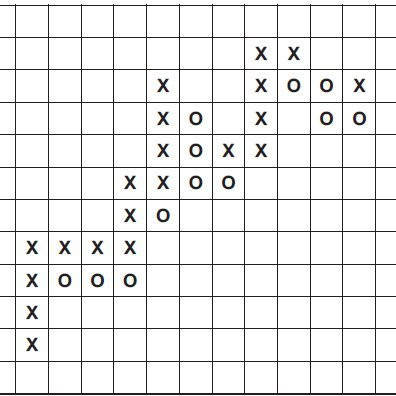

Michael Burry发帖也用星战梗 上一个爱用光剑梗的是李哥🤪 “These aren’t the charts you are looking for. You can go about your business. ” 讽刺AI泡沫:云服务增长从2018-22年的高点(如Alphabet 45%)降至2023-25年的低点(17-29%),但科技CapEx激增至1999-2000泡沫水平;…

These aren’t the charts you are looking for. You can go about your business.

这个周末很火的一张图,乍一看是美联储开始向银行系统大放水,其实这个东西跟之前大家关注的隔夜逆回购ON RRP并不是同一个东西 【隔夜逆回购ON RRP】 指的是美联储将持有的国债出售给交易对手方,并承诺在第二天以略高的价格回购,以此回收过剩流动性——常出现在QE后期回笼流动性的阶段…

JUST IN: 🇺🇸 Federal Reserve looks into "payment accounts" that would grant crypto and fintech companies access to Fed payment rails.

说到这个,也想推荐一下 @OwenJin12 大的这篇文章,写的太清晰了。 medium.com/@owenjin0112/以-rare为例拆解主流交易所合约计算方案-资金费率-借贷利率-现货成交价-指数价格-标记价格又是什么关系-如何识别轧空short-squeeze和幌骗spoofing-3f4ddc4d6bdf

看了玩偶姐姐的文章 最牛逼的流量思维 实际现金=0,但形象估值=几百万美元。 她靠这个信任流,重建现金流。 阶段2:投机—套利—现金流再生 拓展成人用品、推流业务 → 获得意外成功;1.她从流量套利转向金融套利(铭文、Meme、Defi); 2.她发现Ethena项目,存款、加仓、买YT → 奖励让她本金翻倍;…

趁着假期看了一些同业关于小金属的调研纪要(这里感谢一下华西证券有色金属行业研究员熊小姐姐),重点看了铀。 先说铀行业的基本面,铀的供需缺口,未来5年会缺口1万吨铀,这还不叠加政府作为战略储备的缺口,如果把政府储备算进去,未来5年缺口可达3到4万吨…

Powell says if he can’t pay banks to hold reserves the Fed would “lose control over rates.” That’s because the Fed has flooded banks with so many reserves they don’t trade federal funds anymore. The Fed just sets the rate wherever it wants. It’s “Price Fixing.” There is no real…

1/ The recent U.S. equity rally has been driven by leveraged funds, which are now in the process of deleveraging. 2/ AI-related meme stocks, which were heavily hyped, have already gone lower ahead of the market last week. 3/ U.S. private credit is starting to default, with…

The money is not the problem: AI is the new global arms race, and capex will eventually be funded by governments (US and China). If you want to know why gold/silver/bitcoin is soaring, it's the "debasement" to fund the AI arms race. But you can't print energy

has anybody done the math how many hundreds of new nuclear power plants the US will need by 2028 for all these AI daily circle jerk deals to be powered?

趁着暴跌,我和 becky 聊了一会儿我自己这十几年来对大饼价格的理解,录音因为涉及到一些具体的人和公司,不方便发出来,所以我整理个文字版本。 大饼的真实价格发现我认为分为三个阶段,上古的 OTC 交易阶段,中心化交易所订单簿阶段和大饼 ETF 通过后的华尔街屯币阶段。…

视频版来啦,盘口数据持仓和资金费率可视化,帮助大家消化理解吸收,助下次清算行情时大家都可以躲过一劫,顺势而为🫡 盘口观察工具为coinank @coinank_com @CoinankCN

Sam Altman on Sora, Energy, and Building an AI Empire From GPT-5 to Sora, OpenAI has been making a dizzying amount of bets recently. It now acts as a frontier AGI research lab, a big tech product company with nearly a billion users, and a driver of the largest infrastructure…

AGI has been achieved internally. Episode dropping tomorrow.

Buffett compares U.S. capitalism to a casino attached to a cathedral youtube.com/shorts/FtQ8nvu… via @YouTube

youtube.com

YouTube

Buffett compares U.S. capitalism to a casino attached to a cathedral

这几个月经历了BNB和OKB的价值发现,还有HyperLiquid和Aster的DEX。其实未来的币圈超级应用也越来越轮廓明晰了。既CEX+DEX+链上发型资产发射器+稳定币。如果哪个公链能做到这个大循环,那就是大圆满了,既有CEX的产品合规入口,还有DEX满足真正去中心化的交易,还有稳定币和资产的发射平台。当然我不否…

最近在旅行,也在路上思考了很多,结合当下的科技金融发展,简单总结一下。 稳定币是币圈目前唯一跑出来的落地应用。CRCL的涨幅真的让我这个重仓苹果的老登拍断大腿,错失了美股大仓位短时间翻倍的好机会。还有一个落地的币圈玩物是交易所(传统金融模式新瓶装旧酒)…

高盛最近发了2025 AI产业研报《Powering the AI Era》,非常有参考价值。提炼总结一下,可以分为19点: 1. AI是基础设施革命:AI是继铁路、电气化、互联网后的重大技术拐点,其发展依赖资本与基础设施支撑,而不仅仅是代码与模型。 2. 天价成本结构:一座250MW…

红杉的合伙人 Konstantine 刚公开了一段分享「万亿的AI革命:为何它比工业革命更宏大」,其中有五个他们观察到的AI领域正涌现出的明确趋势: - 工作模式从追求“确定性”转向拥抱“高杠杆”; - 价值衡量从学术基准转向真实世界; - 强化学习技术走向应用中心; - AI 开始渗透到物理世界; -…

下午在车上读了一篇文章叫<Market Prices Are Not Probabilities>,挺受启发的,对于目前预测市场的主流论断进行了反驳,简单写下我的读后感。 目前预测市场乃至于 InfoFi 的核心观点是,一个具有充分流动性的订单簿上面的价格,是能比民调更能反应人群对于某事件的信念强度的。 这个 Infofi thesis…

United States Trends

- 1. $BNKK N/A

- 2. Pond 204K posts

- 3. #MondayMotivation 37.8K posts

- 4. Happy 250th 5,881 posts

- 5. $LMT $450.50 Lockheed F-35 1,109 posts

- 6. Good Monday 42K posts

- 7. $SENS $0.70 Senseonics CGM 1,126 posts

- 8. Semper Fi 5,629 posts

- 9. Go Birds 4,266 posts

- 10. $APDN $0.20 Applied DNA 1,101 posts

- 11. Obamacare 21.5K posts

- 12. Victory Monday 2,075 posts

- 13. Rudy Giuliani 27K posts

- 14. Edmund Fitzgerald 4,896 posts

- 15. #SoloLaUniónNosHaráLibres 1,770 posts

- 16. #Talus_Labs N/A

- 17. #USMC N/A

- 18. #MondayVibes 2,864 posts

- 19. The BBC 505K posts

- 20. Devil Dogs 1,638 posts

Something went wrong.

Something went wrong.