Semiotic Labs

@semioticlabs

We build intelligent financial products for the onchain economy. Core devs of @graphprotocol. Backed @odosprotocol & @CambrianNetwork

You might like

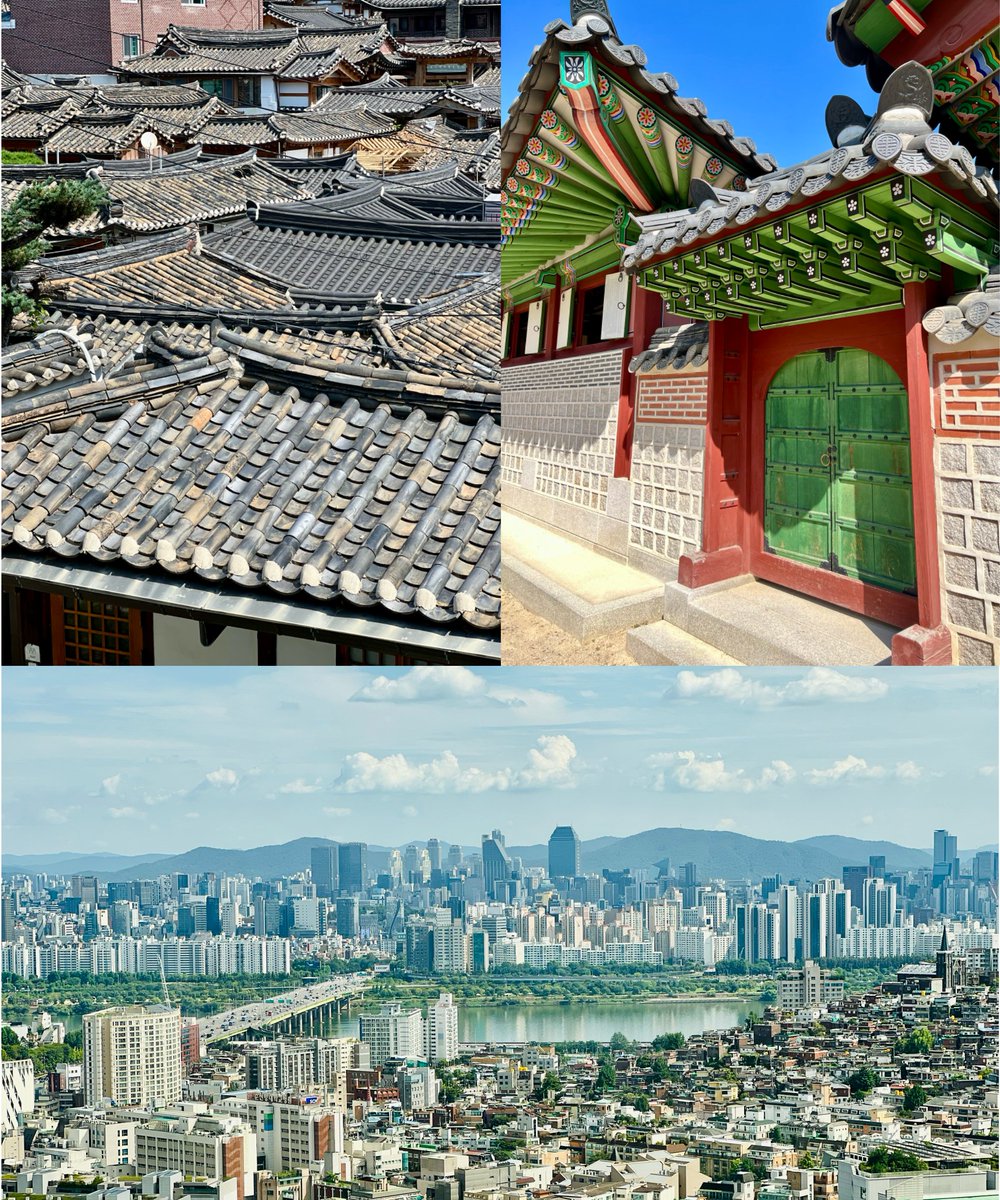

Heading to #KBW2025 in Seoul and #TOKEN2049 the following week. Teams looking past hype to the core infra of agentic economies: let's meet. DM @therealmrswiss to lock a time.

More people should be talking about how AI is becoming cognitive infrastructure.

Stablecoins are native money for AI. Agents demand stable rails, micropayments & global scalability. Stablecoin adoption will scale with both human users & AI agents. Galaxy Digital CEO @novogratz: "in the not-so-distant future, the biggest user of stablecoins is going to be…

AI agents aren’t hype anymore, they’re budgets. -100%+ ROI projected -80% already deploying -50% of budgets allocated The @MultimodalAI report nails the what. The trillion-dollar question is the how. How will agents transact autonomously? We’re building the verifiable payment…

AI agents are reasoning already. What's the most important thing to reason about? How to spend money.

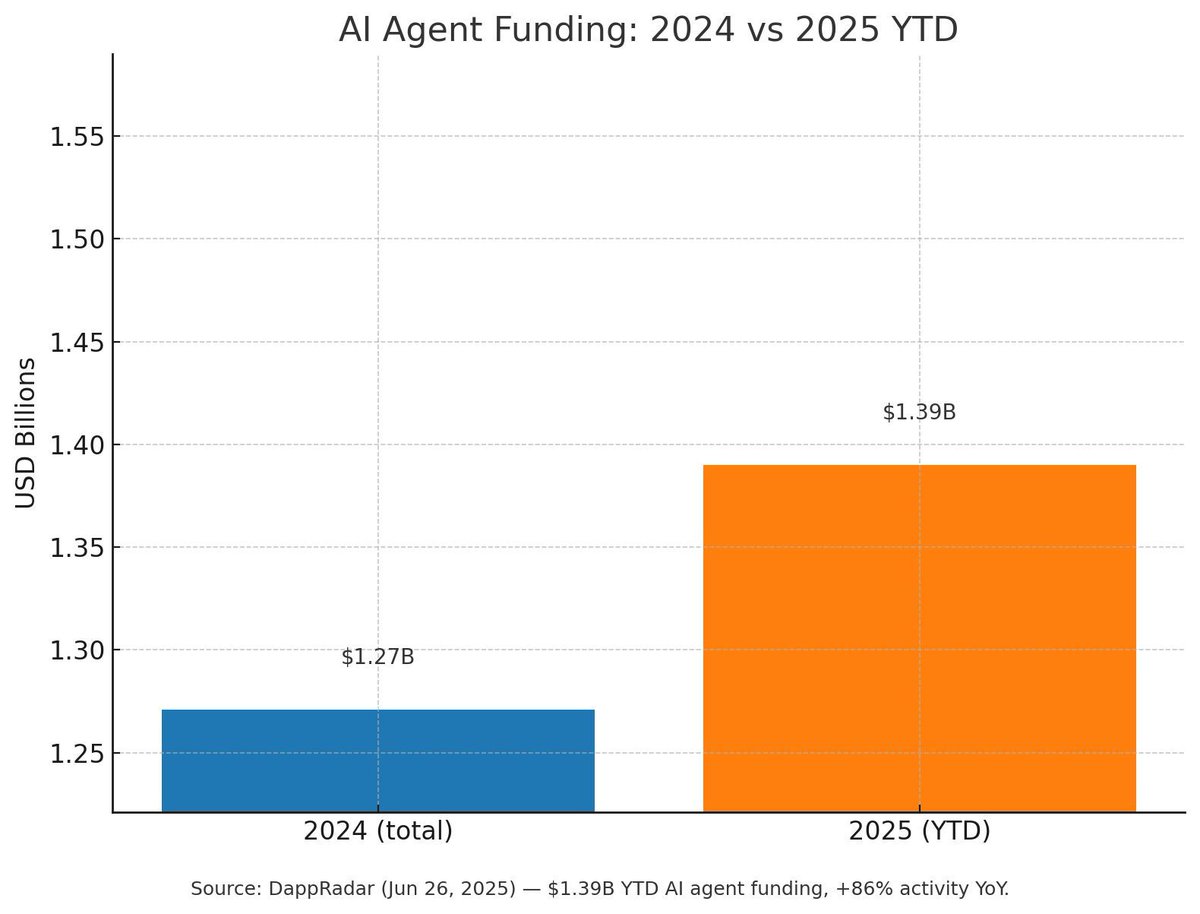

Agent activity onchain is up 86% YoY, with $1.39B raised in 2025, already ahead of 2024’s total. The theoretical phase of AI agents is over.

ZK proofs verify a computation's result without re-running it. But who verifies the data fed into the computation? 🤔 That's why we're obsessed with Verifiable Data Extraction. The next frontier isn't just private computation, but provably correct computation.

Missing Seoul and one of my favorite events, #KBW2025 💙 I can’t make it this year, but the @SemioticLabs and @Odosprotocol teams are there — excited for all the connections and energy!

Checkout isn’t just broken. It’s obsolete. In agentic commerce, the “buy” happens upstream at the moment of intent. If your payments stack doesn’t move with it, you won’t even make it into the cart.

Proud to see our research land in @graphprotocol's Token API Beta. AI-driven NFT spam/scam filtering across ERC-721 and ERC-1155 means safer defaults for builders.

New in The Graph’s Token API Beta: Spam & Scam Filtering is live 🔥 Automatically filters: ⛔ Junk tokens ⛔ Airdrop spam ⛔ Malicious NFTs So you get: ✅ Safer UX ✅ Cleaner wallets ✅ Smarter apps Build with clean, trusted data - effortlessly.

2023: “agents can’t even book a calendar event” 2025: agents are paying each other with crypto via open protocols x.com/Ahmet_S_Ozcan/…

. @Google recently announced the Agent Payments Protocol (AP2): an open standard for agent-led payments across cards, bank rails… and crypto. Protocols, not platforms, will set the rules of agentic commerce. With crypto rails, agents can transact natively on-chain.

Check out my latest article: Odos at WebX Fintech EXPO: Connecting Global Payments and Tokenized RWAs linkedin.com/pulse/odos-web… via @LinkedIn

The @federalreserve ‘s October conference will spotlight stablecoins, tokenization, and AI payments. Imagine writing this 5 years ago. Now imagine not pricing it in.

The London Stock Exchange just won FCA approval for Pisces, a regulated private market for company shares. The platform introduces structured liquidity for institutional investors in private assets. Private assets are about to trade with public-market liquidity rules.

Today your customer is a human. Tomorrow it’s their AI agent. The test becomes Product–Agent Fit: can an agent parse your data, hit your APIs, and pay without tripping human roadblocks?

. @TheEtherMachine just raised $654M in ETH, not USD. That’s IPO-scale capital, raised natively onchain. That means crypto is becoming a primary venue for raising institutional-scale capital.

. @Figure is targeting a $4.1B IPO. A blockchain lender going public is validation that credit, the foundation of modern finance, can run on blockchain rails.

The financial system was built as an “anti-automation system.” CAPTCHAs, SMS codes, and 3DS all assume automation = fraud. That logic collapses when the bot *is* the customer. Unless agents can authenticate and authorize payments natively, Product-Agent Fit fails at the final…

United States Trends

- 1. Jets 90.7K posts

- 2. Jets 90.7K posts

- 3. Justin Fields 13.4K posts

- 4. Aaron Glenn 5,949 posts

- 5. Sean Payton 2,926 posts

- 6. London 207K posts

- 7. Garrett Wilson 3,853 posts

- 8. Bo Nix 3,938 posts

- 9. #HardRockBet 3,461 posts

- 10. #DENvsNYJ 2,404 posts

- 11. Tyrod 1,980 posts

- 12. HAPPY BIRTHDAY JIMIN 165K posts

- 13. #JetUp 2,280 posts

- 14. #OurMuseJimin 211K posts

- 15. Bam Knight N/A

- 16. #30YearsofLove 182K posts

- 17. Breece Hall 2,132 posts

- 18. Kurt Warner N/A

- 19. Peart 1,953 posts

- 20. Sutton 2,910 posts

You might like

-

Sam Green

Sam Green

@0xsamgreen -

Nick Hansen

Nick Hansen

@TwentyTwoNode -

GRTiQ

GRTiQ

@grt_iq -

Ahmet Ozcan | Odos Protocol | Semiotic Labs

Ahmet Ozcan | Odos Protocol | Semiotic Labs

@Ahmet_S_Ozcan -

Graphtronauts

Graphtronauts

@graphtronauts_c -

Kyle Rojas | Working at Avail

Kyle Rojas | Working at Avail

@kyleArojas -

Vincent

Vincent

@vincentpeaq -

Ethereum Daily

Ethereum Daily

@EthereumDaily_ -

Indexer Office Hours

Indexer Office Hours

@TheGraphIOH -

Brandon Ramirez

Brandon Ramirez

@RezBrandon -

Geo

Geo

@geobrowser -

0xMarcus

0xMarcus

@Marcus_Rein_ -

Jim | Wavefive 🌊 ⛛

Jim | Wavefive 🌊 ⛛

@jimwavefive -

Mr. Carl @ The Graph

Mr. Carl @ The Graph

@Hagerling -

Tomasz Kornuta 🇵🇱🇺🇦🇺🇸

Tomasz Kornuta 🇵🇱🇺🇦🇺🇸

@TomaszKornuta

Something went wrong.

Something went wrong.