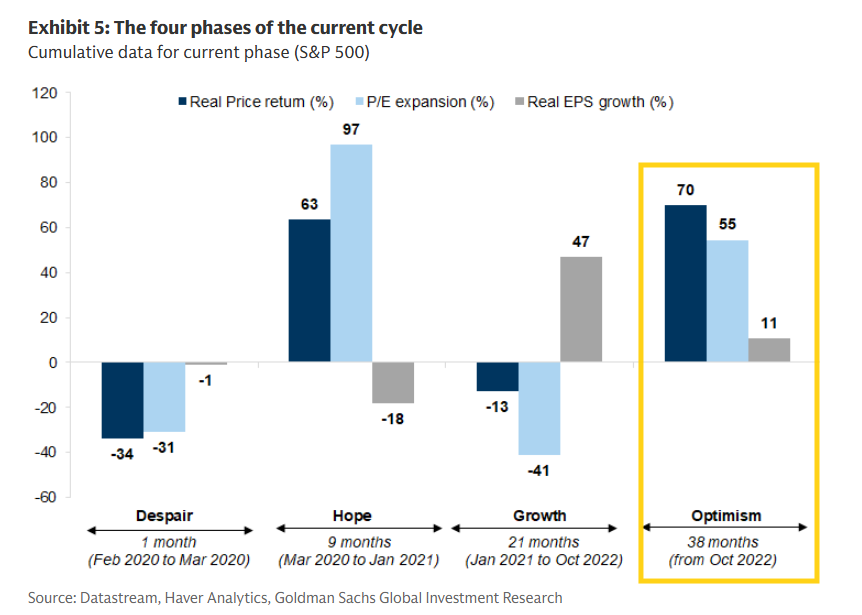

Goldman: If we take the current cycle as having started during the bear market triggered by Covid (which pushed the global economic cycle off course, triggering a global recession), we see a fairly typical evolution of the cycle (Exhibit 5) for an 'event'-driven bear market…

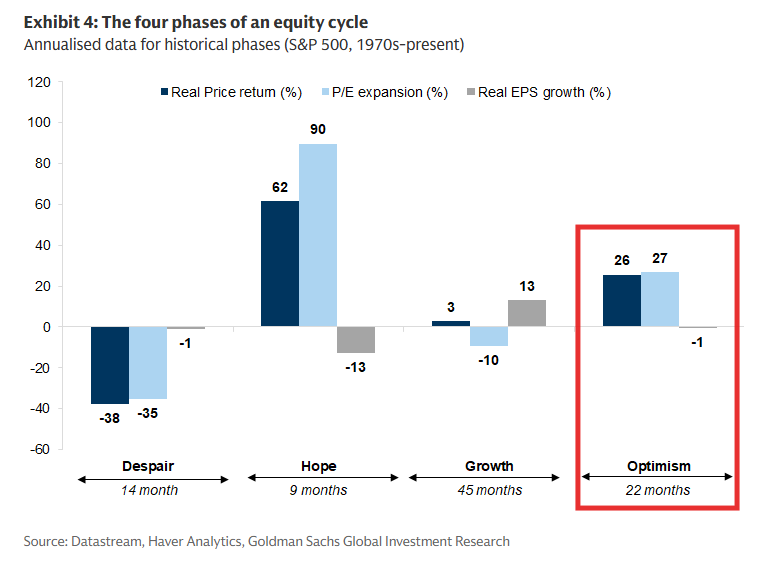

Goldman: In our work on cycles, we find strong evidence that markets evolve through various phases of a typical equity cycle... For simplicity, the four phases can be described as follows: (i) The 'Despair' phase, or bear market, when the market moves from its peak to its…

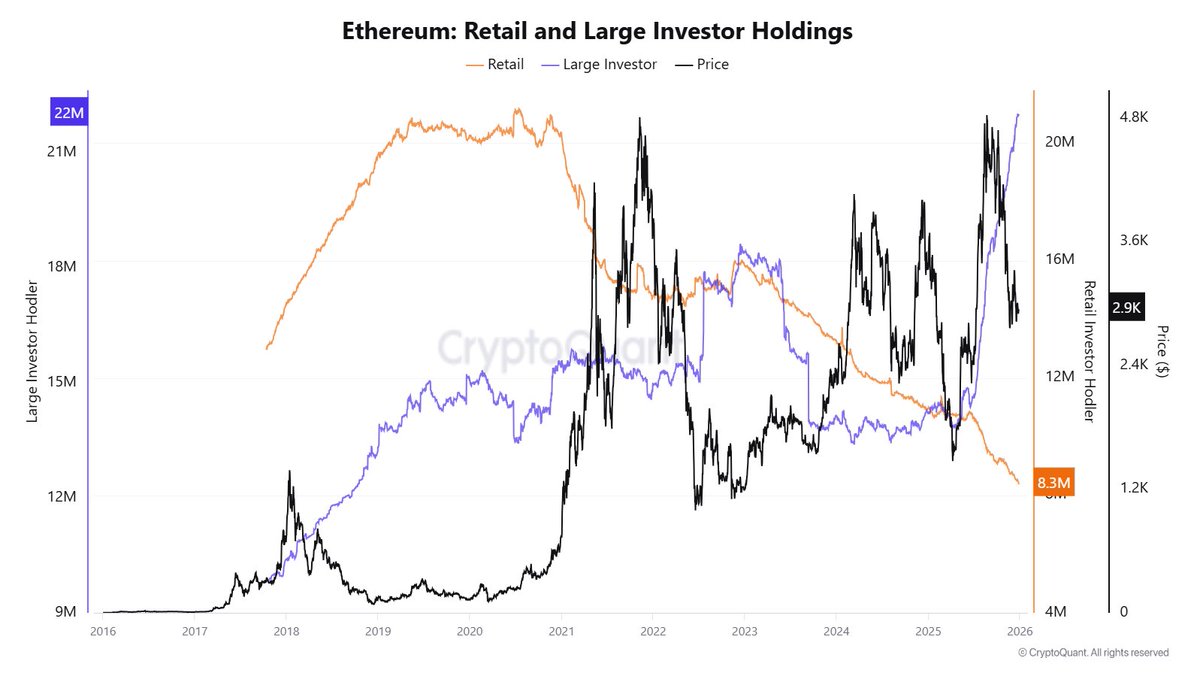

⚠️ONCHAIN ALERT: Ethereum whales are accumulating aggressively while retail trims exposure.

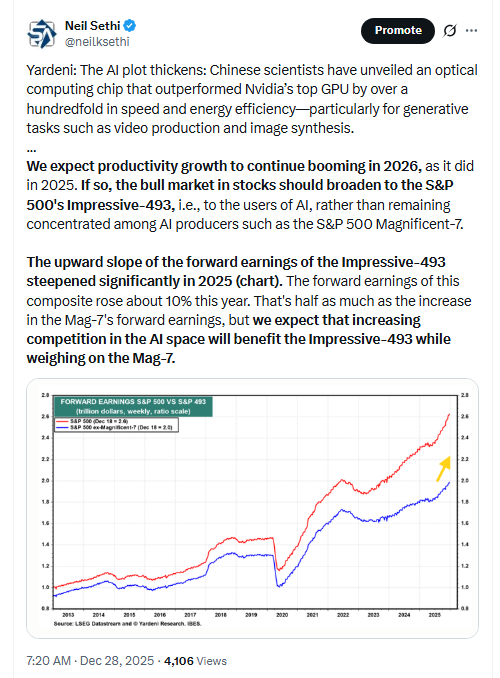

FYI, this is the SCMP article that Ed Yardeni referred to this weekend.

🇨🇳 🇺🇸 Chinese team builds optical chip AI that is 100 times faster than #Nvidia’s market leader - SCMP scmp.com/news/china/sci…

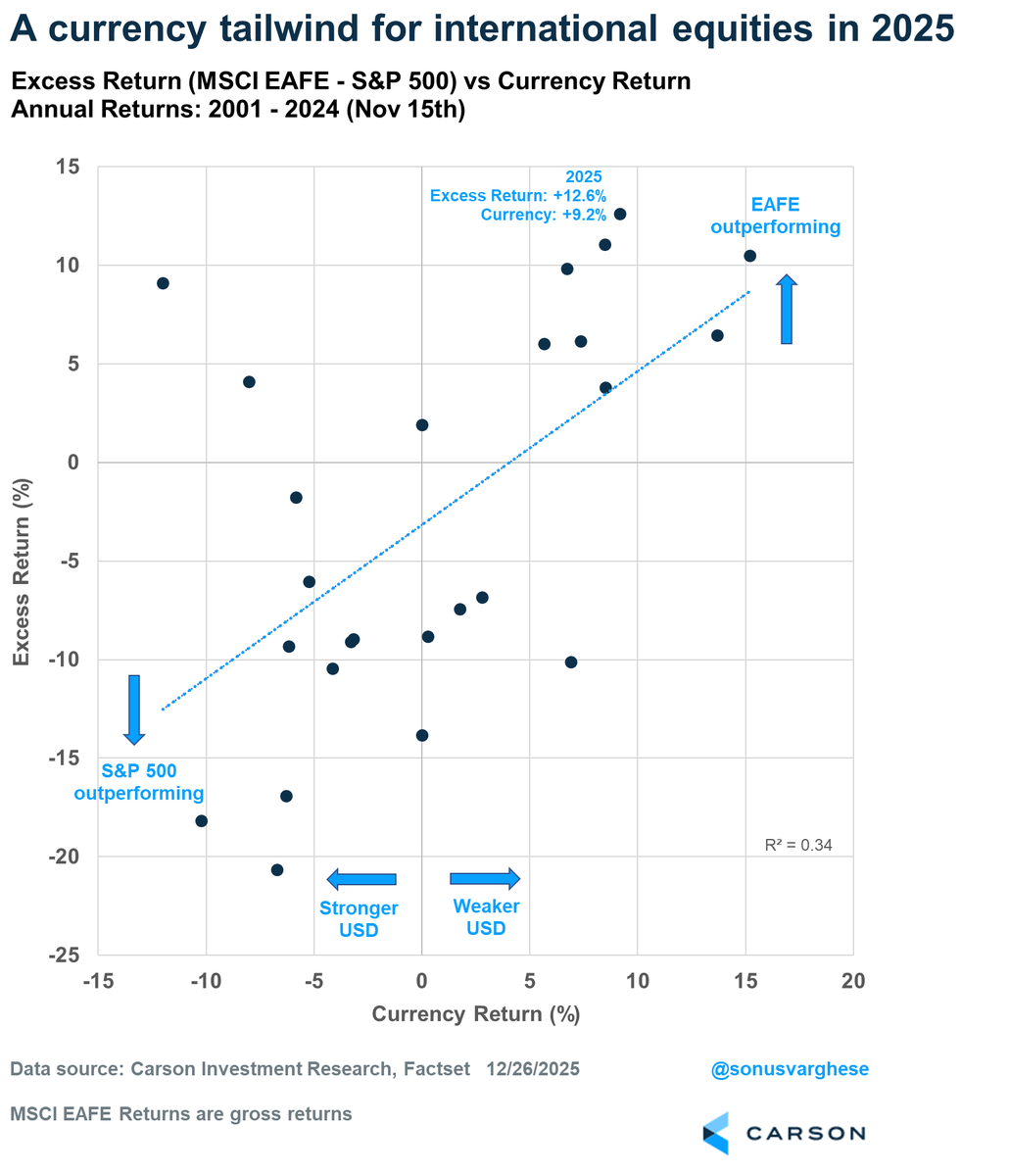

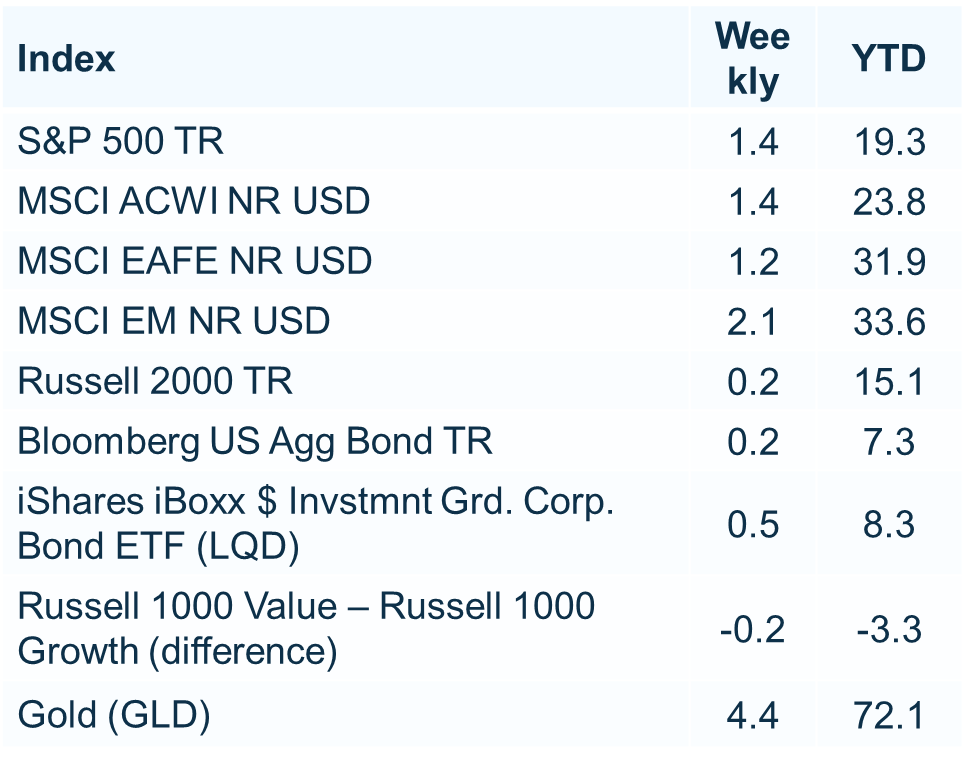

S&P 500: 19.3% YTD (through 12/26) MSCI EAFE: 31.9% Excess return: +12.6% (largest since 2009) MSCI EU: 40.6% Excess: +21.3% (largest since 2006) MSCI EM: 33.6% Excess: +14.3% (largest since 2017) As as happened historically, weak dollar has been a tailwind for USD returns

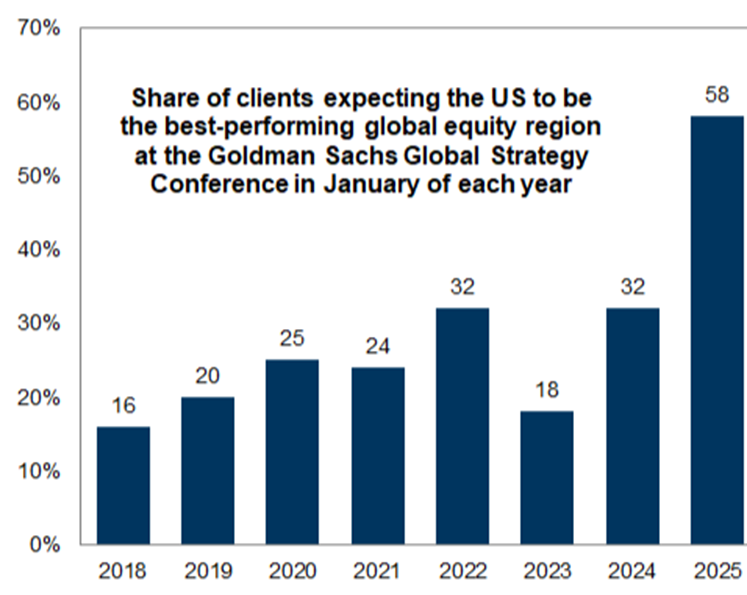

"If it is obvious, it is obviously wrong." Joe Granville At the start of the year, the GS Global Strategy Conference saw a historic number of clients expecting the US to be the best performing region. So of course both EAFE and EM gained more than 30% vs the US 19% in '25.

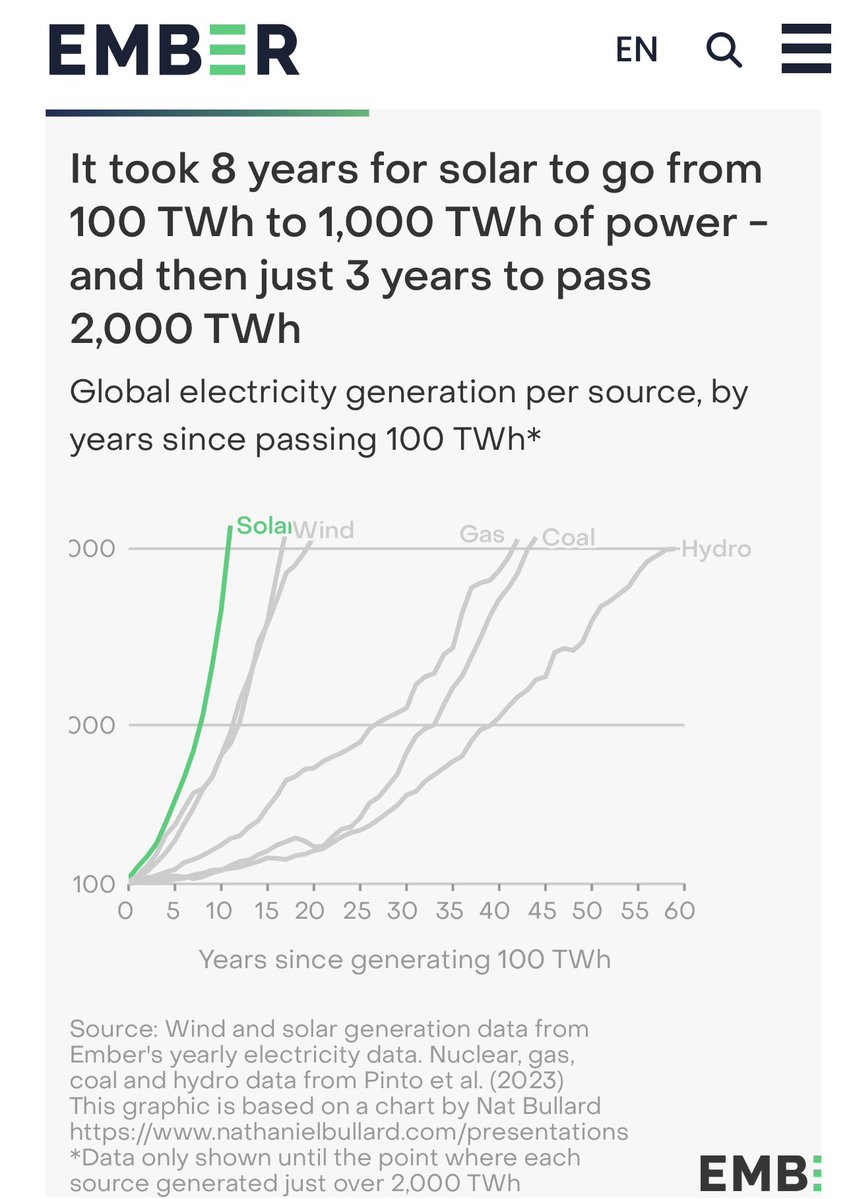

Solar is the fastest-growing source of electricity in history It will become over 50% of all the electricity on Earth by 2036, with the battery supply chain future-proofing the solar takeover Another one of my charts of the year

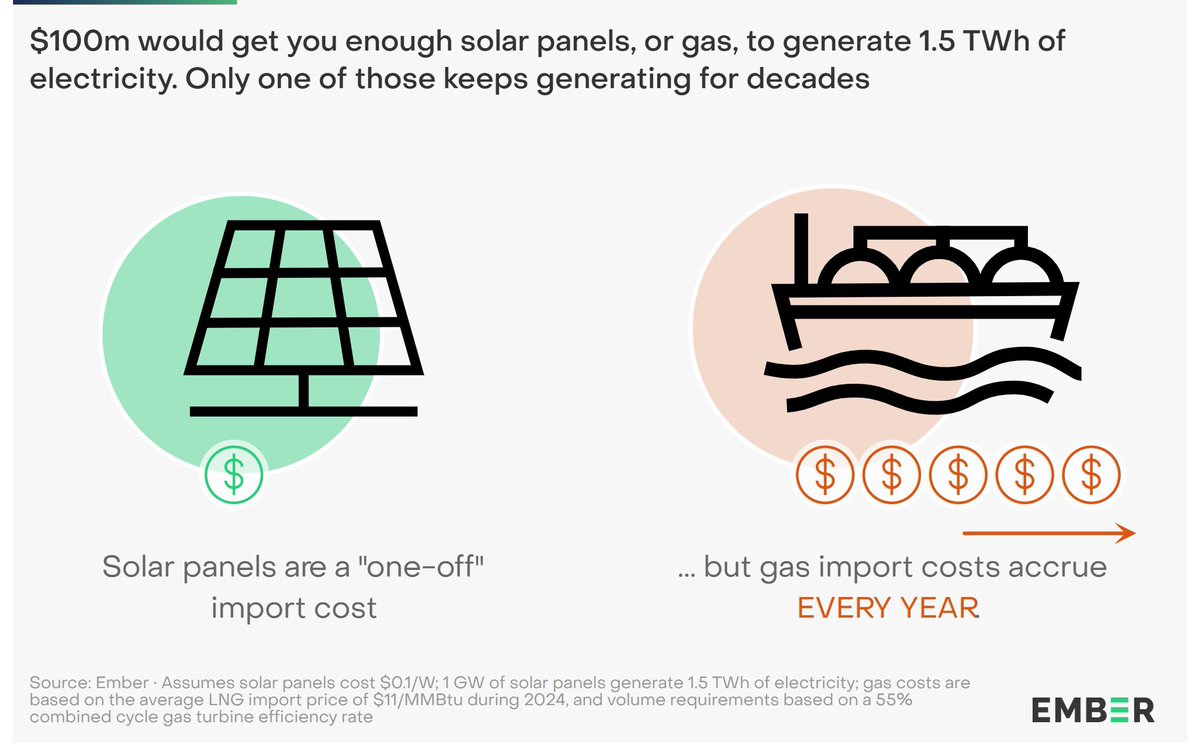

$100m of solar panels saves a country 30 years of gas imports at 2024 prices for the same 1.5TWh of electricity generated That's a $3b saving in gas imports for each $100m of solar deployed Another one of my charts of the year

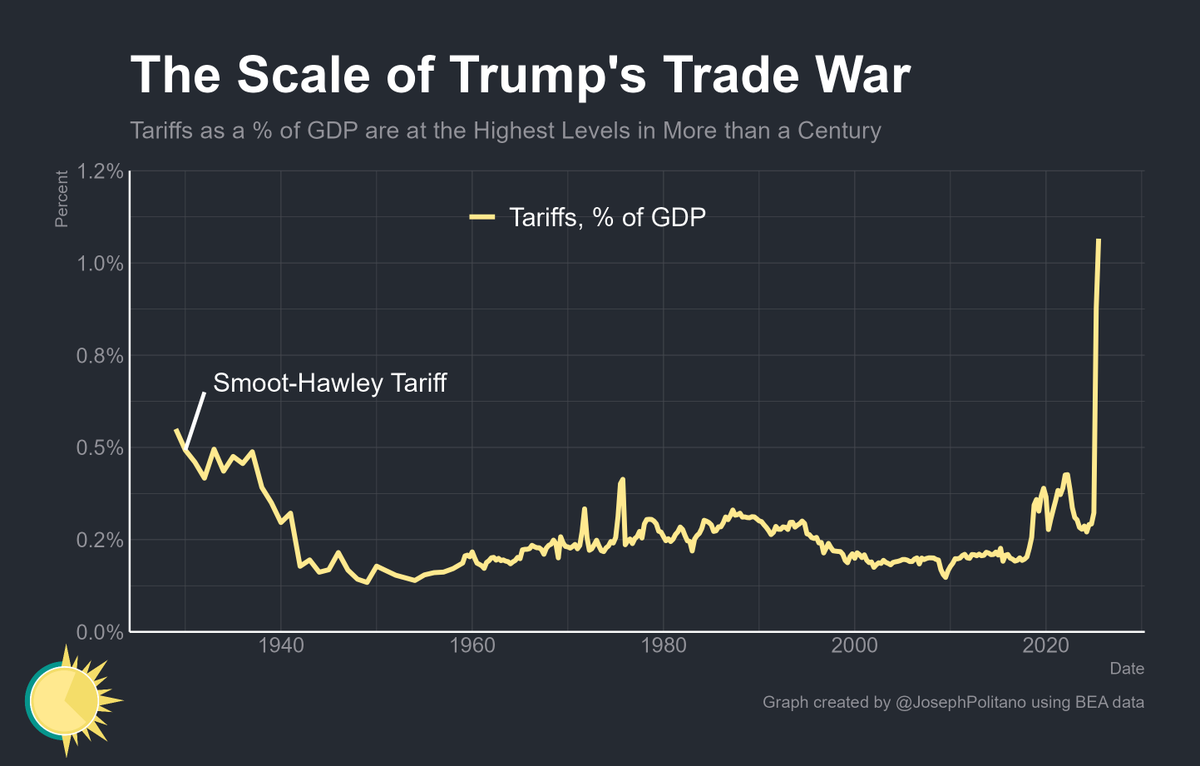

Tariffs as a % of GDP are at the highest level in more than 100 years amidst Trump's trade war—even though tariff rates are still lower than in the 1930s, they have a much higher impact because trade volumes are much larger than in the past

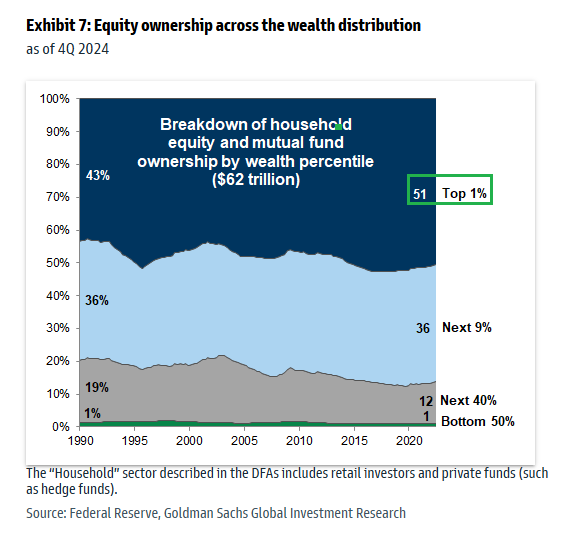

The top 1% own 51% of stocks The bottom 50% own 1% GS

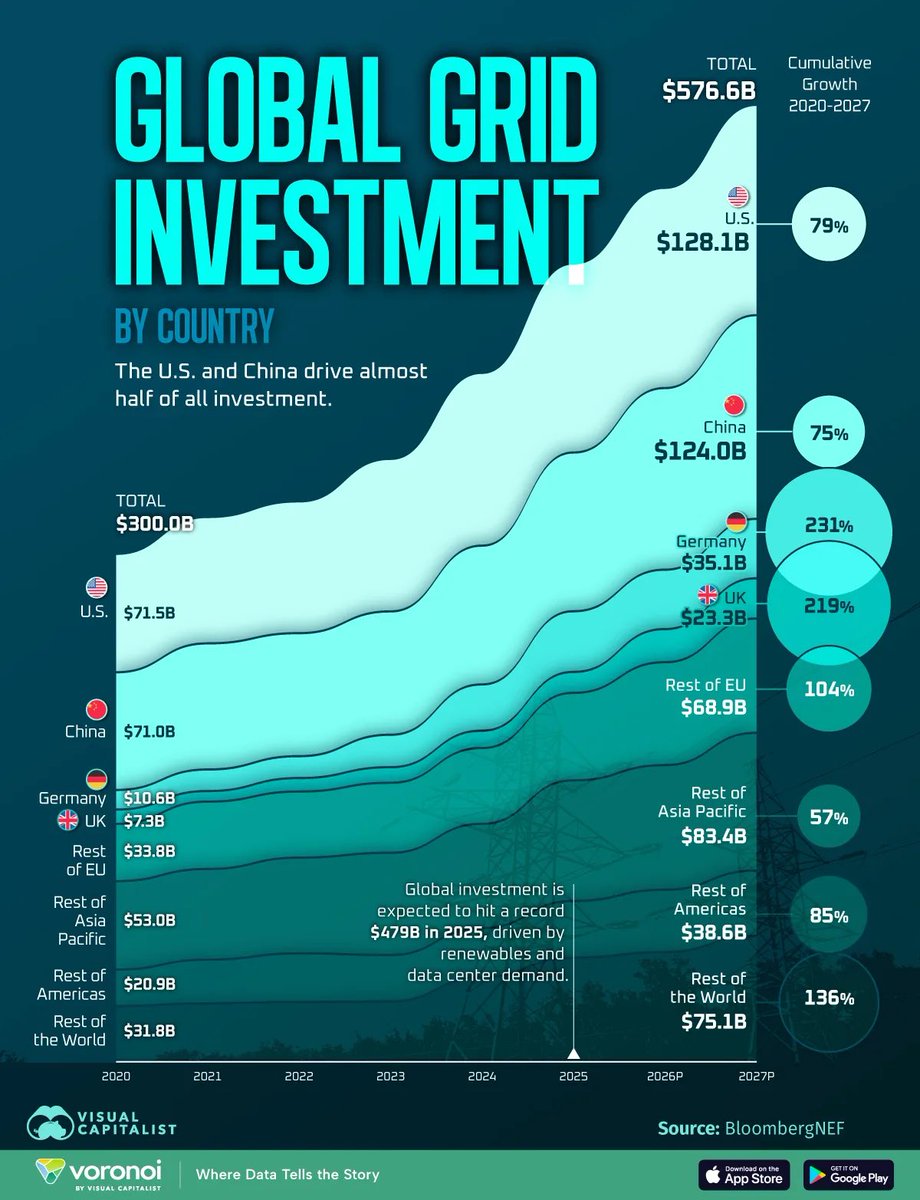

Grid investment is set to rise from about USD 300bn in 2020 to nearly USD 580bn by 2027 as renewables and electrification expand. The US and China dominate spending. But grids are not the only answer: flexibility, energy efficiency and storage can reduce and defer upgrades.

Beautiful trading strategy tear sheets in 5 lines of Python. Build your own in 83 seconds:

It is genuinely hilarious that Bitcoin is a superior asset to gold on every possible dimension. Goldbugs just denying reality at this point.

United States Trends

- 1. #TheMaskedSinger N/A

- 2. #AEWDynamite N/A

- 3. Speedway N/A

- 4. Hornets N/A

- 5. #AbbottElementary N/A

- 6. Fredo N/A

- 7. Collin Chandler N/A

- 8. #ChicagoMed N/A

- 9. Iceland N/A

- 10. Brody King N/A

- 11. Shibata N/A

- 12. Samoa Joe N/A

- 13. Al Harris N/A

- 14. Cuomo N/A

- 15. Lamelo N/A

- 16. TACO N/A

- 17. Speedball N/A

- 18. Al Gore N/A

- 19. La Salle N/A

- 20. Gavin N/A

You might like

-

SportfolioKings

SportfolioKings

@sportfoliokings -

Matthew Davidow

Matthew Davidow

@DavidowMatthew -

Metaculus

Metaculus

@metaculus -

deepvaluebettor

deepvaluebettor

@deepvaluebettor -

Tony Miller

Tony Miller

@Gollumlv -

Hedge Fund Insomniac Guy

Hedge Fund Insomniac Guy

@theinsidersfund -

𝕵oeyTunes2

𝕵oeyTunes2

@joeytunes2 -

Context Capper

Context Capper

@ContextCapper -

Ryan Rothstein

Ryan Rothstein

@WiseRye -

Lineup Sorcerer

Lineup Sorcerer

@LineupSorcerer -

Lock Randers Forty One

Lock Randers Forty One

@brocklanders41 -

werepong

werepong

@werepong1 -

One Stop Sports Spot

One Stop Sports Spot

@StopSportsSpot1 -

Grok NFL Images

Grok NFL Images

@NFLgrokimages -

Prateek Senapati

Prateek Senapati

@PrateekSenapati

Something went wrong.

Something went wrong.