You might like

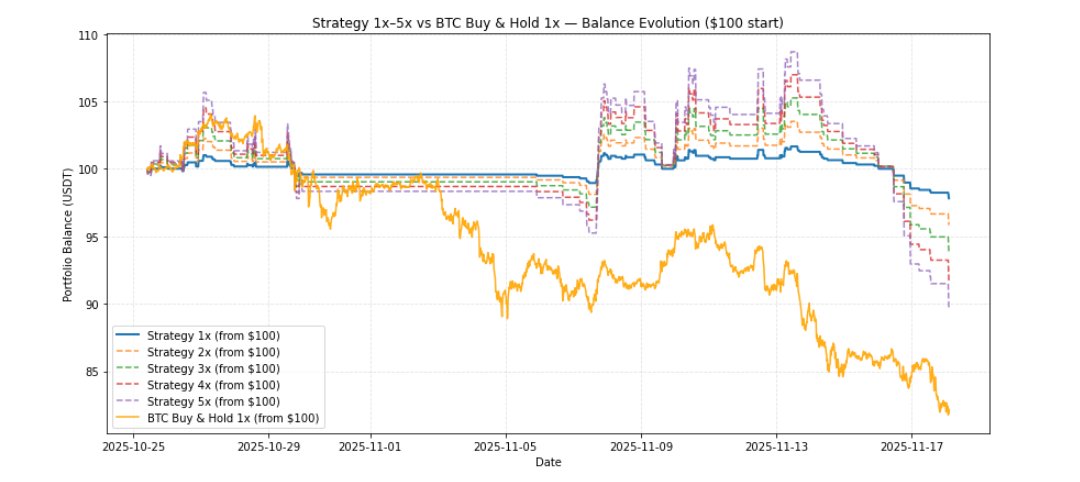

After a month testing the new risk-management update (cooldown after consecutive losses), the portfolio is showing consistently low risk. While BTC buy-and-hold dropped ~18%, the strategy at 1x only fell ~3%. Even leveraged at 5x, it still outperformed the main benchmark.

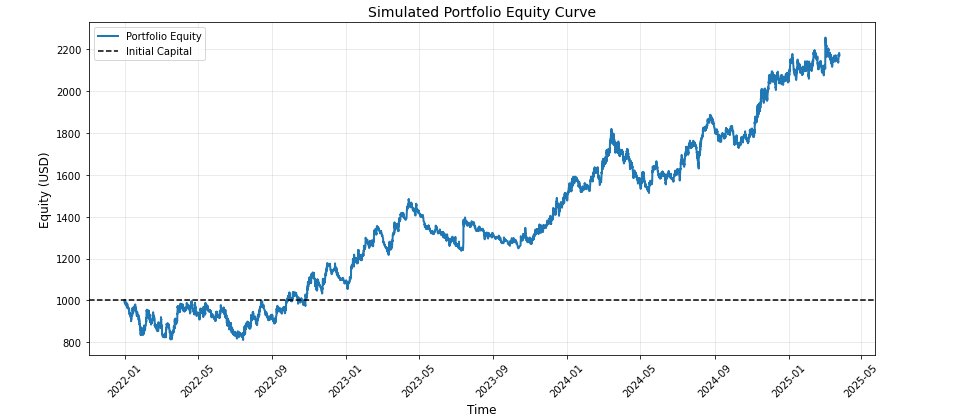

After the latest improvements and risk-control adjustments, the backtest results show a consistent evolution of the system 👇 📈 Overall Return: +586 % 📅 Annual Return: +41 % ⚖️ Sharpe Ratio: 2.78 📉 Max Drawdown: –7.13 % 🔥 Calmar Ratio: 5.78 ✅ Win Rate: 41 %

This is going to be the next real estate cycle generator.

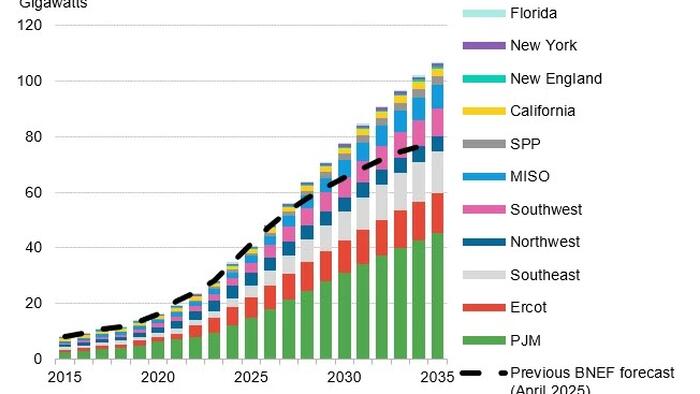

US Data Center Power Demand Could Reach 106 GW By 2035 zerohedge.com/markets/us-dat…

With solar panels and the extremely cold weather in space 🤯

What if the Taiwan invasion narrative is just to bring down the semiconductor sector so that later large capital can buy the dip?

F

Breakdown of the Black Friday data tells us: -Consumer is weakening. -95% of sales volume was financed. -67% of that intends not to pay off within 30 days. -Roughly $1B was spent using BNPL models which are the worst debt. This points to a *really* unhealthy economy.

The real estate bubble persisted.

Don't be that relative at Thanksgiving this year.

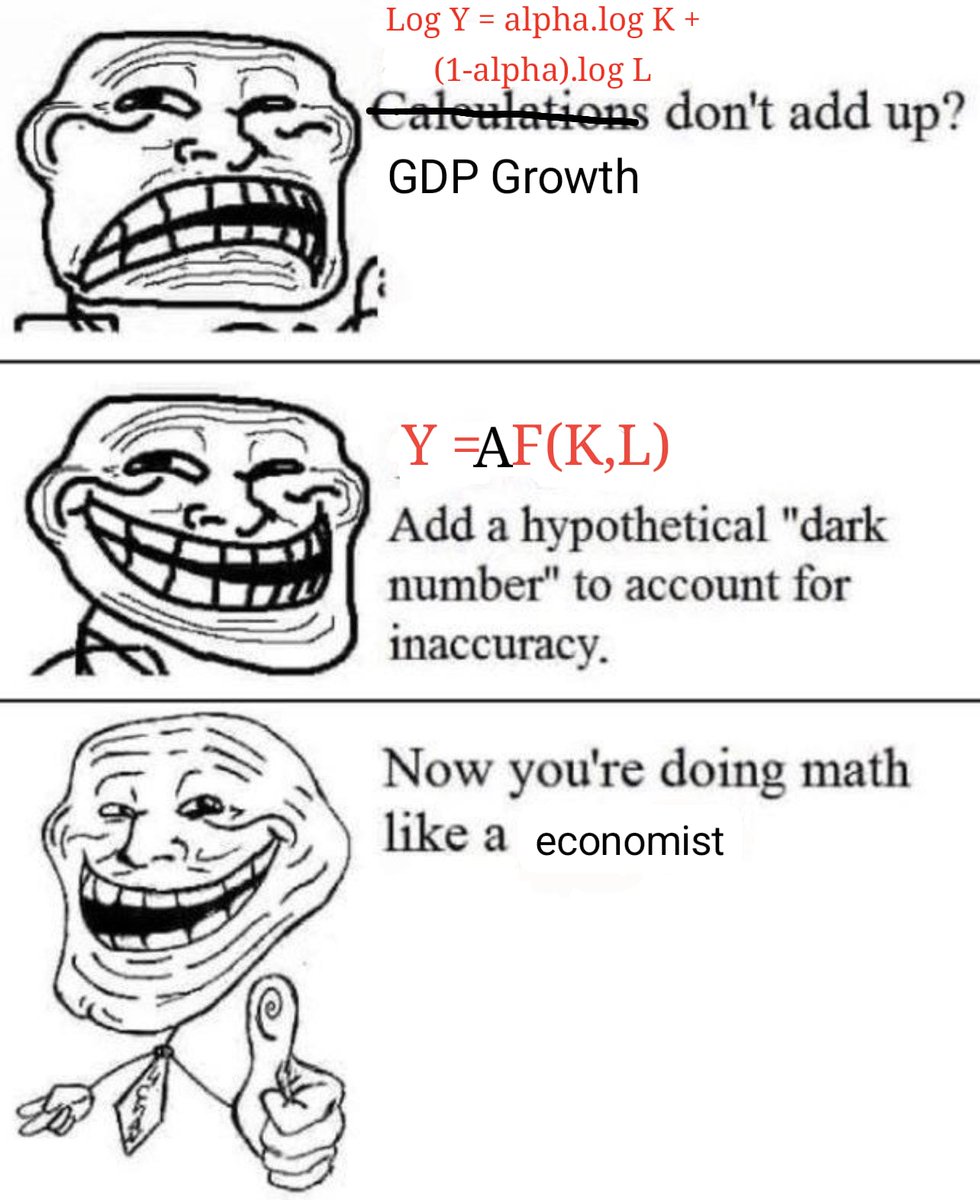

“Now convince the general public that they are predicting instead of gambling”

Good boy🦮

🚨🇺🇸| El comunista Zohran Mamdani cambia el discurso justo un día antes de reunirse con Trump. Agosto de 2025: “Mi administración sería la peor pesadilla de Donald Trump”. 20 de noviembre de 2025: “Tengo la intención de dejar claro al presidente Trump que trabajaré con él en…

Hey @grok please update for me the odds on polymarket about GTA 6 release on 2025.

What if…

What if the top signal is the spiritual, geometrical, Kamasutra number of 6,900?

This stuff is so cool to me. In 2020 a research paper was released using AI to predict soccer goals 2 seconds in advance with 75%+ accuracy. I’m sure the tech has advanced rapidly since then. TLDR: AI can predict KO’s, Goals, Touchdowns, etc and update live odds accordingly

Ok chat, how can I automate this?

From the live phase, we gathered valuable insights not considered before. Using this new information, we adjusted several parameters in the strategy execution and added extra risk-control layers, as there was still room to improve the system robustness.

Bringing continuation to the algorithmic trading system, we deployed the model live. The strategy showed remarkable lower volatility and drawdown vs. BTC Buy & Hold. Final Balance 96.26 vs 92.59 📊 Volatility 8.8 % vs 34.5 % ⚙️ Max Drawdown –4.9 % vs –17.5 % 📉

Bringing continuation to the algorithmic trading system, we deployed the model live. The strategy showed remarkable lower volatility and drawdown vs. BTC Buy & Hold. Final Balance 96.26 vs 92.59 📊 Volatility 8.8 % vs 34.5 % ⚙️ Max Drawdown –4.9 % vs –17.5 % 📉

We have continued refining the strategy, and over the past three years, obtaining from the backtest: 📈 3 years Annualized Return: 30% 🔁 Total Compounded Gain for the 3 years: 117% 📉 Max Drawdown: –19% Too many things to fix, but it’s evolving positively.

United States Trends

- 1. #Kodezi N/A

- 2. Brian Cole 1,958 posts

- 3. Walter Payton 5,181 posts

- 4. Chronos N/A

- 5. Price 267K posts

- 6. Merry Christmas 67.9K posts

- 7. Good Thursday 37K posts

- 8. #25SilverPagesofSoobin 22.3K posts

- 9. $META 11.9K posts

- 10. #thursdayvibes 2,565 posts

- 11. The FBI 107K posts

- 12. #WPMOYChallenge 6,167 posts

- 13. #スビンの存在がMOAの宝物 15.6K posts

- 14. Yihe 2,660 posts

- 15. Metaverse 7,831 posts

- 16. Dealerships 1,580 posts

- 17. Somali 247K posts

- 18. Happy Friday Eve 1,061 posts

- 19. Hilux 10.9K posts

- 20. DNC and RNC 5,151 posts

You might like

-

₿ ᠻˣ

₿ ᠻˣ

@Hustler_Mh -

Rhino

Rhino

@CryptoRhinoo -

Market Fortune

Market Fortune

@MarketFortune_ -

BerenaBadran🐨

BerenaBadran🐨

@Berenabg -

Daniel Fofi Osorio

Daniel Fofi Osorio

@DanielOsorioJ -

Arnold Torres G.

Arnold Torres G.

@ArnoldToga -

LDA

LDA

@leandrodeavila -

Miguel Angel Rangel

Miguel Angel Rangel

@miguerangelv -

Strat Stew

Strat Stew

@TyStew79 -

Pedro Púas

Pedro Púas

@PJJ_Puello -

Alfredo Benedetti

Alfredo Benedetti

@AlfBenedetti -

Trader—kris

Trader—kris

@Trader__Cris

Something went wrong.

Something went wrong.