내가 좋아할 만한 콘텐츠

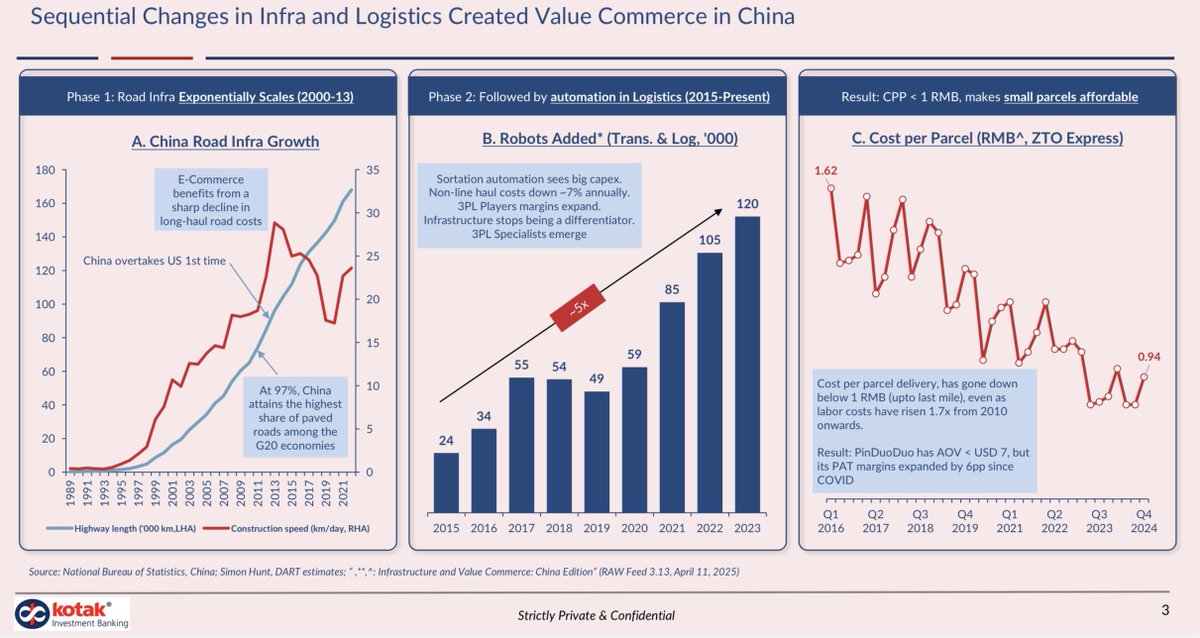

You need a lot of "offline" to create value online -- China's road expansion, followed by logistics automation, helped slash parcel costs to 13 cents, making ultra-affordable e-commerce possible.

The Indian startup and venture ecosystem needs to engage far more with public market participants.

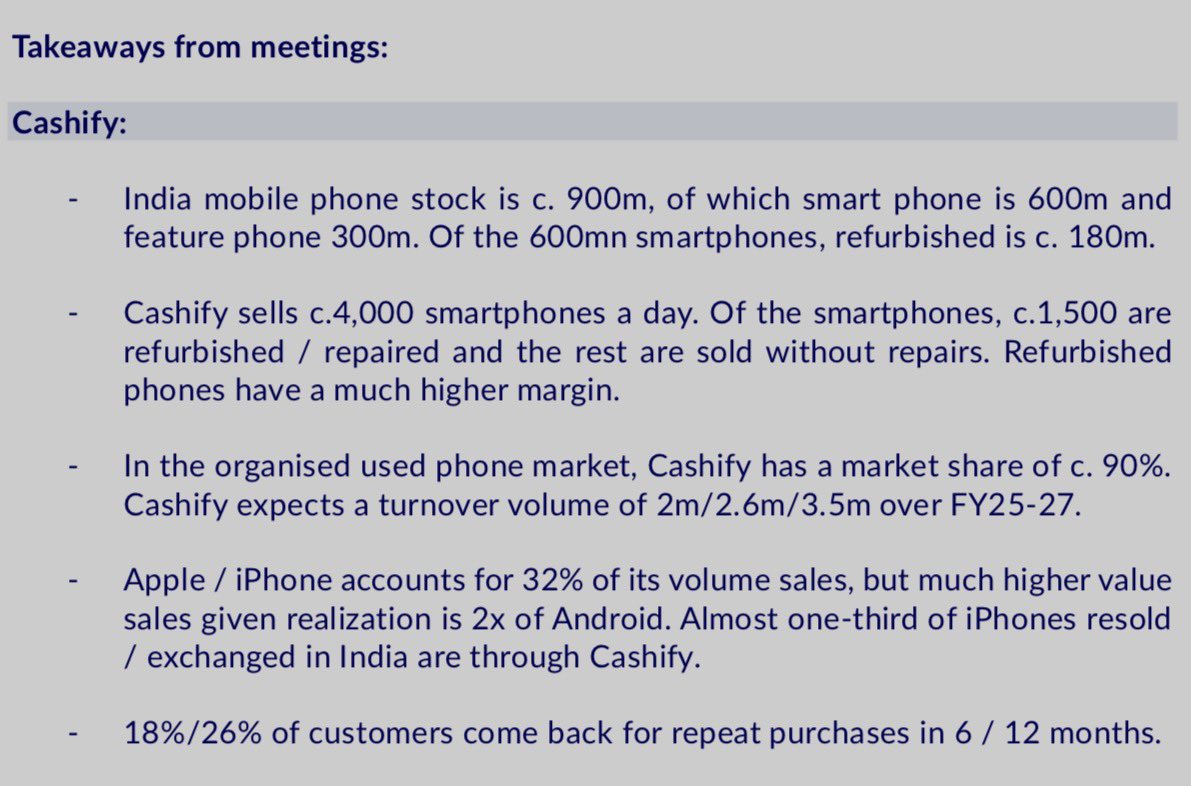

iPhones account for nearly a third of all phones sold on one of the largest refurbished platforms in India.

If you think there's a bubble in AI, SoftBank's Masa regrets to inform you

Quick commerce accounted for 14% of Tata Consumer' sales over the past five quarters, vs 7% from traditional e-commerce - Tata Consumer CEO at a conference this week.

“India’s high cost of capital, averaging 10.8%, hinders economic growth by discouraging investment and innovation. This is due to underdeveloped bond markets, high inflation, sovereign risk, and capital account restrictions. To address this, reforms are needed to deepen the bond…

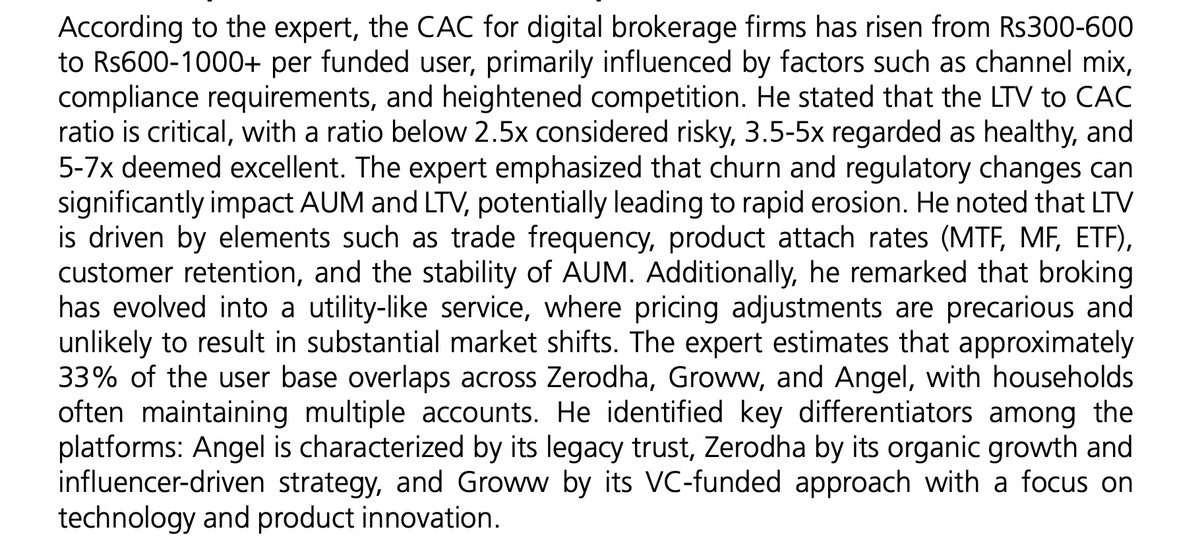

Digital brokers' customer acquisition costs have roughly doubled in recent years. About a third of the user base overlaps across Zerodha, Groww and AngelOne, per former chief growth officer of AngelOne. A healthy lifetime value ratio is 3.5-5x, with 5-7x considered excellent.

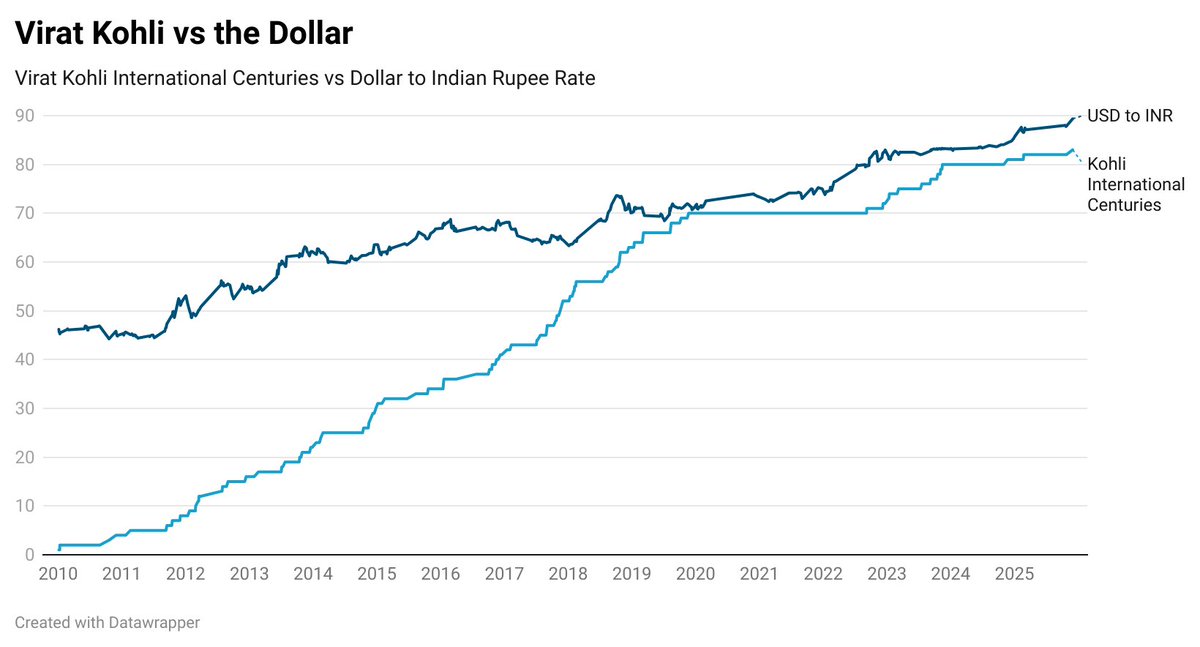

Yeah… people never believe me when I say things like this.. 👇🏻

Broking business has become so competitive, the only way I can survive now is to get Trump & Elon on a podcast 🥲

RBL Bank has a credit card to debit card ratio of 272%(?!)

NRIs transferring funds using stablecoin firms, please be careful on FEMA regulations. This seems dangerous for Indian sovereignty and while the companies will change their models eventually, you can still be traced by an agency asking how the dollars came to India without using…

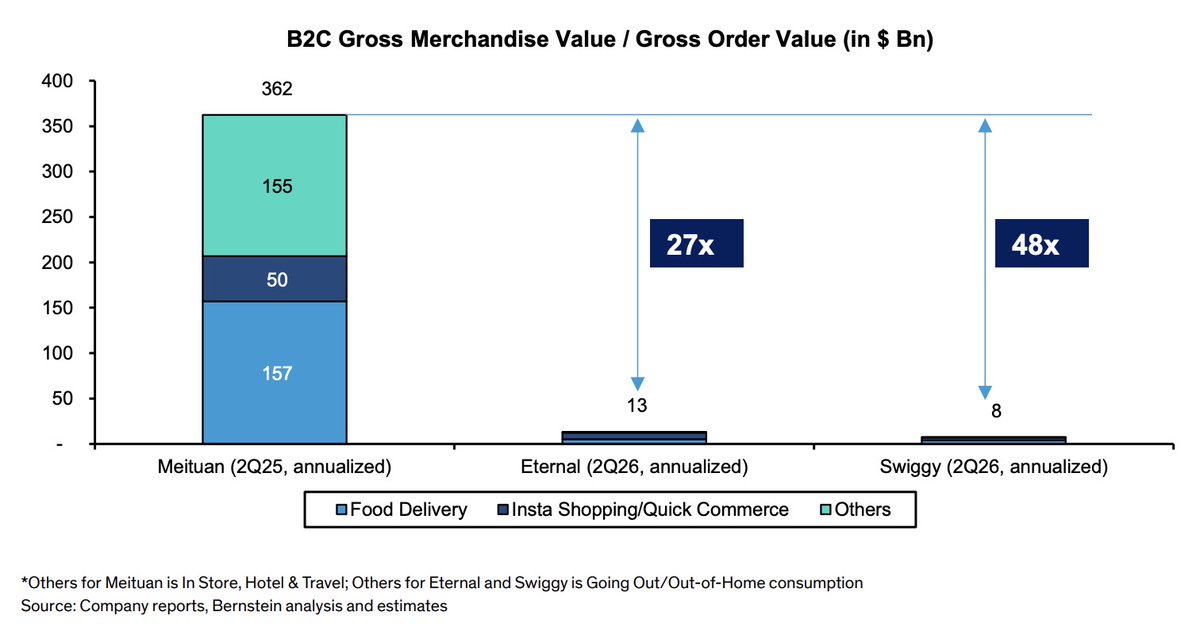

Bernstein: "Our industry discussions confirm that Meituan leadership is indeed visiting India right now and has sought (and is doing) meetings with some of the firms who lead internet based business models in India."

🚨 [EXCLUSIVE] IPL franchise Lucknow Super Giants are in advanced talks with a UK-based investor group for a $200 million minority investment that values the team at about $1.3 billion.

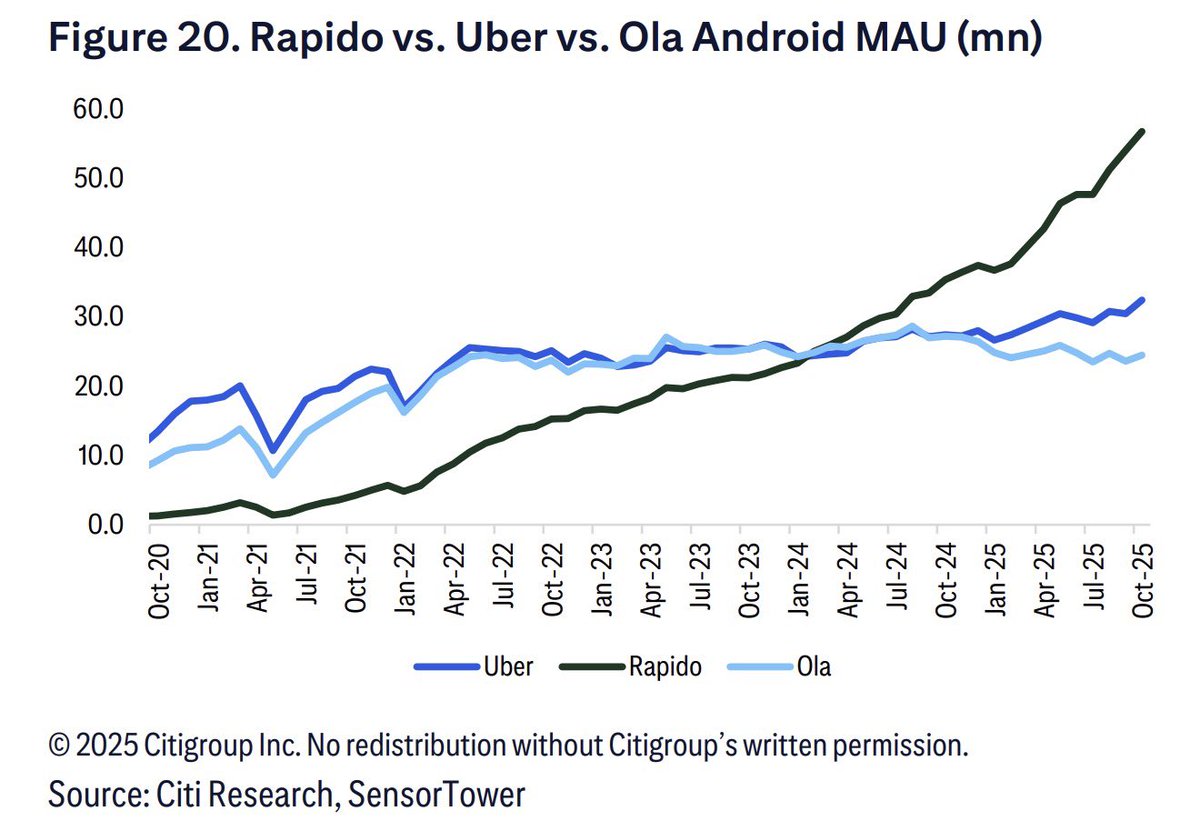

Rapido now has almost double Uber's monthly active users on Android and nearly triple Ola's - Sensor Tower, Citi

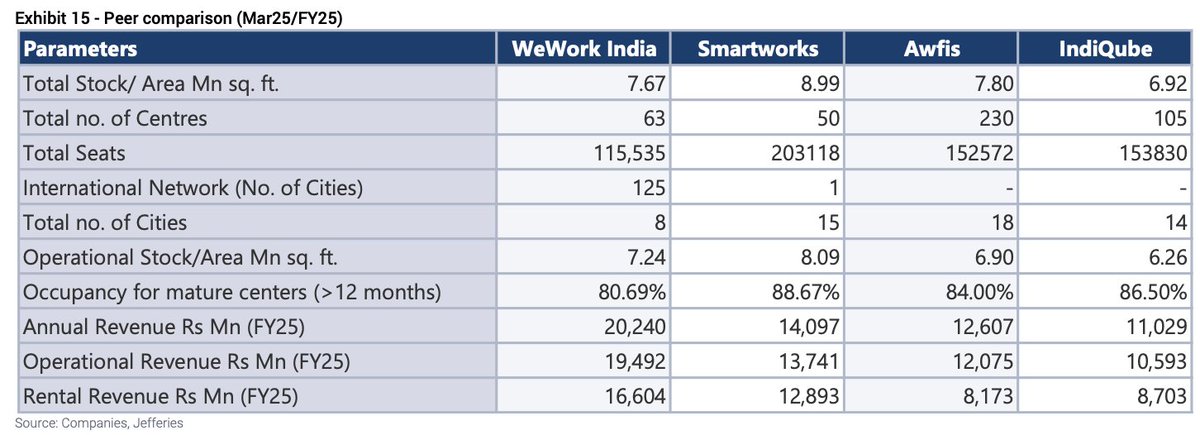

WeWork India generates materially higher revenue per square foot and per seat than rivals.

"The longer your memos, the less likely they are to be read by men who have the power to act on them." - David Ogilvy

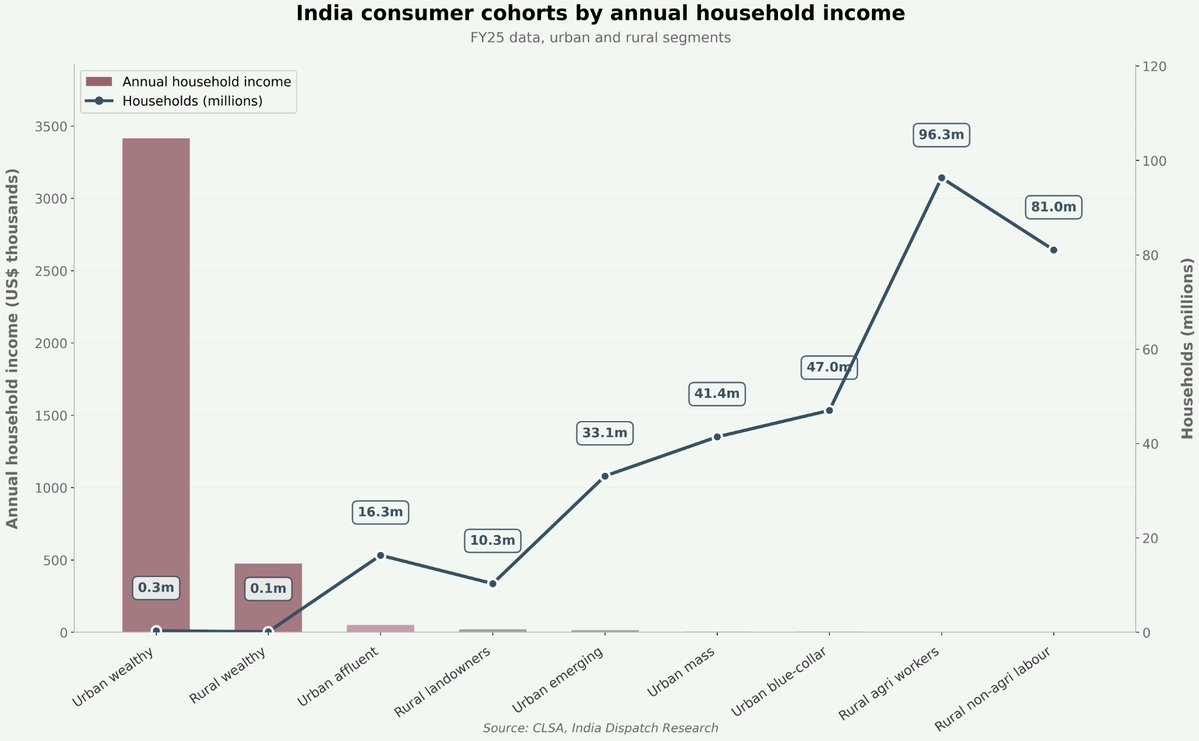

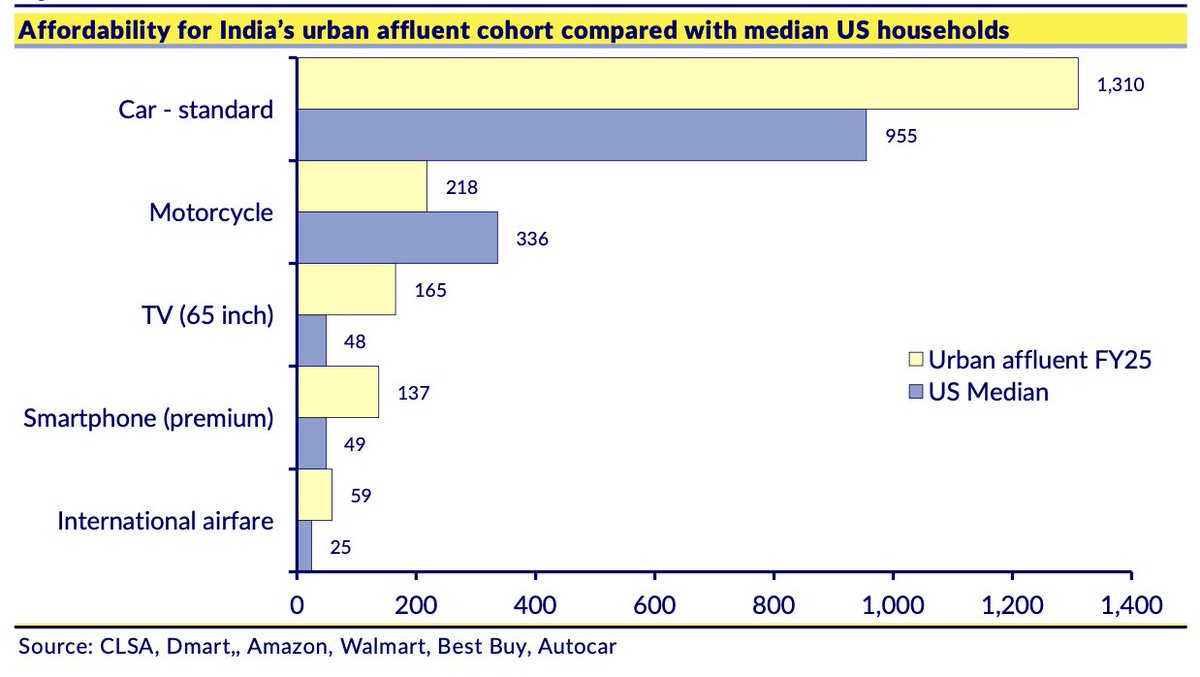

Hours of work needed by India's "urban affluent" and median U.S. households to buy big-ticket durables and travel.

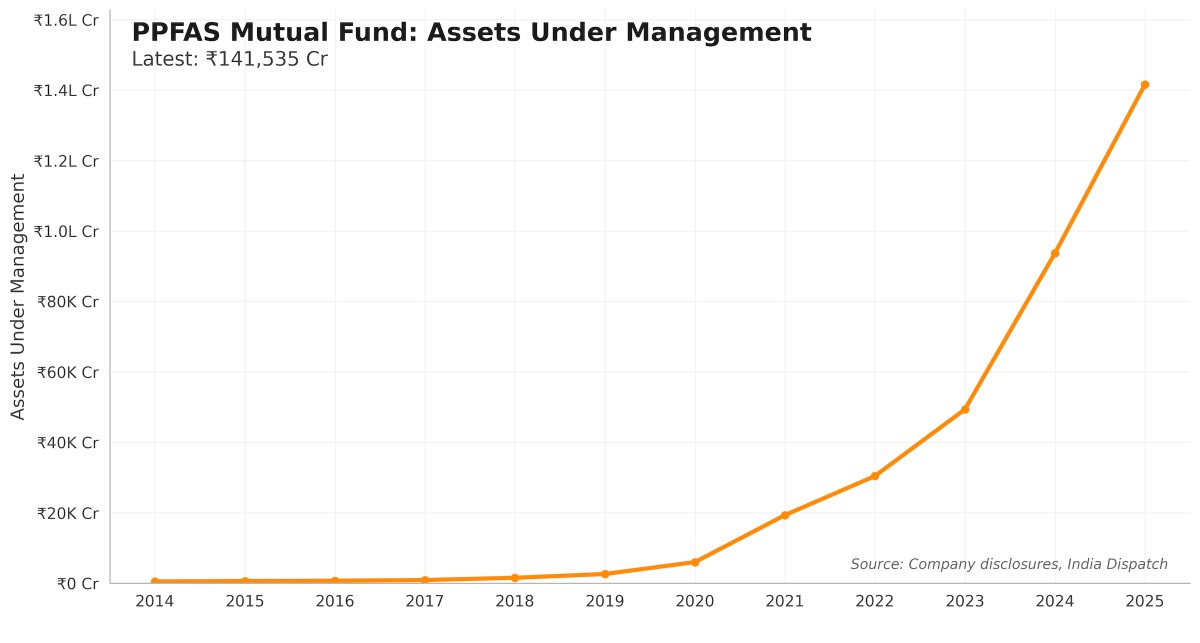

PPFAS assets have surged from $70m to $16b over the last 10 years

United States 트렌드

- 1. Cowboys 73.1K posts

- 2. #heatedrivalry 23.5K posts

- 3. LeBron 103K posts

- 4. Gibbs 20K posts

- 5. Lions 90.6K posts

- 6. Pickens 14.3K posts

- 7. scott hunter 4,741 posts

- 8. #OnePride 10.5K posts

- 9. Brandon Aubrey 7,317 posts

- 10. Ferguson 10.8K posts

- 11. Shang Tsung 27.7K posts

- 12. fnaf 2 25.5K posts

- 13. Paramount 19.5K posts

- 14. CeeDee 10.5K posts

- 15. Eberflus 2,648 posts

- 16. Warner Bros 19.7K posts

- 17. Goff 8,677 posts

- 18. Bland 8,570 posts

- 19. #criticalrolespoilers 1,939 posts

- 20. #PowerForce N/A

내가 좋아할 만한 콘텐츠

-

Bejul Somaia

Bejul Somaia

@bsomaia -

Hemant Mohapatra

Hemant Mohapatra

@MohapatraHemant -

Gaurav Munjal

Gaurav Munjal

@gauravmunjal -

Rajan Anandan

Rajan Anandan

@RajanAnandan -

suhas motwani

suhas motwani

@MotwaniSuhas -

Peak XV Partners

Peak XV Partners

@peakxvpartners -

G V Ravi Shankar

G V Ravi Shankar

@gvravishankar -

Sajith Pai

Sajith Pai

@sajithpai -

Dev Khare

Dev Khare

@dkhare -

The CapTable

The CapTable

@thecaptableco -

Tejeshwi Sharma 🇮🇳

Tejeshwi Sharma 🇮🇳

@tejeshwi_sharma -

Amrish Rau

Amrish Rau

@amrishrau -

Kaushik Subramanian

Kaushik Subramanian

@TheHolyKau -

Deepak Abbot

Deepak Abbot

@deepakabbot -

Jitendra Gupta

Jitendra Gupta

@guptajiten

Something went wrong.

Something went wrong.