내가 좋아할 만한 콘텐츠

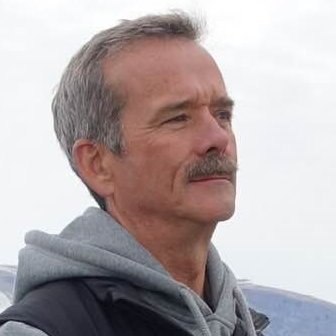

Do not forget to setup AWS reserved compute or cost savings plans.

When your cofounders are being lazy you lock in and look for new cofounders.

"vibe coders don’t understand the code!!!" - javascript dev with 280gb node_modules folder

When the pipe regex hits you.🤓 --json body -q ".body" | egrep "^\s*\`\[" | tr -d "\`." | tail -n1 | jq

Magic.

Look at the flow of liquid metal in the die of a 20,000 ton Giga Press with dual injection system 🤯🌊

One of the best finance books ever written is The The Psychology of Money. It will change how you look at your money and finances forever. These are the 6 most important lessons everyone needs to learn:

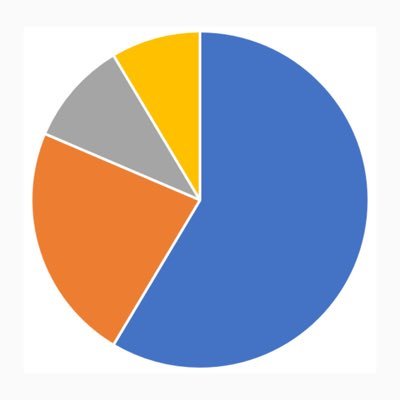

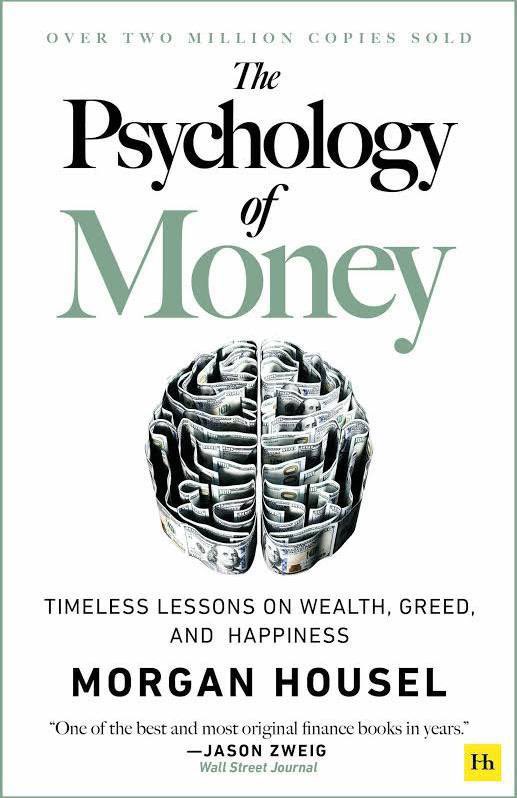

"Many people like to pretend without "magnificent seven", it is all but impossible to outperform the market. Not true. 132 companies have YTD higher than $SPY (as of 20 Nov, 2023). The green area indicates > S&P 500 returns YTD.

As per KoyFin, 132 companies have YTD higher than $SPY (as of 20 Nov, 2023). Many people like to pretend without "magnificent seven", it is all but impossible to outperform the market. Not true. It's a simple math, but not sure why such pretension persists (not just this year).

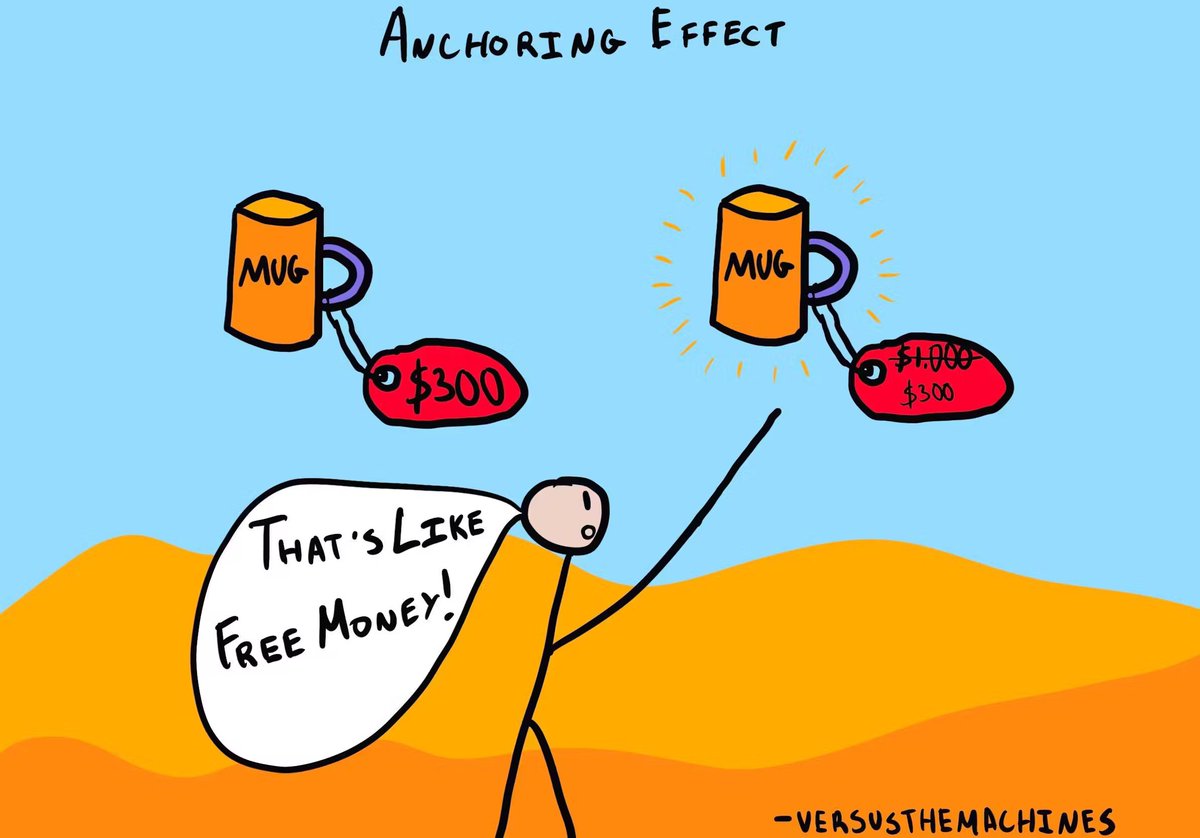

16 Biases that distort your Decision-Making 1. Anchoring Bias You rely heavily on the first piece of information you receive. Example: First seeing an expensive watch makes others seem cheaper.

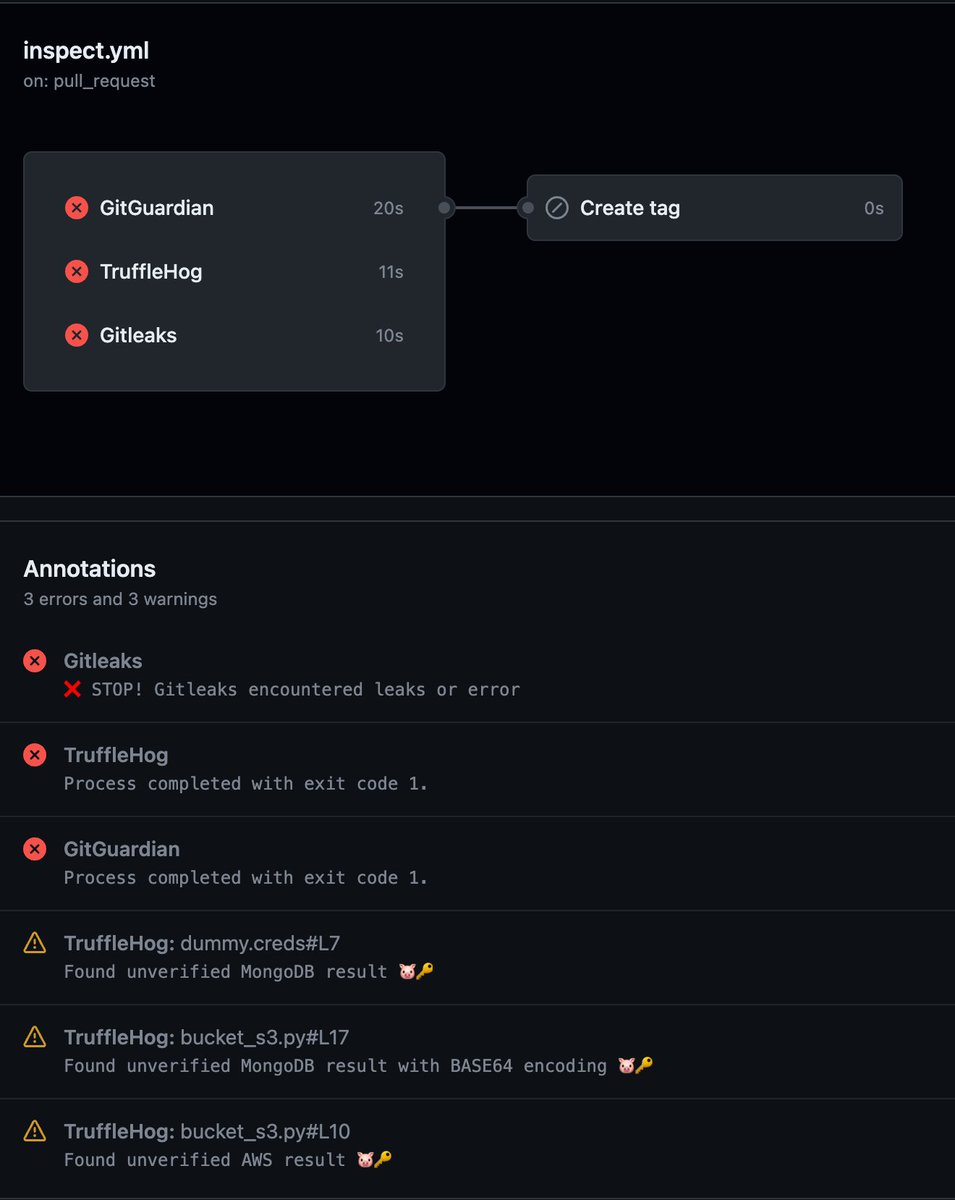

Setting some security pipelines for a new project. Kinda fun. Seems like GitGuardian, TruffleHog and Gitleaks are able to catch most creds I tested, but probably there is no point to run all 3.

Lam Research $LRCX raises dividend by ~16%, forward yield 1.18%. seekingalpha.com/news/4005971-l…

Badger Meter $BMI hiked quarterly dividends by 20% to $0.27/share This is the 31st consecutive years of dividend increases for this dividend champion

S&P 500 stock performance this year: 🇺🇲 Nvidia: +220% 🇺🇲 Meta: +170% 🇺🇸 Tesla: +116% 🇺🇸 AMD: +74% 🇺🇸 Salesforce: +70% 🇺🇸 Broadcom: +61% 🇺🇲 Amazon: +57% 🇺🇲 Adobe: +57% 🇺🇸 FedEx: +55% 🇺🇸 Apple: +50% 🇺🇸 Alphabet: +50% 🇺🇸 Booking: +49% 🇺🇸 Netflix: +44% 🇺🇸 Oracle: +42% 🇺🇸 Microsoft:…

Mondelez $MDLZ increased quarterly dividends by 10% to $0.425/share This is the 11th consecutive annual dividend increase for this dividend achiever

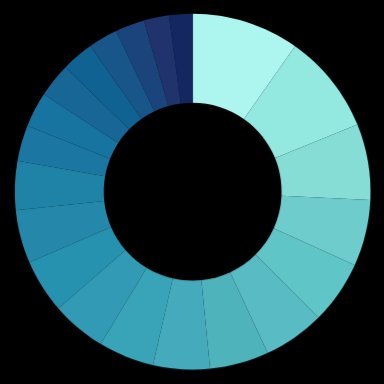

How to get from Revenue -> Free Cash Flow per share ⬇️⬇️⬇️ Which is your favourite metric for calculating growth? * R&D = Research and Development * SG&A = Sales, General and Administrative * D&A = Depreciation and Amortisation

United States 트렌드

- 1. Flacco 89.8K posts

- 2. Bengals 83.1K posts

- 3. Bengals 83.1K posts

- 4. #clubironmouse 3,755 posts

- 5. #Talisman 8,420 posts

- 6. #criticalrolespoilers 8,807 posts

- 7. Rodgers 56.3K posts

- 8. Tomlin 22.7K posts

- 9. #SEVENTEEN_NEW_IN_LA 56.6K posts

- 10. Cuomo 91.3K posts

- 11. #WhoDidTheBody 1,688 posts

- 12. yeonjun 119K posts

- 13. Ramsey 19.7K posts

- 14. Chase 107K posts

- 15. Chase 107K posts

- 16. Pence 78.8K posts

- 17. Who Dey 11.4K posts

- 18. Sliwa 39.8K posts

- 19. Mousey 1,322 posts

- 20. Ace Frehley 108K posts

내가 좋아할 만한 콘텐츠

-

Manon Desmarais CIM FCSI

Manon Desmarais CIM FCSI

@desmarais_manon -

sameer

sameer

@mhdsamr05 -

Pithadiya Nilesh

Pithadiya Nilesh

@PithadiyaNiles1 -

lambuatta

lambuatta

@sirkewalepyaaz -

LawGodAustralia

LawGodAustralia

@LawGodAustralia -

OldWolf

OldWolf

@OldWolfOrigine -

Mysteryfighter

Mysteryfighter

@Mysteryfighter1 -

Todd Mcpherson

Todd Mcpherson

@averagesho177 -

Jesse Fries

Jesse Fries

@Jfries32 -

Y.L

Y.L

@DAVEYULI -

Spencer

Spencer

@spencer_emery7 -

Michael

Michael

@MWinniata

Something went wrong.

Something went wrong.