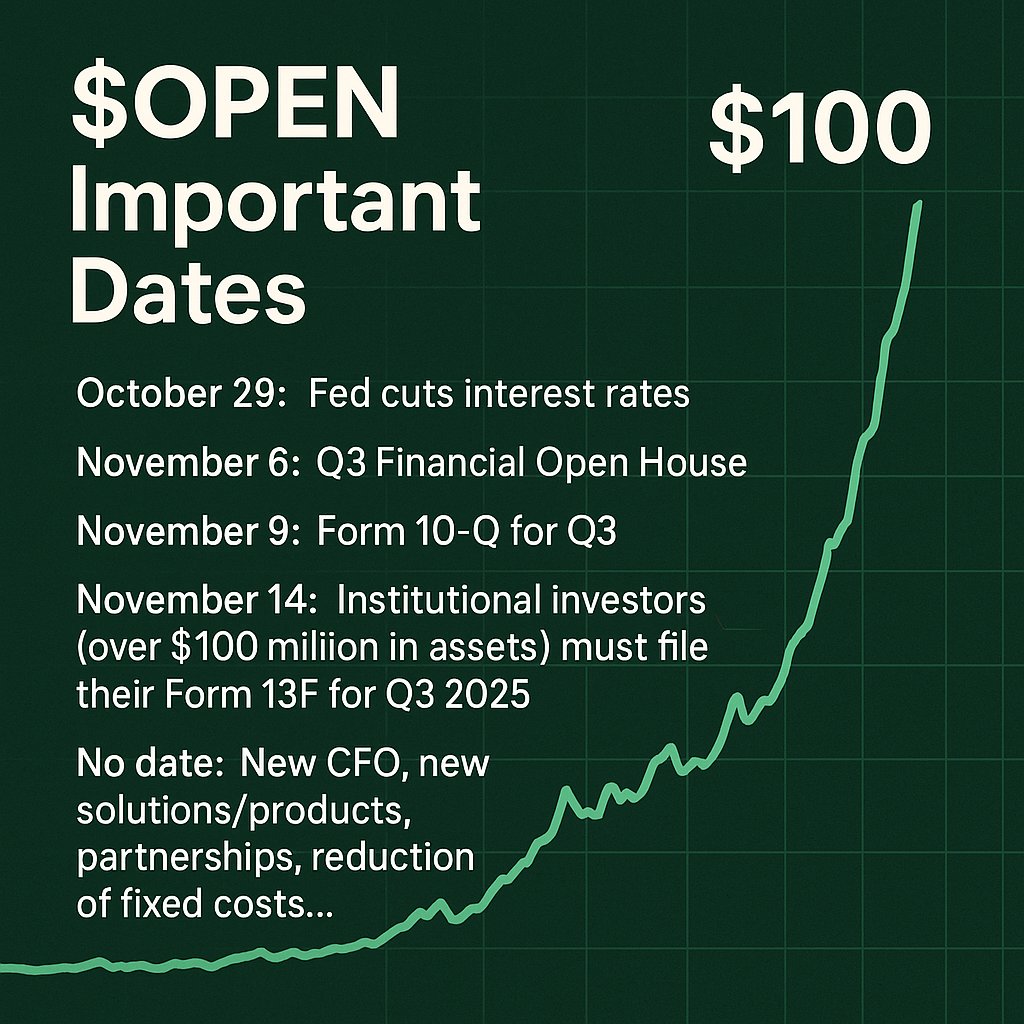

I spent the day working on my OPEN model and after meaningful consideration, I am updating my price target from $25 to $37. I am increasing my revenue and EBITDA forecast by 32.5% and 45% respectively. Lower rates and tokenization optionality have shifted the curve significantly.

$OPEN Take another deep breath and exhale. The next events could trigger a dam break. The expectations of the new @OPENDOOR management are enormous.

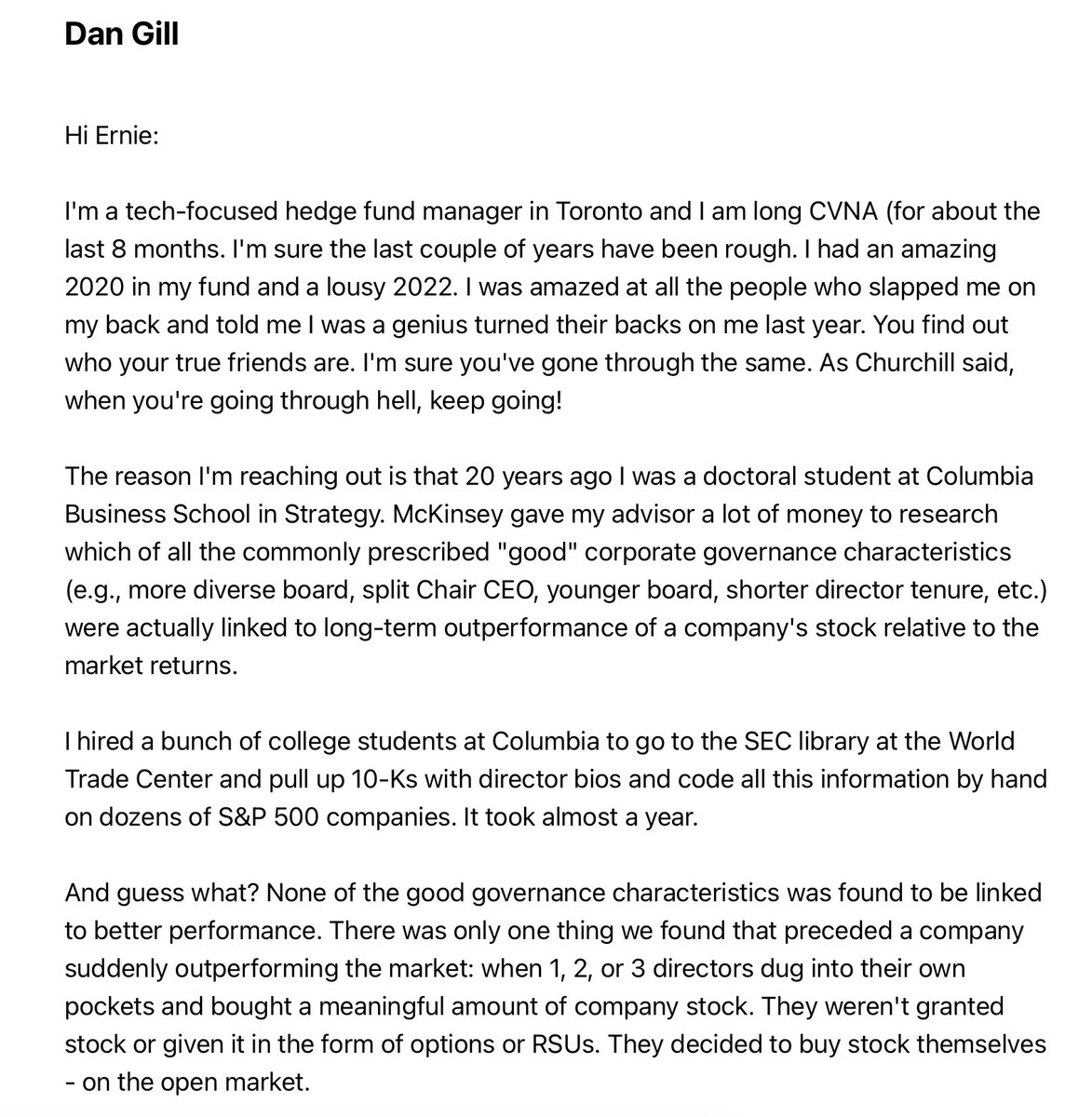

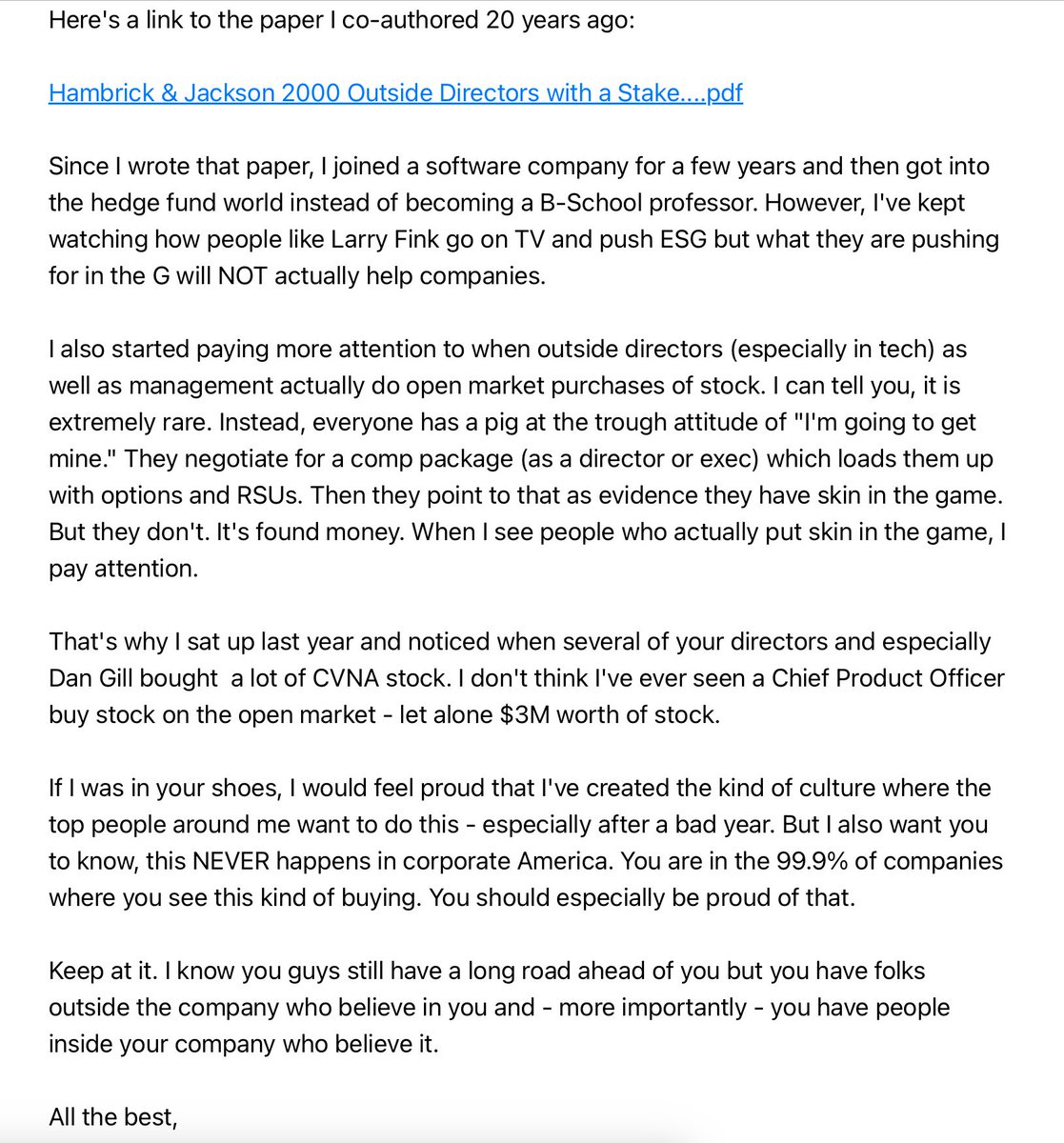

I have taken an initial 210,000 share position in OPEN at $6.44. I believe the company has a massive opportunity to reshape the US real estate and mortgage market. I’m a fan of the new CEO and board members and stand behind @ericjackson and the OPEN army. LFG!

$OPEN @Opendoor: Our data suggests 3Q revenue of at least $885M, clearing the top end of management guidance and consensus of $856M. Our proprietary tracker is showing 4Q tracking comfortably ahead of expectations 👀 Full breakdown + a look into Q4: app.parcllabs.com/articles/resea…

$OPEN Opendoor - Bullish Pennant Price Targets: $9.42, $11.00, $13.48 Bullish Pennant forming on the daily chart. Consolidation continues at the $7.00 level. Price looks to be stabilizing near these levels. Earnings are on 11/6. Next target is $9.42 at the 618 fib level that…

On Feb 28, 2023, with Carvana at $9.42 (after bottoming at $3.50), I emailed Ernie Garcia Jr. He kindly wrote back. A few weeks ago, it hit $413. $CVNA was just as special at $3.50 & $9.42 as it is now. Like all of us.

Our Q3 Financial Open House (known by corpo types as "earnings call") will be on November 6 @ 5 pm. We got some great feedback on how to make sure every day shareholders can be involved. We'll share some details soon.

Imagine fading the President of the United States. $SPY

$GPRO still has the potential to pull an $OPEN type move Almost identical setups

United States 趨勢

- 1. Josh Allen 34.8K posts

- 2. Texans 55.6K posts

- 3. Bills 151K posts

- 4. Joe Brady 5,017 posts

- 5. #MissUniverse 374K posts

- 6. #MissUniverse 374K posts

- 7. Anderson 27.2K posts

- 8. McDermott 4,364 posts

- 9. Maxey 11.7K posts

- 10. #TNFonPrime 3,403 posts

- 11. Al Michaels N/A

- 12. #StrayKids_DO_IT_OutNow 37.6K posts

- 13. #htownmade 3,666 posts

- 14. Dion Dawkins N/A

- 15. Shakir 5,580 posts

- 16. Costa de Marfil 23.2K posts

- 17. STRAY KIDS DO IT IS DIVINE 39.2K posts

- 18. CJ Stroud 1,250 posts

- 19. James Cook 5,673 posts

- 20. Knox 5,774 posts

Something went wrong.

Something went wrong.