CY

@notesbycy

💭Here to connect and learn. 80% of my posts will be deep dives on market, stocks, and crypto.

If the recent market crash is causing you anxiety: 1. Extend your investment time horizon. (This is only valid if you have strong conviction and are not leveraging/margin trading.) 2. Stop obsessing over the daily chart. Focus on the timeline that actually matters. 3.…

All of this is noise if you don't use leverage. There are only 2 questions you need to ask as a long term holder: Will tomorrow be more digital than today? Has the liquidity cycle and business cycle topped or is it still rising to finance the $10trn that needs to roll in the…

Same thing happens all the time... the crypto market is focused on a big breakout, gets levered long ahead of it, it fails at first attempt so everyone gets liquidated... only then does the actual breakout occur, leaving everyone sidelined.

$NVO Novo Nordisk is potentially a great long-term play due to its market leadership in the enormous diabetes and obesity sectors. As a large-scale drug manufacturer, its future isn't reliant on a single clinical trial outcome, which is a major advantage in an industry defined by…

$ROOT is heavily mentioned on X lately. Investing is looking beyond the hype to understand the business and form a strong conviction of its potential. Let's look at its evolution over the past few years, quarter by quarter. Hopefully it provide you with greater conviction.…

When it comes to stocks, most focus on price action and top-level metrics like P/E and P/S. But to truly understand a company, you have to understand its business and journey. I've been watching $STNE for a while, and its volatile net income always intrigued me. So, I went back…

While many look at pure growth, the core dynamic in the insurance industry is balancing premium with risk. $ROOT approach on leveraging test drive and driving score for premium calculation is truly genius. It yields 3 favorable outcomes. 1) For excellent drivers (Good Score):…

I’ve been seeing a lot of chatter on X about “peak cycle” and how the economy looks late-cycle. So I wanted to tackle this head on and share a few thoughts of my own... This is from the August 21st MIT publication: A classic late-cycle economy typically has all the following…

I don't get the hype on $LMND. While they were a pioneer in the digital-first insurance space, the underlying drivers don't seem to justify the current valuation. The company is not profitable and the path to profitability appears to be a long one. We can argue that EV / Sales…

$ROOT has been popping up on my feed, and I finally took a deep dive. Honestly, the more I looked, the more interesting the story got. Here are a few reasons why I find it so compelling. Note: I like the business model and opportunity. Not commenting on the valuation etc.. 1.…

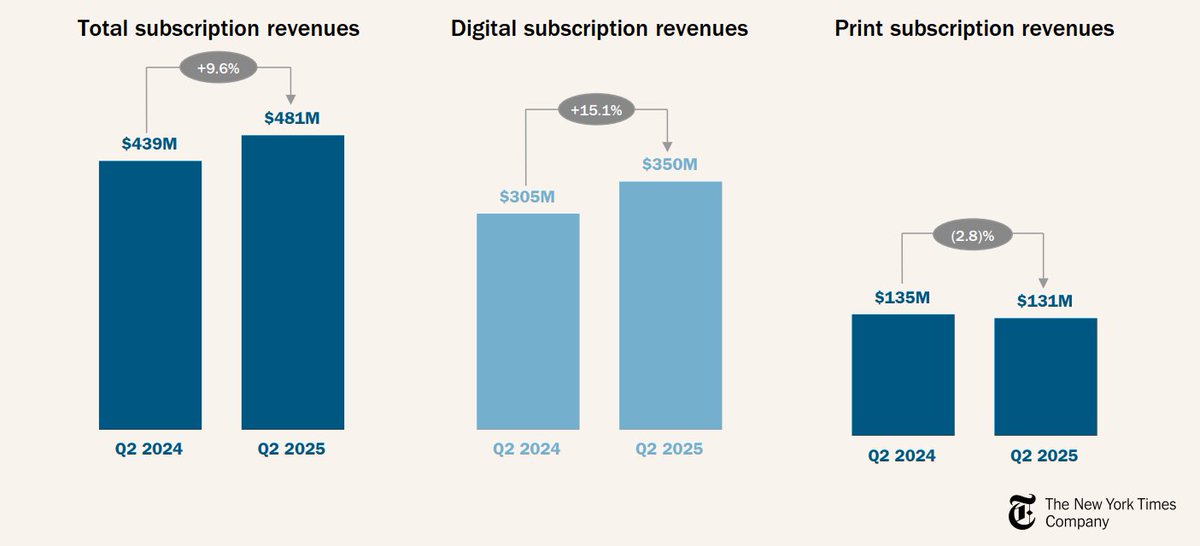

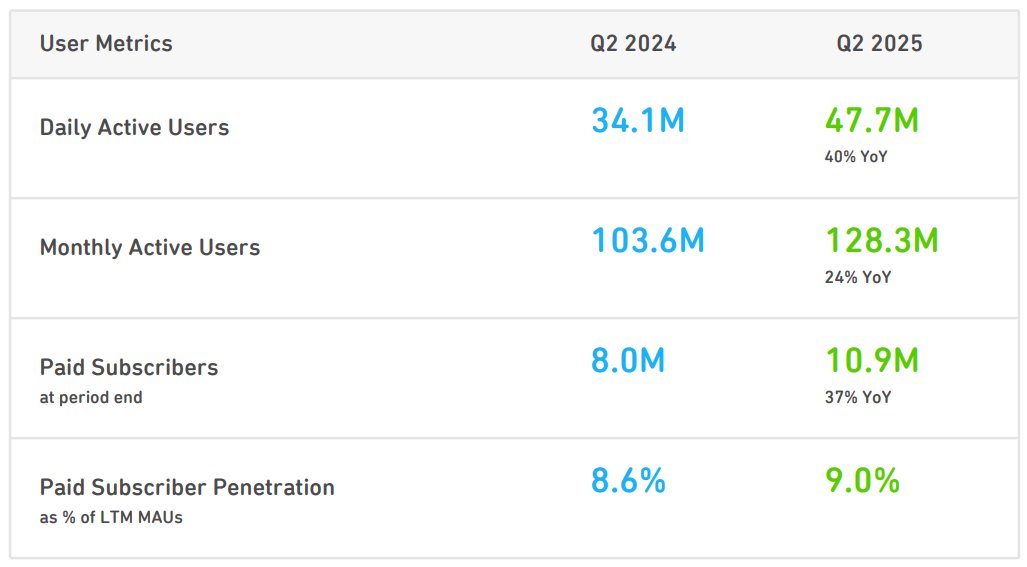

Not something i typically look at but was curious on whether news publishing companies is still viable as a business. For this, i look into $NYT which is pretty interesting but i am not convinced. Here’s what I'm seeing: 1. They're Fighting the AI Fight: Not surprising to see…

Crypto is still being adopted at twice the speed on the internet from 5m IP addresses vs 5m wallets (very like for like). 1/

A few years back, I got hooked on Duolingo. It's a seriously engaging app for learning a new language, but like most people, I never actually subscribed to the paid version as the free one was amazing enough. Recently, I was looking into $DUOL and was genuinely shocked by the…

This is important. Key to understand that a huge proportion of crypto projects won't be here in 1 year. Yes, alt coin will be pump for sure during the bull cycle. Key to have an exit strategy so you don't end up becoming exit liquidity or ride the wave down.

95% of the time in crypto alts will do perform poorly. Bitcoin will beat them. But 5% of the time for brief periods they give 10-20-30x gains…you make lifetime wealth in weeks. This 5% is gonna happen here very soon. Do nothing. Patience simba.

Nearly 90% of the global population under the age of 20 will reside in emerging markets by 2050. These regions are also projected to account for approximately 65% of global economic growth by 2035.

United States Tendenze

- 1. phil 104K posts

- 2. Falcons 18.3K posts

- 3. Falcons 18.3K posts

- 4. phan 86.1K posts

- 5. Josh Allen 7,707 posts

- 6. Columbus 242K posts

- 7. Jorge Polanco 7,246 posts

- 8. Bijan 4,262 posts

- 9. Tyler Allgeier 1,062 posts

- 10. Mitch Garver N/A

- 11. Dawson Knox N/A

- 12. Mike Hughes N/A

- 13. #DirtyBirds 1,451 posts

- 14. Kincaid 1,940 posts

- 15. Josh Naylor 2,269 posts

- 16. #BUFvsATL 1,689 posts

- 17. Starship 56.5K posts

- 18. Doug Eddings 1,139 posts

- 19. Monday Night Football 8,320 posts

- 20. #RiseUp N/A

Something went wrong.

Something went wrong.