Venkat

@svnraju7

I work at an investment bank, specializing in equities and fundamental analysis. All views expressed are my own.

Tal vez te guste

Big positive for BLS Int✅ • Earlier, the MEA had debarred BLS from participating in its tenders for 2 years • BLS challenged that ban in the Delhi High Court • High Court has now quashed that debarment order BLS can now again participate in all MEA & Indian mission…

#BlsInternational very positive as Hon’ble Delhi high court quashed the order of ban imposed by MEA in Oct 2025.

NVIDIA just released free online courses. No payment required. Here are the best courses you don’t want to miss in 2025:

If you are planning a trip to Vietnam in 2026, Save this Thread 🧵 We explored Ho Chi Minh, Da Nang & Hanoi. Totally worth it 😍 Here are all the details of the full itinerary, food & travel recommendations 👇🏻

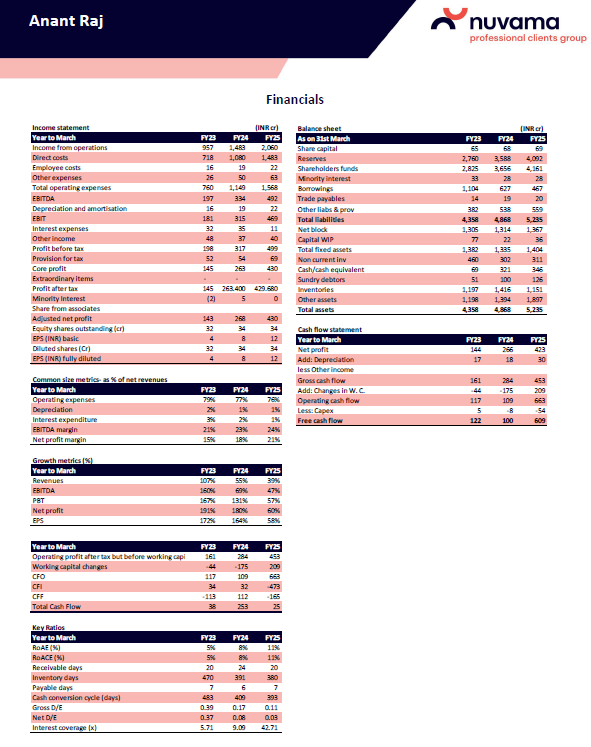

Anant Raj – Nuvama Interaction | Key Highlights from Emerging Ideas Conference 🚀Anant Raj Is Entering Its Biggest Growth Cycle Yet – Dual Engines Firing ENGINE 1 → Real Estate Development (NCR-focused, large land bank) 🔹312-acre paid land bank, among the deepest launch…

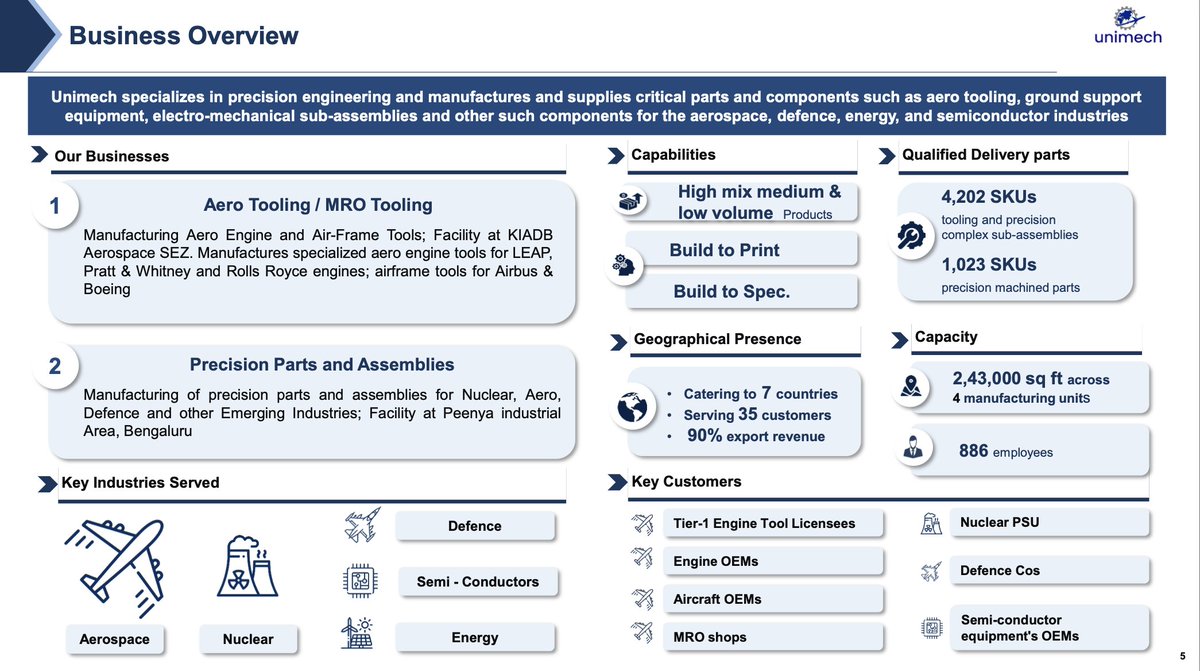

🚀 Unimech Aerospace: The Rise of India’s Next Precision Engineering Powerhouse (Aero • Defense • Nuclear • Semicon • Micro Turbines) Everyone thinks Unimech = “aero tooling company.” But the company is now building products and components for 6+ high-tech industries: ✈️…

Airfloa Rail Technology Ltd 🔖 🎯Revenue Guidence 82% growth For FY 26. ➡️3 Yrs Profit Growth ~ 127% 🔥 🕵️Promoter Holding ~ 54.20% A MEGA THREAD 🧵⬇️⬇️⬇️⬇️

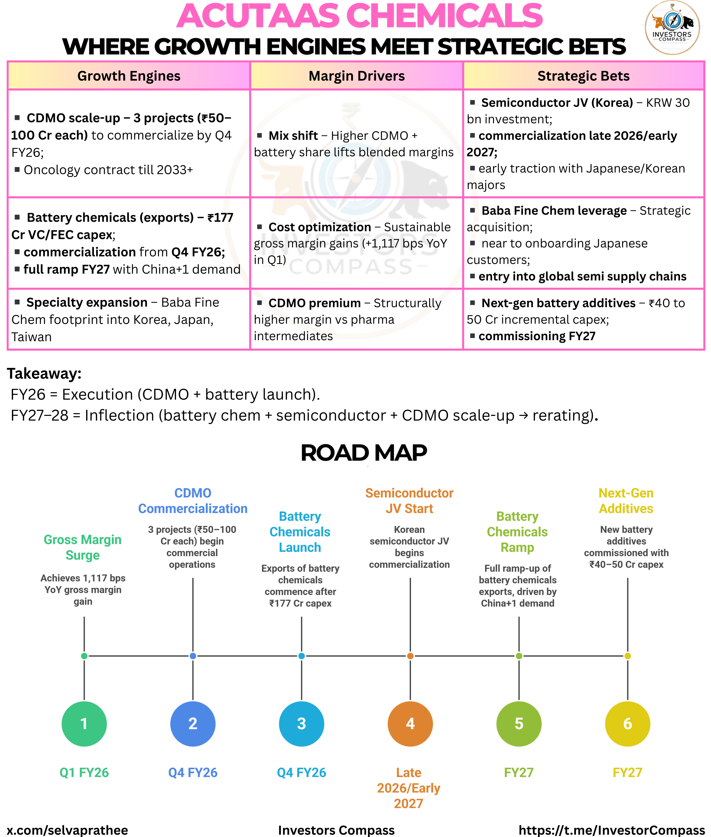

Study Acutaas chemical business model and learn how operating leverage play the game. => Q2 FY26 financial performance Q2 FY26 revenue is shown at about ₹306 crore, up roughly 24% year-on-year and about 48% quarter-on-quarter, driven mainly by strong pharma/CDMO growth and…

KSB with nuclear pump order in hand is missing??

👉Indian 🇮🇳Government is undertaking excellent growth intatives in nuclear power sector ✨ A list of 4 stocks which are undertaking the crucial nuclear power projects 🌟 A detailed 🧵 Thread 👇 !!! #StockMarket #StockMarketIndia #StocksToWatch #stocks #stock #invest…

Acutaas Chemicals – Roadmap Execution Tracker - A rare case where every growth engine has a dated trigger: 1⃣ CDMO (3 projects) 🗣️ “Commercialized by end of this financial year… revenue from H2 FY26.” ▪️ FY26-end = go live ▪️ H2 FY26 = monetisation begins 2⃣ Battery…

Acutaas Chemicals – The Inflection Playbook | Where Growth Engines Meet Strategic Bets - Not just another chemical company. It’s quietly evolving into a platform across pharma, batteries & semiconductors. - Why it matters 1 | Growth Engines = Cash Generators ▪️CDMO scale-up –…

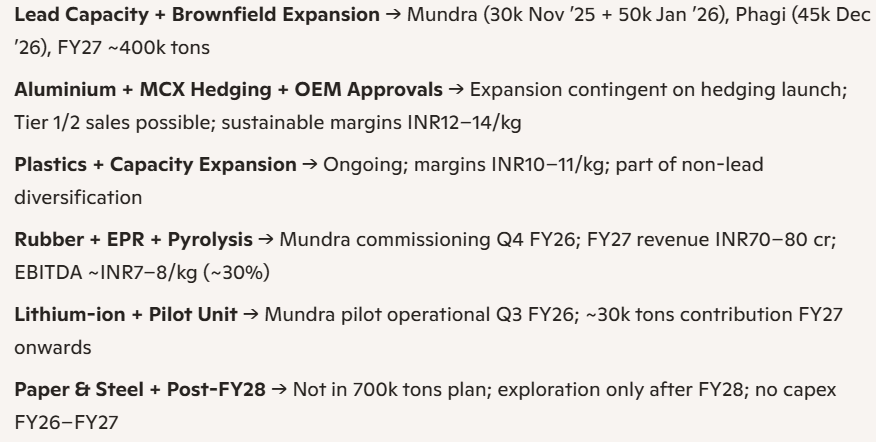

Gravita is driving Brownfield-led lead/aluminium/plastics expansion, new vertical diversification (rubber + lithium-ion), and regulatory tailwinds (BWMR/EPR), while paper & steel remain long-term bets post-FY28. ESG milestones and value-added products reinforce…

India’s Silent Auto Powerhouse That Builds Your Vehicles… Before They’re Built 95% of people don’t know this company. Yet, it assembles up to 75% of entire two-wheelers for OEM's, as an outsourced system partner. Not a parts vendor. Not Tier-1. A new category: Tier-0.5…

Techno Electric & Engineering Company Ltd - High Growth + Low PE Stock ? ( Deep Dive) For Data Centers , Power , T&D & Smart Meters Theme We Discuss Q2 FY 26 Results + Concall Why Is Market Not Rewarding This Stock ? Data Centers Revenue Potential ? Is There Upside Potential…

ORIANA Power #Oriana #OrianaPower H1 FY26 Concall Pointers: Guidance: 2000-2500cr revenue for FY26 Similar/better OPM Vision: 1000cr PAT by FY28 On track to achieve the same Revenue mix shift (short term and long term) : FY 26: 90% Solar; 10% BESS FY 27: 60% Solar; 40% BESS…

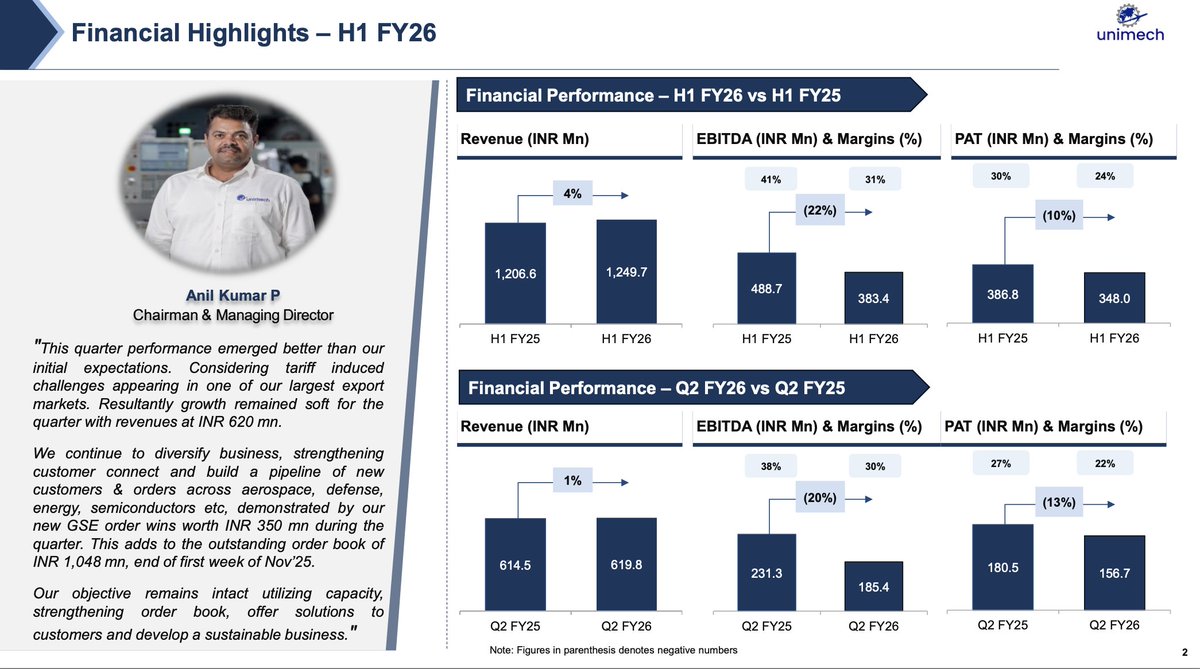

Unimech Aerospace & Manufacturing Ltd – Good Company to Track, But Going Through Near-Term Issues Unimech is an interesting aerospace player, but right now the company is facing problems, and that’s why valuations are correcting. Today, most of the revenue comes from the…

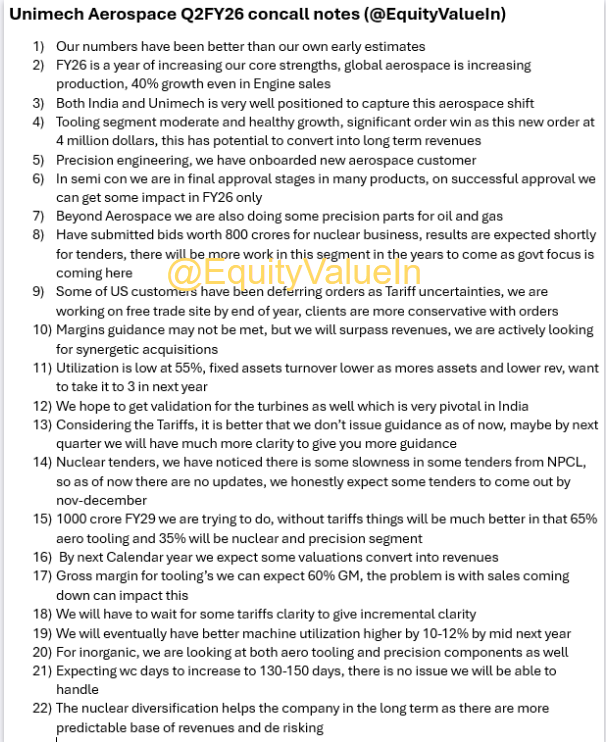

Unimech Aerospace Q2FY26 concall notes , my notes from the call just concluded, I continue my wait and watch approach and not initiating yet three important things 1) Tariffs have shifted the inventory model at US customers end that is leading to some slowdown in the revenues…

Unimech Aerospace , as expected in below post Q2 is likely to be weak , which now makes things very interesting for us Below is my take on Unimech aerospace , yes I am waiting for peak pessimism to happen post Q2 numbers , waiting and watching closely We dont own the stock…

Nuvama on Gujarat Fluorochemicals With global diversification efforts underway—targeting Japan, Korea and Europe—GFL is positioning its next-generation fluoropolymers across high-value segments such as semiconductors, data centres and AI infrastructure. The company expects a…

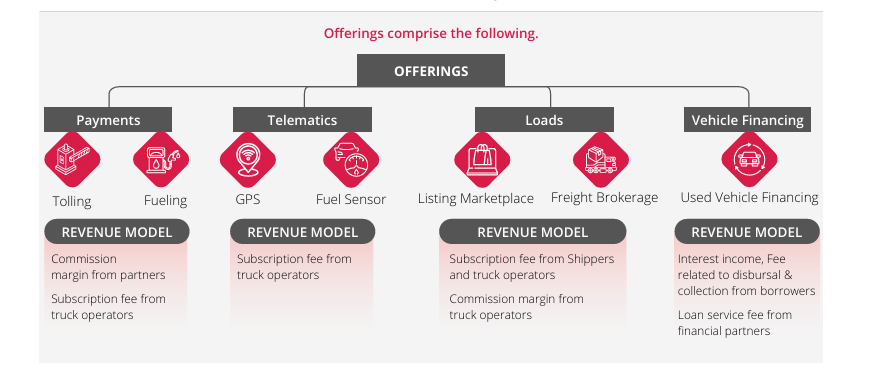

🚛 BlackBuck Ltd (Zinka Logistics) : The Digital Highway for India’s Truckers Imagine you’re a trucker driving from Delhi to Chennai. - You’ve dropped a load but have no freight for the return trip. - You call brokers, wait half a day, maybe get a lead. - Meanwhile, fuel theft,…

United States Tendencias

- 1. Sam Darnold 12.2K posts

- 2. Rams 53K posts

- 3. Stafford 13K posts

- 4. Puka 34.2K posts

- 5. Seattle 22.5K posts

- 6. Al Michaels 1,017 posts

- 7. Sam Bradford N/A

- 8. #TNFonPrime 3,478 posts

- 9. Portuguese 21.7K posts

- 10. Shaheed 5,082 posts

- 11. Kenneth Walker 3,228 posts

- 12. Kubiak 2,067 posts

- 13. McVay 4,041 posts

- 14. Cooper Kupp 2,072 posts

- 15. #LARvsSEA 2,129 posts

- 16. Portugal 45.9K posts

- 17. Ben Shapiro 26.9K posts

- 18. Kobie Turner N/A

- 19. Pelicans 3,271 posts

- 20. Charbonnet 2,461 posts

Tal vez te guste

-

Sumanth

Sumanth

@DarlingSumanth -

Bruce Wayne

Bruce Wayne

@Prabhas_wayne -

Jorn van Dijk

Jorn van Dijk

@jornvandijk -

Jashhhh

Jashhhh

@JaswanthJaswan1 -

Khabar Lahariya

Khabar Lahariya

@KhabarLahariya -

Blood Donors India

Blood Donors India

@BloodDonorsIn -

Pavan

Pavan

@PavanPrabhas_ -

Shivaji Vitthalrao🇮🇳

Shivaji Vitthalrao🇮🇳

@shivaji_1983 -

PraBoss

PraBoss

@balu_prabhas -

Arjunnnnnnnnnn Prabhas

Arjunnnnnnnnnn Prabhas

@ImArjun_M2R -

Vicky Varma

Vicky Varma

@VickyVarma_ -

Prabhas

Prabhas

@Foul_Soul_ -

REBEL ★ FAN

REBEL ★ FAN

@AbhinavPrabhas_ -

KAMAL

KAMAL

@KamaalSheihk -

PRABHAS ™ RAjASAAB

PRABHAS ™ RAjASAAB

@madhuhoney14348

Something went wrong.

Something went wrong.