Stat Arb

@quant_arb

Gods Chosen Quant | DMs open 📥 (plz no essays) | @QuantitativeArb | Views my own. Not financial advice.

Tal vez te guste

‼️ Quant Roadmap 2024/25 Ultimate Edition 🚨 Containing: - Hundreds of resources - GBs of free data - Guidance on strategies - Much more! [link below!]

![quant_arb's tweet image. ‼️ Quant Roadmap 2024/25 Ultimate Edition 🚨

Containing:

- Hundreds of resources

- GBs of free data

- Guidance on strategies

- Much more!

[link below!]](https://pbs.twimg.com/media/GSUa62JWgAAg55a.png)

Stay safe please. I see a lot of bad-looking tweets from you. There's no reason to do anything in emotions. If you need to talk to someone, you can always write to me. And to all those bragging about best PnL ever - you are worse than any retail options workshop seller.

GitHub of an unemployed 22yo: GitHub of a distinguished engineer at Google:

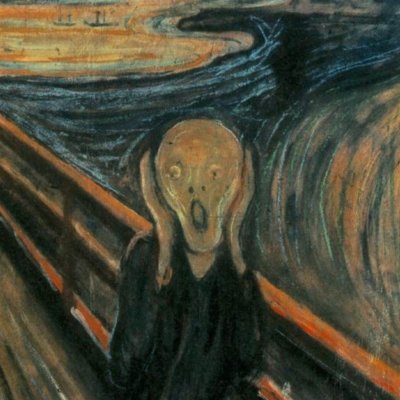

How undergrads feel learning the efficient market hypothesis

Much easier to find edges short term than trying to be the fastest imo. Latency helps but alphas probably an easier angle to go for once you optimize the basics of being fast

Having edge in the (midprice*forecast*scaling*) part is where most of the money is and then getting spread rights also helps. midprice as edge is just being very fast to update from market data forecast is usually just how you bake in actual short term edge into your quotes

Having edge in the (midprice*forecast*scaling*) part is where most of the money is and then getting spread rights also helps. midprice as edge is just being very fast to update from market data forecast is usually just how you bake in actual short term edge into your quotes

basic formula for MM prices: our fair value = (midprice*forecast*scaling) + skew for inventory our fair value + spread = quotes spread using a function of risk, market spread, and how aggressive we are.

basic formula for MM prices: our fair value = (midprice*forecast*scaling) + skew for inventory our fair value + spread = quotes spread using a function of risk, market spread, and how aggressive we are.

By a mile the most detailed information you can find online without working at a shop. Coming from someone with real experience running HFT operations & has had pnl attribution under their name on a top HFT desk by volume

If you want some info on how to do market making in these markets, I have some great articles on the topic which go into detail.

If you want some info on how to do market making in these markets, I have some great articles on the topic which go into detail.

Stablecoin markets are piss easy to MM, if you want some easy market making experience. Go MM stablecoin to stablecoin markets. Super non-toxic, can literally do it manually. I made money doing it manually at one point.

Yeah I mean a lot of these efficiencies can be exploited in Python though. I used to run my setup as arbitrage scanner in rust spits out arbs to my python algo and then Python executes/ makes decisions/ manages portfolio. Keeping the data feed websockets and calculating the…

Stablecoin markets are piss easy to MM, if you want some easy market making experience. Go MM stablecoin to stablecoin markets. Super non-toxic, can literally do it manually. I made money doing it manually at one point.

telegram alerts is all you need for notifications. its the easiest to set up by a mile

United States Tendencias

- 1. Good Sunday 43.1K posts

- 2. Discussing Web3 N/A

- 3. Auburn 46.7K posts

- 4. MACROHARD 7,251 posts

- 5. Brewers 66.4K posts

- 6. Gilligan's Island 5,062 posts

- 7. Wordle 1,576 X N/A

- 8. #SEVENTEEN_NEW_IN_TACOMA 37.5K posts

- 9. Georgia 68.3K posts

- 10. #MakeOffer 19.8K posts

- 11. Kirby 24.5K posts

- 12. #SVT_TOUR_NEW_ 29.8K posts

- 13. QUICK TRADE 2,372 posts

- 14. #HawaiiFB N/A

- 15. #BYUFOOTBALL 1,028 posts

- 16. mingyu 106K posts

- 17. Utah 25.5K posts

- 18. Boots 51.4K posts

- 19. Holy War 2,094 posts

- 20. FDV 5min 2,280 posts

Tal vez te guste

-

NT Quant

NT Quant

@NT_Quant -

jeff.hl

jeff.hl

@chameleon_jeff -

Liquidity Goblin

Liquidity Goblin

@liquiditygoblin -

Vertox

Vertox

@Vertox_DF -

Nik Algo

Nik Algo

@nik_algo -

HangukQuant

HangukQuant

@HangukQuant -

QuantSeeker

QuantSeeker

@quantseeker -

rbit

rbit

@crypto_hades -

major

major

@xmgnr -

cephalopod

cephalopod

@macrocephalopod -

Formula δ1

Formula δ1

@FormulaDeltaOne -

PyQuant News 🐍

PyQuant News 🐍

@pyquantnews -

Quant

Quant

@quant_xbt -

Kris Sidial🇺🇸

Kris Sidial🇺🇸

@Ksidiii -

Robot James 🤖🏖

Robot James 🤖🏖

@therobotjames

Something went wrong.

Something went wrong.