Paramjeet Singh

@paramjeet2005

Technology | Finance - Investments | Fitness - Long Runs | and some not so boring stuff

คุณอาจชื่นชอบ

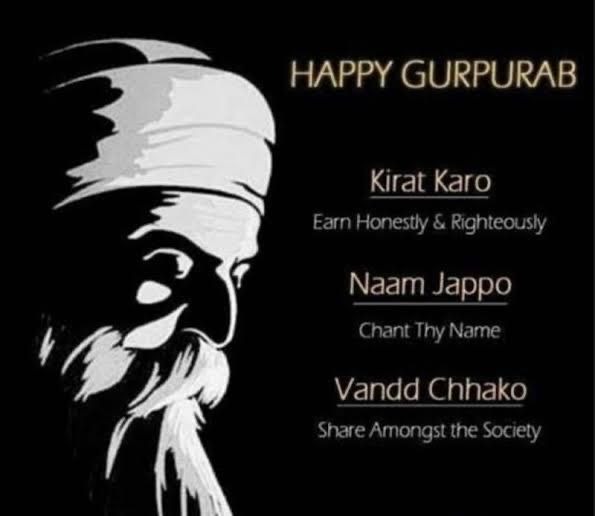

"Hind Di Chadar" (Protector & Shield of India) On 24th Nov - Monday ,we mark 350th Shaheedi diwas of Guru Teg Bahadur sahib. The martyrdom of Shri Guru Tegh Bahadur Ji has no parallel in human history. Kashmiri Pandits were under life threatening pressure from Iftikar Khan,…

FIRE - Financial Independence, Retire Early FIRL - Financial Independence, Retire Late I strongly think FIRL >>> FIRE. Always.

💰 9 Golden Rules of Personal Finance 💡 1️⃣ Rule of 72 – 72 ÷ Interest Rate = Years to double your money. 2️⃣ Rule of 70 – 70 ÷ Inflation Rate = Years for money’s value to halve. 3️⃣ 4% Withdrawal Rule – Withdraw 4% yearly from retirement savings. 4️⃣ 100 – Age Rule – Ideal equity…

moneycontrol.com/science/scienc… Segmented sleep is a deeply natural human trait...middle-of-the-night awakenings are not necessarily sleep disorders...

Three real powerful messages from ages ago🙏🙏🙏 Happy Gurpurab

If new developments (e.g. revised guidance, sales/pat growth, cash flow, new big orders etc.) in stocks in your portfolio excite you more than its stock price movement - would help in holding your stocks for longer term. Price in turn will follow earnings over a period of time.

If new developments (e.g. revised guidance, sales/pat growth, cash flow, new big orders etc.) in stocks in your portfolio excite you more than its stock price movement - would help in holding your stocks for longer term.

Three step play in stock markets: i) Survive (avoid unnecessary risks) ii) Compound & iii) Finally thrive Timeframe is in decades!

When to Sell a Stock: 1. A decline in governance standards 2. Egregiously wrong capital allocation 3. Irreparable damage to the business Source: "What I Learned about Investing from Darwin" by Pulak Prasad

1. Avoid big risks 2. Buy high quality at a fair price 3. Don't be lazy, be very lazy Source: "What I Learned about Investing from Darwin" by Pulak Prasad

When underlying businesses are growing, don’t get frustrated with no movement in the stock price. Keep accumulating it. When it moves – it will be quick and lumpy, 5-10 baggers. To benifit this up move, we have to make sure, the allocation is damn big.

Soft assets - Stocks, MFs etc. bring in growth. Hard assets - Land, Real Estate, Gold etc. bring in stability & capital preservation. One needs to decide what % of capital allocation or portfolio to having in both and at what point of time in life.

To become a truly successful equity investor: 1. Courage to Buy 2. Patience to Hold 3. Make Volatility your Friend (visualise/ assume your portfolio to be 20-25% lesser than the current value, all the times)

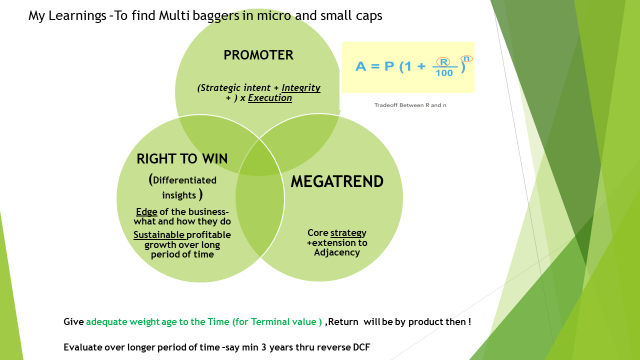

My Investment framework for micro and small cap below . Please do comment so that we learn from each other

i) Ability to think for/about a point of time - Easy ii) Ability to think about a period of time - Not so easy but easily doable with a mindset change :) This is what helps in having a long term thinking and understanding compounding in toto.

United States เทรนด์

- 1. Giannis 61.9K posts

- 2. Spotify 1.63M posts

- 3. Tosin 65.9K posts

- 4. Bucks 39.1K posts

- 5. Leeds 102K posts

- 6. Steve Cropper 1,572 posts

- 7. Milwaukee 17.8K posts

- 8. Andrews 9,719 posts

- 9. Brazile N/A

- 10. Poison Ivy 2,122 posts

- 11. Isaiah Likely N/A

- 12. #WhyIChime 2,105 posts

- 13. Phantasm 1,649 posts

- 14. Miguel Rojas 2,789 posts

- 15. Mikel 32K posts

- 16. Danny Phantom 7,383 posts

- 17. Knicks 25.2K posts

- 18. Purple 52.5K posts

- 19. Eddie Kingston N/A

- 20. Maresca 49.6K posts

คุณอาจชื่นชอบ

Something went wrong.

Something went wrong.