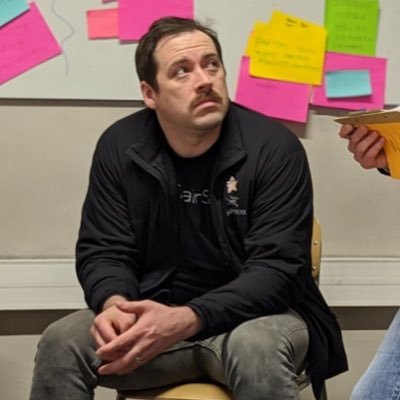

Vance Spencer

@pythianism

Co-founder @hiframework. Tweets not financial advice. Views my own.

You might like

what grey-market chinese peptide do you recommend if your heart is three sizes too small?

People have unique relationships to money and carry different life experiences related to it that you may never be able to empathize with This is why programmable money, and yield-bearing stablecoins specifically, are so interesting

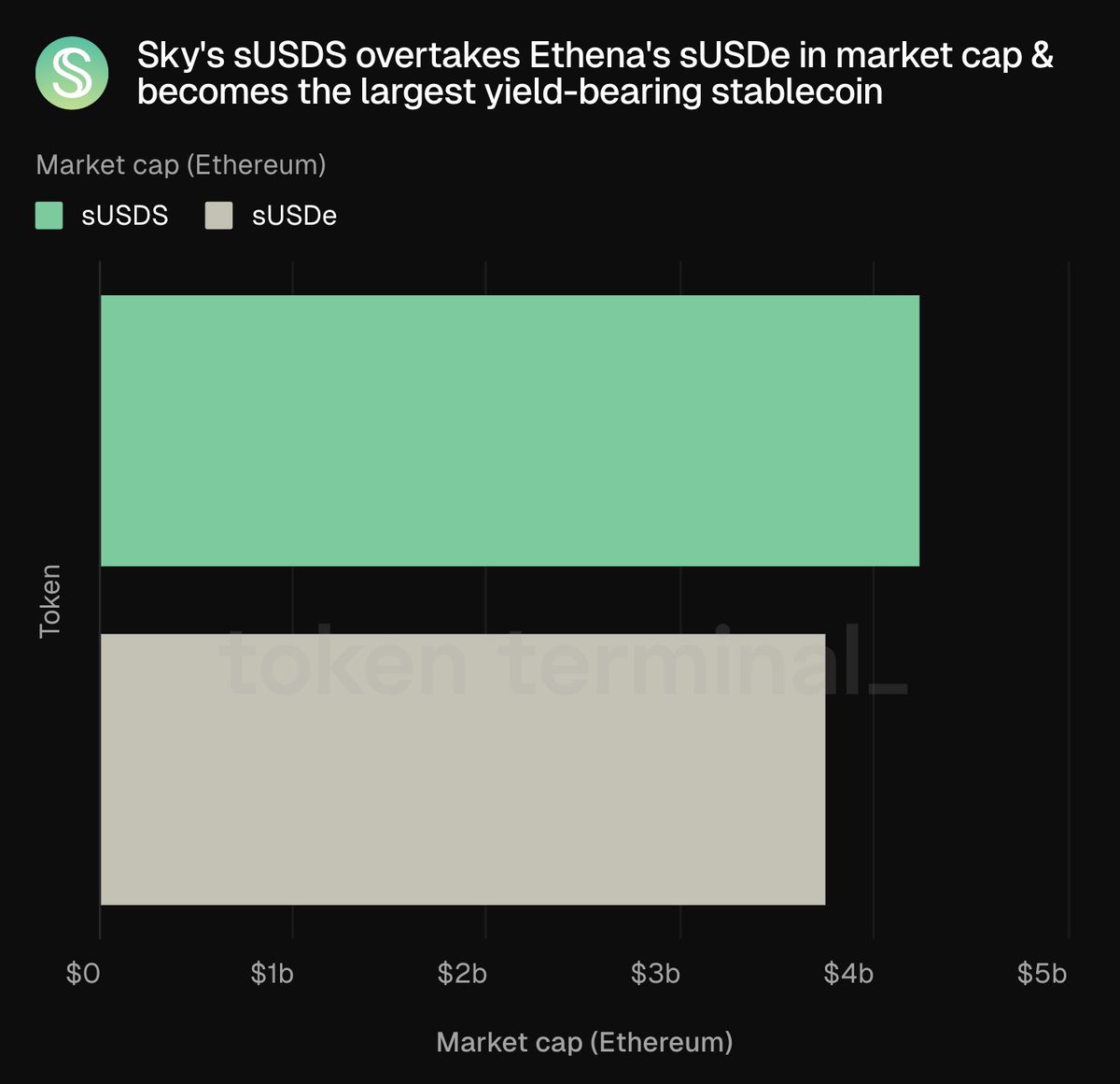

ICYMI: @SkyEcosystem's sUSDS overtakes @Ethena_Eco's sUSDe in market cap & becomes the largest yield-bearing stablecoin.

fusaka

Sky is now the largest USDC pool in DeFi, passing Aave's USDC market, driven in large part by USDE unwind We should all be rooting for a diverse and competitive yield ecosystem 🚀

I don't think people truly appreciate the ascendancy of Dr. Hassett to the role of Chairman of the Federal Reserve Especially when coupled with DeFi innovation exemptions at the SEC

sUSDS from @SkyEcosystem has surpassed @ethena_labs’ sUSDe in supply, making it the largest yield bearing stablecoin.

The guys who run the world's largest asset manager are talking about the importance of tokenization probably something

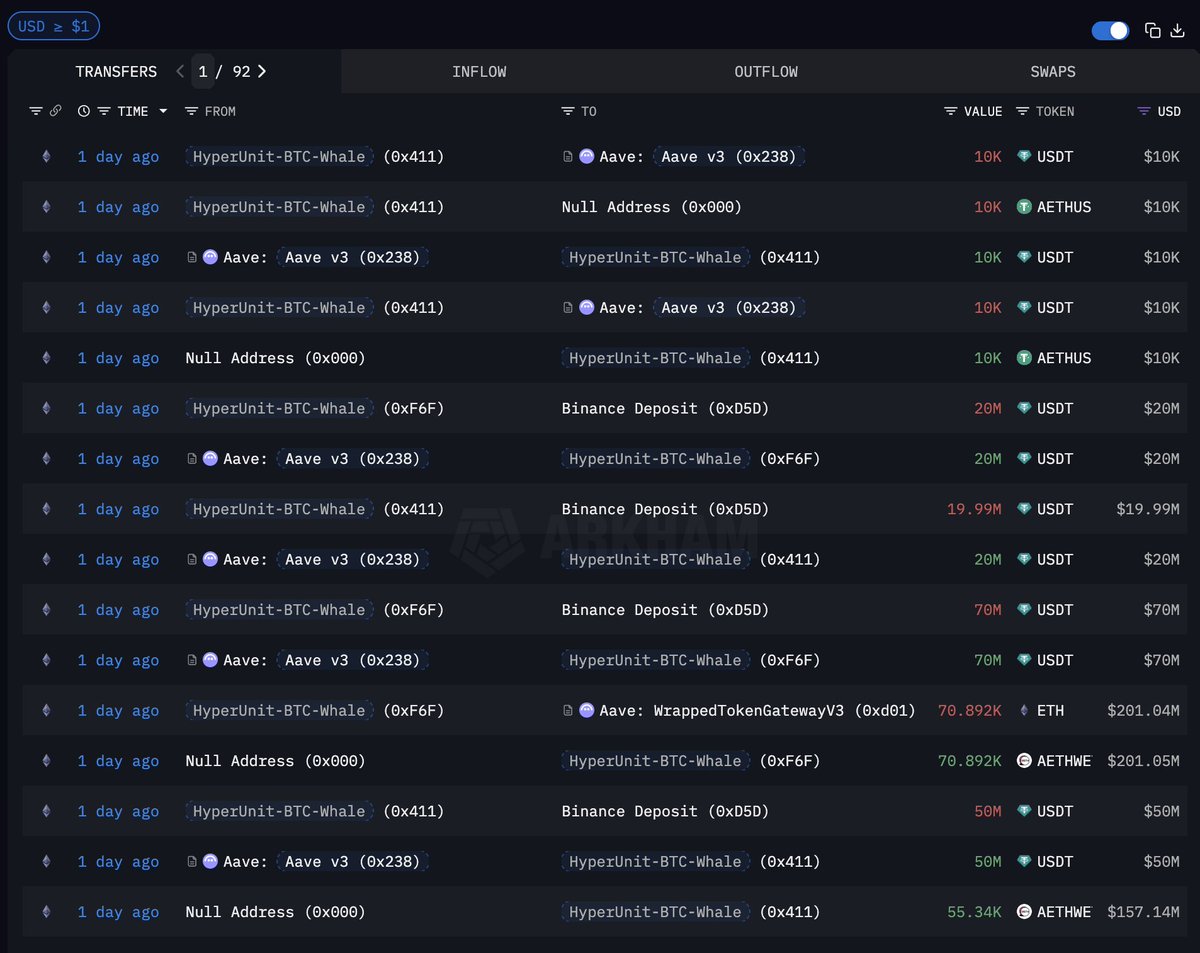

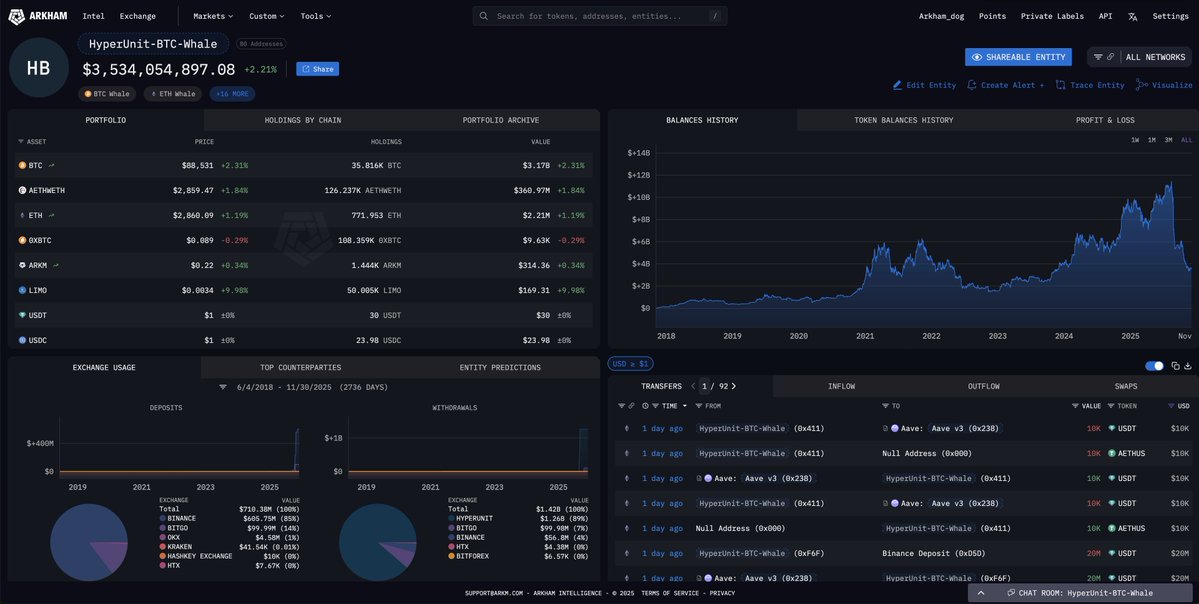

THE $10B HYPERUNIT WHALE IS LEVERING UP ON $ETH The whale who made $200M shorting the market crash on 10/10 recently unstaked $361 MILLION of his ETH and deposited it to AAVE. He took out $160M in USDT against the ETH, and deposited all the USDT to Binance. He’s freeing up…

If you aren't first you are last

Total supply of @SkyEcosystem’s sUSDS hit a new all-time high of $4.10B, exceeding the previous record by $600M.

Dflow winning the Kalshi orderflow and tokenization streams on Solana is a huge validation of their approach to market structure and best in class execution Congratulations to both Kalshi and DFlow

While a lot of F500 companies are on year 3-5 debating how to launch their stablecoin Paypal is just getting scalepilled with @SkyEcosystem and @sparkdotfi Whoever is running PYUSD is cooking fr

What does launching spPYUSD in Spark Savings actually change for @sparkdotfi risk? Here’s the summary in simple terms before the vote 👇

Euromaxxxing

Buybacks are a marathon, not a sprint The immediate effect is mostly on market psychology, signaling that you are building something worth buying. You then descend into the Long March (2-3 years), where you buy 5-10 VCs out of 5-10% network shares each But after that, you…

Study

Often times the periods of fastest USDS growth happen after some of the most tumultuous crypto price action @SkyEcosystem is now closing in on $10Bn total stablecoin supply, and the goal remains $100Bn Scale and risk management will matter now more than ever

There has been so much breath wasted about vesting schedules and token unlocks. If the assets were valuable, it wouldn't be an issue at all.

Often times the periods of fastest USDS growth happen after some of the most tumultuous crypto price action @SkyEcosystem is now closing in on $10Bn total stablecoin supply, and the goal remains $100Bn Scale and risk management will matter now more than ever

United States Trends

- 1. Bama 71K posts

- 2. Mendoza 17.2K posts

- 3. Indiana 54.5K posts

- 4. #UFC323 43.7K posts

- 5. Ohio State 28.9K posts

- 6. #NXTDeadline 34.1K posts

- 7. Sayin 88.1K posts

- 8. Georgia 74.9K posts

- 9. Gus Johnson 1,324 posts

- 10. Miami 263K posts

- 11. Ryan Day 2,615 posts

- 12. #Big10Championship 1,119 posts

- 13. Pat Spencer 7,300 posts

- 14. Heisman 8,785 posts

- 15. Buckeyes 7,640 posts

- 16. #iufb 4,242 posts

- 17. #AEWCollision 10.2K posts

- 18. Jeremiah Smith 3,378 posts

- 19. Fulton 3,852 posts

- 20. Cavs 8,097 posts

You might like

-

Robert Leshner

Robert Leshner

@rleshner -

Matt Huang

Matt Huang

@matthuang -

Arthur

Arthur

@Arthur_0x -

Andrew Kang

Andrew Kang

@Rewkang -

Hasu⚡️🤖

Hasu⚡️🤖

@hasufl -

Darren Lau

Darren Lau

@Darrenlautf -

Art of The CMS

Art of The CMS

@cmsholdings -

kain.crates

kain.crates

@kaiynne -

Framework Ventures

Framework Ventures

@hiFramework -

Hayden Adams 🦄

Hayden Adams 🦄

@haydenzadams -

Santiago R Santos

Santiago R Santos

@santiagoroel -

Larry Cermak

Larry Cermak

@lawmaster -

Stani.eth

Stani.eth

@StaniKulechov -

tuba 🦈

tuba 🦈

@0xtuba -

Alex Svanevik 🐧

Alex Svanevik 🐧

@ASvanevik

Something went wrong.

Something went wrong.