OANDA

@OANDA

OANDA Corporation is a trusted & award-winning provider of forex trading. Losses can exceed deposits.

You might like

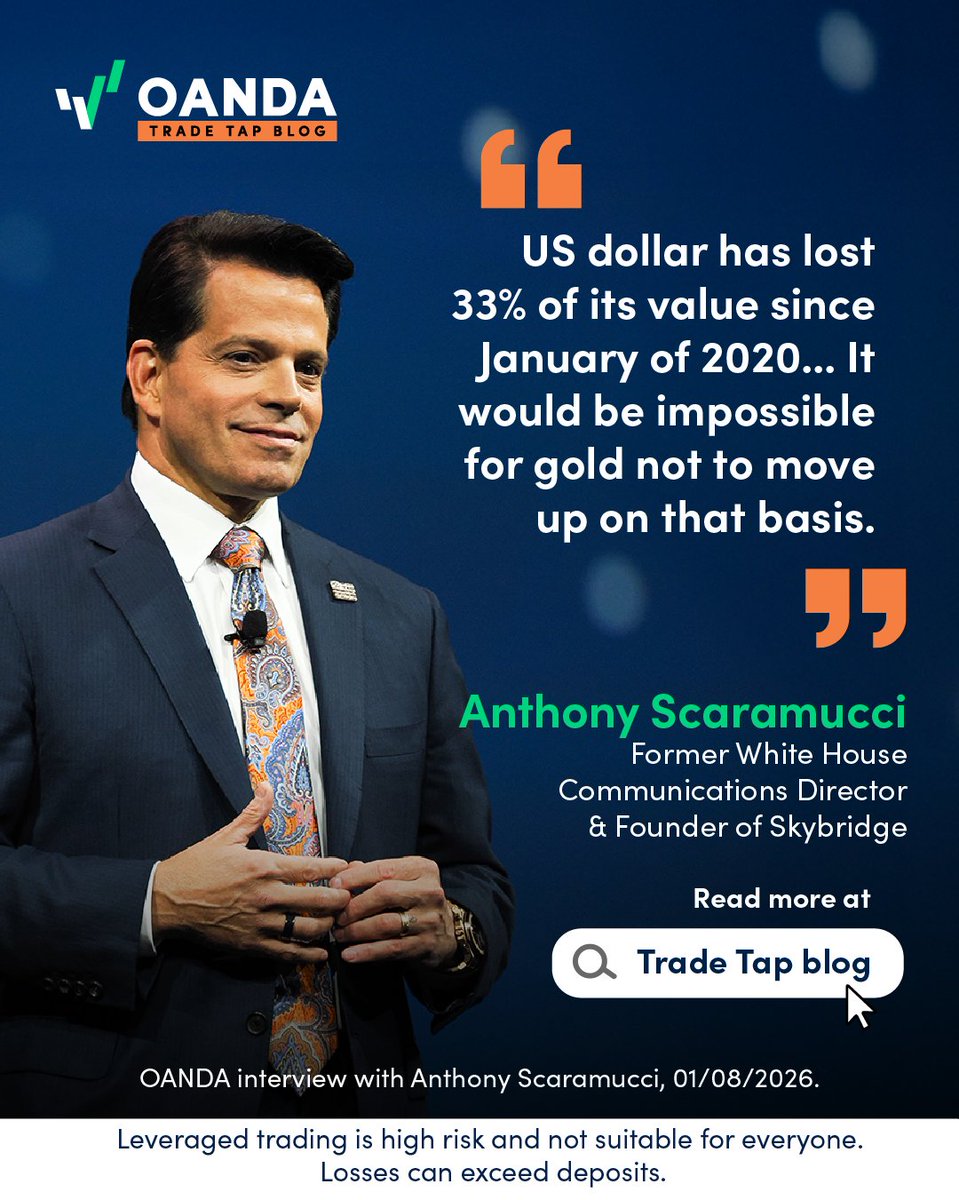

In the first year of Trump 2.0 we have seen big gains for gold, with the dollar heading in the opposite direction. We sat down with @Scaramucci to find out more about the President's second term so far bit.ly/3Lvg1ir

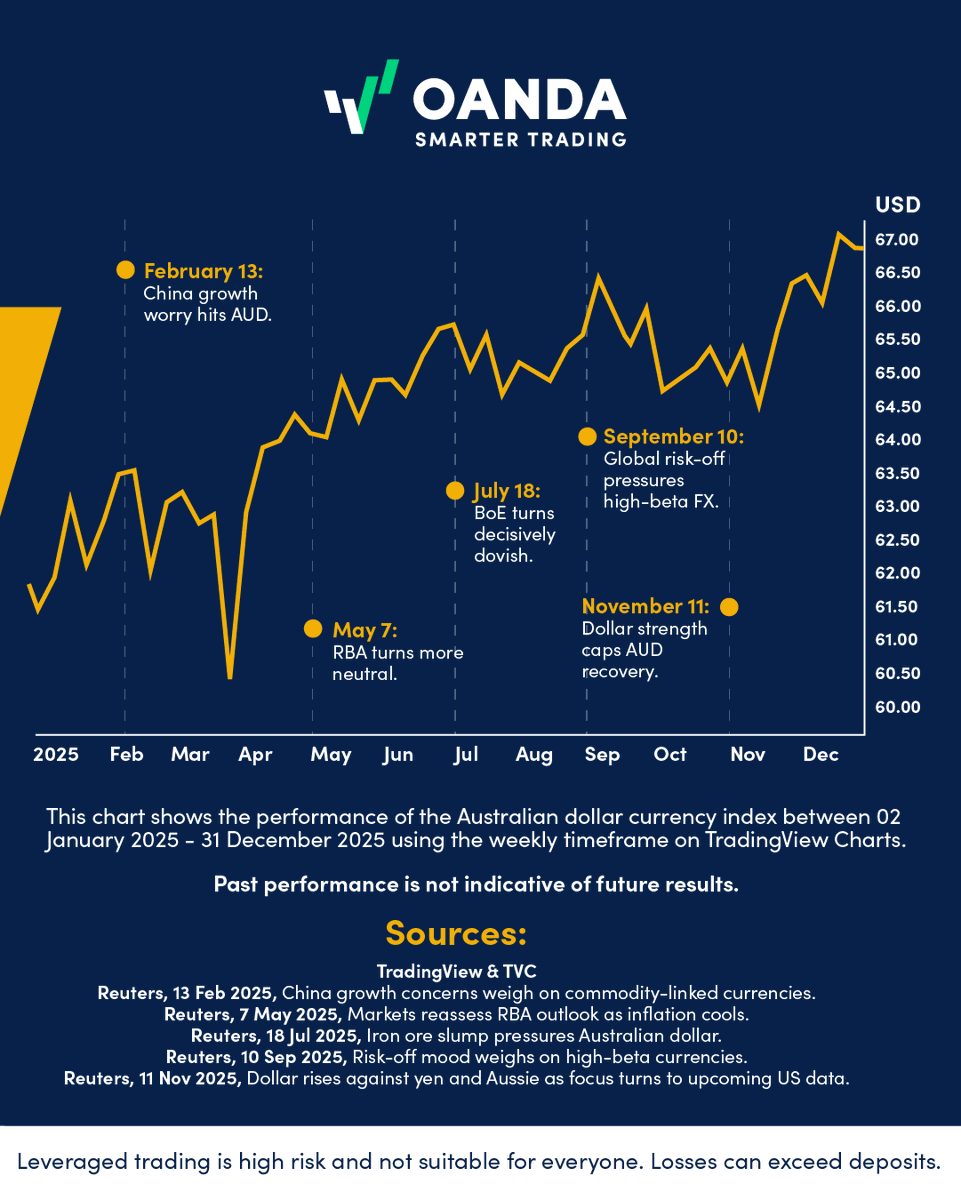

China demand, RBA signals, and global risk swings drove every major move. See the events that steered the Australian dollar in 2025.

Silver has hit all time highs after Trump's threat of European tariffs. Is this a short-term spike, or the start of a bigger move in metals?

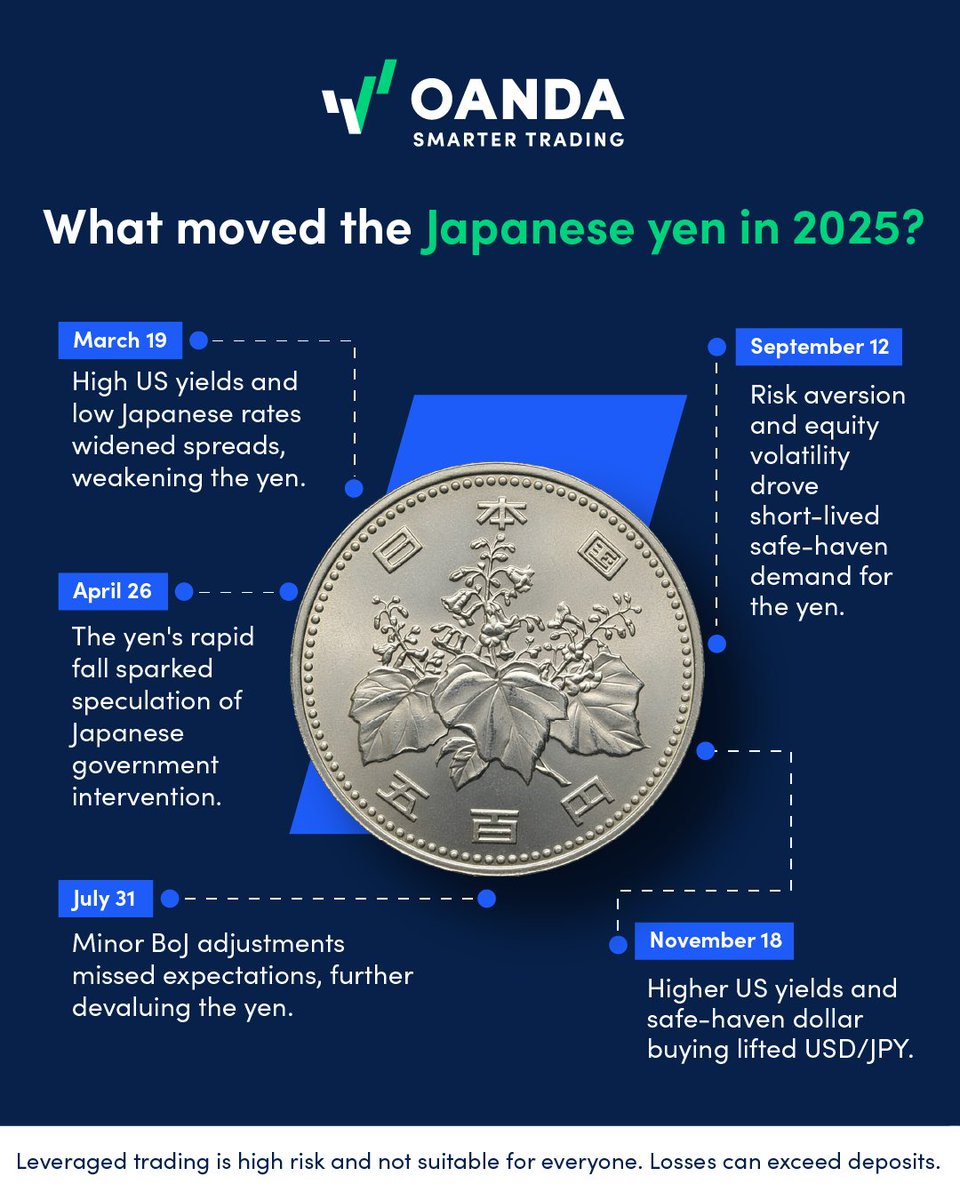

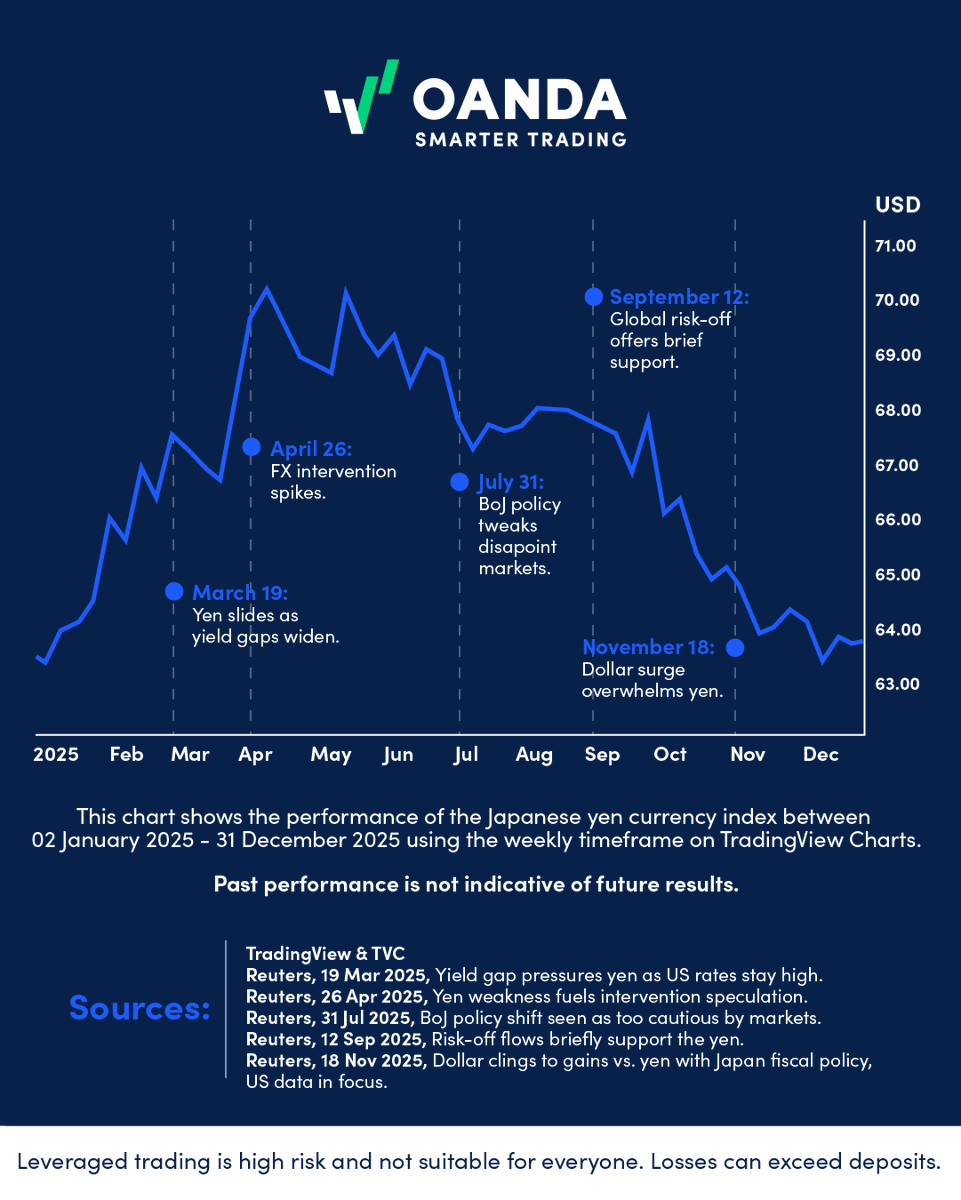

A year in one chart. US yields, BoJ policy shifts, and risk-off flows shaped every major swing. See the key moments that drove USD/JPY this year.

We sat down with former White House Communications Director @Scaramucci to discuss Trump 2.0 and the impact on the markets, a year into the President's second term. Delve deeper into the markets here bit.ly/3NrpmZa

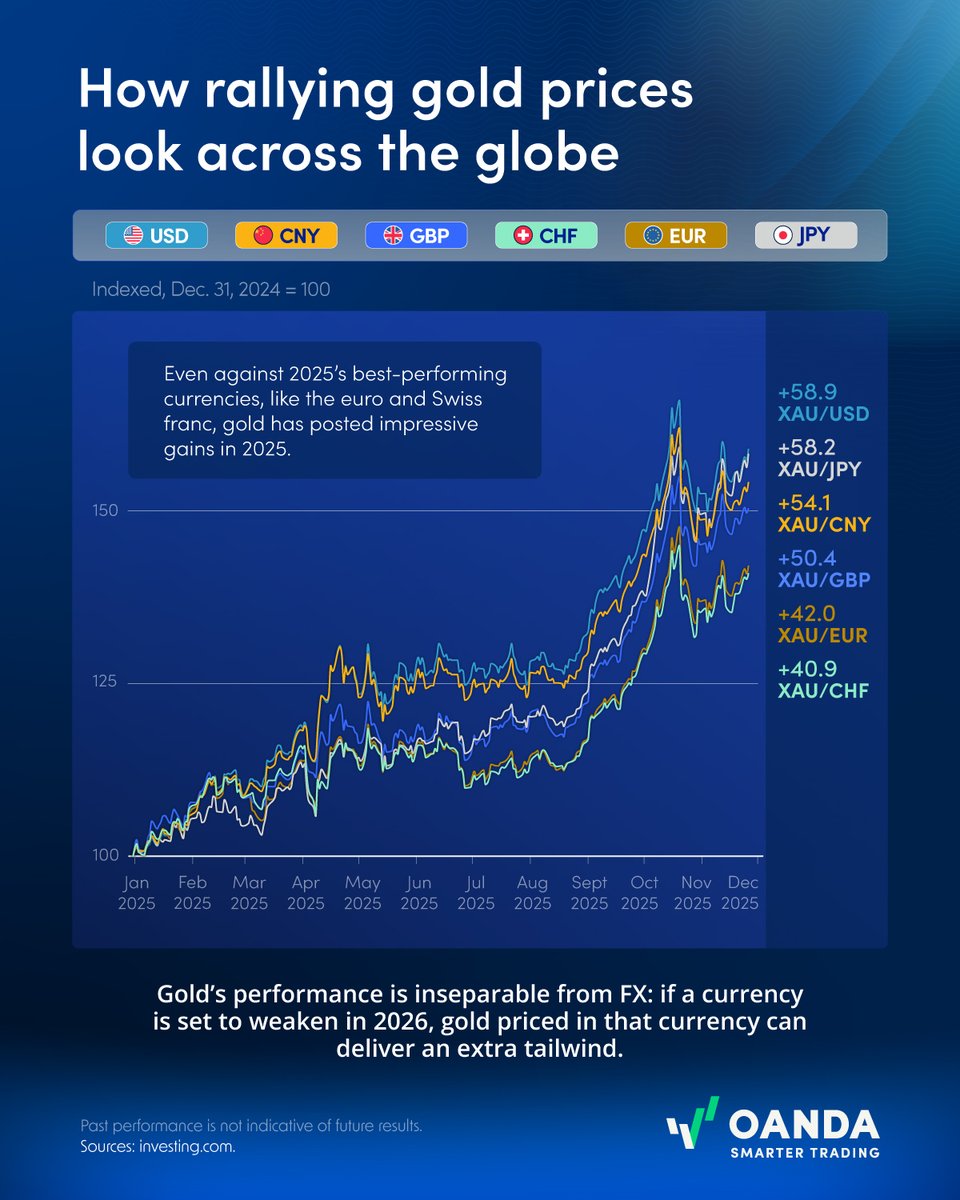

Even the world’s strongest currencies haven’t escaped gold’s rally in 2025 ⛏️ Here, we've partnered with @OANDA to explore gold prices in major currencies, revealing how broadly the metal’s surge has played out worldwide. visualcapitalist.com/sp/oan04-how-g… #oan04

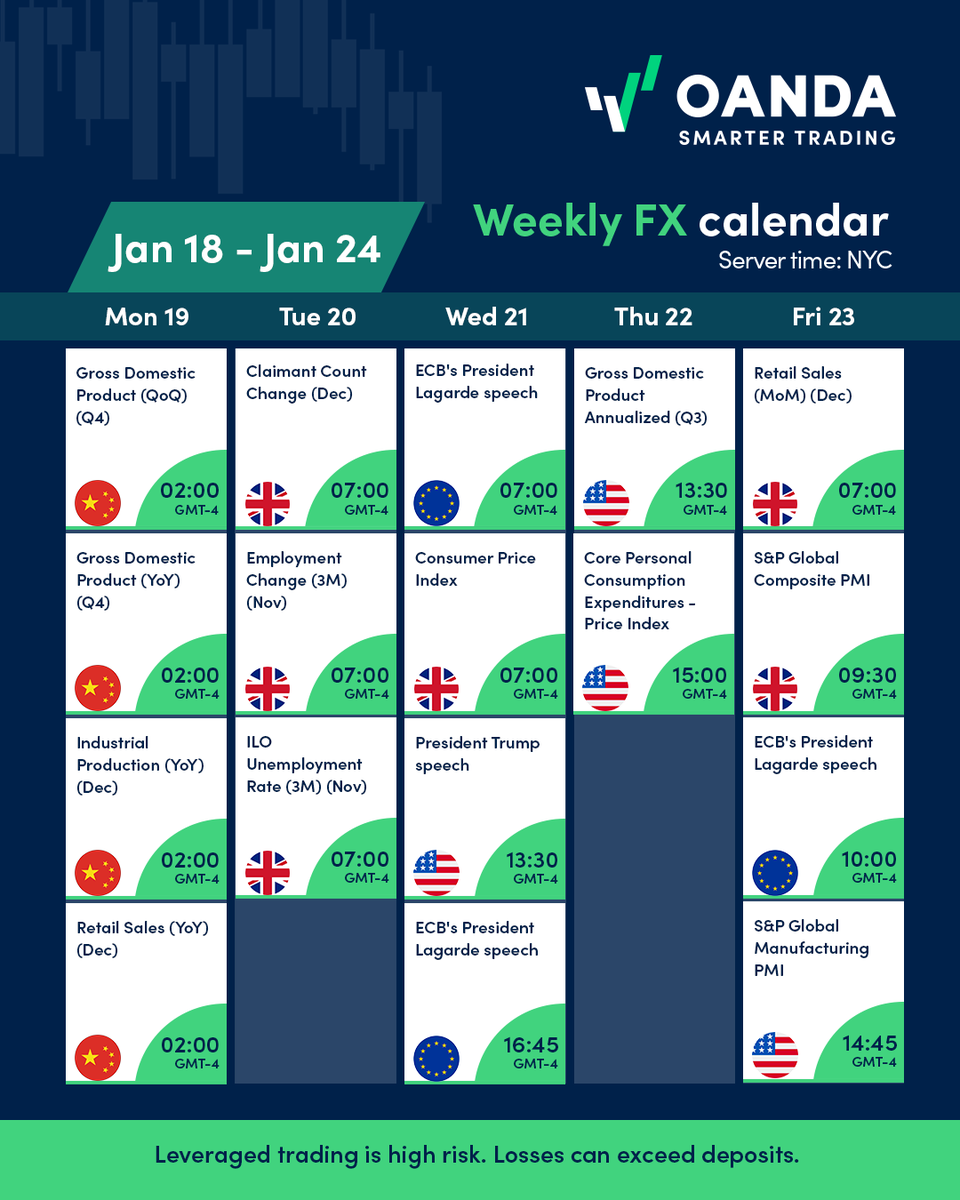

Trump’s speech takes center stage in a busy mid-January FX calendar, with US inflation data shaping expectations for rates and the dollar.

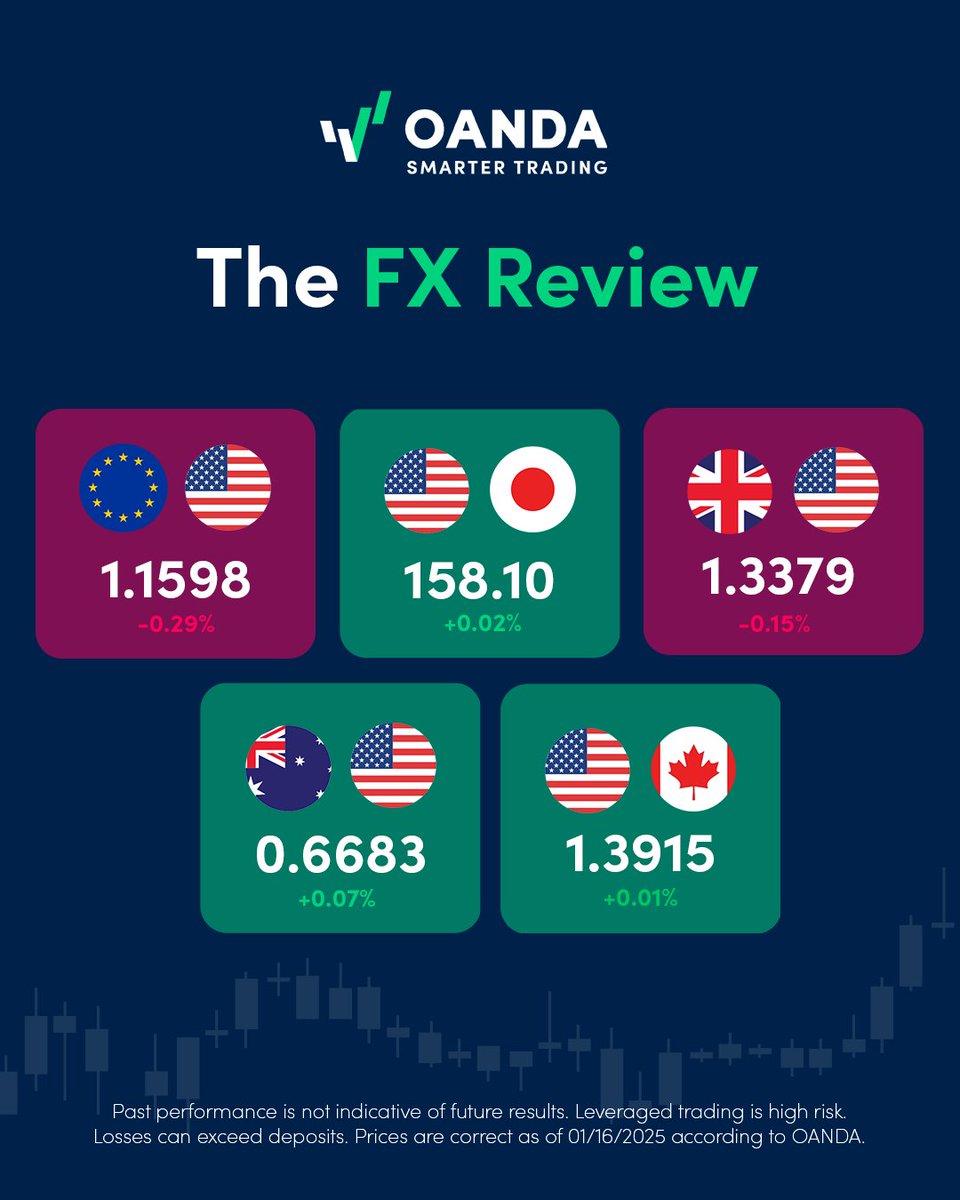

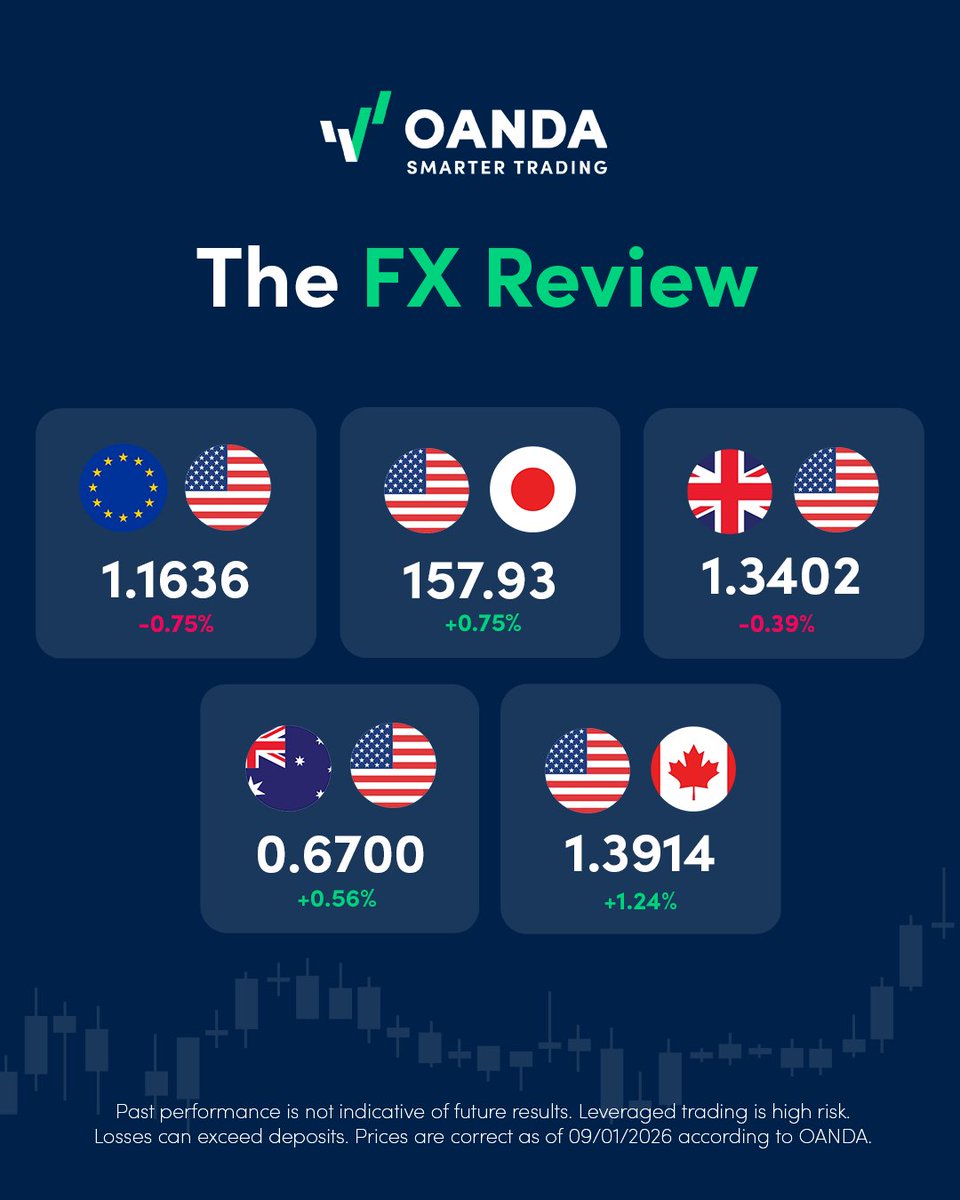

Week 3 has come to an end. Let's have a look at have major FX pairs performed.

The US dollar heads into 2026 with mixed signals. GDP remains strong, but unemployment has risen to 4.6%. A new Fed chair appointment and geopolitical risk could drive volatility in the months ahead. How will the dollar react?

As U.S. trade rules shift under Trump, countries like Mexico and Canada are pulling ahead, while others fall behind 🌎 In partnership with @OANDA, we visualize how Trump’s trade policies are reshaping export competitiveness. visualcapitalist.com/sp/oan04-trump… #oan04

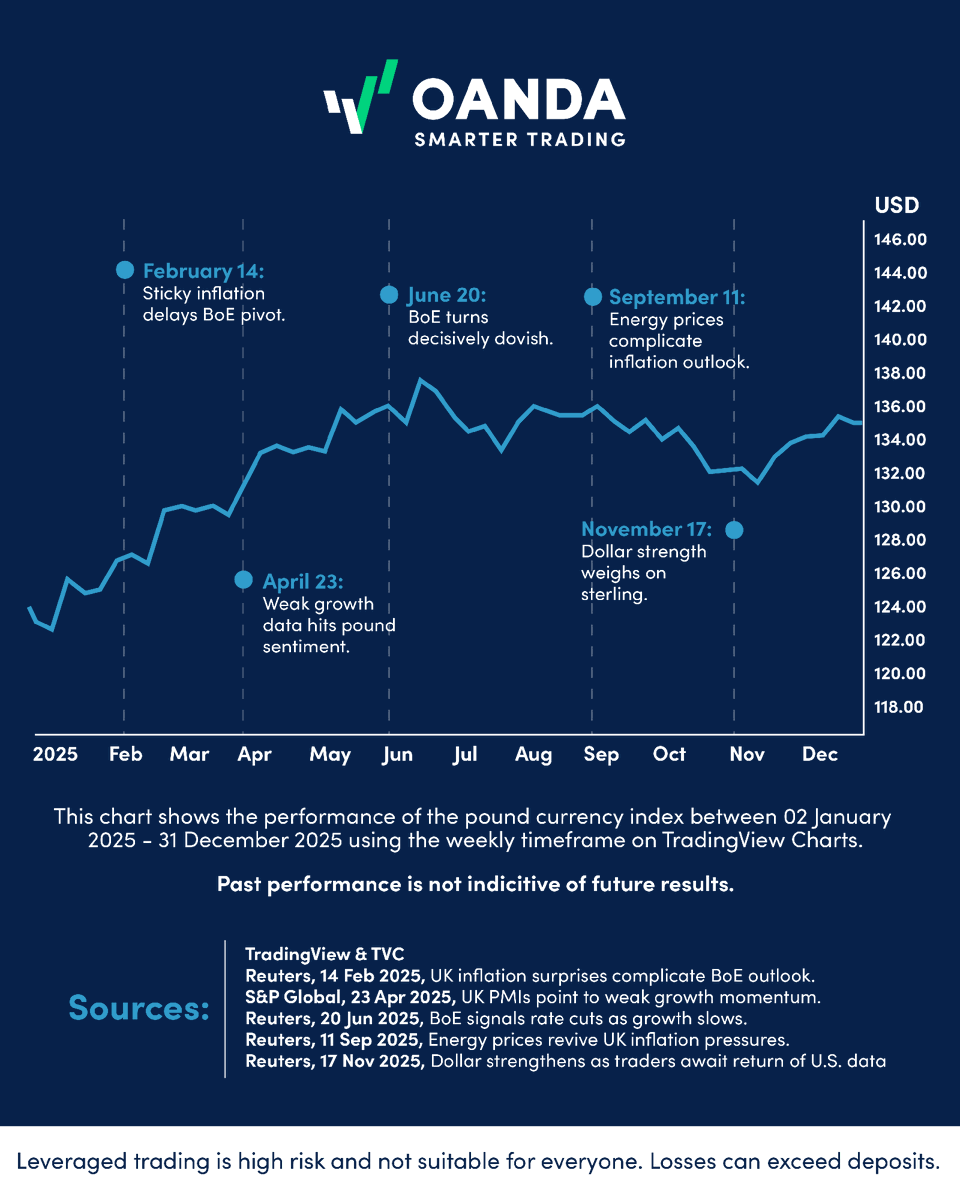

UK inflation, weak growth, and shifting rate bets set the pace. That is what moved GBP in 2025.

Inflation data takes centre stage in a busy mid-January calendar, with US CPI and PPI leading the risk for FX markets.

Historically, Fed rate cuts put downward pressure on the U.S. dollar over time 💵 In partnership with @OANDA we examine how the U.S. dollar has responded to past rate-cut cycles, and what it could mean going forward. visualcapitalist.com/sp/oan04-what-… #oan04

Week 2 has come to an end. Let's have a look at have major FX pairs performed.

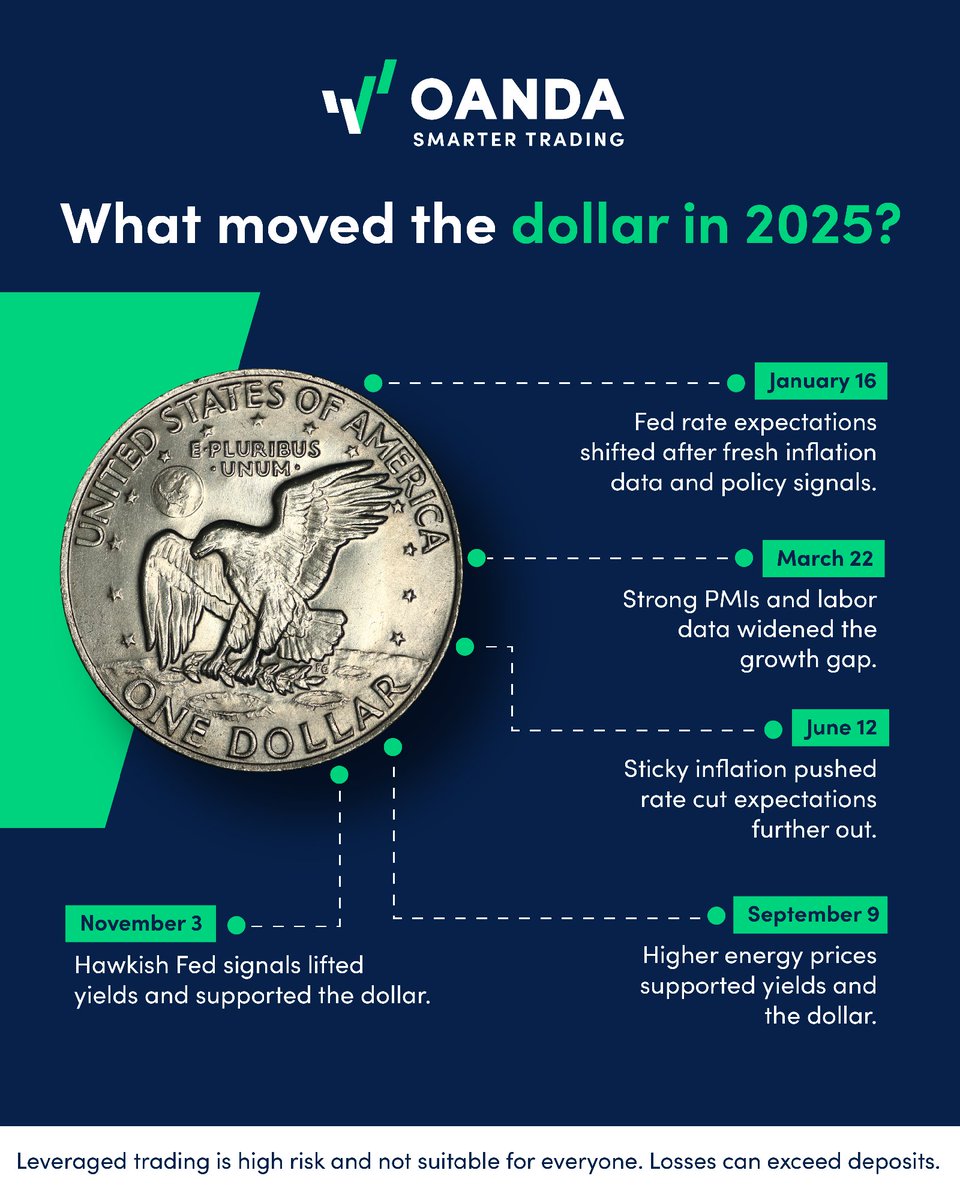

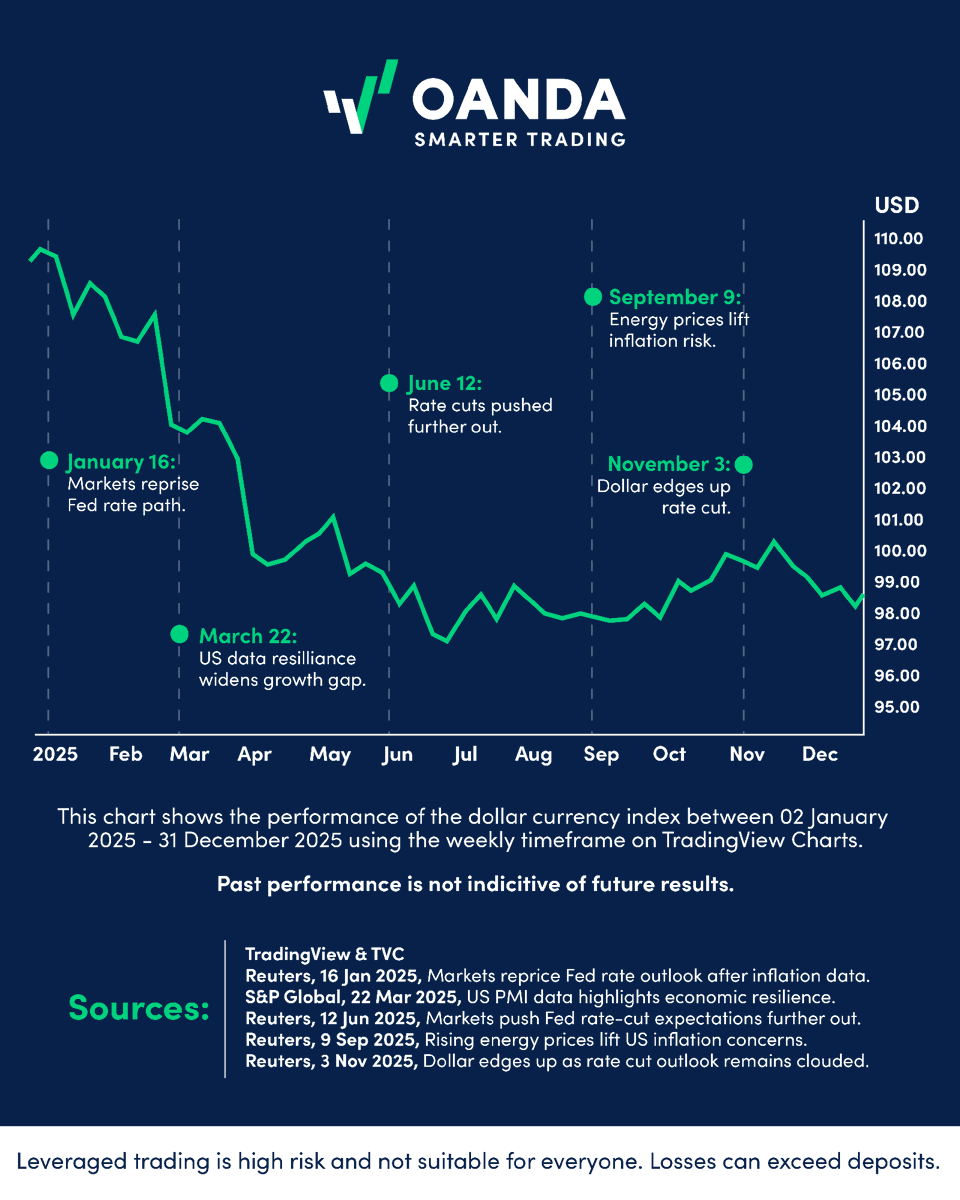

The dollar’s moves in 2025 had clear drivers. Fed signals, US data strength, and energy prices led the way.

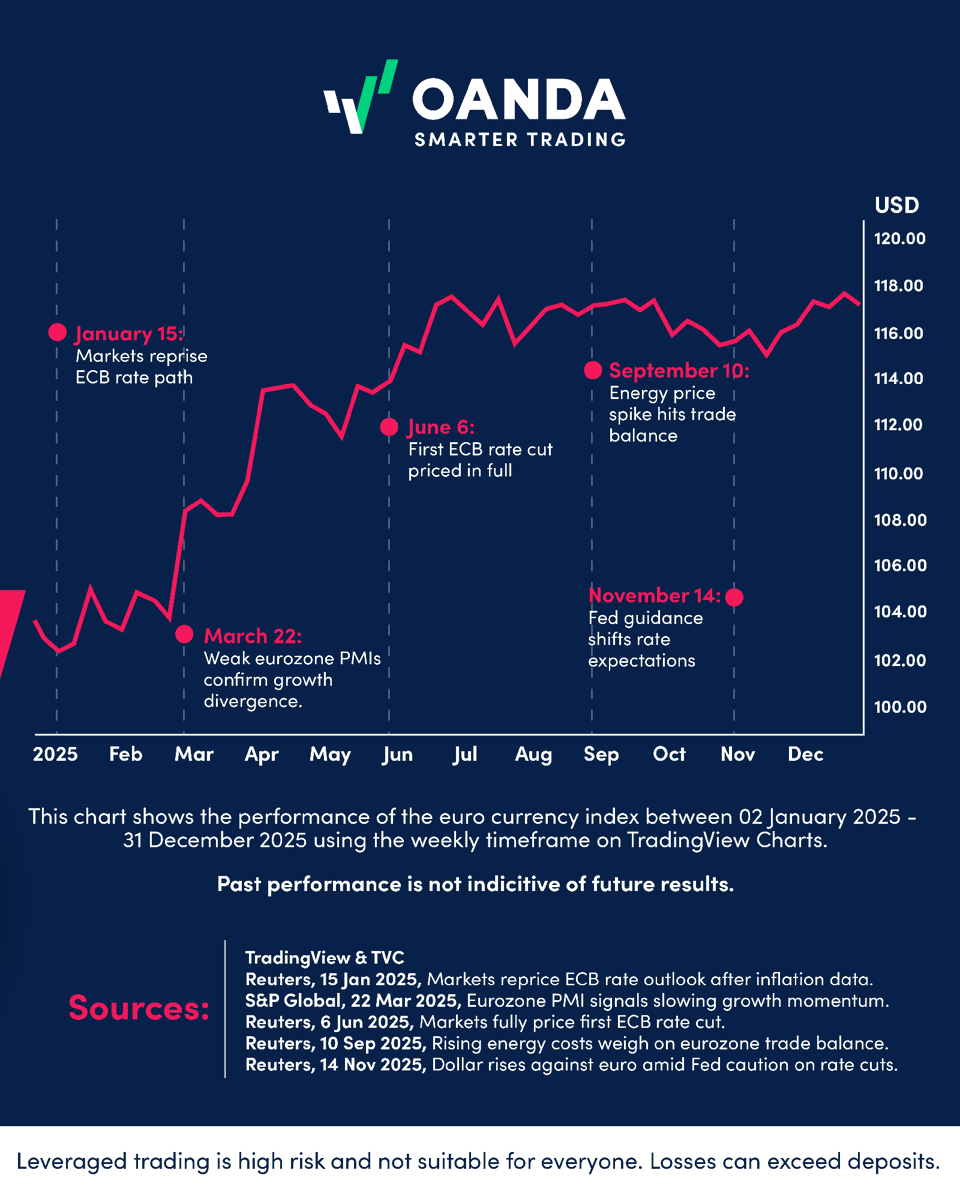

The euro did not move by accident in 2025. Policy shifts, growth data, and energy prices all played a role.

All eyes on the US dollar. Services PMI and NFP are up next. Strong growth data, weakening labor market. Volatility is likely.

United States Trends

- 1. #OlandriaxRahulMishra N/A

- 2. Tom Homan N/A

- 3. Kanye N/A

- 4. Roval N/A

- 5. Ran Gvili N/A

- 6. #MondayMotivation N/A

- 7. Michael Burry N/A

- 8. Amex N/A

- 9. $GME N/A

- 10. #MaduroCiliaHeroes N/A

- 11. $SLV N/A

- 12. Chris Madel N/A

- 13. #MondayMorning N/A

- 14. Medic N/A

- 15. Signal N/A

- 16. Scheelhaase N/A

- 17. Maia 200 N/A

- 18. Paul Newman N/A

- 19. JUST ANNOUNCED N/A

- 20. Udinski N/A

You might like

-

MarketPulse by OANDA Group

MarketPulse by OANDA Group

@marketpulsecom -

FXCM

FXCM

@FXCMOfficial -

FXStreet Team

FXStreet Team

@FXstreetUpdate -

Finance Magnates

Finance Magnates

@financemagnates -

Tradeview Markets

Tradeview Markets

@Tradeview_ -

EarnForex

EarnForex

@EarnForexBlog -

David Song

David Song

@DavidJSong -

Trade Live with IG

Trade Live with IG

@TradeLiveWithIG -

FOREX.com

FOREX.com

@FOREXcom -

Chris Lori FX

Chris Lori FX

@chrislorifx -

Tradu

Tradu

@TraduOfficial -

Forex Guy

Forex Guy

@4xguy -

DailyForex

DailyForex

@Daily_Forex -

FxPro

FxPro

@FxProGlobal -

Kathy Lien

Kathy Lien

@kathylienfx

Something went wrong.

Something went wrong.