rebirth_unknown

@stacktoodeeep

people calling for $101k, didn't you just see they crashed binance alts to nearly 0 and 101k touched. how much more down do you want from this?

An entire generation watched The Big Short, thought Michael Burry was cool, and spent the next decade calling everything a bubble.

the users seriously have no clue just how bad hyperliquid is, almost sad, but i guess no one cares

DeFi protocols should be quoting Hyperliquid oracle prices rather than CeX's that have every intention of liquidating users for profit. On Hyperliquid nobody but the user has control over their funds, CeX's or malicious MM's can't sell user funds to push prices to even 0 just to…

I will never forget the level of crime that happened this weekend

timelapse of $BTC 30s chart, 116k to 100k hyperliquid liquidations included sound on

You actually had people saying "fill the wicks lower" Brother those prices are never happening again the entire universe had to get wiped out to even reach that Stone cold retards

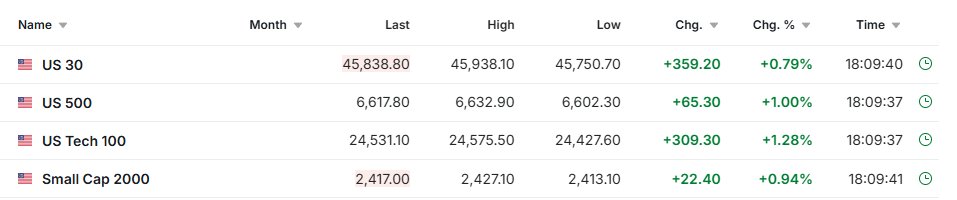

bitcoin down, stonks futures up, crypto turning into the worst trade possible for 2025

The $SOL bulls are back. 📈

This says a lot about XRP, did not realize it also got tagged on Coinbase.

markets rekting every single direction, no idea any longer except hope it all pumps to the moon

Update on my JLP loan: I’ve been borrowing 44,000 USDC, and so far I’ve paid about $15 in interest. My sHYUSD position is already worth $44,100. Net gain: $85

Just borrowed some USDC at 8% against some of my JLP, which I converted to sHYUSD currently yielding 17% Gud tek

The word engineering doing some heavy lifting here

After some very hard work by the engineering team during the middle of Friday night / Saturday morning, the system came back online at 3AM and other components including the pricing and risk engines were live too. We had to be careful to make sure there were no bad orders or…

get your funds off binance immediately. x.com/CryptoCurb/sta…

btw, the only reason a CEX posts stuff like this is if they are severely implicated. get your funds off binance.

Withdraw your funds from binance.

If you can force liquidation transfers and book internal short P&L while delaying withdrawals by “going down” the hole shrinks fast. 8-12 bps in fees on record notional, fees alone become material in a $100–$300B turnover day Binance, Bybit, hyperliquid I don’t trust them.

$BTC Looks like $115K was a key trigger for some large players too (likely a firm)

you're welcome

general rule of thumb, plot the .5 fib on these daily wicks. thats the area you want to see respected

Sad stuff

On Oct 10, 2025, extreme market volatility caused by global macroeconomic events led to significant losses for some Binance users. Binance has reviewed the impact and fully covered these losses, distributing ~$283M in compensation across two batches, including following…

We've spent the last 10 months analyzing EVERY single tariff development: Here's the EXACT playbook for investors. 1. Trump puts out cryptic post on tariffs coming for a specific country or sector, markets drift lower 2. Trump announces large tariff rate (50%+) and markets…

with hyperliquid oracles being trash, how does hype liquidity work when the prices are basically based off of nothing?

Binance Boycott is the #1 trending tag on Turkish twitter. Turks make up for 20-25% of all Binance users. They need to discover Hyperliquid, trade where things are transparent and fair for all. #BinanceBoykot Hyperliquid.

United States Xu hướng

- 1. Columbus 80.4K posts

- 2. #WWERaw 34.7K posts

- 3. #SwiftDay 9,008 posts

- 4. #IDontWantToOverreactBUT N/A

- 5. #IndigenousPeoplesDay 3,757 posts

- 6. Middle East 174K posts

- 7. Seth 30.6K posts

- 8. Marc 38.7K posts

- 9. Knesset 133K posts

- 10. Thanksgiving 45.9K posts

- 11. #MondayMotivation 13.5K posts

- 12. The Vision 87.2K posts

- 13. Victory Monday 2,111 posts

- 14. Flip 50.5K posts

- 15. Good Monday 42.8K posts

- 16. Bron Breakker 4,033 posts

- 17. Bronson 5,885 posts

- 18. Heyman 4,131 posts

- 19. Branch 50.3K posts

- 20. Egypt 168K posts

Something went wrong.

Something went wrong.