Timothy Peterson

@nsquaredvalue

Bitcoin Pathfinder | Network Economist Author of "Metcalfe's Law as a Model for #Bitcoin's ₿ Value" & "The Debauchery of Currency: a Bloody History of #Money"

You might like

#bitcoin is the first money that requires no physical space to store it, no courier to carry it, no bookkeeper to count it, no auditor to check on it, no security guard to protect it, and no government to issue it.

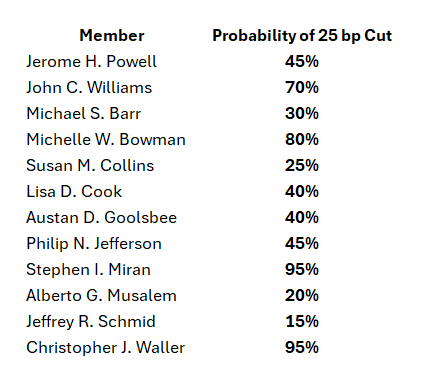

The market is pricing in a 70% chance of a rate cut by the Fed next month based on the recent comments by Waller. The market is wrong. The vote is still 6-6. This is maximum entropy => max uncertainty => max risk.

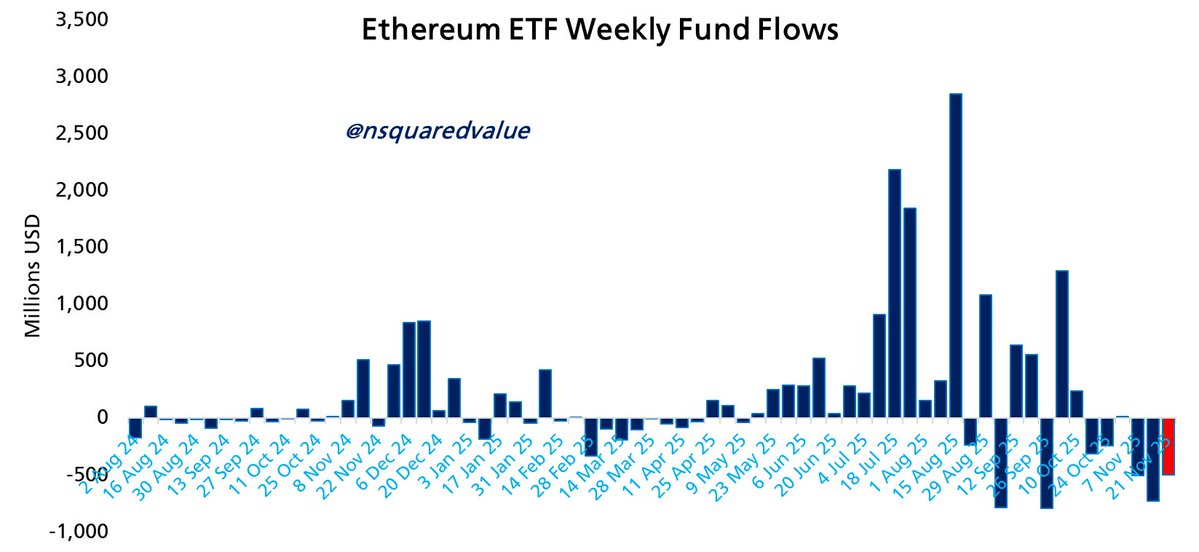

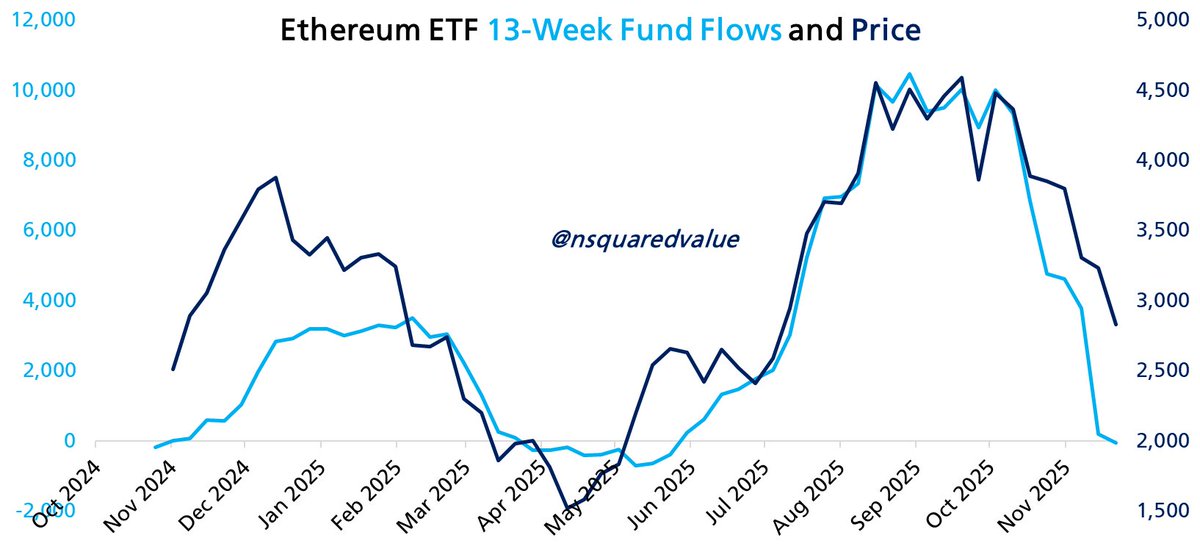

Ethereum ETF fund flows are down 5 of the past 6 weeks. Fund flows have been leading price for 6 weeks and based on the relationship in this chart $ETH could fall to $2,000 or lower. Alternatively fund flows could recover and mitigate the decline.

I did provide plenty of warning bitcoin

Bitcoin ETFs lose $1 billion per week for 3 consecutive weeks. AUM down -35% since October 3rd.

Reality check on the "Use tariffs to pay down the debt." Total tariffs collected = 0.50% of the debt. The debt has increased nearly 7% per year for the past 30 years. You would need 14x tariff revenues just to cover this year's increase. And next year the debt would go up again…

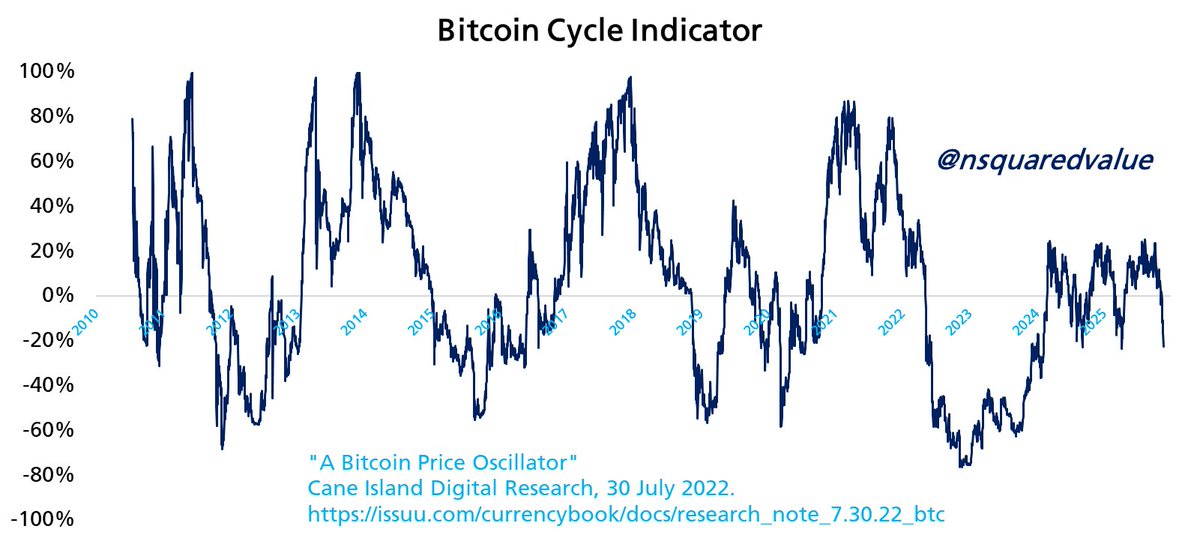

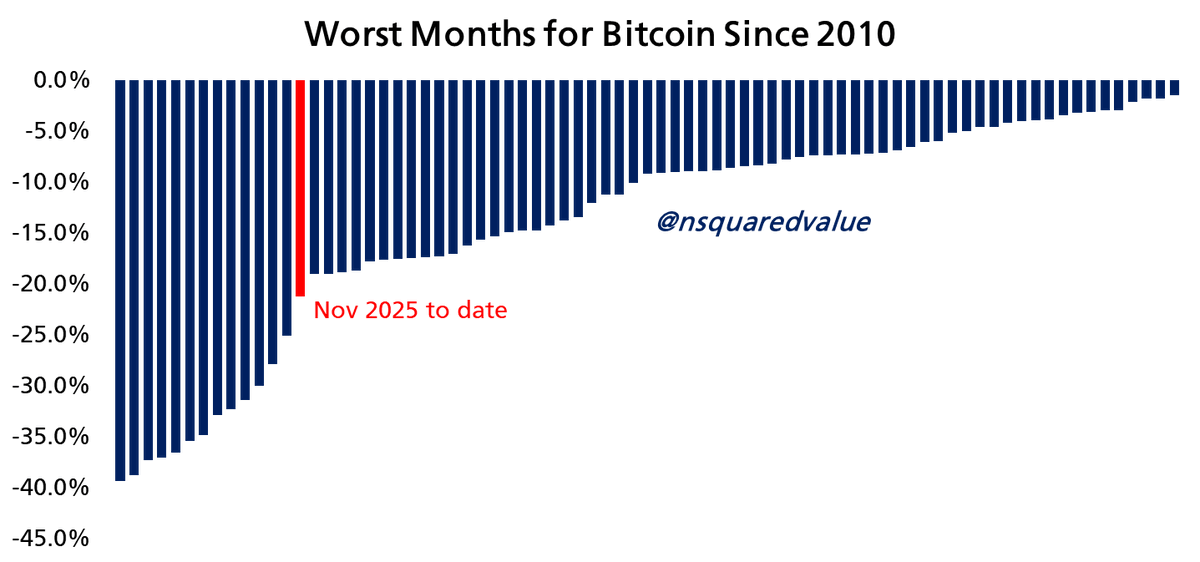

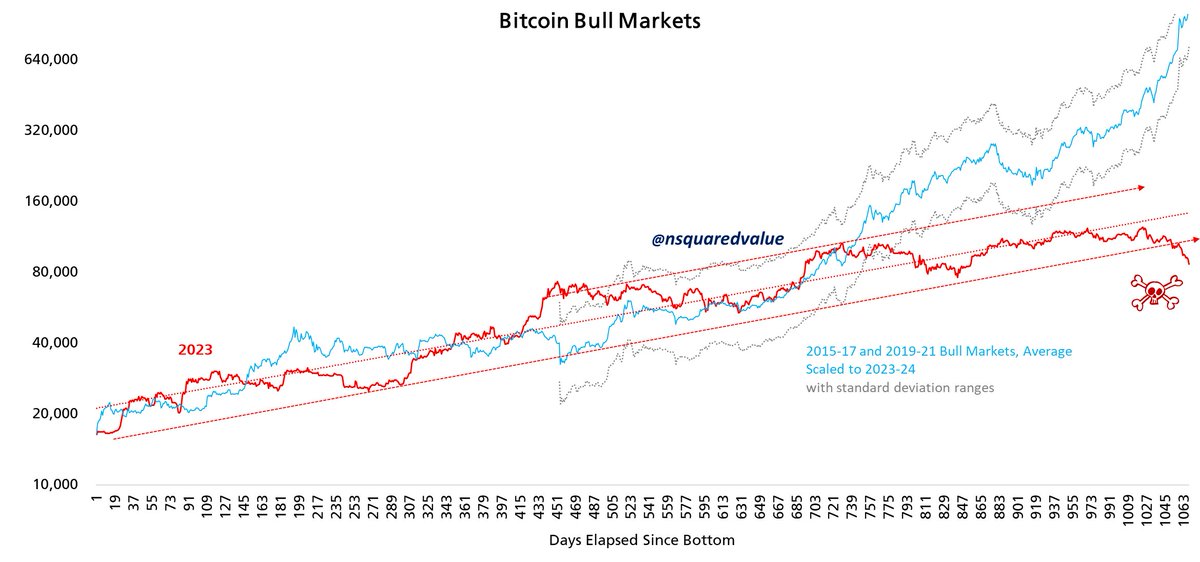

These bitcoin charts are being retired as they have run their course.

Bitcoin

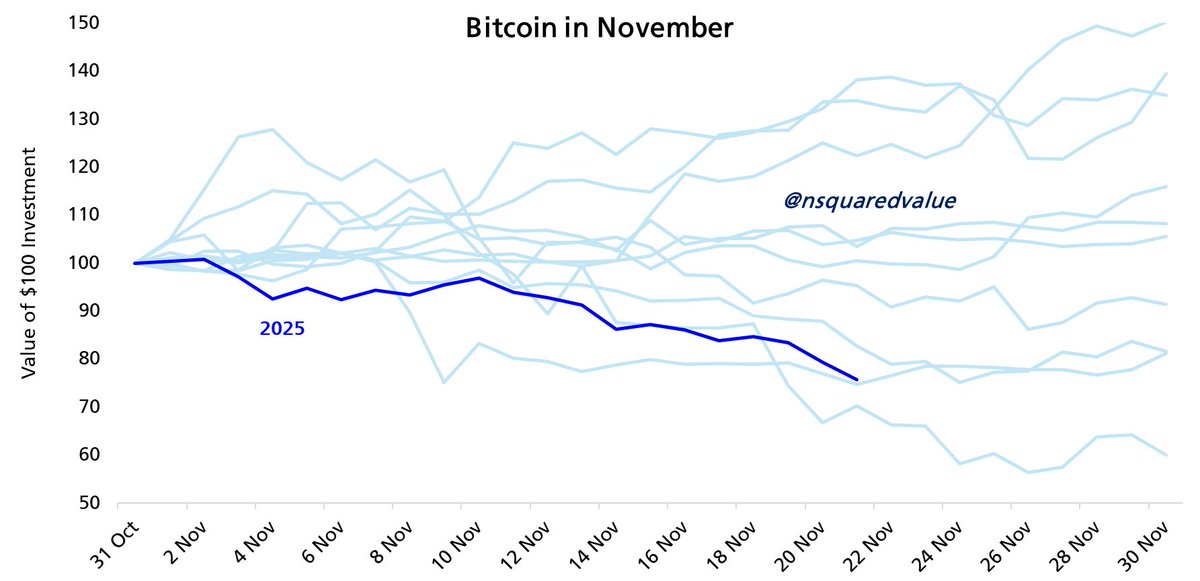

1/6 People don't like bearish comments but there is some seasonal risk I've identified for Bitcoin. I've looked at this a number of ways (not all shown here) and feel I should warn about November.

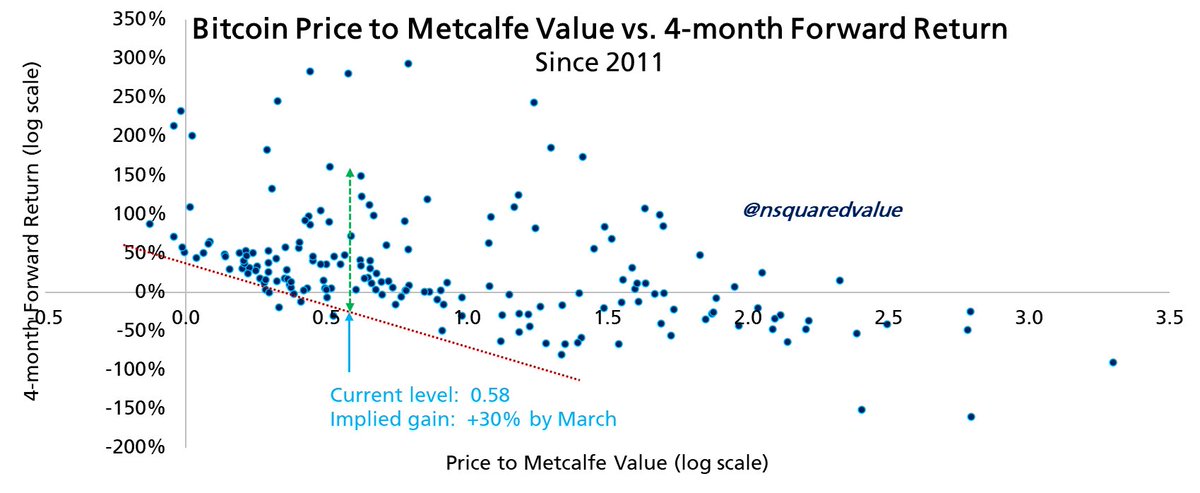

Bitcoin Current Valuation implies +10% to +50% by March

Things I'm looking at as indicators that Bitcoin has hit bottom: 1) $VIX >30?? 2) $WGMI , idk, < $30? 3) CCC yield, maybe 13-14%? 15%? Things I'm not looking at: Bitcoin price. This is the worst indicator to look at. There's no magic formula and no magic number.

$VIX hit 28 today and closed above 26. I looked through history back to 1990 and when it hit this level it went higher 90% of the time reached 33 on average. => More downside likely to come.

Understanding $VIX The CBOE Volatility Index, aka "fear index," measures expected stock market volatility over the next 30 days based on S&P 500 options pricing. It serves as both a sentiment gauge and a contrarian indicator.

Bitcoin in November: It feels bad because it is bad. This month ranks in the bottom 10% of daily price paths since 2015.

United States Trends

- 1. #BaddiesUSA 40.4K posts

- 2. Rams 25.7K posts

- 3. Cowboys 93.6K posts

- 4. Eagles 133K posts

- 5. #TROLLBOY 1,511 posts

- 6. Stafford 11.7K posts

- 7. Bucs 11.3K posts

- 8. Scotty 8,002 posts

- 9. Baker 19.5K posts

- 10. Chip Kelly 6,135 posts

- 11. Raiders 61.7K posts

- 12. #RHOP 9,208 posts

- 13. Teddy Bridgewater 1,059 posts

- 14. Stacey 29.2K posts

- 15. #ITWelcomeToDerry 10.8K posts

- 16. Todd Bowles 1,584 posts

- 17. Pickens 30.2K posts

- 18. Ahna 4,852 posts

- 19. Browns 107K posts

- 20. Shedeur 122K posts

You might like

-

Fidelity Digital Assets

Fidelity Digital Assets

@DigitalAssets -

Willy Woo

Willy Woo

@woonomic -

Murad 💹🧲

Murad 💹🧲

@MustStopMurad -

Mike McGlone

Mike McGlone

@mikemcglone11 -

Mark W. Yusko - Two Point One Quadrillion

Mark W. Yusko - Two Point One Quadrillion

@MarkYusko -

Bitstein

Bitstein

@bitstein -

Santiment

Santiment

@santimentfeed -

Bit Harington

Bit Harington

@bitharington -

ChartsBTC

ChartsBTC

@ChartsBtc -

Charlie Shrem

Charlie Shrem

@CharlieShrem -

Jesse Powell

Jesse Powell

@jespow -

Cæsar 🏦

Cæsar 🏦

@PARABOLIT -

Chris Burniske

Chris Burniske

@cburniske -

_Checkmate 🟠🔑⚡☢️🛢️

_Checkmate 🟠🔑⚡☢️🛢️

@_Checkmatey_ -

David Puell

David Puell

@dpuellARK

Something went wrong.

Something went wrong.