Rob Anton

@robanton0

Love Sports, The Beach, and Alternative Investments. Founding Partner of Next Edge Capital

You might like

Why Warren Buffett Is Sitting on Record Cash — and What That Says About the Market, by @leadlagreport open.substack.com/pub/leadlagrep…

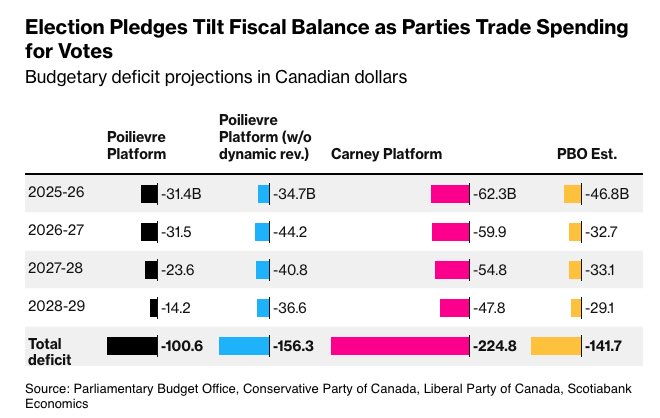

If you’re looking for a non-partisan analysis of both parties fiscal platforms, here’s one from the economics team at ScotiaBank.

This man knows the market. He predicted: 1) Dot-com Bubble (2000) 2) Great Recession (2008) 3) The COVID Bubble (2021) Howard Marks just went on Bloomberg and said "tariffs are changing everything." Here is his latest warning: 🧵

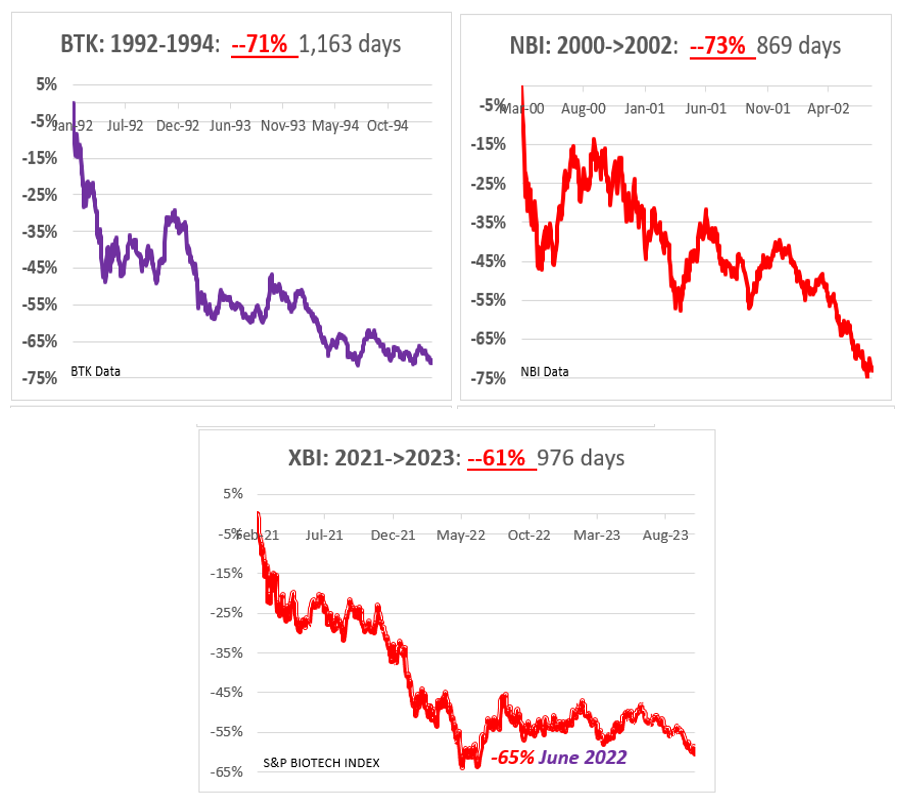

#biotech indicator extremes match or eclipse dire readings at prior lows. 1) % of Bios > 50 DMA sunk to single digits. Each 5 prior times readings achieved this threshold since the meltdown -66% low in May/June 2022, rallies of +13%, +29%, +10%, +25% & +20% ensued for the $IBB…

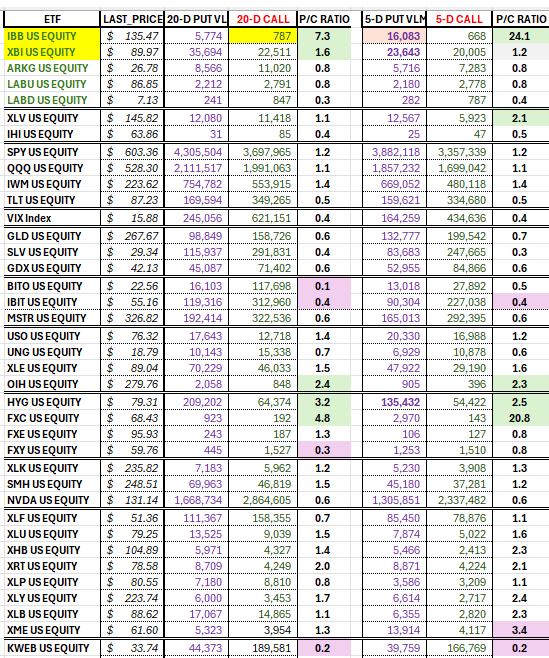

Remarkably, literally no one is interested in Calls on the $IBB over the past month (7-to-1 Put-to-Call ratio average daily), and especially over the past week (24-to-1 Put-to-Call ratio). Looks like everyone is on one side of the boat. #biotech

Physical gold BUYING has gone apocalyptic: Gold inventories in the 3 largest COMEX gold vaults just surged by 15 MILLION ounces in 2 months. That's a +115% increase, putting physical gold holdings ABOVE 2020 pandemic levels. What is happening? Let us explain. (a thread)

why is trump starting a trade war with its closest ally canada? i explain for @gzeromedia

Interesting and a lot more paid to come to say the least.

The Great Toronto Condo Crash Gathers Momentum The stories of losses on Pre-construction sub 500 sqft Dog Crate Condos & even on slightly larger 600+ sqft units just keep on coming The same themes but different problems & really bad outcomes More details are emerging 2/

Wow

Robert Anton, President and Partner, Dave Scobie, COO and Partner, Larry Guy, Managing Director, Cheng Dang, EVP of Finance and Rich Goode, EVP, of @NextEdgeCapital, along with their team and representatives from Ridgewood Capital Asset Management, joined us to open the market…

📈EVERY Major "2024 Outlook" from the World's Top Banks, Asset Managers, Private Equity & Consulting Firms Credit and thank you to Anthony Cheung for posting on Linkedin. Let's dive in! BANKS (US): J.P. Morgan shorturl.at/eltPT J.P. Morgan Private Bank…

What could possibly go wrong ....

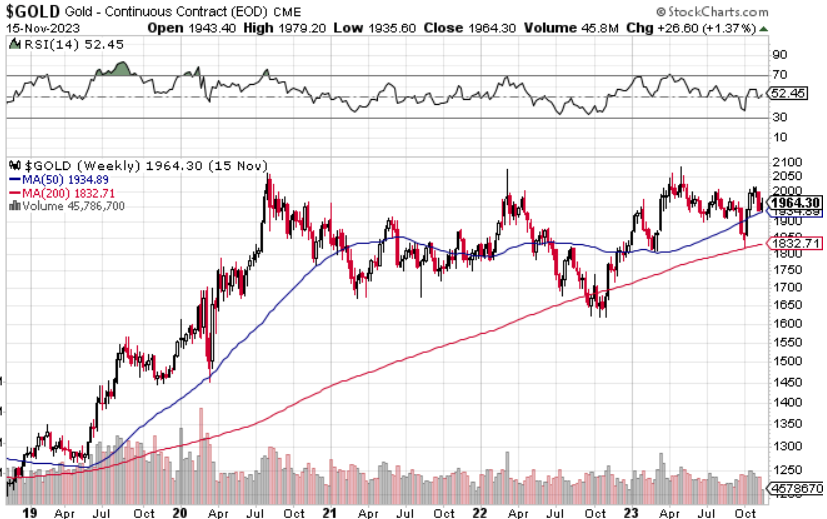

#Gold making all time highs in most currencies and the pos usd will be next. Meanwhile many precious metals stocks are near bottoms. Especially juniors. We are at the cusp of a 5-10 year mega move that will see #preciousmetals metals create generational wealth for early entrants

On the pantheon of #biotech futility, this super-bear has now ascended to the 2nd longest ever, approaching 1,000 days, as it grounds every small cap to dust, where trading at cash is the new overpriced. $XBI down -61% is a stone's throw away from the -65% June 16th 2022 low.

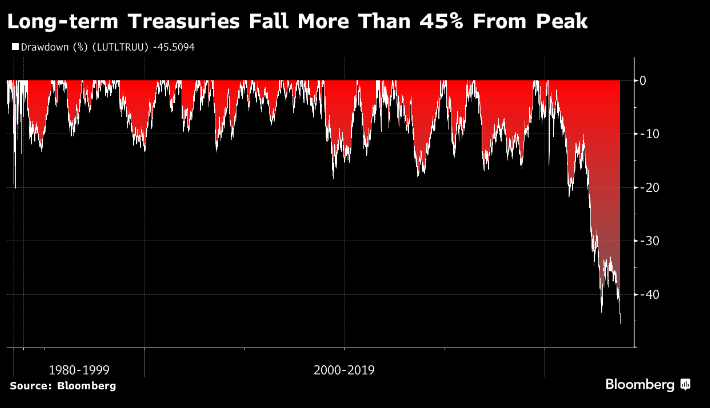

Good Morning Everyone! I can’t believe I am saying this but the slump in 10-year and 30-year bonds is approaching the epic drops we saw in stocks during the 2008 financial crisis and the dot-com bubble bust: 📉 10-year bonds are down 46% (vs. 49% for dot-com stocks) 📉 30-year…

View the latest monthly commentary, performance and portfolio statistics for the Veritas Next Edge Premium Yield Fund: nextedgecapital.com/funds/veritas-… #AlternativeInvestments #NextEdgeCapital #Veritas

View the latest monthly commentary, performance and portfolio statistics for the Next Edge Biotech and Life Sciences Opportunities Fund: nextedgecapital.com/funds/next-edg… #AlternativeInvestments #NextEdgeCapital #Biotech #LifeSciences

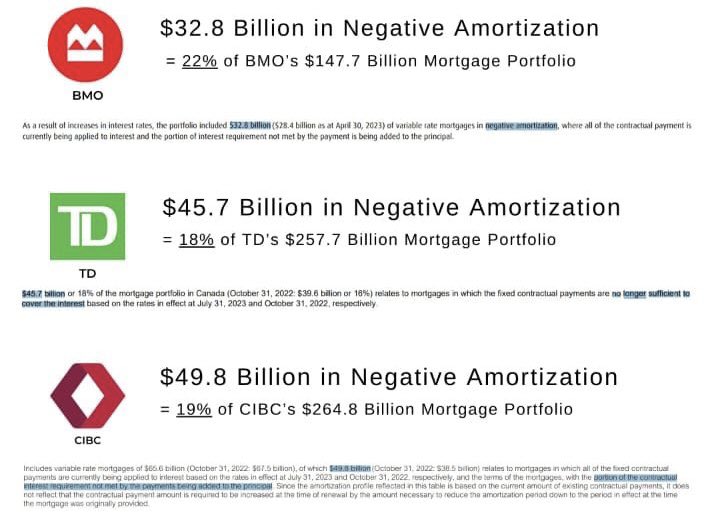

🚨Canadian banks under pressure. BMO, TD and CIBC have negative amortization on a FIFTH of their mortgages. Rates need to come down. Or principal will keep rising in a down market. Big problem.

Join us for a discussion on September 14 at 4:15 PM EDT. Featuring Matt Zabloski, sub-advisor to the Next Edge Strategic Metals and Commodities Fund, as the speaker.

Join us for a discussion on opportunities in the resource sector from a leading expert on September 14 at 4:15 PM EDT. Featuring Matt Zabloski, sub-advisor to the Next Edge Strategic Metals and Commodities Fund, as the speaker. Register now: us06web.zoom.us/webinar/regist… #Alternatives

United States Trends

- 1. Harbaugh 105 B posts

- 2. #WWENXT 9.832 posts

- 3. #RHOSLC 6.053 posts

- 4. Duke 29,5 B posts

- 5. Caleb Foster N/A

- 6. #NewYearsEvil 5.148 posts

- 7. Usha 11,5 B posts

- 8. Thea 6.500 posts

- 9. Louisville 8.202 posts

- 10. Ravens 97 B posts

- 11. Greenland 433 B posts

- 12. Markstrom N/A

- 13. Demond Williams N/A

- 14. Izzi 5.011 posts

- 15. #NJDevils 1.917 posts

- 16. Monken 6.957 posts

- 17. Lamar 37,5 B posts

- 18. Meredith 3.399 posts

- 19. Ashli Babbitt 117 B posts

- 20. Wes Miller N/A

Something went wrong.

Something went wrong.