SoftwareIQ

@software__iq

A modern research platform purposefully built for the software industry. Sign-up today!

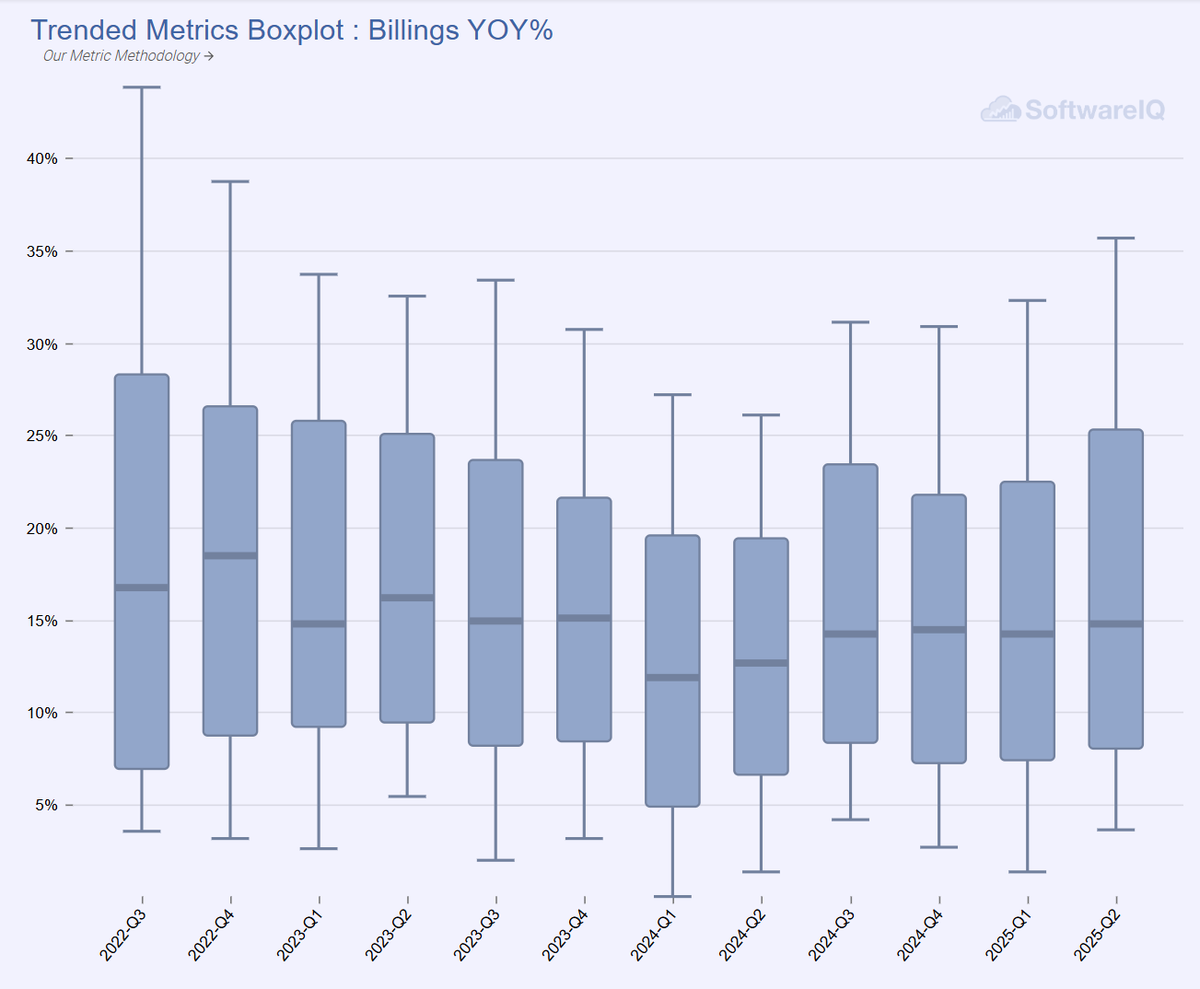

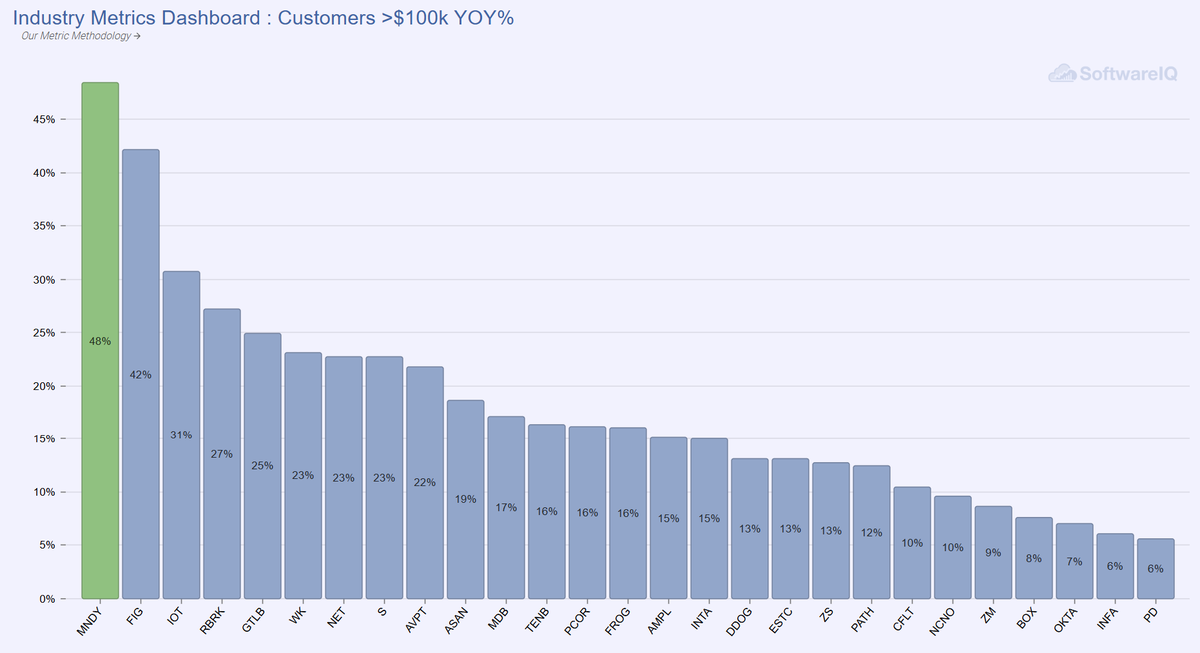

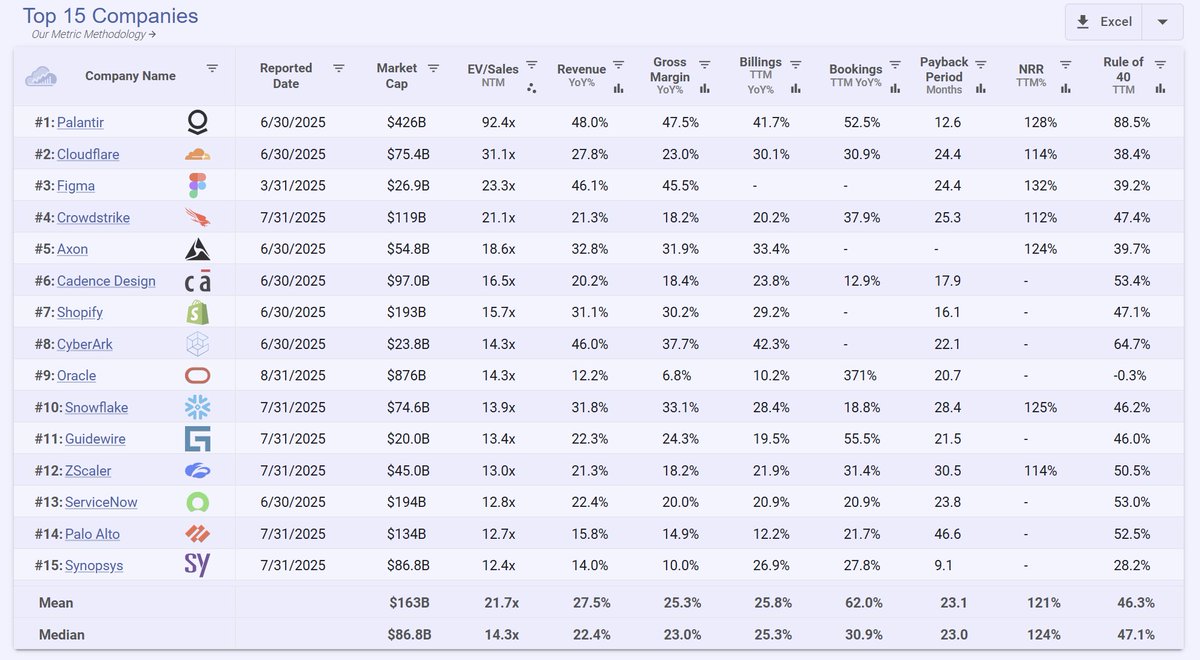

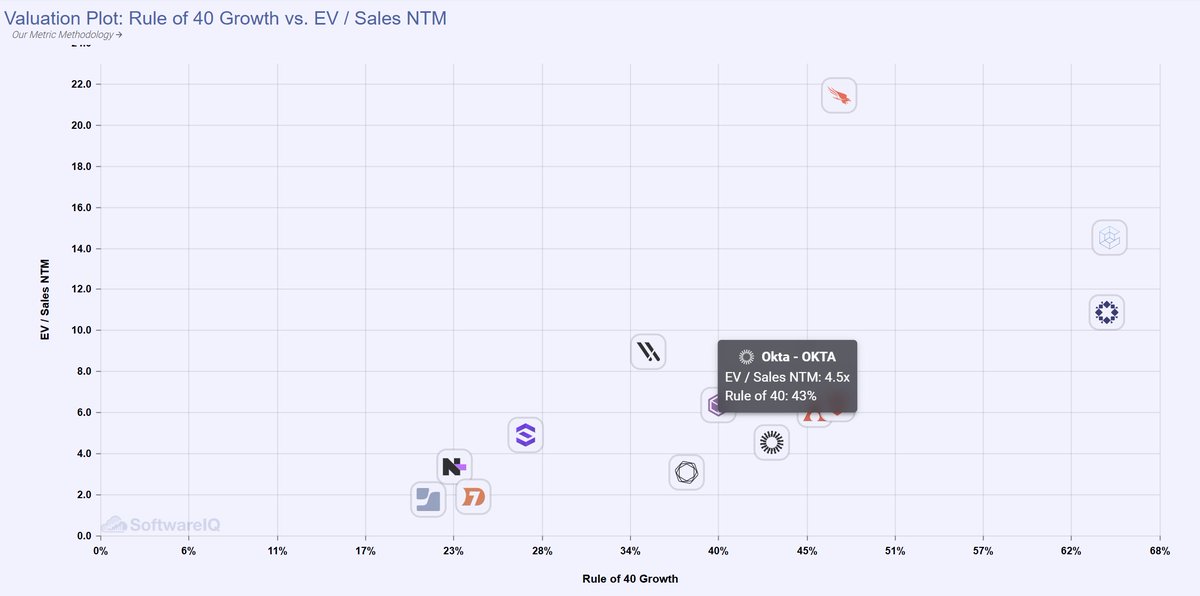

Median software valuation now well below liberation day valuations and at 3-year lows. Growth rates stabilizing/showing modest re-acceleration.

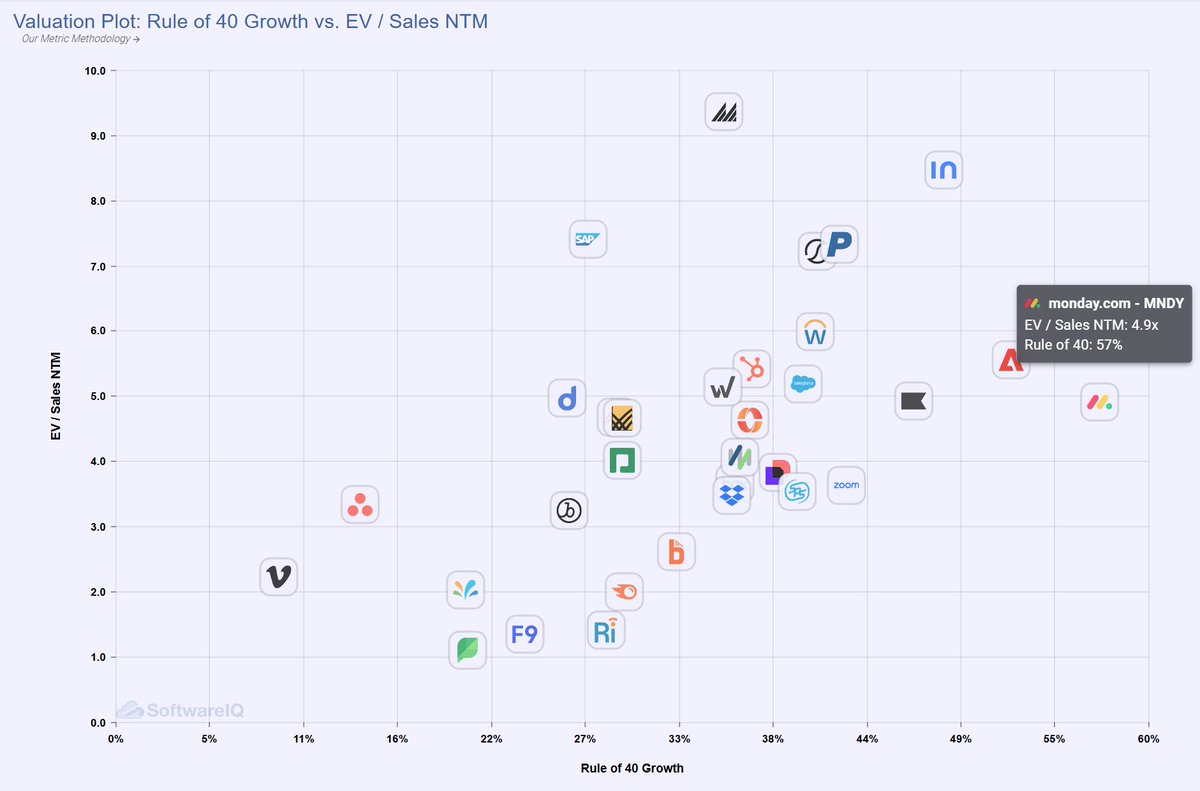

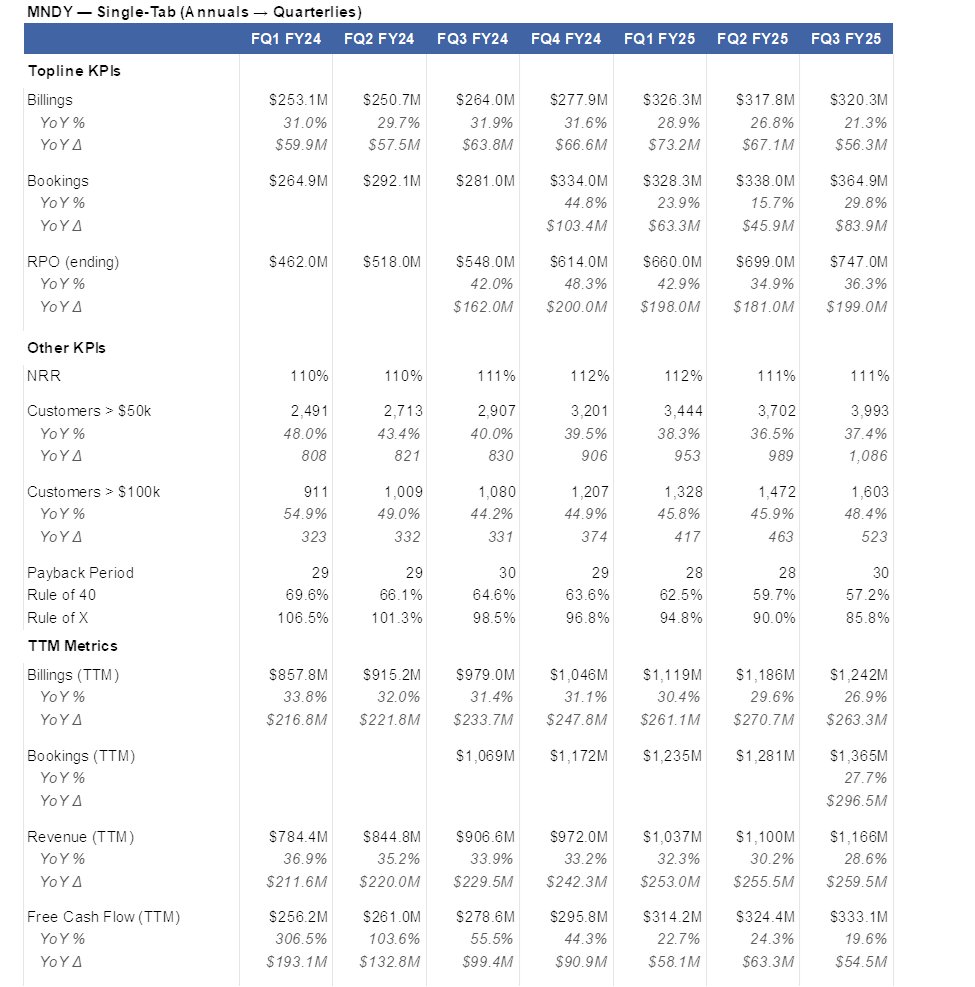

Favorable r/r in MNDY ~5x sales at a rule of 60. The opportunity upmarket is untapped. While core SMB business is softening, growth in upmarket continues to accelerate. Customers >$100k growing 48% still only 27% of ARR. Additionally new products now 10% of ARR as CRM and…

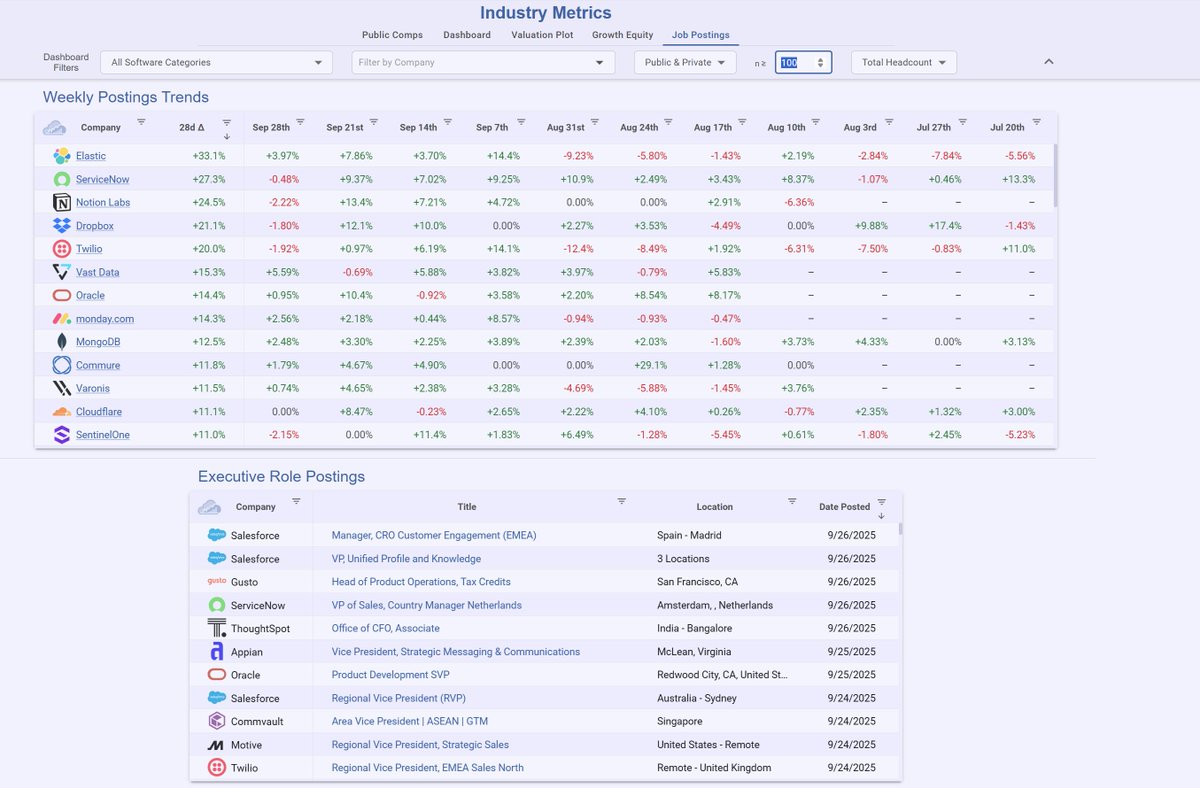

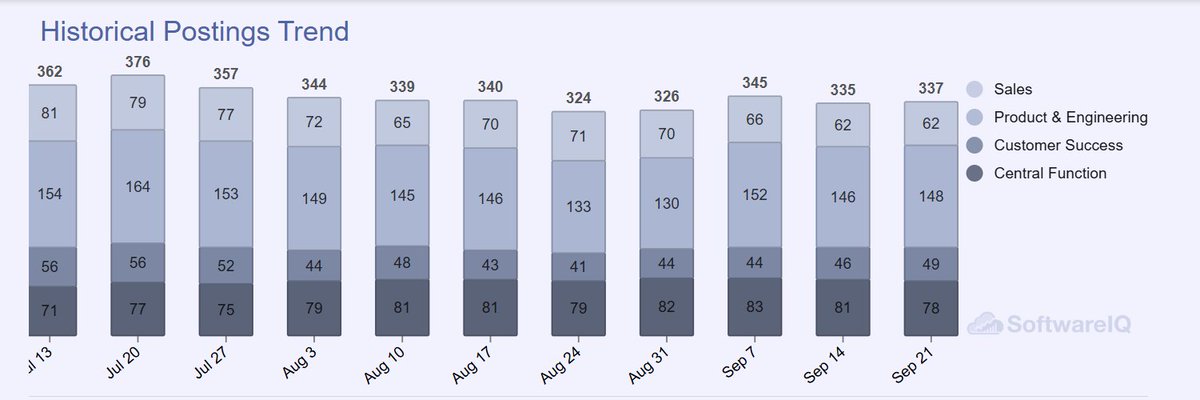

Weekly postings through November. On upcoming reports, strong QoQ postings trends in Samsara, Rubrik, Elastic, Zscaler.

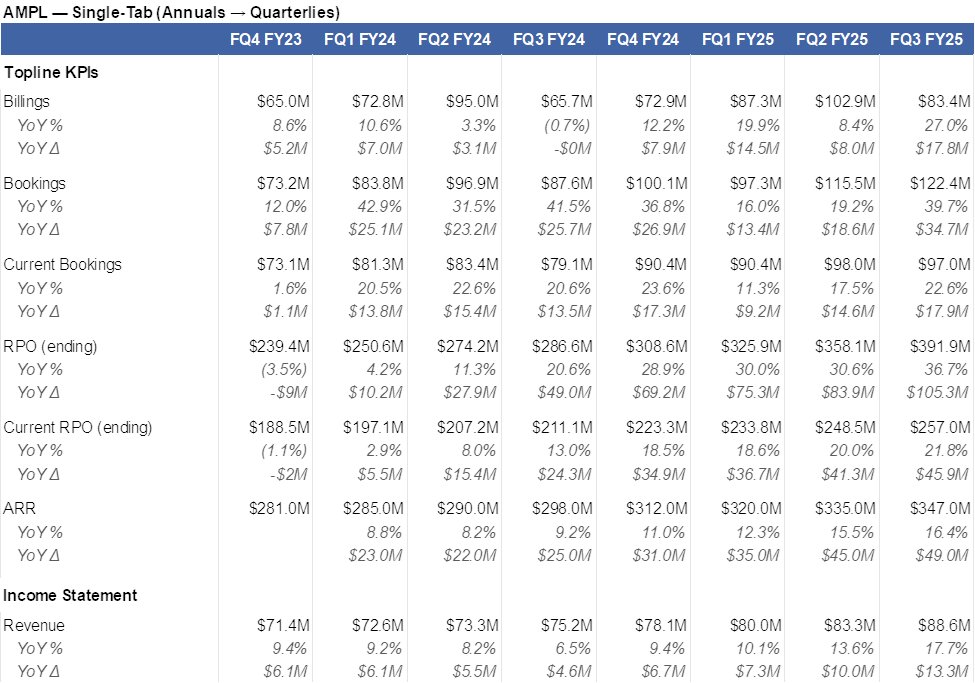

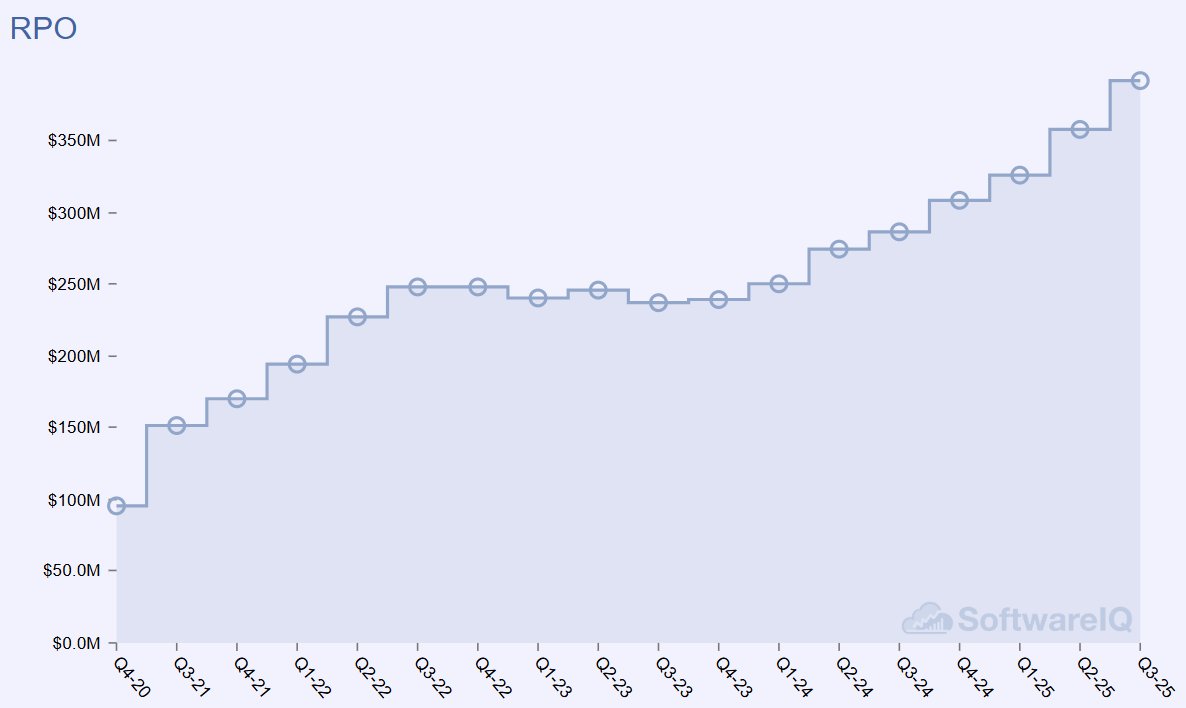

Amplitude $AMPL numbers have gotten a lot better while without much of a move in the stock. <4x sales for a category leader moving up-market with some option value on app proliferation. Top-line metrics continue to accelerate. Unit economics are ok, but getting better. GRR…

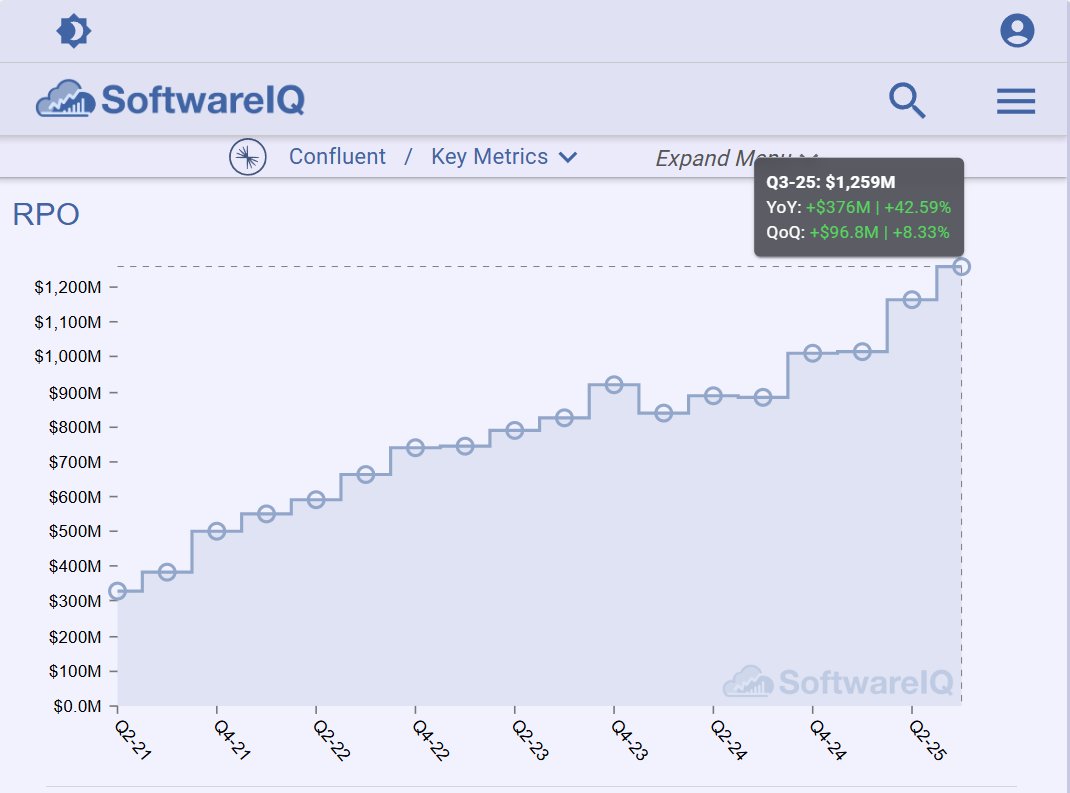

Q3 Confluent bookings acceleration continued (RPO +42%). Cloud seq add below 24 with additional headwind in Q4. Flink ARR up 70% sequentially. Emphasis on consumption GTM materially affected 24. Solid bookings in 25 sets-up well for 26. Contracts are a leading indicator here.

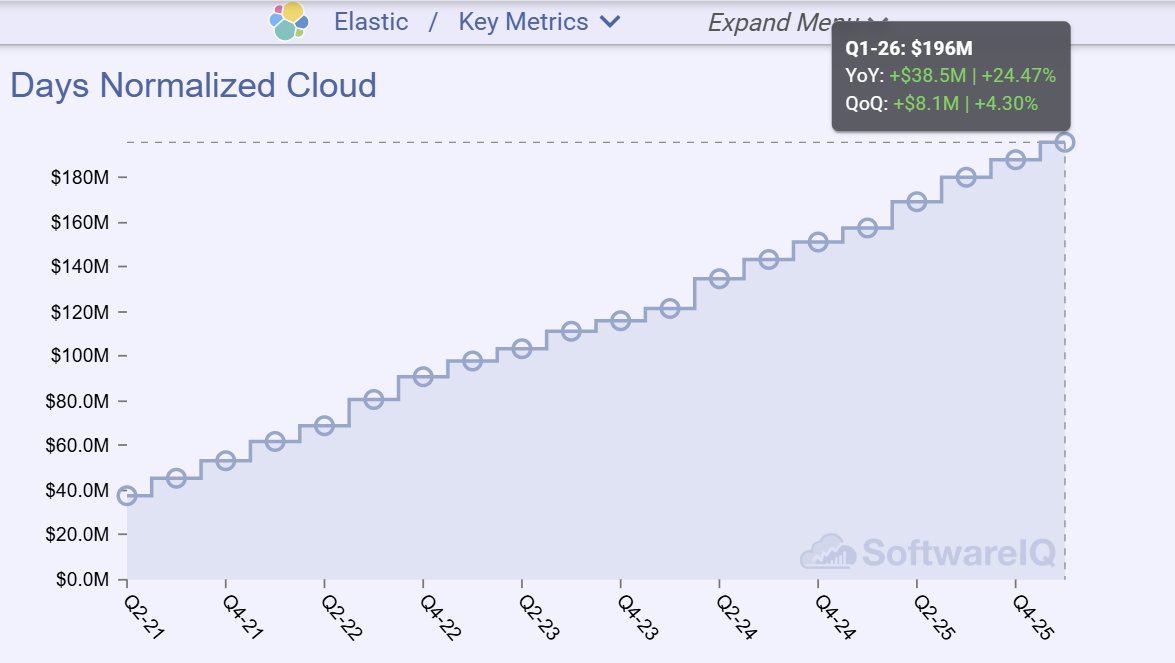

We've launched a 91-day normalized revenue for cloud and ratable SaaS revenue models now live on the platform. Capture and visualize underlying sequential trends across quarters without manual adjustments!

We've rolled-out updates on our job posting datasets available now to pro subscribers. Take a look today! Get insight faster across your coverage with filters based upon role type (ie quota bearing roles, product/engineering). See company specific trends with pro! Top of…

Most richly valued SW continues to be expensive! Requirements include a good story, momentum and decent FCF margins (excl. ORCL). There is a high variance in growth rates from teens to 40s.

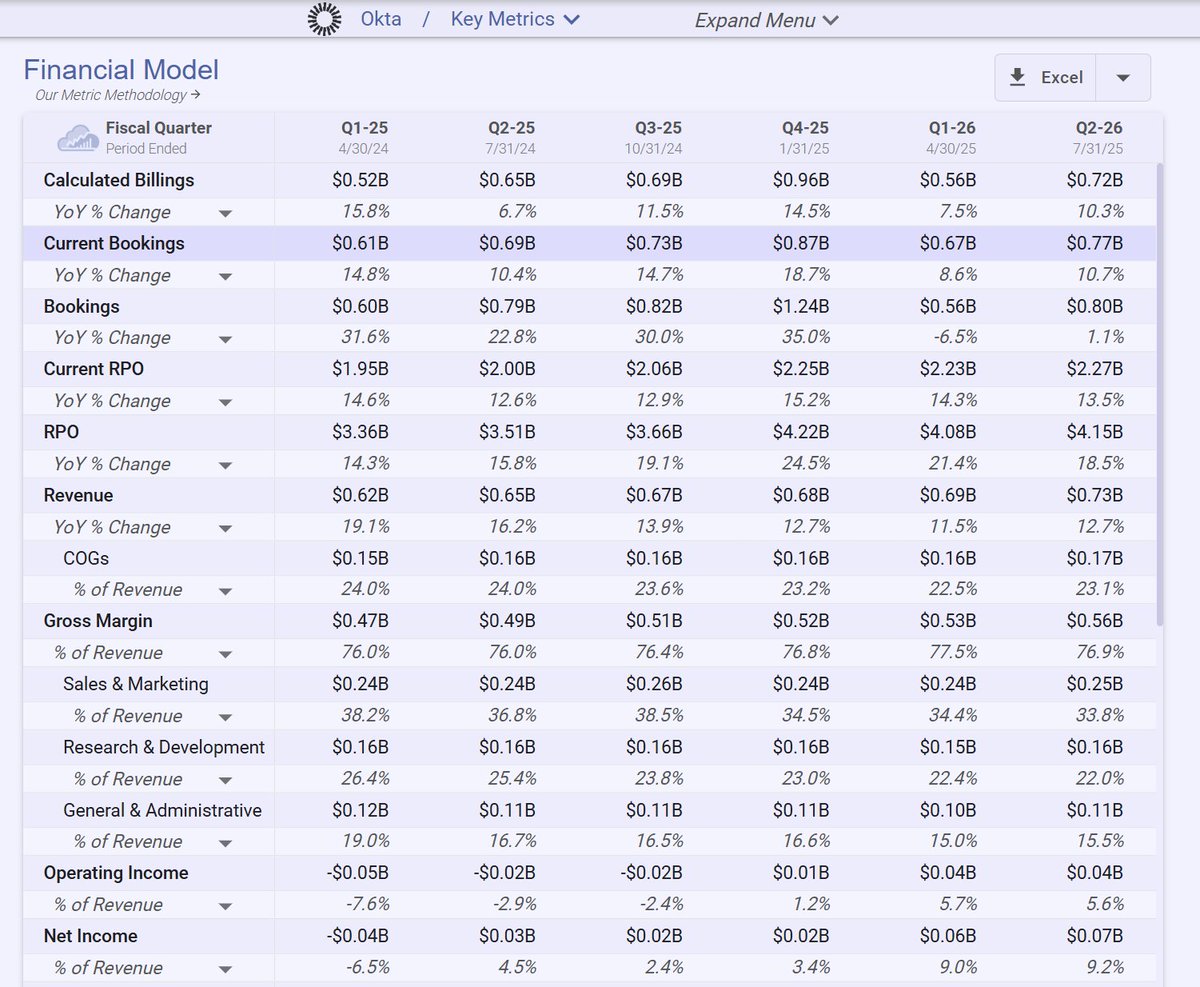

The $OKTA story remains an execution story for H2. Performance YTD has been soft after a strong Q4, with stable hiring trends. Not sure any incremental disclosure will drive stock without execution (especially given Okta's past GTM inconsistency). Bookings strength in FY25…

United States Trends

- 1. Knicks N/A

- 2. #NationalChampionship N/A

- 3. #WWERaw N/A

- 4. #CFBPlayoff N/A

- 5. Max Christie N/A

- 6. Don Lemon N/A

- 7. Mike Brown N/A

- 8. Marcus Freeman N/A

- 9. #GoCanes N/A

- 10. Mavs N/A

- 11. Hoosiers N/A

- 12. Thibs N/A

- 13. Dwight Powell N/A

- 14. Jeff Hafley N/A

- 15. Finn Balor N/A

- 16. #NeverDaunted N/A

- 17. UConn N/A

- 18. Azzi N/A

- 19. McDermott N/A

- 20. MLK Day N/A

Something went wrong.

Something went wrong.