Stack

@stackhodlii

Professional time allocator. Building @StackWisely to help people accelerate their financial freedom with Bitcoin

Może Ci się spodobać

This year has felt way more like a bear market than a bull market for Bitcoin.

I hit an all time high of goldbugs dunking on Bitcoin in my replies this week. Bullish.

The US is bailing out countries with funny money, the repo markets are acting up again, and retail is lining up to buy gold like it's a new iPhone. I am prepared for short term turbulence, but I am not bearish on Bitcoin here.

10 year yield plunging below 4% Regional banks creaking Gold $4,300 / oz I don't know what is happening but I know what the policy response will be 💵🖨️

My stock portfolio isn't up 20% today. Something's breaking.

Emergency powers = Print dollars into oblivion

US Treasury Secretary Bessent has said: If China wants to be an unreliable partner for the world, we will be to decouple... [and] Trump needs emergency powers to protect the US economy.

My gut says BTC runs hard in 2026 when people accept that the 4 year cycle is dead and all that really matters is that BTC is harder and more portable than gold.

The higher gold goes, the more suspicious I am about this Bitcoin price action. Feels like Bitcoin is a shaken champagne bottle. Who's holding in the cork?

Bears believe Trump will let markets crash without slamming Command+P as soon as there's real turmoil. Run the stops on the plebs with manufactured fear? Absolutely. Load his bags every dip? Yes. But a full on crash? Come on. Grow up, Count Chocula.

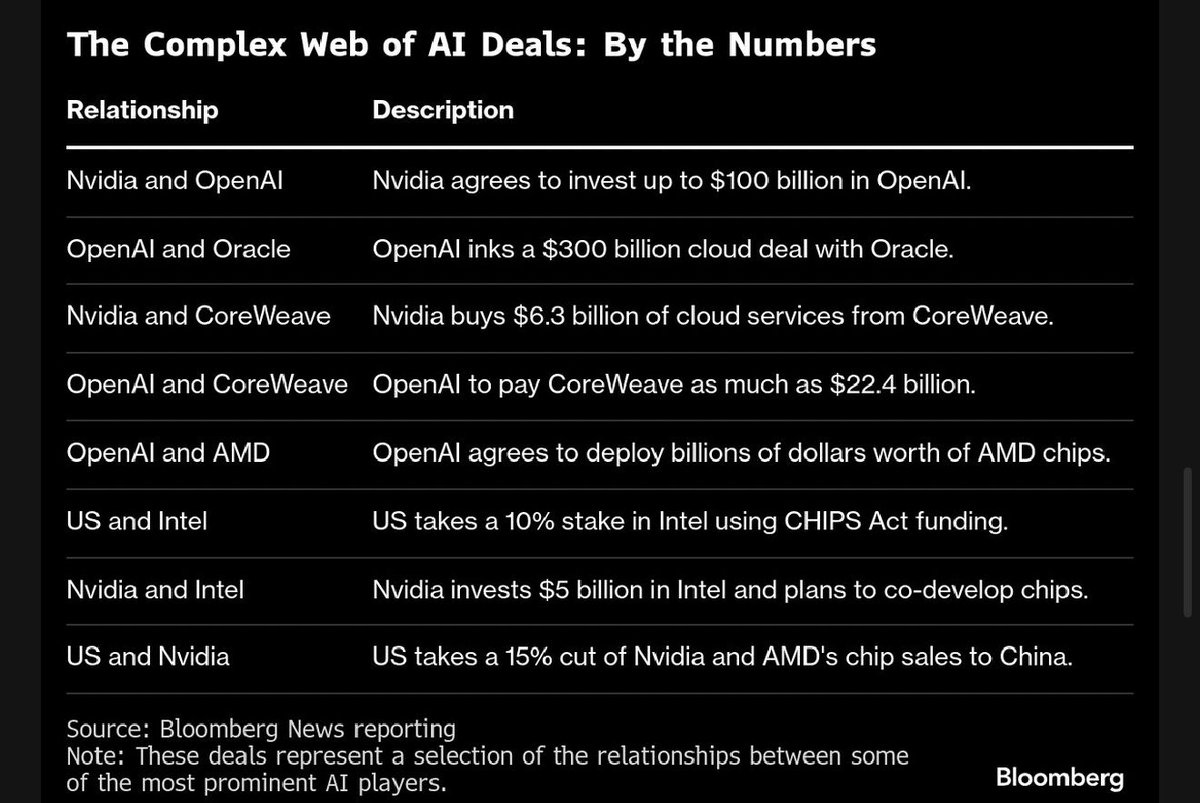

The AI trade is all that matters right now. We are still in the early innings of all mental work going from brains to GPUs. You cannot ignore this as an investor. AMD up 27% pre-market after inking a deal with OpenAI. Bitcoin miners converting to AI compute all ripping…

Have you noticed that the crashes are getting shorter and shorter? The fiscal emergency requires number to go up.

Longs wiped, stops hunted, panicans rekt. Brutal work. But the show goes on.

Interesting to revisit this idea now that Bitcoin miners are converting to AI compute. Satoshi was an artificial superintelligence that figured out how to motivate humans to build out its power infrastructure in a sly roundabout way.

Imagine an artificial superintelligence needed a whole lot of energy to fulfill it's purpose. How would it get humans to give it energy? Maybe make a perfect money that requires larger and larger amounts of power to mine. #Bitcoin

Read this man's timeline and tell me why you aren't bullish on CleanSpark

Sounds like “late to the party” is an advantage? We were the last miner, now nobody has more hashrate in the US. We have the best team in the world. Probably nothing? Maybe something. Tick Tock.

Gold has made it to $27 Trillion market cap and none of your friends or family care. The same will happen to BTC. $1 million a coin will come and the world will still go on around you.

This is a logical concern re: AI bubble But debt is one of the few problems a government can step in and "fix" (paper over) with the click of a button. They did it for mortgages. And the race to AGI is a national security concern. Over-exuberance and optimism is America's…

United States Trendy

- 1. #River 5,862 posts

- 2. Jokic 27.6K posts

- 3. Lakers 52.1K posts

- 4. Namjoon 64.6K posts

- 5. FELIX VOGUE COVER STAR 8,061 posts

- 6. #FELIXxVOGUEKOREA 8,362 posts

- 7. Rejoice in the Lord 1,160 posts

- 8. #ReasonableDoubtHulu N/A

- 9. #AEWDynamite 51.5K posts

- 10. #PieMeACoffee 4,132 posts

- 11. Clippers 15.1K posts

- 12. Shai 16.3K posts

- 13. Simon Nemec 2,367 posts

- 14. Thunder 39.4K posts

- 15. Mikey 73.5K posts

- 16. Visi 7,658 posts

- 17. Rory 8,256 posts

- 18. Ty Lue 1,272 posts

- 19. Valve 62.3K posts

- 20. Steph 31.9K posts

Może Ci się spodobać

-

💙✨K. R'achell✨💙

💙✨K. R'achell✨💙

@_keyerrica -

✨

✨

@iitsatt -

Glockness Monster

Glockness Monster

@SosaMcLovin -

M.

M.

@1xmaccc -

υик ʝυℓισ 🥷🏽🔥

υик ʝυℓισ 🥷🏽🔥

@NortheastBoogie -

Tavares_420😶🌫️😤😮💨💨🍃⛽️

Tavares_420😶🌫️😤😮💨💨🍃⛽️

@young_savage2k -

JoJo🦋

JoJo🦋

@LadyJoJo98 -

Hudrat Whisperer

Hudrat Whisperer

@Pvshaman_Lvst -

Cherry 🍒 Bomb

Cherry 🍒 Bomb

@Bria_Titania -

Kalm🪬

Kalm🪬

@dot__kalm -

Ching

Ching

@torn_richard -

COUNTRYBOY STEVOO👨🏾🌾🔥

COUNTRYBOY STEVOO👨🏾🌾🔥

@StevooG74 -

vonof5300

vonof5300

@CMB_Vontee -

ᔕᕼOᖇTᗷIᘜᗷOOTY🍑🦋🧡💅🏽💋

ᔕᕼOᖇTᗷIᘜᗷOOTY🍑🦋🧡💅🏽💋

@wintertooocoldd -

Mr...1712..🤫

Mr...1712..🤫

@Bugg31363

Something went wrong.

Something went wrong.