quantify.tools

@quantifytools

Data driven market analysis tools. Powered by Tradingview. Free trial: http://quantify.tools. Tradingview profile: http://t.ly/6IHUM

คุณอาจชื่นชอบ

All free tools, their documentation and practical usage guides ↓ 1. Go to quantify.tools 2. Click 🚀 icon 3. Open indicator page

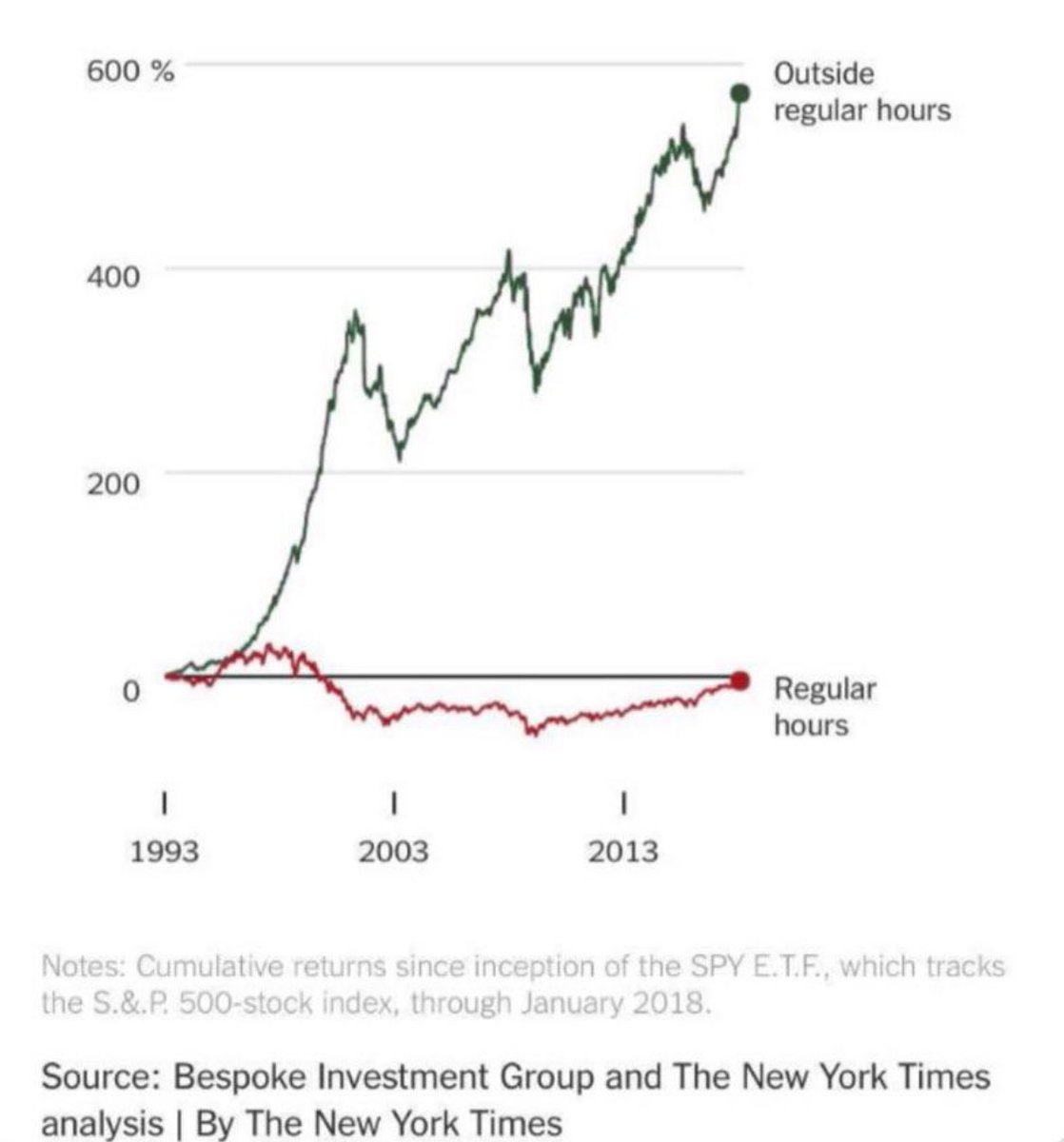

May the flows be ever in our favor

$ES is showing strong weekly flows with a bunch of sellers absorbed into limit orders, suggesting bottom is in. - Absorption print - High volume, high spike - Major levels taken out This can also be seen in stocks making up the index, suggesting sector wide signal strength 👇

How many realize this metric has nothing to do with social sentiment?

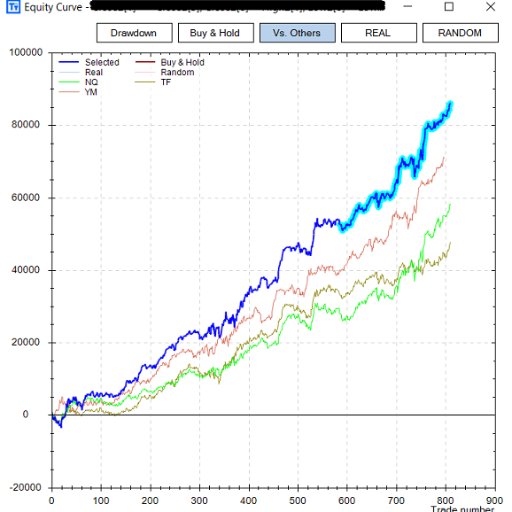

It really is that simple

Markets go up. Markets go down. When they go crazy low, buy. When they go crazy high, sell. The rest is noise.

How many "buy the dip" hopium posts did you see a month ago and how many do you see now? Timeline sentiment suggests stage is being set for capitulation, despair is in the air.

It appears the answer to ”is it different this time” is yet again no.

Imagine if you quantified PM/AH sentiment using price/volume and used that to track smart money

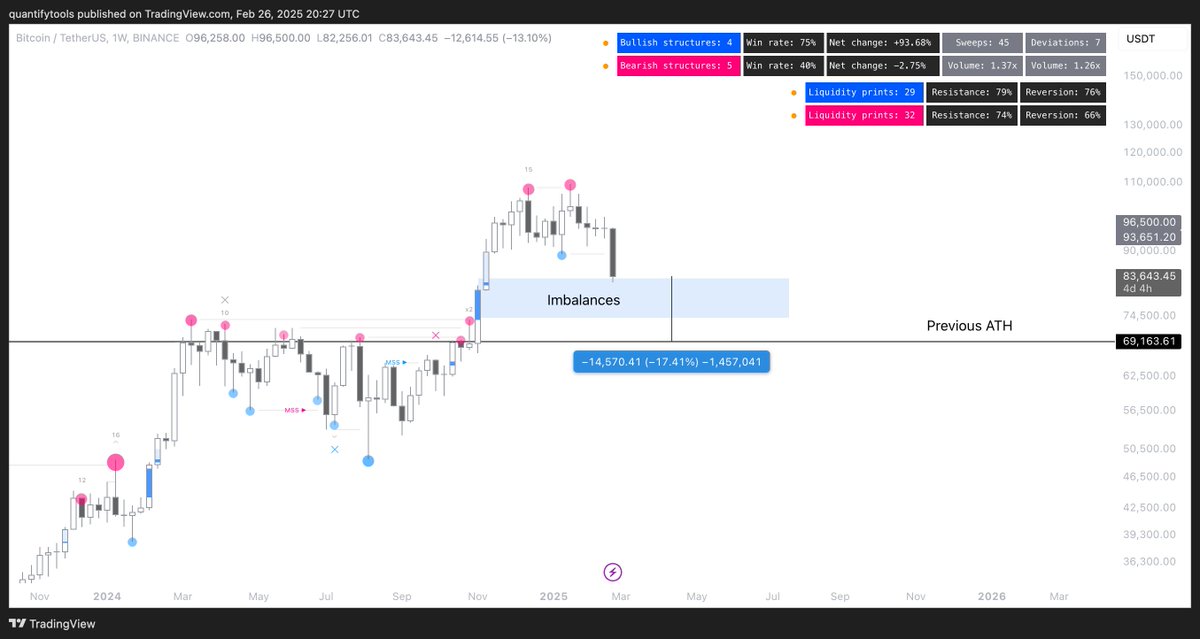

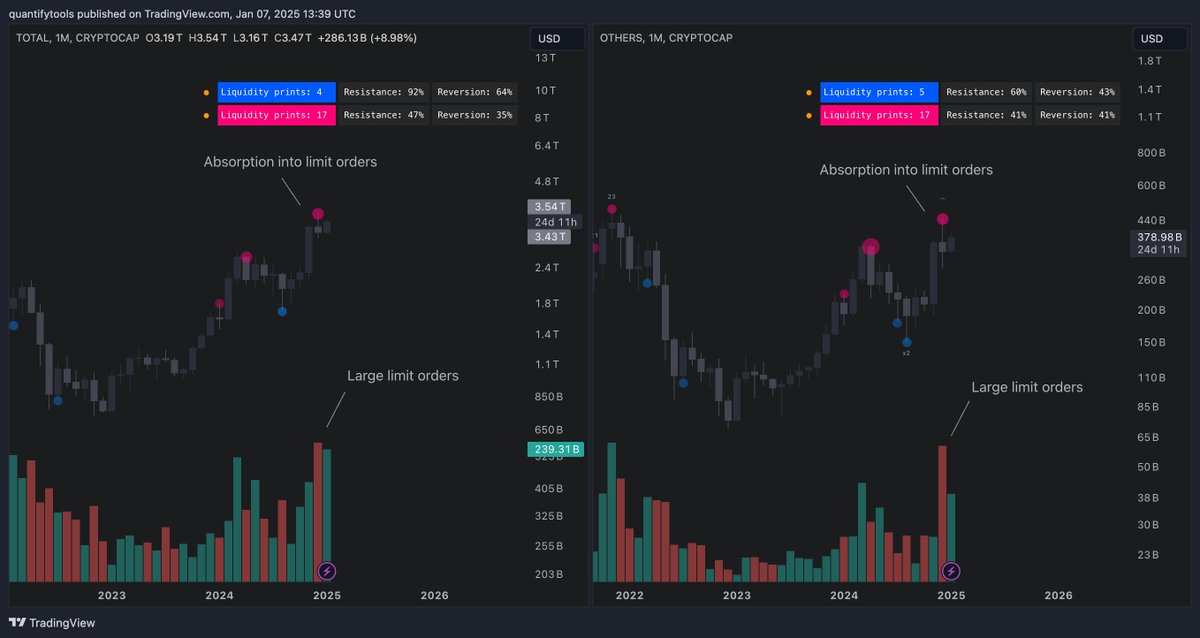

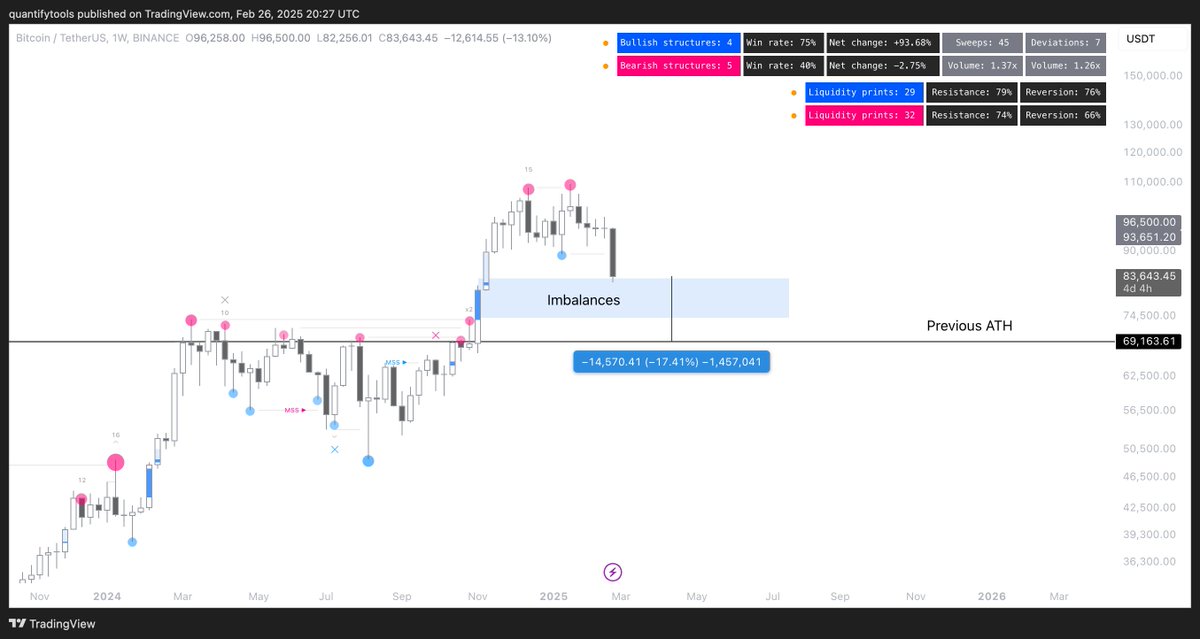

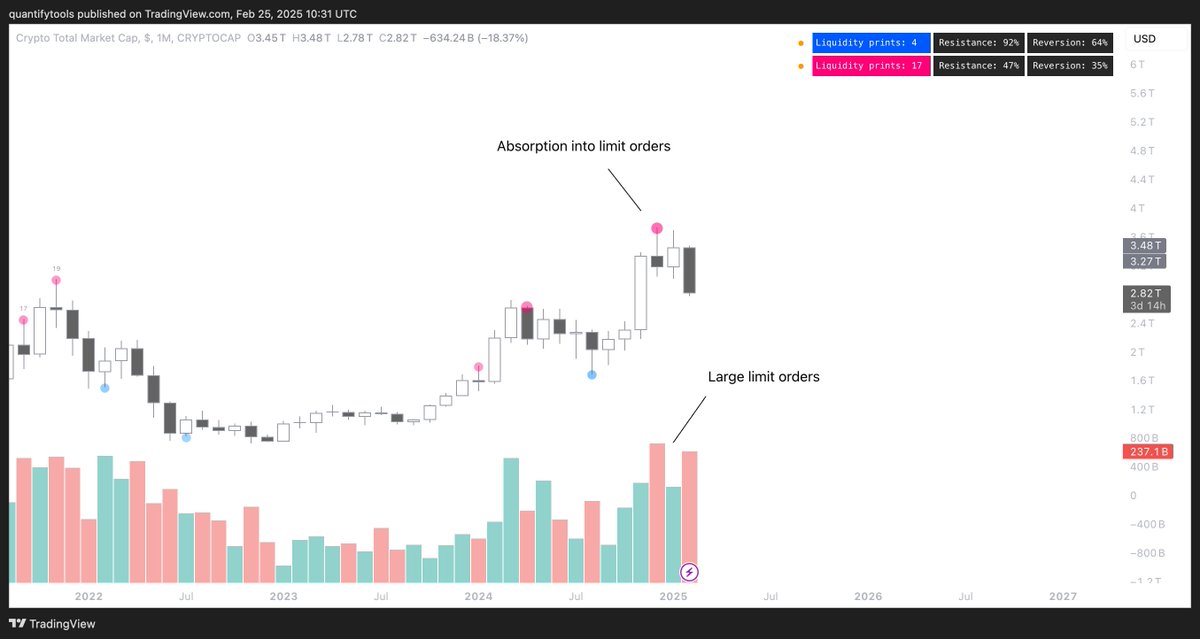

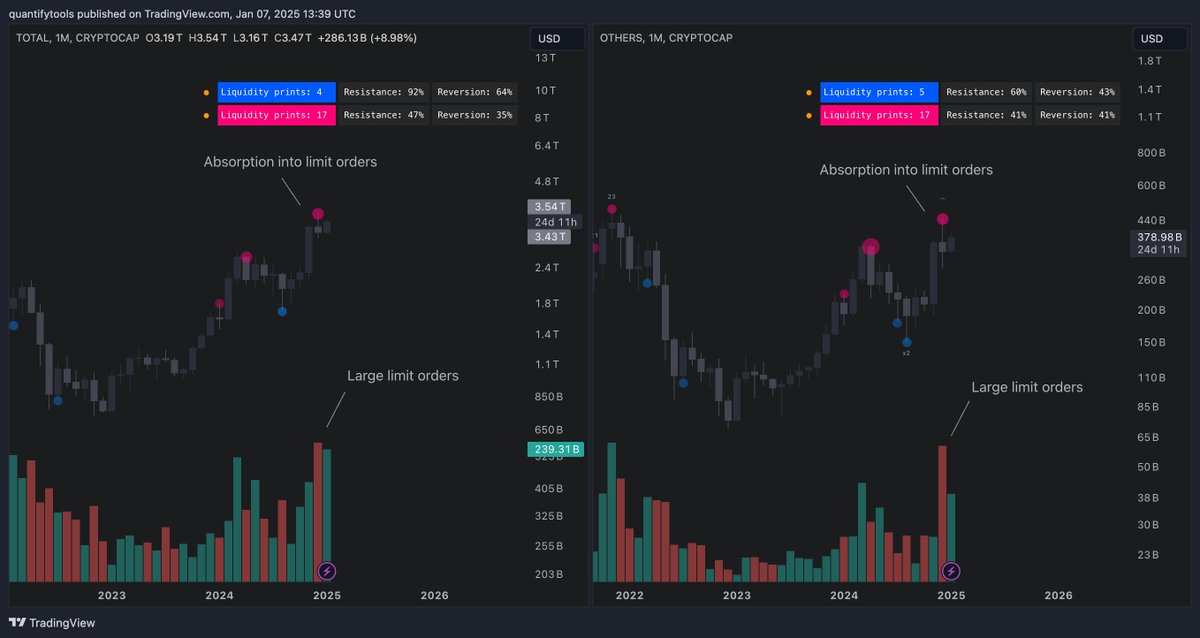

Lots of absorption in crypto on weekly charts. HTF Imbalances largely filled. Large wicks typically get some backfill, but reversals as such argue for an invalidation of bearish bias, especially with a strong bullish narrative (US strategic reserve) $BTC

friendly reminder that nobody who ACTUALLY made tens of millions of dollars from trading WILL NOT TEACH you for $50/month how to do it too if you fall for this, you are not going to make it in trading/investing or personal life

We made the note 2.5 months ago that deep pockets are off-loading $BTC and especially altcoins. The correction is now here, putting focus on where the larger players might be interested in getting back in. So, where to look for entries? Keep it simple stupid - previous ATH.…

Easy to stare vertically up charts and get sucked into a narrative everyone agrees on. But disguised in HTF charts, someone is off-loading $BTC & small caps. What do they know? Price creates narratives, not narratives create price. Whatever you do, do the thinking yourself.

A bit of a wild card to this are US stocks, which appear to have topped. We still have an unresolved imbalance at ~5605 on $ES. Plenty of room to go, which could spill further sell pressure into crypto.

We made the note 2.5 months ago that deep pockets are off-loading $BTC and especially altcoins. The correction is now here, putting focus on where the larger players might be interested in getting back in. So, where to look for entries? Keep it simple stupid - previous ATH.…

At @quantifytools, we resume to be kinda worried on tweets like this on large flushes. Signals pain is not there yet.

Someone always knows. Follow the flows.

Easy to stare vertically up charts and get sucked into a narrative everyone agrees on. But disguised in HTF charts, someone is off-loading $BTC & small caps. What do they know? Price creates narratives, not narratives create price. Whatever you do, do the thinking yourself.

United States เทรนด์

- 1. Josh Allen 25.4K posts

- 2. Texans 43.9K posts

- 3. Bills 139K posts

- 4. Joe Brady 4,081 posts

- 5. #MissUniverse 286K posts

- 6. #MissUniverse 286K posts

- 7. Anderson 25K posts

- 8. Maxey 9,210 posts

- 9. #TNFonPrime 2,695 posts

- 10. McDermott 3,122 posts

- 11. Costa de Marfil 19.2K posts

- 12. Al Michaels N/A

- 13. Shakir 5,254 posts

- 14. Beane 1,798 posts

- 15. #htownmade 2,583 posts

- 16. Dion Dawkins N/A

- 17. #BUFvsHOU 2,954 posts

- 18. James Cook 5,392 posts

- 19. Spencer Brown N/A

- 20. CJ Stroud N/A

คุณอาจชื่นชอบ

-

ココペリ at 機械化工房ミライエ

ココペリ at 機械化工房ミライエ

@dondon_bot2022 -

マルコフ( ˇωˇ )

マルコフ( ˇωˇ )

@Markov_system -

あいば@botter

あいば@botter

@aiba_algorithm -

Atsu

Atsu

@Atsuto0722 -

tenka

tenka

@tenka_rb -

Super さるお

Super さるお

@saruo_hunbook -

yseeker

yseeker

@yseeker0 -

Mweng’e Alfred

Mweng’e Alfred

@AlfredMwenge -

Dan McKay

Dan McKay

@greatmckay -

sanpan

sanpan

@sanpan101 -

Iyinflair

Iyinflair

@sonofjola -

Joe Timothy

Joe Timothy

@JoeTimo88434093 -

Alienmetaking

Alienmetaking

@AlienmetaKing

Something went wrong.

Something went wrong.